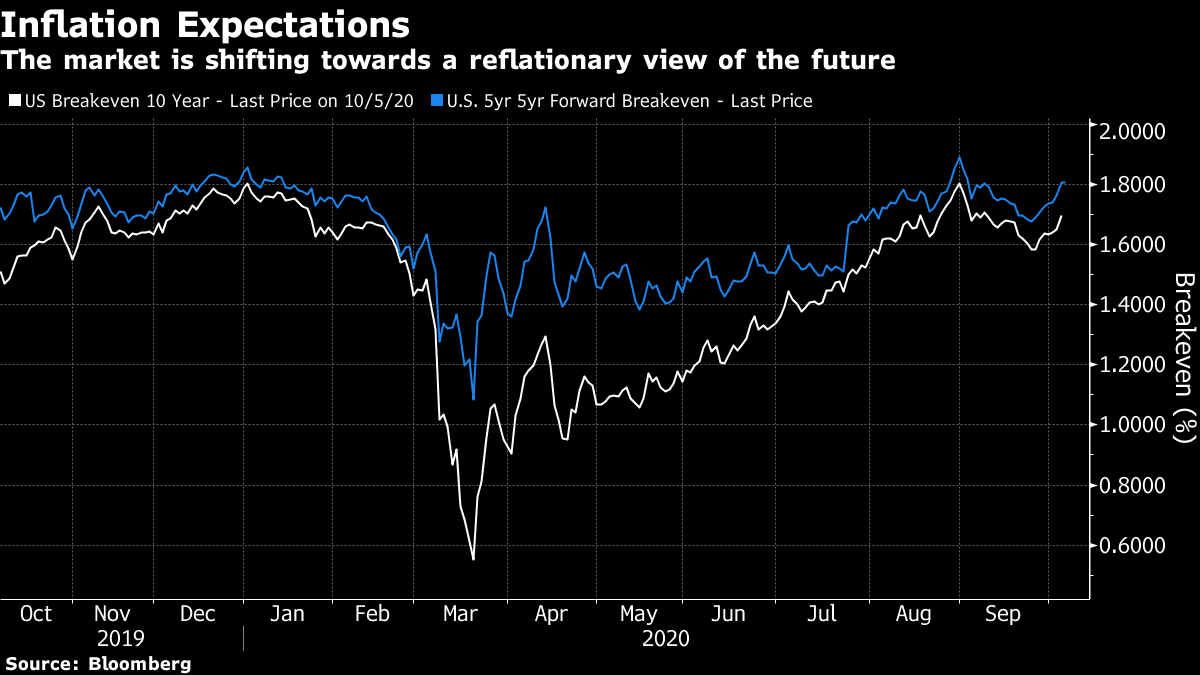

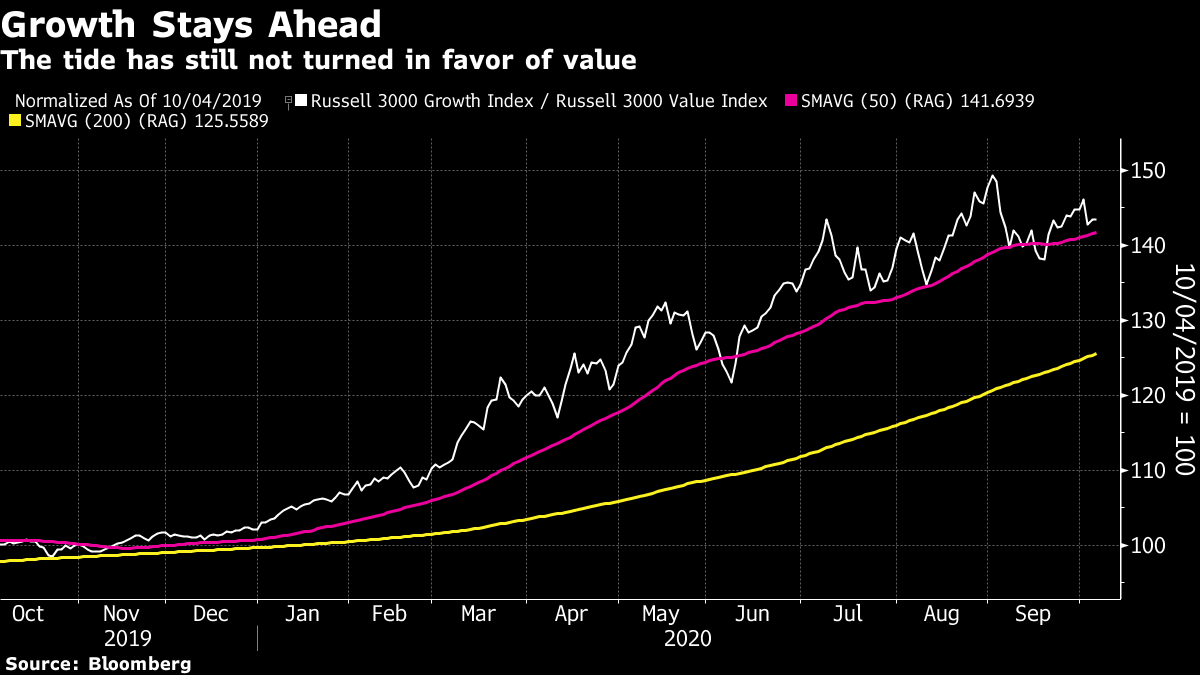

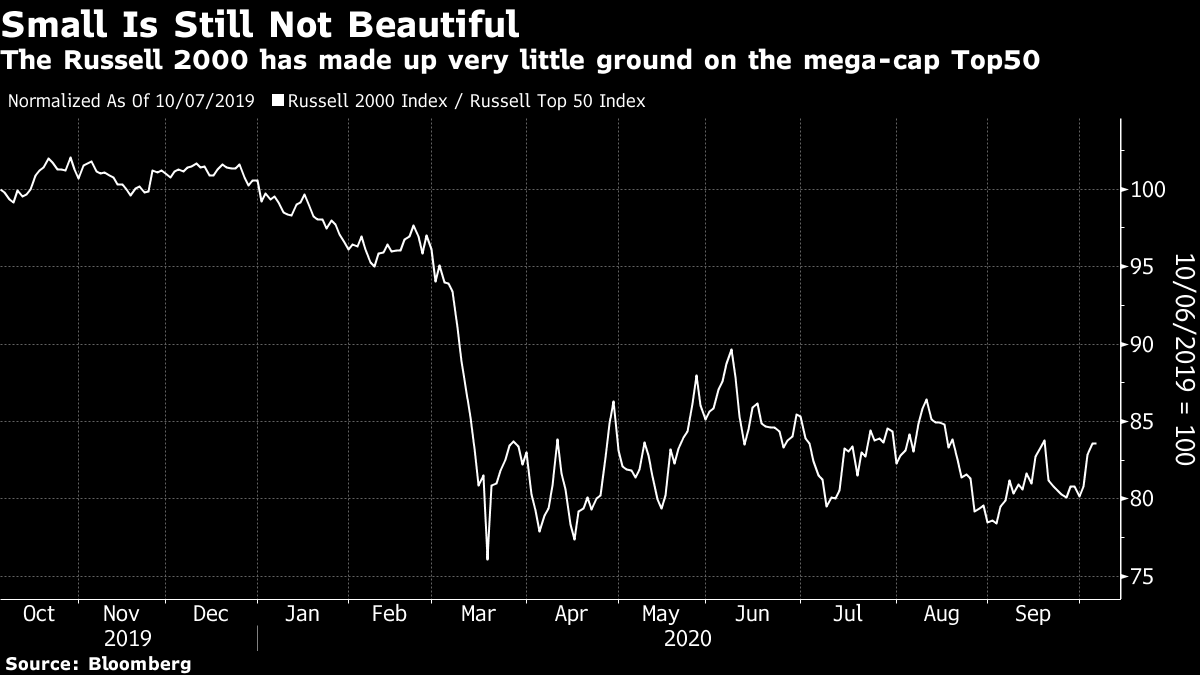

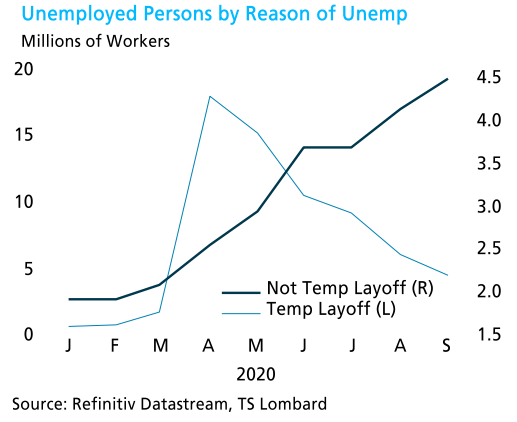

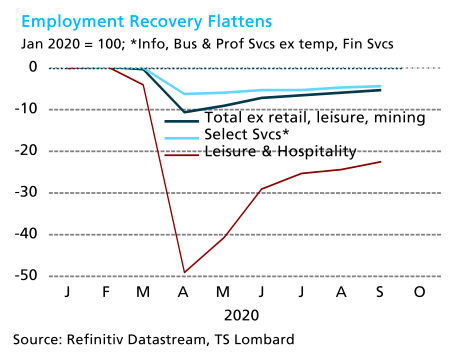

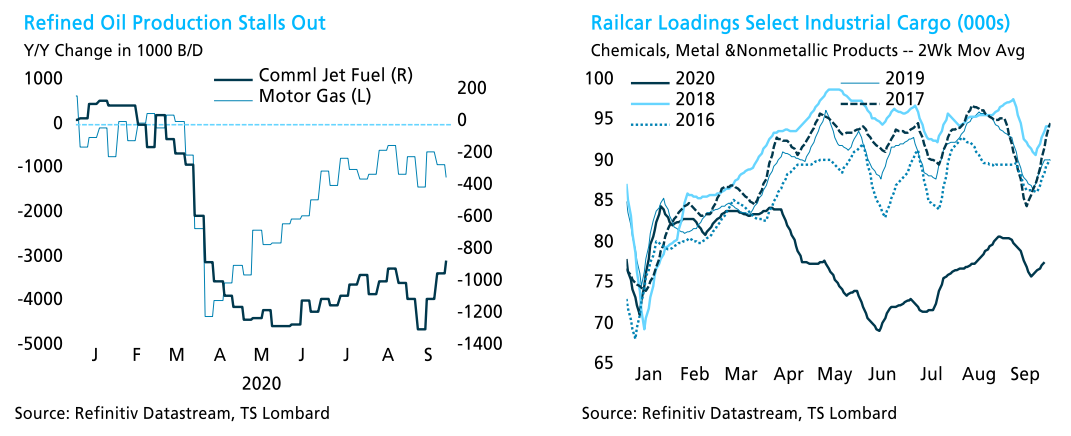

A Tweet and a SwooshA day of medical drama accompanied quite a shift in the market. The most important words weighing on us all Monday came from President Trump. In one of his more consequential tweets, he said: ""Feeling really good! Don't be afraid of Covid. Don't let it dominate your life. We have developed, under the Trump Administration, some really great drugs & knowledge. I feel better than I did 20 years ago!" The opening and closing statements sound a bit like hyperbole, but at their core was an attempt to reinforce a pro-growth narrative. Rather than take fright and start to limit our behavior once more in the face of rising numbers of positive tests, we should instead look at Covid-19's dwindling power to take lives, and move on. After a few days when it seemed that a very different and more fearful narrative could take precedence, Trump is trying to turn his illness to the economy's advantage. His messaging supports further opening. Meanwhile, his return to the White House also makes it more likely that some kind of fiscal stimulus can be agreed, and the whole incident concentrates minds nicely. Thus a scenario in which the economy keeps opening despite the disturbing medical developments of the last few days, while the U.S. Treasury still helps out with some more money, looks plausible again. That is the message if we look at the performance of stocks relative to bonds. If we use the best known exchange-traded funds for the S&P 500 and for long-dated Treasuries, stocks just enjoyed their best day of outperformance since May. It is almost exactly two years since U.S. stocks peaked relative to bonds, and there is a lot of ground still to make up, but this was a shift toward reflation:  Inflation expectations also rose, in line with this narrative. They aren't yet back to where they were when Federal Reserve Chairman Jerome Powell unveiled the central bank's new inflation strategy in August, and they remain well below the Fed's official target of 2%. Still, the trend again was a renewed belief in some reflation:  Turning to the yield curve — the spread between short and long yields, the two-10-year and two-30-year curves have steepened to the top of their range since the crisis. While there is still ample room for them to steepen further, a steeper curve does suggest a greater belief in a reflationary future. (As the bond market is behaving almost as though the Fed is already using yield curve control, the market signal this sends may not be that useful):  In other markets, the dollar had a bad day (implying a return of some risk appetite), while staying within recent bounds, while oil was strong (and again stayed within recent bounds). Still, if we look at the internal patterns within the stock market, there is little sign of any great reflationary optimism. Generally if growth is outperforming value, that implies a belief that growth is scarce — and growth stocks haven't really begun to give up any of the ground they have gained on value this year:  Smaller companies had a decent day in the U.S. but again the pattern remains — there is no sign of any protracted trend of outperformance of the mega-caps by small-caps, despite the horrible drubbing they took earlier in the year. Again, continuing insipid small-company performance doesn't suggest great optimism for reflation:  So the picture is of rebounding optimism amid Monday's political and medical drama, bounded by a continued downbeat assessment of growth prospects. As ever, these narratives are bound together by the virus, and its effect on the economy. Steve Blitz, U.S. economist for TS Lombard, offers an interesting analysis of the U.S. labor market. Many of those temporarily laid off earlier this year are now back at work, but the numbers describing themselves as permanently unemployed are rising:  Breaking down unemployment into sectors, he shows that the recovery from Covid-19 is following the widely predicted Nike "swoosh" shape, with a sharp dip followed by a much longer and slower recovery:  Similar "swoosh" shapes can be found in other real-time indicators cited by Blitz, including rail car loadings for chemicals, and refined oil production:  Faced with underlying weakness like this, it is critical to persuade people to go about their work as normal in the face of the virus. Hence the presidential tweet. And on top of that, the sluggishness of the recovery suggests some more money from Uncle Sam is in order. To quote Blitz: The lesson being learned is that the best stimulus for the economy is reopening, but the size of its bounce in Q3 also ties to the size of the CARES Act, and Fed policy. There is no more room for the Fed to ease, other than buy more Treasury securities in the event of a sharp equity market correction. This leaves to the onus of growth on the fiscal side – as both Powell and Mnuchin explained to Congress a couple of weeks ago. With the virus cutting off activity for a significant portion of the economy and thereby capping growth, transferring income to the affected firms and workers is paramount to keeping the economy afloat.

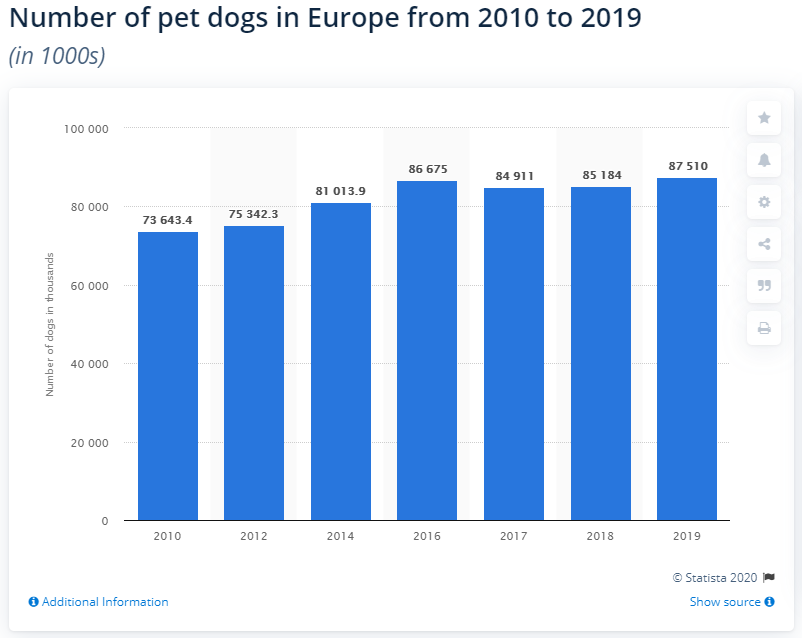

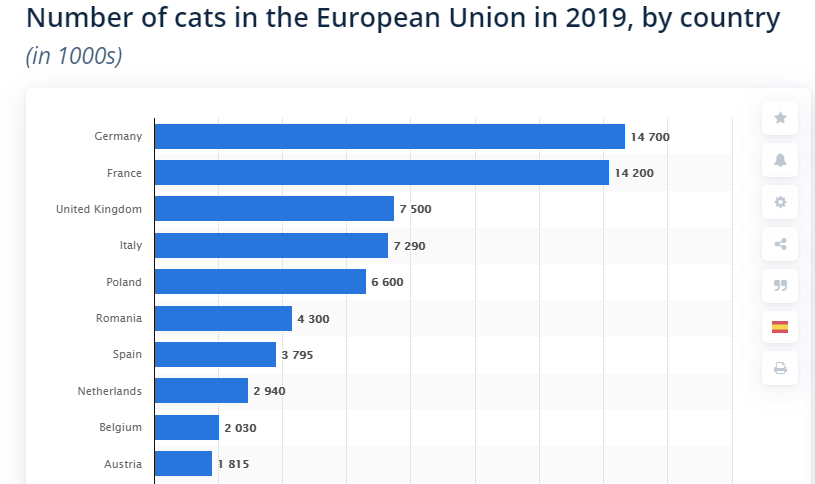

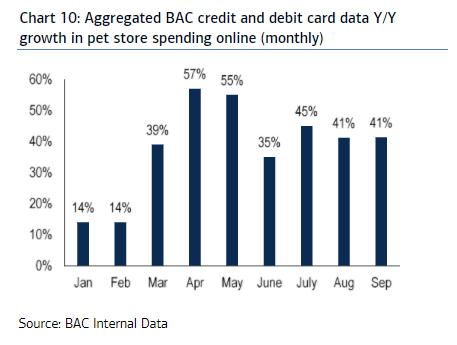

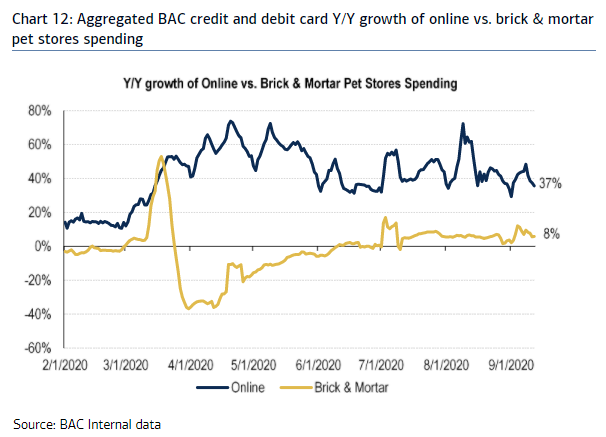

Monday's market action shows greater optimism that a fiscal deal can be reached, and that the steady reopening after Covid will continue. That would mean reflationary growth, now driven more by fiscal spending than minimal interest rates. But while hopes have risen since the shocking early news of the president's diagnosis, those hopes remain constrained. Even with the president back in the White House, uncertainty will persist while there are doubts over his fitness, and over the chances for a fiscal deal. Survival/Investment TipsThe Pets.com sock puppet was on to something. He was just 20 years ahead of his time. I have spent most of the last six months in an apartment with four other human beings and two cats. The cats have been invaluable in defusing the frequent risk of imminent conflict between the humans. Pets are great at this. Families can be riven by all kinds of difficulties; love for the pets is generally non-negotiable. If the cats helped a large family get through lockdown, the support they have given for those who've had to go through the experience on their own must be that much greater. Pets give you someone to talk to. And unlike parents/spouses/children, there's no danger that they'll talk back. Even before the pandemic arrived, more Europeans were choosing to own a dog:  Meanwhile, pet saturation across Europe isn't equal, at least for cats. Judging by these numbers from Statista, there is plenty of space for Britain and Italy in particular to reduce stress with a few more cats:  From the point of view of investors, pets bring guaranteed demand for a range of other products. While many of us are going to cancel a number of streaming service subscriptions when and if life returns to normal, cats and dogs (and lots of other furry, feathery and scaly friends) are for keeps. Thus if there is one industry that should offer secular growth post-pandemic, it should be pet products and services. Unfortunately, pure plays on the pets industry are hard to come by. The huge U.S. retailer PetsMart Inc., for example, is now owned by private equity, while a number of the best-known pet food brands are part of larger consumer products conglomerates. This helps increase demand for the few pure-play investments that can be found. They have been leapt on with enthusiasm as one of the few Covid-positive themes out there. This is how the U.K. group Pets at Home Group Plc, which runs a chain of large pet shops and veterinarians, has performed compared with the FTSE-250 over the last five years:  The company benefited from being designated "essential" during the worst of the pandemic, and its latest trading statement continues to be very bullish. In the U.S., the outlook is also good, prompting a big thematic report from BofA Securities Inc. on opportunities in the sector. Using Bank of America Corp. internal data, they found that growth in spending on pet-related retail products during 2020 has been remarkable and sustained:  They also found, unsurprisingly that online retailers have managed to do better than bricks-and-mortar rivals — although people evidently went to great lengths to stockpile pet food at the beginning of the pandemic. What is impressive is that even physical pet stores are seeing spending running 8% ahead of the same period last year:  It is possible that this trend is being overplayed. Even so, pet ownership does look like that wondrous thing, a secular growth trend. And even some of the worst dislocations forced by the pandemic, such as a projected exodus from the cities into suburbs and rural areas, should reinforce the trend. Maybe it's time to go long cat-flap manufacturers. Survival TipsMovies about cats have a bad reputation these days. And understandably so. But for a great paean to cats, which all the family can enjoy (providing they like cats), I strongly recommend Kedi (which I believe is Turkish for cats). It tells the story of six feral cats in Istanbul and their relationship with humans, yet works even better as a great documentary about Istanbul and the Turkish way of life. Gorgeous to watch, it's the cinematic equivalent of drinking a cup of hot cocoa. Or stroking a cat. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment