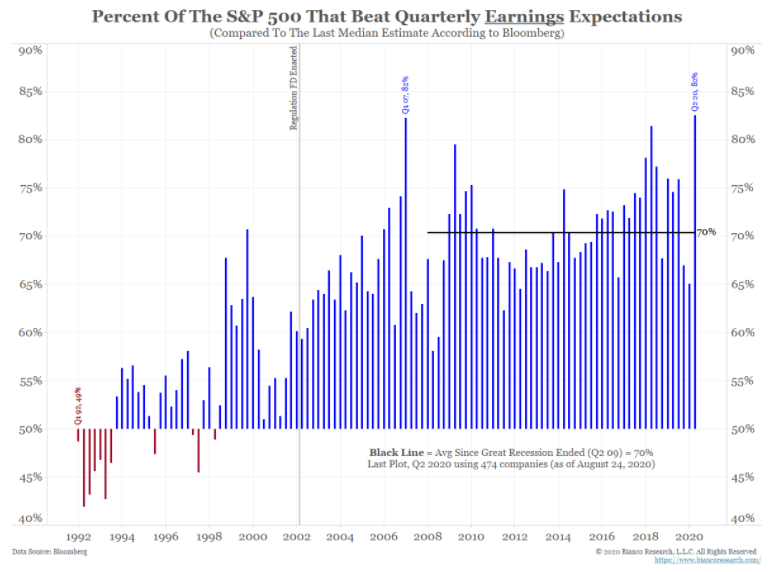

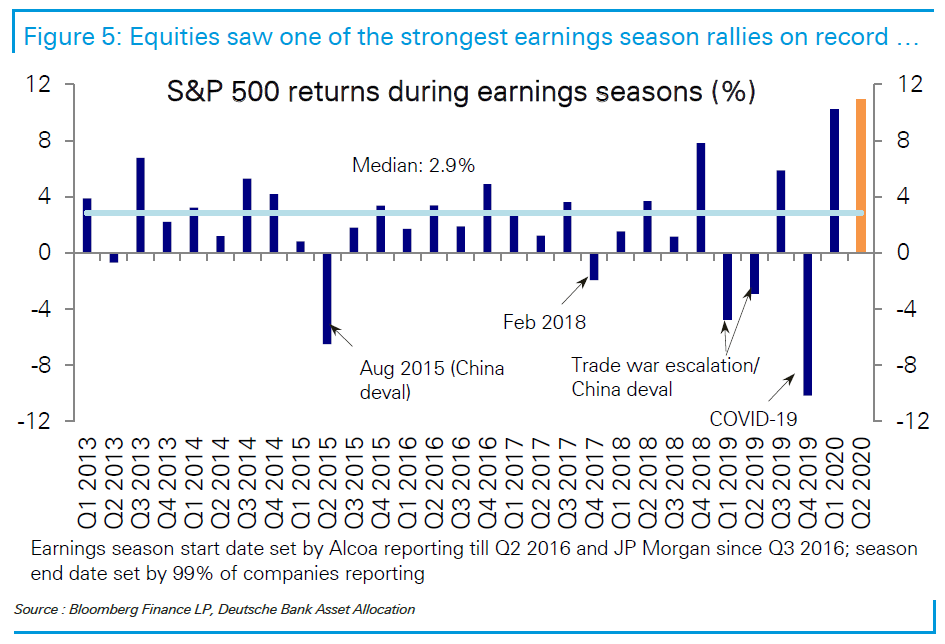

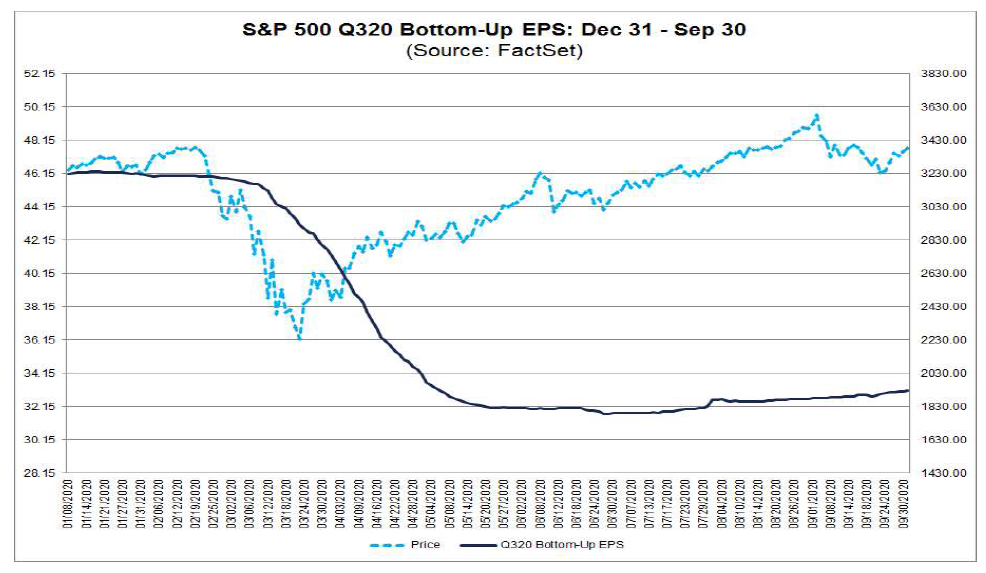

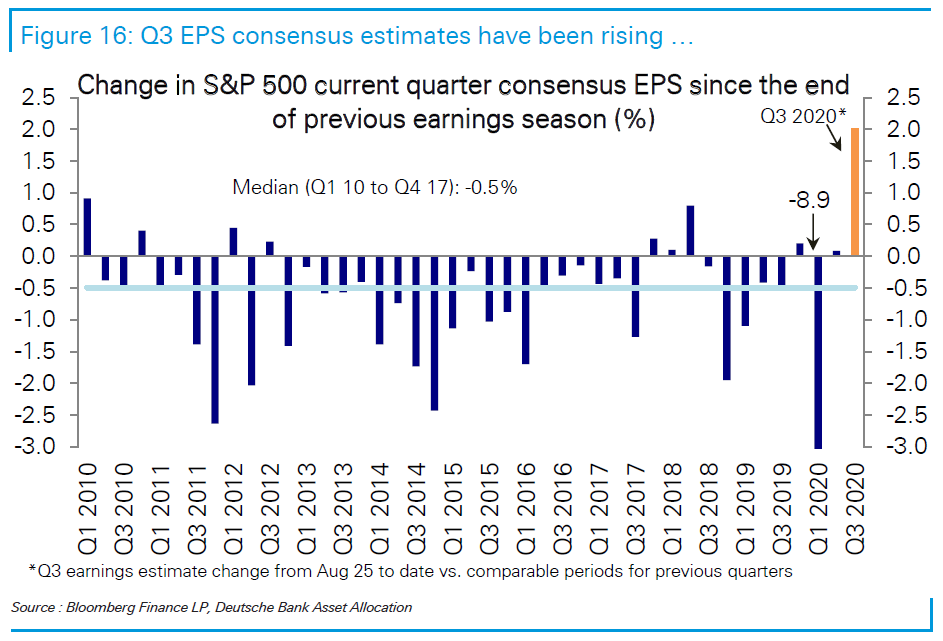

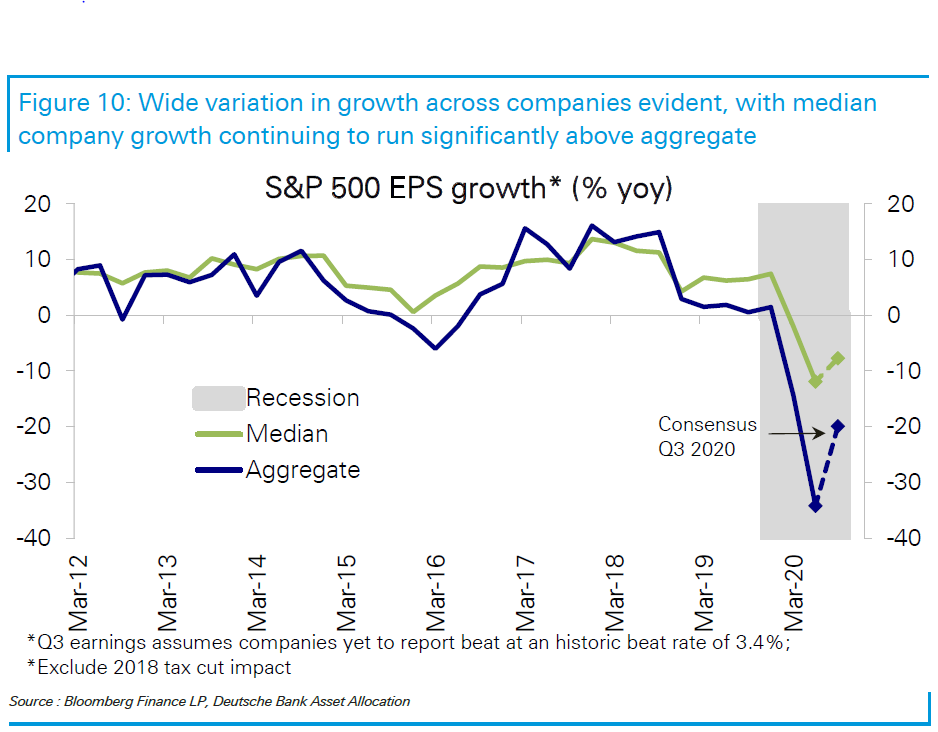

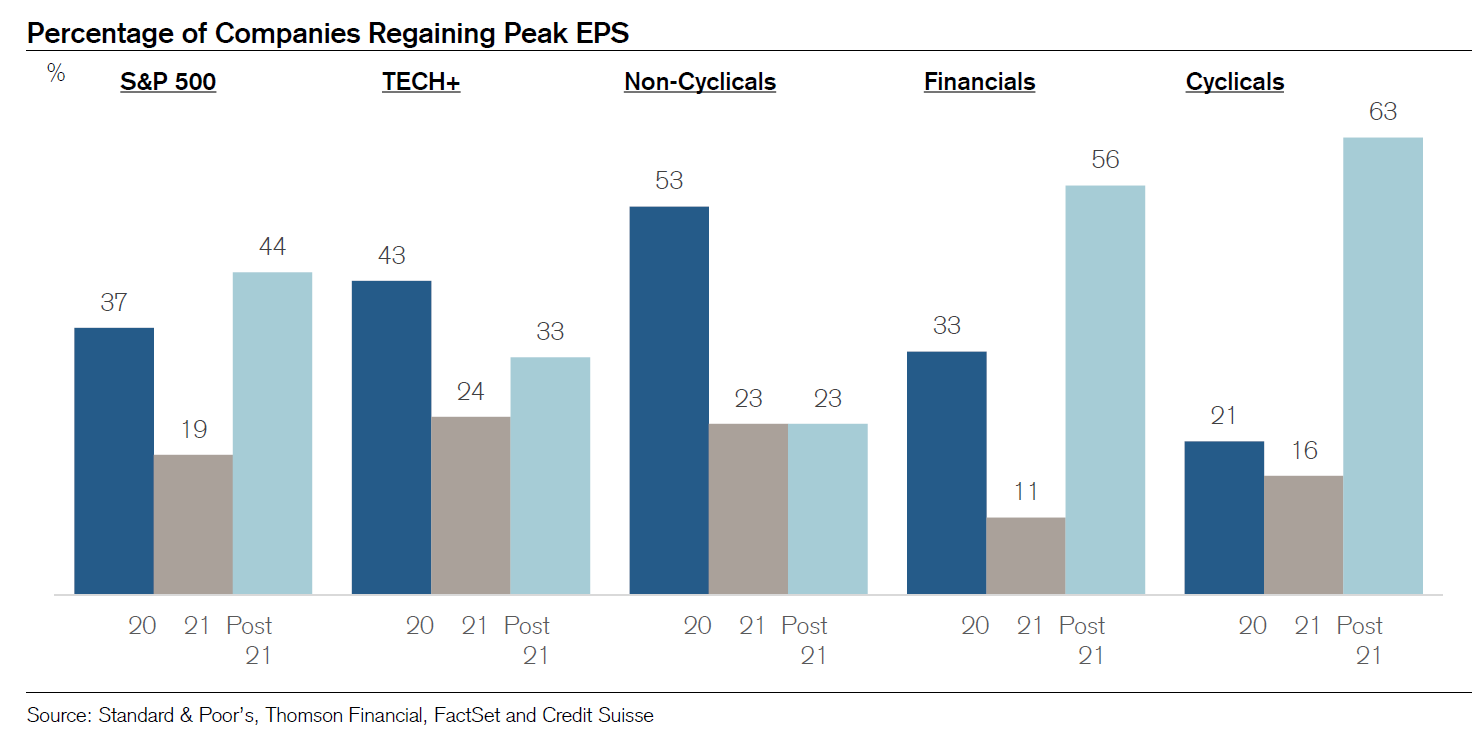

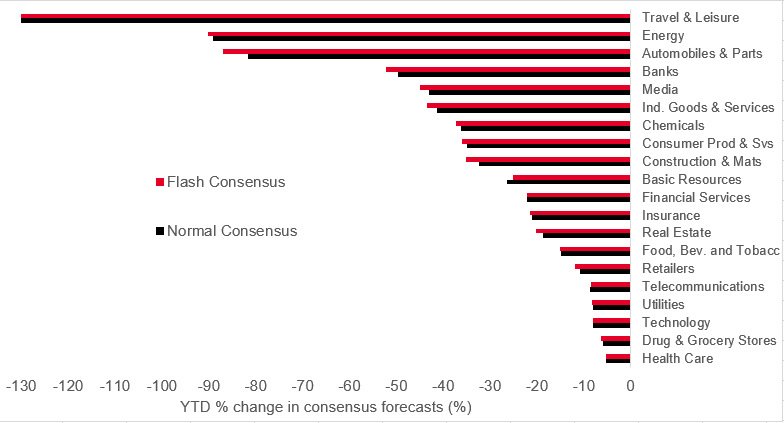

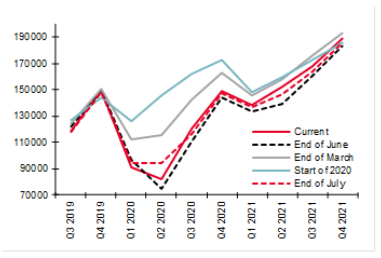

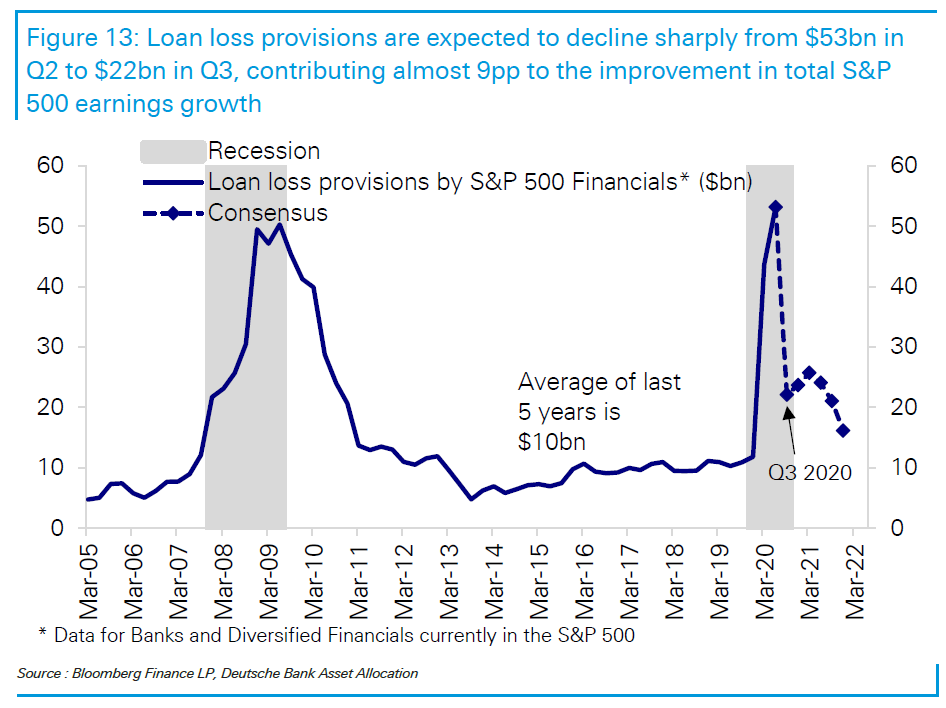

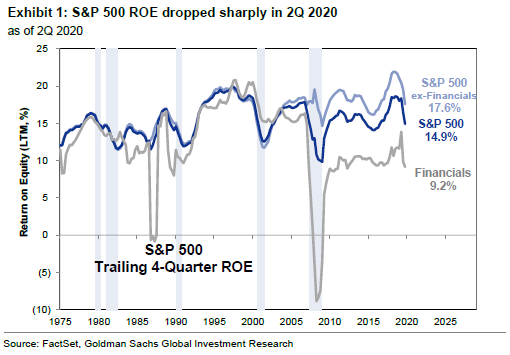

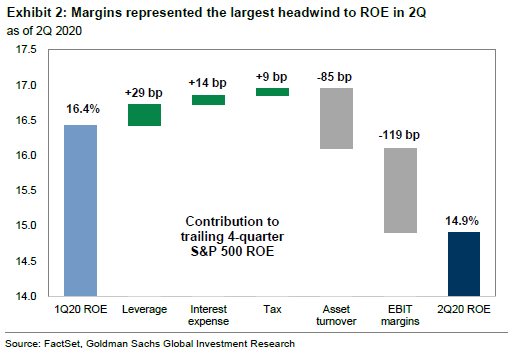

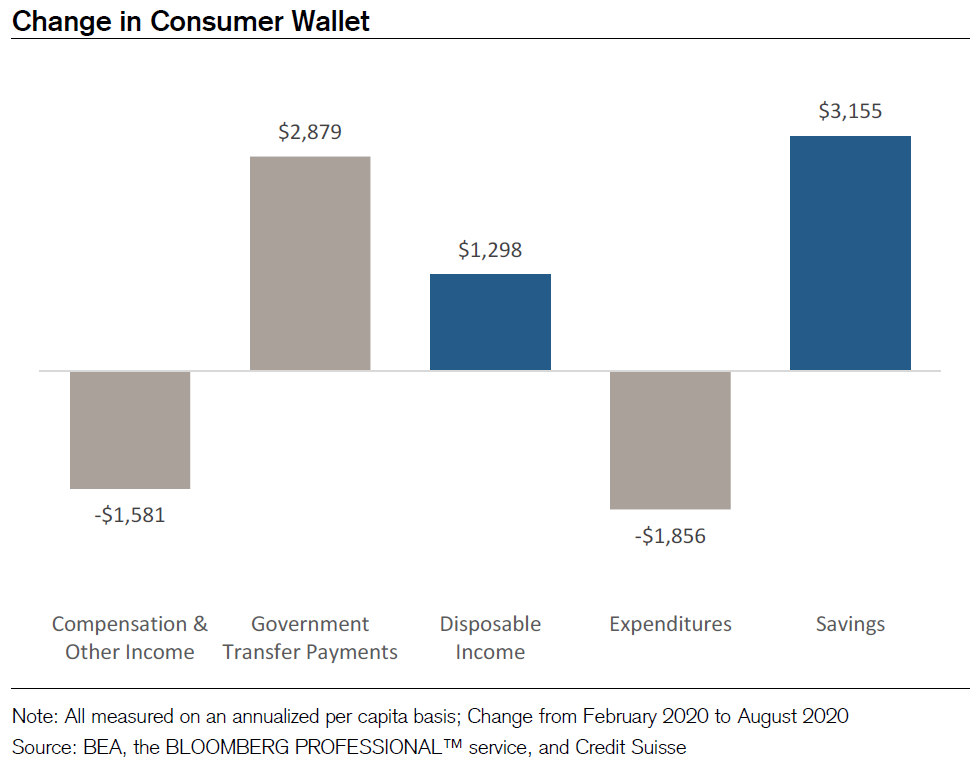

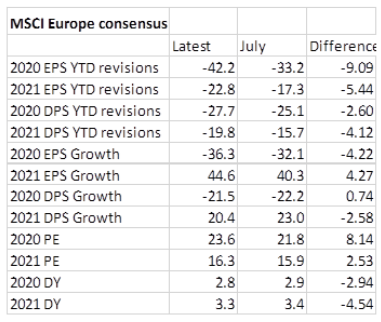

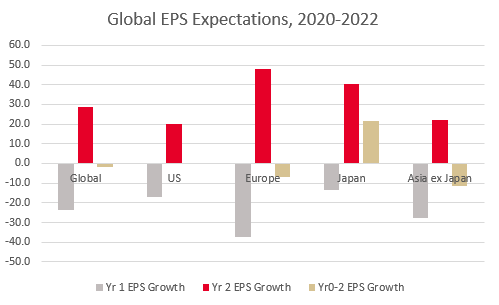

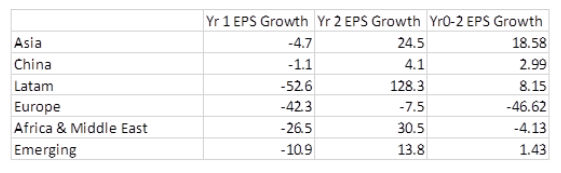

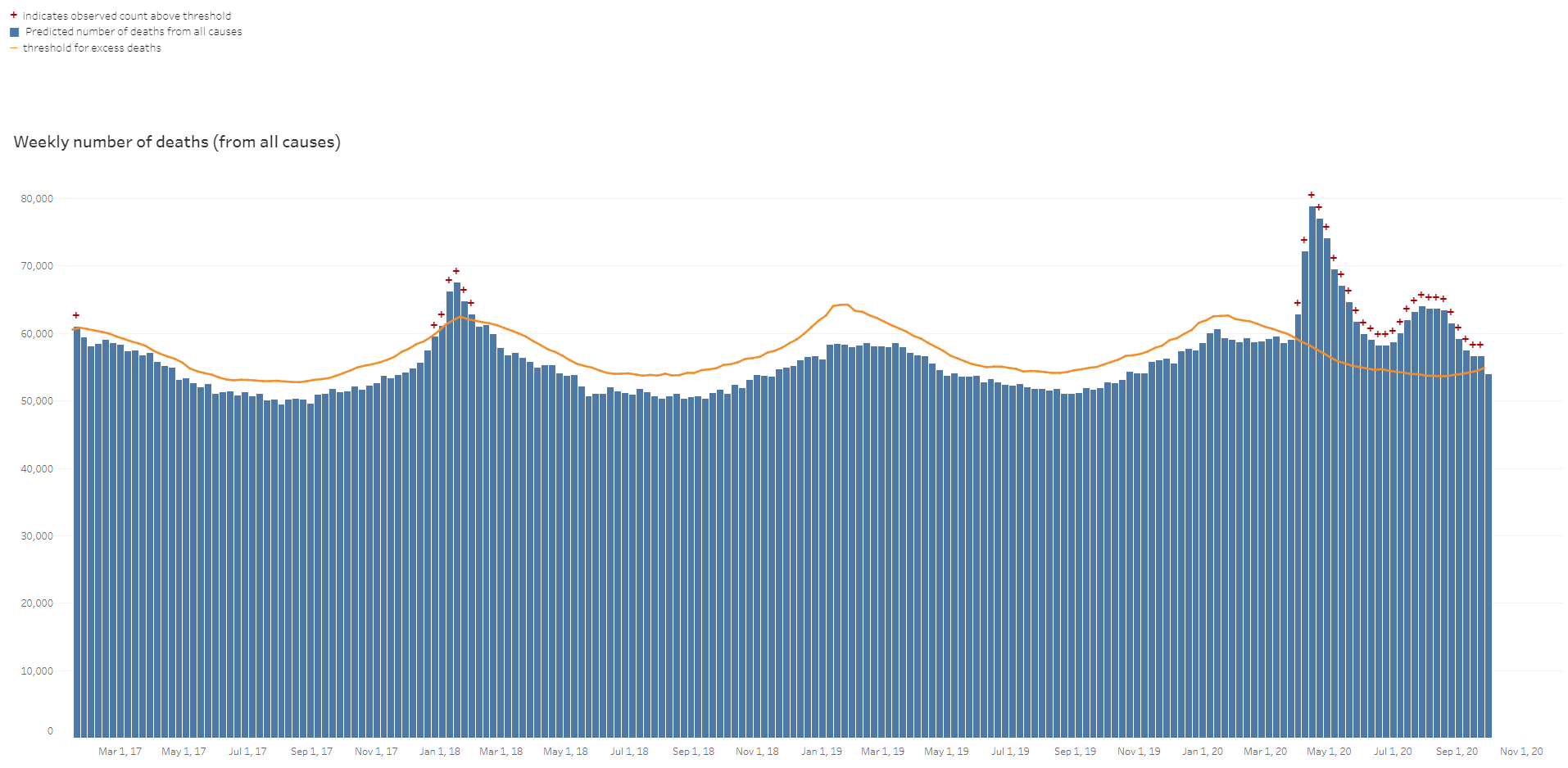

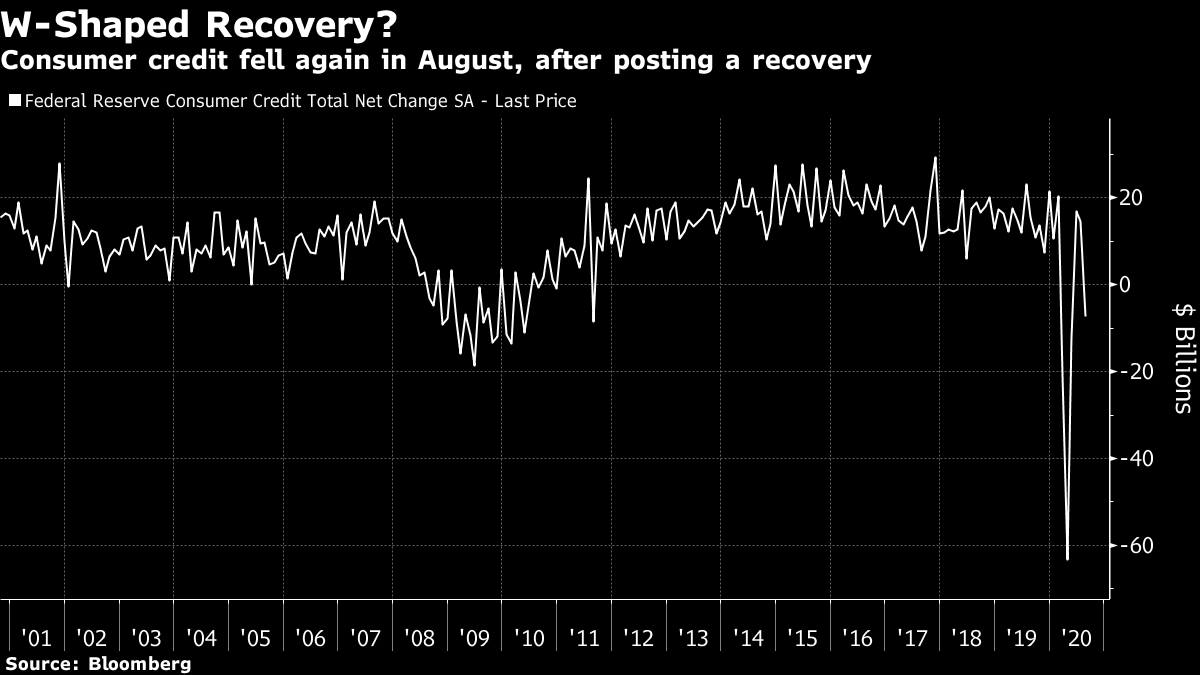

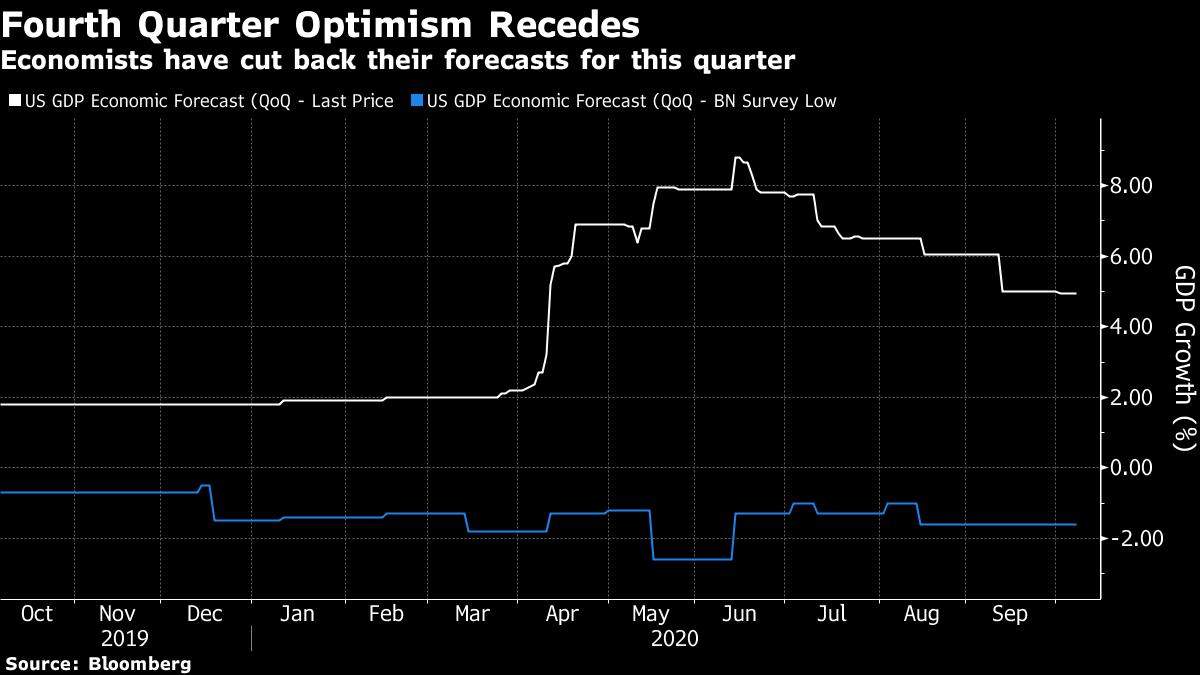

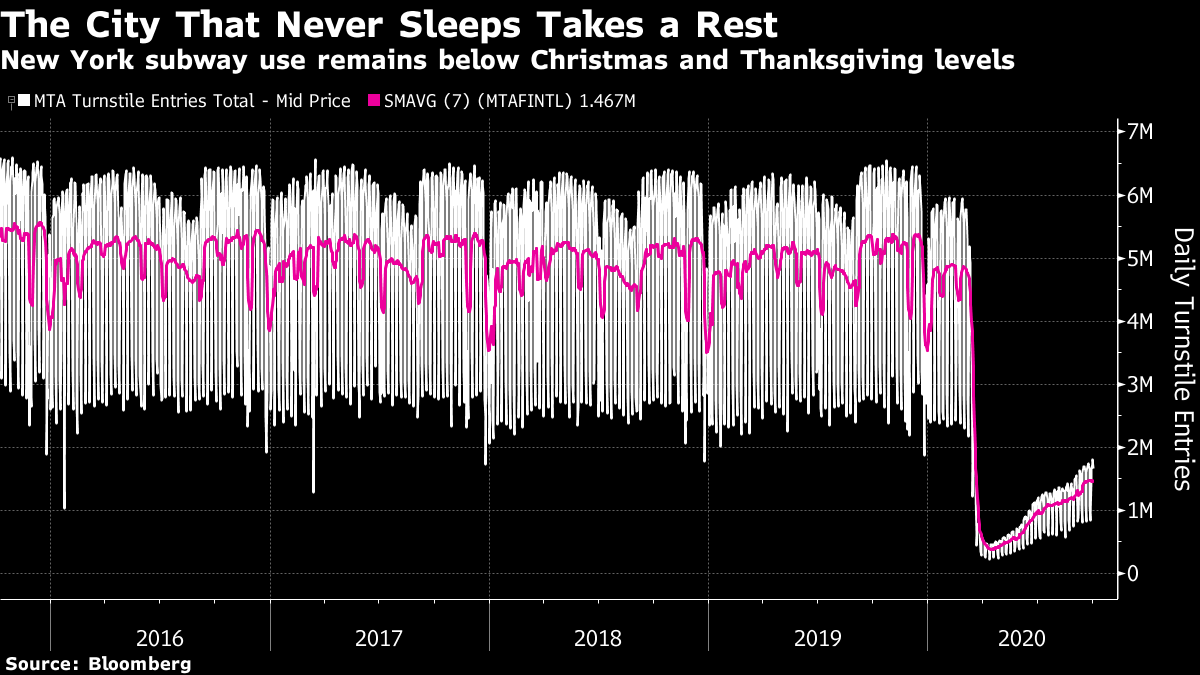

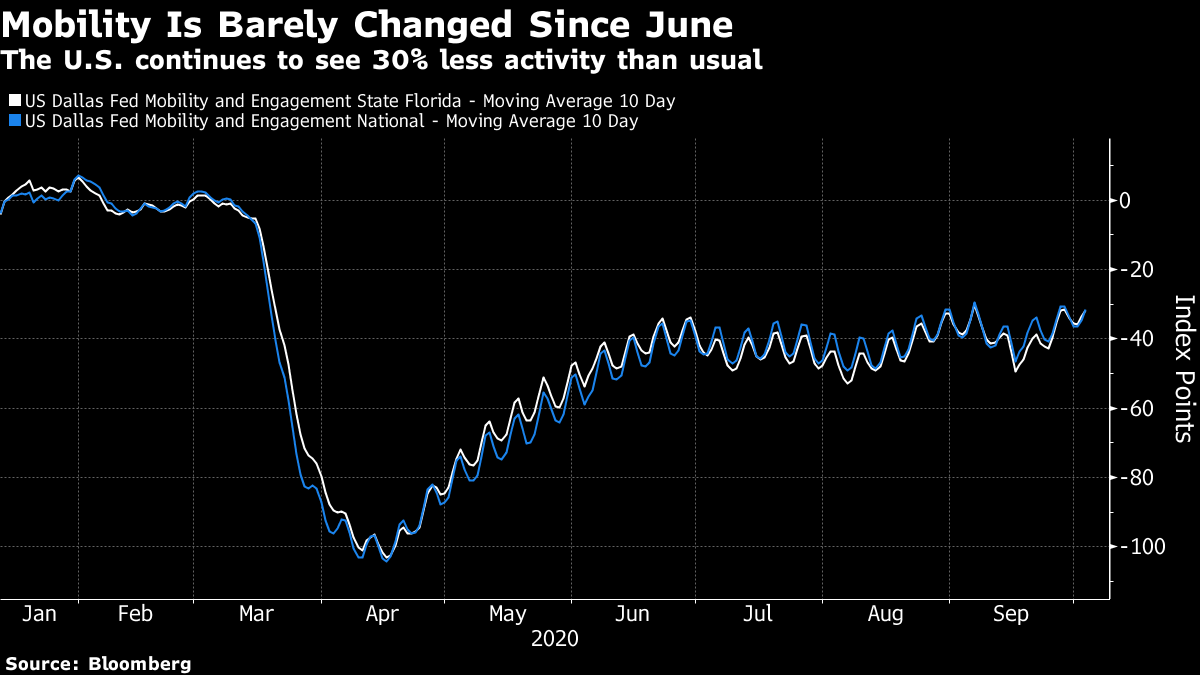

The Expectations GameIn business, as in politics, much comes down to expectations. Last week's presidential debate might have been perceived differently had the Republicans not, inexplicably, prepared the public for Joe Biden to be senile. Strangely, the Democrats made the same mistake for the vice-presidential debate, and had us briefed for Kamala Harris to slice apart her opponent with such brilliant prosecutorial cut and thrust that by the end Mike Pence would plead guilty to any charge. And indeed, after a debate in which both made some good points, Harris may have been harmed by unduly high expectations. For now, it's time to look at the prospects for earnings, as the third-quarter reporting season starts next week. It won't have quite the same share of mind as usual, but will still matter. Normally, earnings season is like a presidential debate. Companies try to douse down expectations ahead of the event, so they can reap the rewards when they "beat" their own lowered bar. Analysts keep scorecards on earnings surprises, and the whole exercise becomes an excuse to sell stocks to people. This time, however, base effects after the last nine months make the expectations game harder to play. Last quarter saw a record percentage of S&P 500 companies beat their estimates, as shown in this chart from Bloomberg Opinion colleague James Bianco:  That helped to ensure that stock returns during earnings season were among the strongest on record. This chart is from Bankim Chadha of Deutsche Bank AG:  Meanwhile, expectations for the third quarter rose significantly during the period, albeit not by anything like enough to explain the gain in share prices. This chart is from FactSet:  Estimates have increased 4.1% during the quarter. How unusual is this? Over the last 15 years (60 quarters), they fell by an average of 5.2%. This is very, very unusual behavior. The following chart from Chadha shows gains and losses following the end of prior earnings seasons over the last decade:  These are aggregate figures. That raises the issue of the pandemic's impact on different sectors. A few big companies benefited, while many smaller ones were hurt. The degree of variance is also unusual. In this chart from Chadha, we compare overall earnings per share growth for the S&P 500 with the change recorded by the median stock. Usually these numbers are quite close. At present, the median is far above the aggregate, indicating that Covid-19 has been particularly cruel to a a specific group:  Within the U.S., Jonathan Golub of Credit Suisse Group AG shows that most cyclical companies aren't expected to get their earnings back to where they were last year until 2022 or later. A protracted earnings recession is priced in:  Travel and leisure companies have unsurprisingly borne the brunt. The following chart, from Andrew Lapthorne of SG Quantitative, shows changes in consensus forecasts for full-year 2020 earnings since the year started. Red bars show the "flash" or most recent estimates, which in most cases don't differ much from the consensus as normally measured, including those that haven't been updated for a while. These data are global, and everything is down.  Lapthorne also shows that in the greater picture, estimates haven't changed much over the last three months — which can probably be attributed to the fact that the pandemic hasn't delivered the feared second wave as yet, but has also refused to go away. This chart shows the numbers for the Nasdaq-100, and indicates that tech companies may have difficulties living up to expectations next year, as forecasts for 2021 are higher now than they were in January:  Then there is the problem that Covid-19 confusion has left more to judgment of auditors and financial officers. Loan-loss provisions by S&P 500 financial companies shot up earlier in the year, and are expected to reduce substantially. This reflects the good news that the Covid recession doesn't look as severe a credit event as once appeared likely. But it will mean that a group of financial companies will report much better earnings when nothing has actually changed:  Rather than trying too hard to quantify all these numbers, then, it is perhaps more helpful to say that the pandemic and its economic impact have left people with minimal idea what to expect. Rather than keep scorecards of earnings beats and misses over the next few weeks, we should keep our eyes on the latest polls of polls and prediction markets for the presidential election, while listening intently to what executives on earnings calls have to say about the state of their business. Stimulus, or Not Looking into the guts of expected earnings does show why the issue of fiscal stimulus, or more accurately a benefits package, is regarded as so important. As David Kostin, chief U.S. equity strategist at Goldman Sachs Group Inc., shows, return on equity for the S&P 500 fell spectacularly with the onset of the pandemic:  This happened largely because companies opted to take a hit, and allowed their margins to tighten sharply. This is largely, and laudably, because they declined to close facilities or lay off workers:  This explains why companies would like some help. Were it not for government aid, the odds are that there would have been far more job losses already. Looking at consumers' balance sheets, it is clear that the CARES Act was critical. Until August, government transfer payments had more than counterbalanced loss of compensation. Meanwhile, with so much uncertainty, individuals opted to save rather than spend if possible. Those savings are now muffling the effects of the delay in working out a successor stimulus. Some money from the taxpayer would do a lot to bolster consumption. Without it, the compensation bar in this chart will be much lower, and the transfer payments bar will disappear, so the implications for expenditures are horrible:  Current expectations are based on the assumption of more government help. There is room for debate over whether this is a good idea. But those who want share prices to stay high would definitely prefer politicians to come up with something. Global Contagion Lapthorne has global data comparing expectations across regions. This shows that despite growing optimism about the European economy in recent months, hopes for companies' profits have continued to decline, significantly, through the summer:  European brokers are, however, braced for an epic recovery next year. Globally, earnings are projected to be slightly behind 2019's, but there's plenty of variation. The U.S. will have made back the lost ground (although that depends in large part on great hopes for the FANGs). Meanwhile, the one developed market where analysts seem confident that companies will be well ahead of where they were last year is Japan. That is what happens to countries that manage to keep a lid on the contagion. As Japan has just managed to get through a transfer of power after a long-serving premier suffered a health crisis, with barely anyone noticing, the country's securities might have more going for them than many realize:  Meanwhile, Lapthorne's data for emerging markets show again that there are strong returns to any country that can keep a lid on the virus, and steep penalties for those that don't. Latin America is projected to suffer a 52.6% earnings decline this year, to be followed by a 128.3% rebound next year. The chances are that there are plenty of wildly mispriced stocks out there, for those with the patience and fortitude to look for them. The problem is to work out which are too expensive and which are too cheap.  Covid: Another Reason for StimulusThe main reason there is so much anxiety in the U.S. is that the pandemic refuses to go away, and so its effect on the economy persists. There is some good news. The latest numbers from the Centers for Disease Control suggest that for the first time since the outbreak, there are no "excess deaths" above the number that would normally be expected at this time of year. This is an important landmark, but it remains to be seen whether it can be sustained:  It might not have been reached without continuing social distancing measures, which dampen economic activity. And the end of stimulus payments at the end of July had a sharp impact on consumer credit, which dropped during August, according to latest figures from the Federal Reserve. This is very unusual:  Meanwhile estimates for economic growth in the quarter that has just started have steadily been cut back over the last three months, according to Bloomberg's survey of economists. Some respondents still expect a slight decline this quarter:  This is because economic mobility remains depressed. One dramatic example is the New York subway. Most of the city has a minimal problem with the virus these days, but use of the subway (widely blamed for the way the virus spread like wildfire earlier in the year), remains far lower than would be seen even in a typical Thanksgiving or Christmas week:  New York City is a liberal bastion where many can work effectively from home, so it may be an extreme example. But the index of mobility and engagement compiled by the Dallas Fed suggests that low mobility remains a national phenomenon. This chart gives figures both for the U.S. as a whole, and for Florida, where the governor has been aggressive in reopening. The two are almost indistinguishable. If there is lingering concern about contagion, people will choose to be less economically active:  This suggests that the president is right to encourage people to return to normal — but also that some more money from the government might help. Survival TipsMy advice today is that there is much to be said for changing teams late in your career. The great New England Patriots quarterback Tom Brady is trying his hand, in his 40s, at quarterbacking for the lowly Tampa Bay Buccaneers. It's been an adjustment, but he's handling it so far, with the Bucs 3-1 for the season (the Patriots are 2-2). And he looks almost as young as ever. He made the right call. I say this with confidence as this is the second anniversary of my first day at Bloomberg, after 29 years plying my trade somewhere else. Bloomberg and the Financial Times are great news organizations and I am proud of every minute I've spent at both. I miss many great friends from the FT, but despite all the miseries of 2020 I do seem to feel 10 years younger now than I did two years ago. Change, and knocking yourself out of your comfort zone, can be really good for you. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment