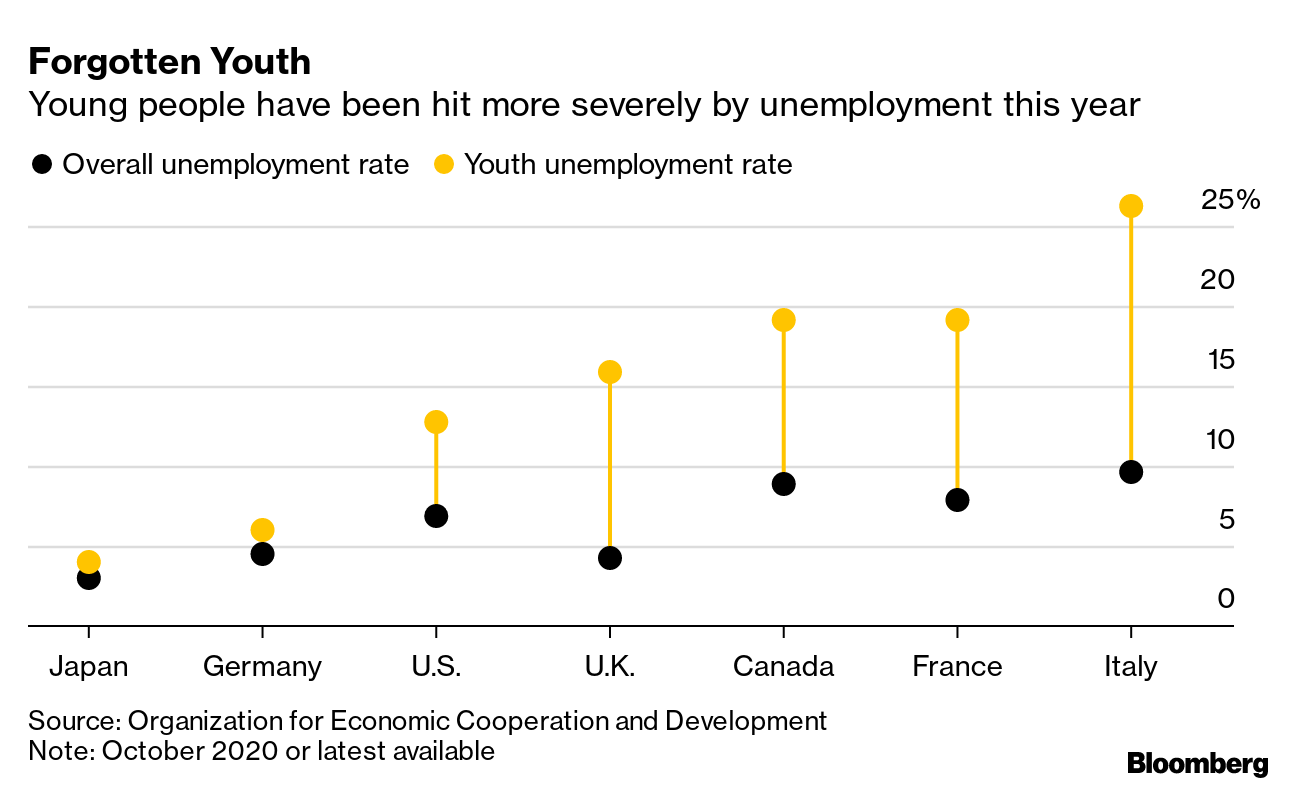

| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. The leaders of Poland and Hungary, who effectively vetoed the EU's 1.8 trillion-euro spending package, are meeting today as pressure builds on them to relent on their opposition to tying funding to upholding the rule of law. Prime Minister Viktor Orban will host Polish counterpart Mateusz Morawiecki in Budapest as the rest of the EU looks for any sign of compromise. One Polish official, however, signaled that without any plan to draw up a counterproposal, the meeting is unlikely to provide the breakthrough many are waiting for. The situation puts German Chancellor Angela Merkel, whose country holds the rotating EU presidency, in a tricky spot: She may have to further tweak the proposed mechanism without alienating countries like the Netherlands, which has said that the current draft is the bare minimum. Officials in Brussels say that even if some nations were willing to accept changes, frugal governments would veto the deal for fear that aid would be mis-allocated in the absence of democratic checks and balances in illiberal countries. — Alexander Weber What's HappeningBrexit Doubt | Britain is stalling discussions over a trade deal and the outcome of the talks remains "highly uncertain," according to French Foreign Minister Jean-Yves Le Drian. The EU and the U.K. remain "extremely far apart" on the topic of fishing rights and there's no convergence on the rules for fair competition, Le Drian told a parliamentary committee in Paris. Lithuania's Turnaround | The EU's worst-hit economy after the 2008 crisis is set to be its least-affected during the Covid-19 pandemic. Lithuania's brutal 2009 recession made it a testing ground for the harsh austerity that later ravaged Greece. It was better-prepared this time, reacting fast when the coronavirus struck and got lucky as surging e-commerce helped its logistics industry. Italian Proposal | The European Central Bank should consider wiping out or holding forever government debt it buys during the current crisis to help nations recover and restructure, a top Italian government official told us. "Monetary policy must support member states' expansionary fiscal policies in every possible way," according to cabinet undersecretary Riccardo Fraccaro, Prime Minister Giuseppe Conte's closest aide. Lobster Deal | The 27-nation Parliament is also due today to approve a mini-trade accord with the U.S. that scraps EU tariffs on American lobster. Under the $200 million deal, reached in August when the EU was keen to offer President Donald Trump cheap gifts, the U.S. will cut by 50% its levies on a handful of European goods including crystal glassware, cigarette lighters and prepared meals. Virus Update | German Chancellor Angela Merkel extended a partial lockdown for at least three weeks to just before Christmas, tightening limits on private gatherings but keeping schools and most businesses operating. Von der Leyen warned against relaxing virus restrictions too much and too soon, and the Austrian far right attempted to undermine a mass-testing campaign before the holidays. Here's the latest. In Case You Missed ItSpanish Budget | Pedro Sanchez's budget deal will shore up the foundations of his minority government and offer the chance of some political stability in Spain but has left his right-wing opponents furious. The prime minister — already vilified by conservatives for sealing a coalition deal with far-left group Podemos — cut deals with nationalists from Catalonia and the Basque Country to pass his spending plan. Pipeline Pledge | Energy giants financing Nord Stream 2 are sticking with the natural gas pipeline that links Russia to the continent's industrial heartland even under the threat of U.S. sanction. Rainer Seele, the CEO of Austria's OMV, said the EU needs to pursue its own energy interests and there's no foreseeable risk that could stop the project. BlackRock Rebuke | The Commission drew a rebuke from the EU ombudsman for failing to fully consider conflicts of interest when it hired BlackRock to advise on new sustainable-finance rules for banks. The decision doesn't cancel the mandate, but it's a small win for environmentalists who have long targeted the world's largest asset manager because of its outsized holdings of fossil fuel companies. Disrupted Derivatives | The EU's markets regulator dealt a blow to the City of London by blocking European banks and investors from trading big derivatives contracts in the U.K. once the Brexit transition period ends. Companies will need to move trading to the EU or other venues abroad, like Wall Street, that already have regulatory approval. Medicine Strategy | The EU will seek to overhaul the system for key patents such as those that have fueled legal battles between car makers and technology companies. Competition chief Margrethe Vestager promised that regulators will weigh reforms to improve the framework in place for so-called standard-essential patents and work on industry-led initiatives "to reduce frictions and litigation." Chart of the Day  While the people at greatest risk of suffering severe cases of Covid-19 are of retirement age, the economic disaster caused by the pandemic disproportionately affects the young. Tilman Kuban, who leads the youth wing of Merkel's party, says they are the "triple losers" of the crisis because it's costing them in terms of education, social opportunities and future government benefits. A look at unemployment rates across Group of Seven economies shows how severely the crisis has hurt 15-24 year olds. Today's AgendaAll times CET. Like the Brussels Edition?Don't keep it to yourself. Colleagues and friends can sign up here. For even more: Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. |

Post a Comment