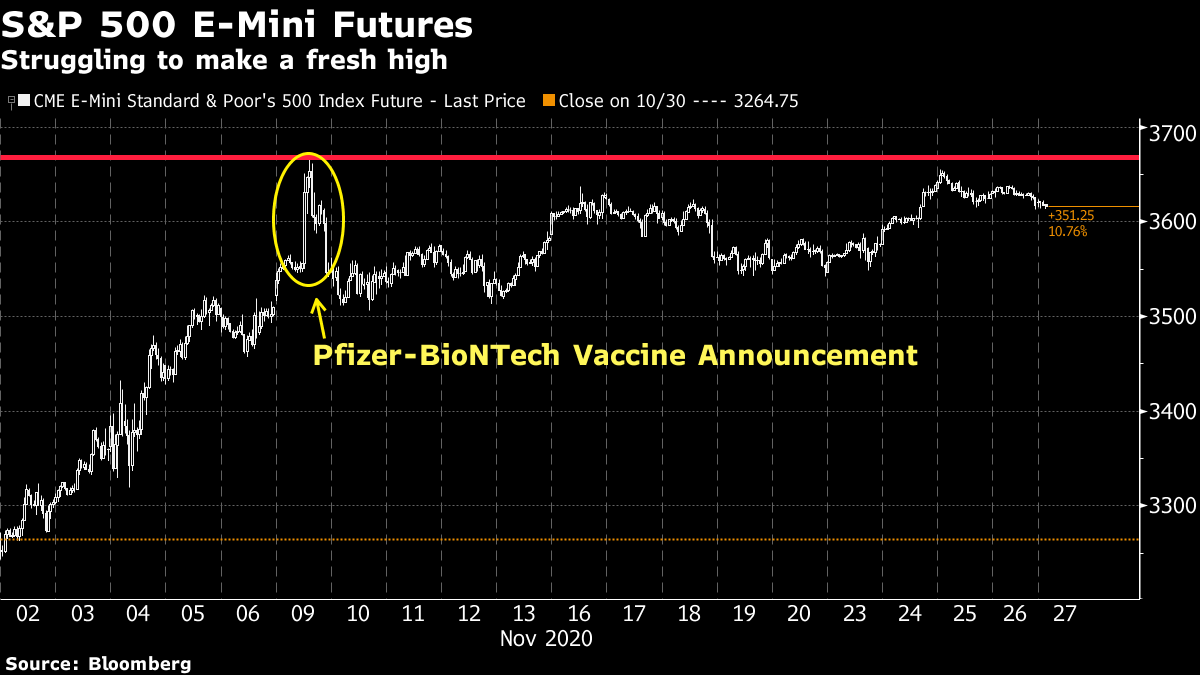

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. Europe's stimulus package remains at an impasse, in-person Brexit talks are to restart and more trials are likely for one of the Covid-19 vaccines. Here's what's moving markets. Bloc StimulusPoland and Hungary vowed to veto the European Union's spending plans following a meeting, dashing hopes that a compromise would be found over the pair's objection to tying stimulus money to rule-of-law standards. Elsewhere, European Central Bank Chief Economist Philip Lane said the euro-area economy is seeing initial signs of strain in financing conditions with some "worrying signals" in recent data. The European Union is now starting the effort of wooing U.S. President-elect Joe Biden's team in the hope of accelerating talks to normalize trade relations. That after some progress was made on a mini tariff-cutting deal between the two, with the EU removing levies on U.S. lobster. Face-to-FaceU.K. and European Union negotiators are ready to start face-to-face talks again this weekend following the quarantine period for key officials following a Covid-19 infection. Michel Barnier, the EU's chief negotiator, is to update diplomats on the state of the talks on Friday and provide a briefing on one of the main areas of disagreement, fishing. Domestically, the U.K. is still digesting the impending shift to its new system of virus restriction tiers, the need for the government to raise billions in taxes to balance the books and a continued push for Scottish independence. More TrialsAstraZeneca is likely to conduct an additional global trial of its Covid-19 vaccine candidate following questions raised about the efficacy of the treatment after initial results were released. The U.K., however, has taken steps to get the vaccine approved before the rest of Europe by skirting EU regulators. In Europe, Germany surpassed 1 million virus cases, Swedes are losing faith in the herd immunity strategy and Italy has opened up a path for quarantine-free flights to the U.S. And in Canada, Ontario is following the lead of New York in restricting fees that food delivery companies can charge as coronavirus cases continue to rise. Bitcoin SteadiesBitcoin and other digital coins steadied on Friday after some of the biggest declines the crypto market has suffered since the beginning of the pandemic, which had raised new questions about the boom in the assets. Bitcoin itself is still up around 140% for the year, sparking memories of 2017 when the runup in the cryptocurrency was followed by a spectacular bust. This time, however, watchers think the rise is different owing to growing institutional interest, exemplified by the listing of a Bitcoin exchange-traded note this week. Coming Up…European and U.S. stock-futures are steady, ending the week in cautious fashion, and oil pared its weekly gain ahead of next week's OPEC+ meeting. It is a quiet day for earnings in Europe with the season having wound down, though there will be a smattering of data in the form of euro-area business confidence and French GDP numbers, plus the market will digest China's industrial profits rising at the fastest pace in nine years. Watch too for any effect of President Donald Trump saying he'll relinquish power if the Electoral College confirms Joe Biden as the election winner, though he signaled that he may never formally concede. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Mark Cudmore is interested in this morningThe November 9 Pfizer-vaccine related high in the S&P 500 futures hasn't again been breached, despite the subsequent investor euphoria in other markets. That was the first in a series of positive vaccine headlines but the optimism is wearing thin for the world's benchmark equity index. The S&P 500 suffers slightly from the rotation to value from growth stocks; the small-caps focused Russell 2000 Index and the Dow Jones Industrial Average have both surged to fresh records this week. If this rotation continues gradually, then the S&P 500 will soon rise again, but if it occurs amid volatility, then the trading costs will be a net-negative for investor appetite. There's also a particularly large amount of S&P 500 selling for month-end portfolio-rebalancing. This would suggest that the bulls can resume their march higher from next Tuesday, but the one catch is that it has brought attention to the fact that the year-end selling pressure on U.S. stocks due to rebalancing may be much larger again in December. With the virus resurgent across America, there's a chance that November 9 high may survive through the end of year, despite it being less than 2% away.  Mark Cudmore is a Bloomberg macro strategist and the Managing Editor of the Markets Live blog. Bloomberg Terminal users can follow him there at MLIV. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment