| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. EU budget negotiations are continuing and if each side digs in its heels, then delays in the 1.8 trillion-euro economic recovery package will become unavoidable. Germany put an offer on the table promising a bit more money (up to 9 billion euros) further down the road but doesn't mess with the numbers that were agreed between the bloc's leaders after four endless nights in July. It also refuses to put illiberal democracies on a tighter leash, insisting that the terms attached to EU budget disbursements can't substitute EU Treaty provisions for upholding the rule-of-law. Will this be enough to convince EU lawmakers and reluctant parliaments to give their required backing? We may have a bit more clarity today. — Nikos Chrysoloras and John Ainger What's Happening Quit Threat | As Brexit negotiations heat up in London today, it's clear the stakes couldn't be higher. Yesterday, the U.K. renewed its threat to walk away if no deal is in sight by Oct. 15. EU officials, who don't recognize that deadline, are pessimistic about that level of progress by then. Still, despite all the bluster, the two sides might be lurching toward a deal. Virus Update | For those of you who live in Brussels, scrap your evening plans to go to the bar. As of today, the second hardest hit capital in Europe after Madrid ordered all bars to close for one month. Here's the latest on the virus. Beachfront Battlefield | The sandy beach of a ghost town in Cyprus's Turkish-controlled north has become the latest battlefield for Turkey as it pushes for a two-state solution in the divided nation. Selcan Hacaoglu brings you the details of what is becoming an increasingly concerning standoff.

Italy's Blessing | At the height of the pandemic in March, investors braving a violent Italian bond selloff were seriously weighing the risk that the nation could be forced out of the euro bloc. Few would have bet then that mere months later, the country would be boasting the lowest debt costs on record. Here's the story of what happened and why the nation's leaders need to cash in. Debt Tsunami | Not all is so rosy though. As Covid-19 wreaks havoc, a gathering tsunami of distressed credit risks wrecking a decade of efforts aimed at bolstering the fragile financial industry. The fallout could also undermine the extraordinary efforts by governments and central banks to prevent an economic meltdown. In Case You Missed It Pipeline Problems | German Chancellor Angela Merkel has an $11 billion headache over a pipeline to bring Russian gas to the country under the Baltic sea. Neighboring Poland slapped a record fine on Gazprom over the Nordstream 2 project, underscoring how the pipeline project has emerged as one of the biggest geopolitical focal points in the spiraling tensions between the West and Putin's Russia.

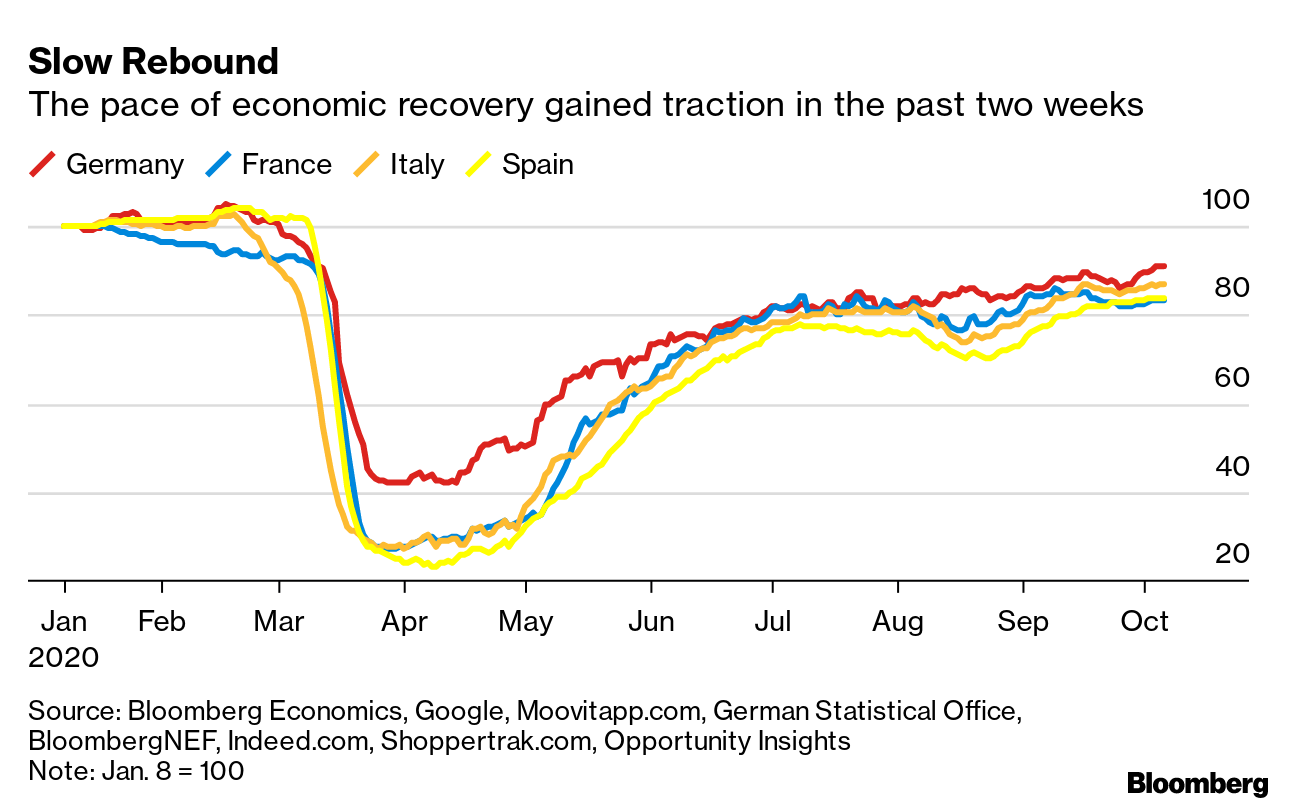

Lean On Lagarde | European Central Bank President Christine Lagarde ruled out removing the institution's unprecedented monetary support until the coronavirus crisis is over. She may not have it all her way though, with German central bank chief Jens Weidmann striking a rather different tone. Spain Stimulus | Spanish Prime Minister Pedro Sanchez unveiled a 72 billion-euro stimulus plan, 80% of which will come from the EU's recovery fund, to help the embattled economy rebound from one of region's deepest contractions and a resurgent coronavirus outbreak. Investors have become increasingly worried Spain could be Europe's next problem child. Race Problem | Credit Suisse apologized for "any offense" caused by a black performer who dressed as a janitor at a party for the bank's chairman last year, causing former Chief Executive Officer Tidjane Thiam to leave the room. The incident has fueled a debate about racism within banking and in Switzerland. Home Banking | So how much will you really be able to work from home after the pandemic? A lot more than you might think, if you work for a European bank. Find out how it might affect you here. Chart of the Day  After a period of economic weakness in August and September, the pace of recovery in most advanced economies gained traction in the past two weeks, though activity is still far below pre-Covid levels, according to Bloomberg Economics gauges that integrate high-frequency data such as credit-card use, travel and location information. Germany remains at the forefront of the recovery but activity has also increased in France, Italy and Spain. Today's Agenda All times CET. - 8:45 a.m.: Video conference of home affairs' ministers

- EU Council President Charles Michel visits Ireland

- MEPs vote on rule of law and fundamental rights resolution as well as the ongoing protests against corruption in Bulgaria

- ECB publishes account of September meeting

- EU foreign policy chief Josep Borrell and Commissioner Janez Lenarcic in Addis Ababa, Ethiopia

Like the Brussels Edition? Don't keep it to yourself. Colleagues and friends can sign up here. We also publish the Brexit Bulletin, a daily briefing on the latest on the U.K.'s departure from the EU. For even more: Subscribe to Bloomberg All Access for full global news coverage and two in-depth daily newsletters, The Bloomberg Open and The Bloomberg Close. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. |

Post a Comment