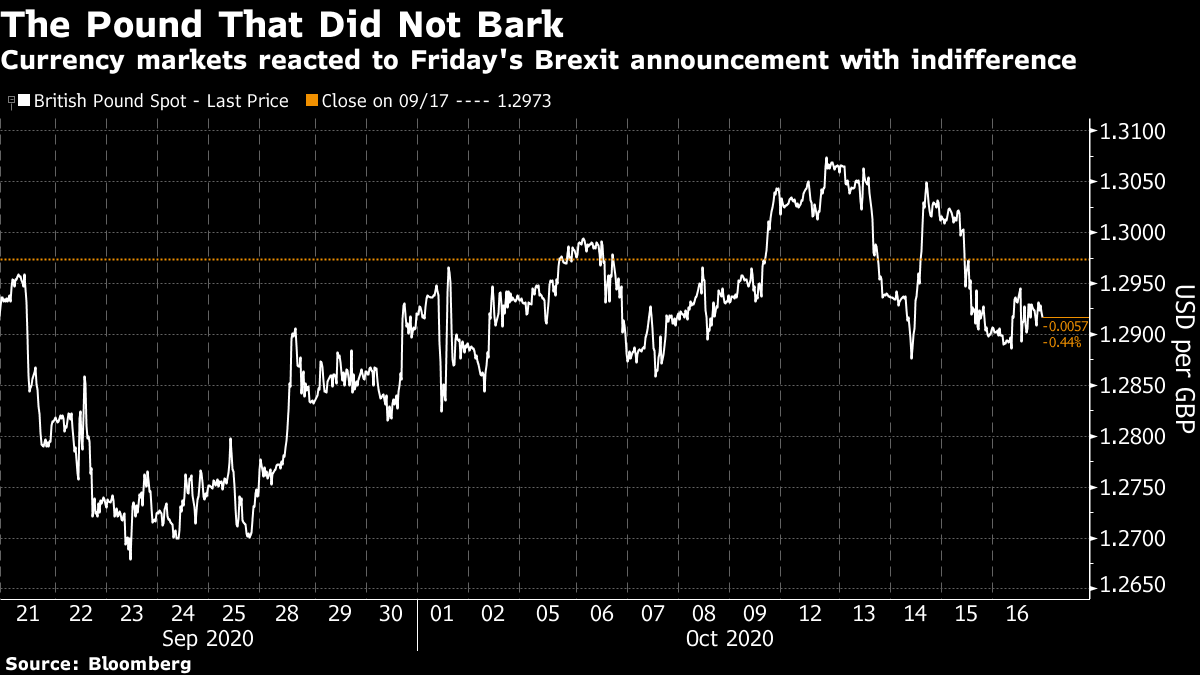

Rebuff for Boris The pound delivered a stinging rebuke to the U.K. Prime Minister Boris Johnson at the end of last week, by doing almost nothing. Friday brought Johnson's announcement that he was giving up on negotiations with the European Union over a new trade deal. Such a deal must be reached by Jan. 1, or the U.K. will trade with its biggest trading partners on the minimal terms dictated by the World Trade Organization (which Johnson refers to as the "Australia" option). He said: since we have only ten weeks until the end of the transition period on January 1, I have to make a judgment about the likely outcome and to get us all ready. And given that they have refused to negotiate seriously for much of the last few months, and given that this summit appears explicitly to rule out a Canada-style deal, I have concluded that we should get ready for January 1 with arrangements that are more like Australia's based on simple principles of global free trade. The EU is 17 miles away from the U.K. and can be reached by train. Australia is on the other side of the planet. On the face of it, the notion that the U.K. will trade on the same terms with both is horrifying. There is fear of debilitating logistical problems as a new and much more restrictive regime has to be imposed overnight. Britain's business community is strongly opposed. And Friday was a day that Johnson had himself imposed as a deadline. Brexit, and particularly the risk of just such an exit from the EU without a trade deal, has dominated moves in sterling for the best part of five years. So we might have expected a sharp fall for sterling. Instead, it had its quietest day in a month:  This isn't because traders think a "no-deal" exit wouldn't be so bad after all. It is because nobody believes a word Johnson says. There were enough weasel words in his statement to give him a path back, and his attempt to show strength in the negotiations simply isn't serious, in the eyes of currency traders. This was the judgment of Marc Chandler, investment strategist at Bannockburn Global Forex: The reason that there has not been an agreement is that neither side is willing to compromise. However, given the size differential and trade composition, the UK is at a distinct disadvantage, as French President Macron baldly stated. There are considerable costs in leaving the EU even with a deal. Custom checkpoints where there were previously none and additional rules and regulations will boost the cost of goods and services even if there is an agreement. While an exit is disruptive regardless, the resort to the WTO's basic rules is projected to hit growth quickly but also lower the path going forward. Simultaneously, the government is pushing a bill that would let it unwind past foreign acquisitions, especially by state-owned enterprises (obviously, China is top of mind), and the Bank of England is widely expected to ease policy next month (November 5). The contagion surge is obviously challenging on public health grounds, but it is also posing political challenges for Prime Minister. Johnson's position is weaker than the EU's anyway, because the U.K. is so much smaller. The resurgence of Covid-19 in the U.K., and the now passionate opposition to his plans for further lockdowns, weaken him further. Then there is the U.S. election. A "no-deal" exit would almost certainly mean the return of a hard customs border in Northern Ireland, and this would be a problem for Joe Biden, who is of proud Irish ancestry. In a rare example of Biden using his Twitter feed to announce policy, he said: We can't allow the Good Friday Agreement that brought peace to Northern Ireland to become a casualty of Brexit. Any trade deal between the U.S. and U.K. must be contingent upon respect for the Agreement and preventing the return of a hard border. Period. Any future post-Brexit U.K. trade policy will require a good trade deal with the U.S., so a Biden victory would cut off Johnson's leverage with the EU still further. Put this together, and traders soon parsed Johnson's statement to read that he had left ample room to return to negotiations. They could also see, as Therese Raphael points out, that some kind of basic deal remains overwhelmingly in the interests of both sides. The pound is near the bottom of its recent range against the euro, and so traders are worried by the risk of whiplash in the event of a deal, which would immediately raise gilt yields and aid U.K. bank stocks. With the downside risks already adequately priced and unchanged by Johnson's announcement, and with the upside risks still considerable, the pound stayed where it was. In the unlikely event that Johnson doesn't cave in time, and Britain drops out in disorderly fashion, Bloomberg Intelligence colleague Tanvir Sandhu suggests a "Brexit cocktail": - The 10-year gilt yield drops below zero;

- The Bank of England sets negative rates next year;

- The front-end of inflation expectations overshoots, thanks to the inflationary impact of new tariffs, and the fall in sterling;

- The FTSE-100 might outperform continental European indexes — the international profits of its many multinationals would be flattered by the fall in sterling.

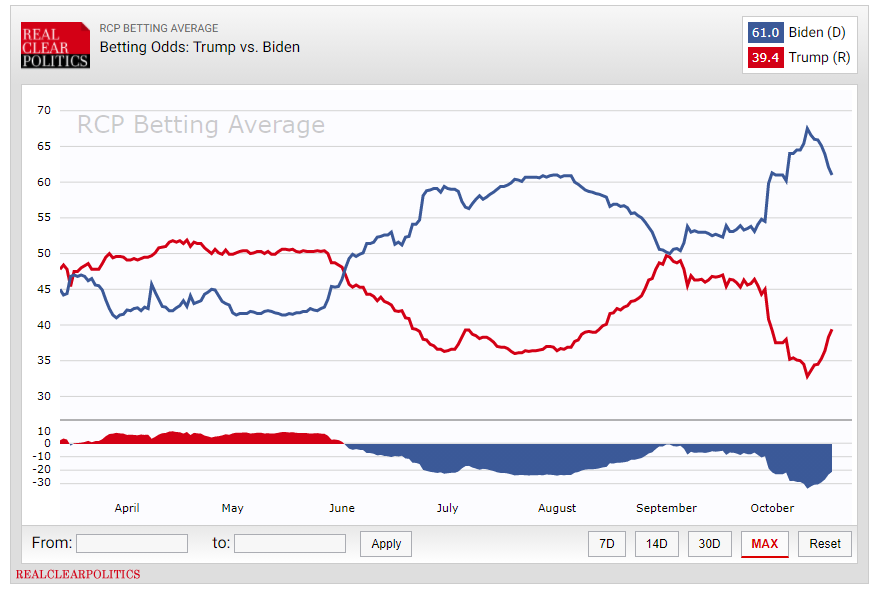

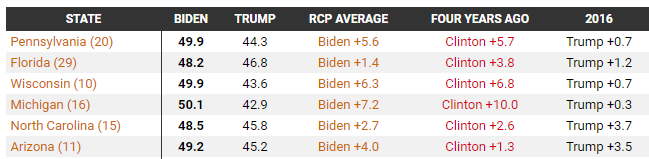

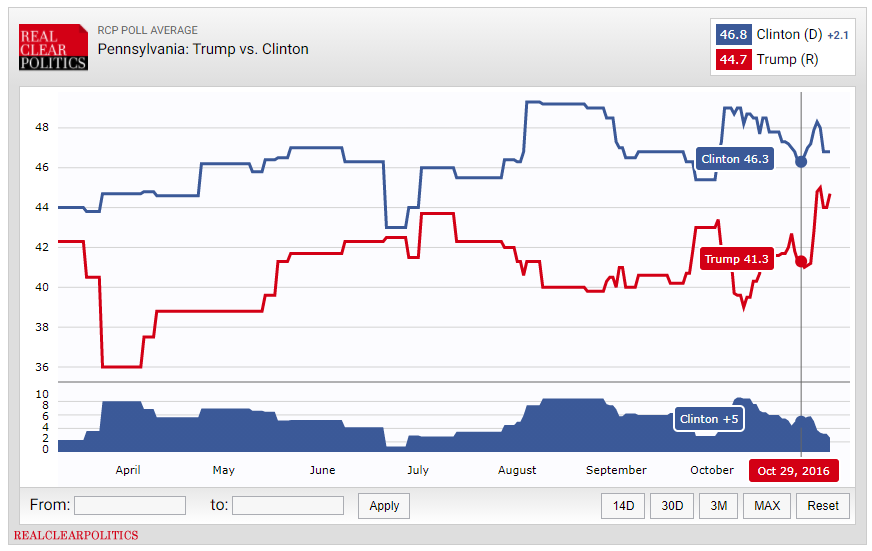

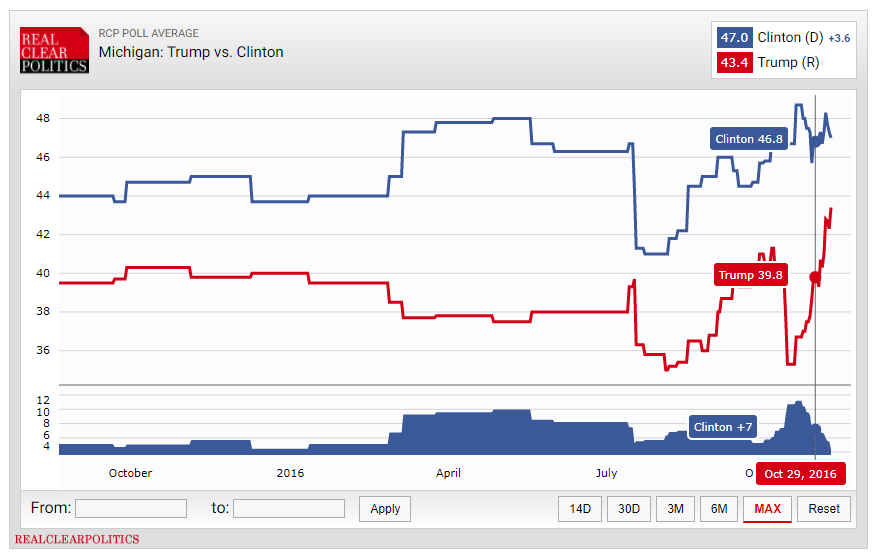

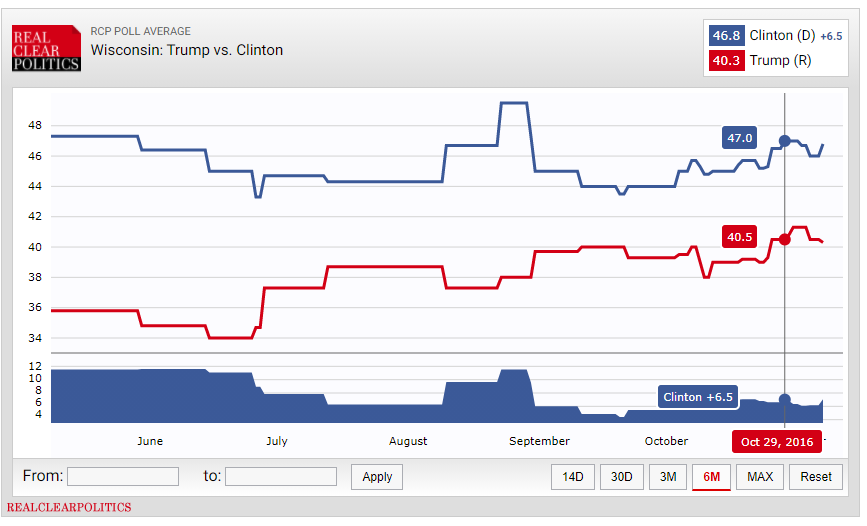

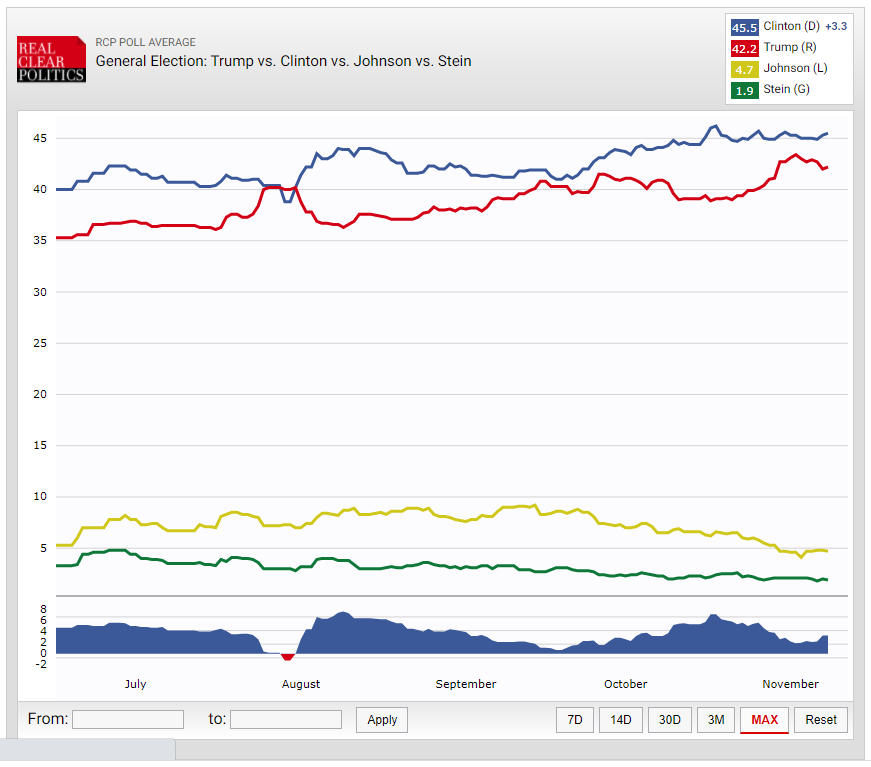

So if Johnson inadvertently follows through on his latest promises, a lot of investors will need to move in a hurry. And attention will inevitably move to whether Scotland will leave the U.K. For the long term, it is bad for the U.K., its economy and its currency that it has a prime minister nobody believes. America: 2016 On Our Mind Election day in the U.S. is two weeks away. The excitement is intense on the campaign trail, even though Joe Biden's lead in polls has been wide and consistent. This excitement largely hasn't been shared in markets, where brokers are adapting to the growing likelihood of a Biden victory by emphasizing the positives — such as more fiscal spending and a much less disruptive approach to trade — rather than the negatives, like higher corporate taxes and re-regulation. Some even say that a "blue wave" — meaning that Democrats would make the net gain of four seats they need to control the Senate as well — is fully priced in. However, the markets that express the most direct views suggest the race is tightening. These are the latest betting odds, as compiled by RealClearPolitics. As far as people with money at stake are concerned, Biden has lost the bounce he received from President Trump's coronavirus diagnosis at the end of last month. His prospects have declined in the last week, and his probability of winning is now put at 61%.  Models based on polls suggest his chances are more than 80%. Aggregators of polls show a national margin varying from 10.7 percentage points (FiveThirtyEight) to 9 percentage points (RealClearPolitics). Neither shows a sharp dip for Biden in the last week. What is going on? I suspect at this point that the lessons of 2016 are being over-learned. Everyone now knows that Trump can hold on to the presidency without winning the popular vote, and that the polls in the crucial battleground states are what matters. They also know that those polls were badly wrong last time, particularly in the Upper Midwest. Hence, I doubt anyone believes Biden is cruising to victory as comfortably as the polls predict. There is one key piece of evidence that the election is still on a knife-edge, which has been cited often of late. Biden is leading comfortably in the Upper Midwest, and in Florida. But RealClearPolitics shows that his lead in each of Pennsylvania, Florida, Wisconsin and Michigan is narrower now than Hillary Clinton's was on the same date in 2016. In all cases, Trump won:  Yet there are two factors that suggest Biden's lead in these states is more meaningful than Clinton's was. First, it's necessary to look at the pattern of the polls. Four years ago, President Trump's fortunes were close to their nadir after the Entertainment Hollywood tape. The polls narrowed sharply over the final weeks. This is Pennsylvania. The date of the revelation of FBI director James Comey's letter to Congress saying that he was reopening the investigation into Clinton's emails is marked:  Trump was rallying even before the letter, and gained much more thereafter. The polls necessarily come with a lag, and are consistent with the notion that a lot of previously undecided people decided in the last few days to go with Trump. The momentum was all on his side. Now, here is Michigan:  The gap was slightly wider, but the pattern is the same. There is a surge of support for Trump in the last two weeks, and given the lag in polling data, it again was not so surprising that he ended just in front. This was visible at the time, and President Barack Obama made an unscheduled campaign trip to Michigan in the last weekend before the vote. Finally, in Wisconsin, a pick-up in Trump's support toward the end is just visible, but this was one state that truly blindsided the pollsters, in large part because there were far fewer polls than in Michigan and Pennsylvania.  So it is true that Clinton had a better lead at this point, but the polls correctly showed her losing support to Trump in a dramatic way. Using 2016 as a model, Trump still needs to find a big surge of support from somewhere. This leads to a second major point of difference. In 2016, the unpopularity of both candidates meant there were two viable alternative candidates — Gary Johnson of the Libertarians, for conservatives who couldn't stomach Trump, and Jill Stein of the Greens, for liberals who detested Clinton. In September they at one point polled at 12% between them. This shows the RCP average for all four candidates. Both Stein and particularly Johnson's polling numbers fell badly in the last month of the campaign — and the final polls overstated their vote. Four years ago, there was a large pool of undecided voters who decided in the last few weeks that rather than make a protest vote they were prepared to support Trump:  There is no similar pool of undecideds or would-be protest voters to whom Trump can appeal this time. The 2016 precedent doesn't give as good a reason to ignore the polls and bet on Trump as it appears. Something might yet happen in the next two weeks. Biden needs to avoid major gaffes. Mobilization on election day and for the legal battle that could follow remain vital. But as it stands the odds available on a Biden victory look generous. And a "blue wave" still isn't priced in, and more likely than the market anticipates. Survival Tips Thank you for the increasing pile of suggestions for panic-button music. Here are a few more that might help in the next few weeks. First, if you like the solo piano, try Liszt's setting of Schubert's song Standchen, played here by Khatia Buniatishvili. Or if the solo human voice does it for you, here is Barbara Hendricks singing Schubert's original song. For something that relaxes in a different way, try the closing Presto from Mendelssohn's gloriously life-affirming octet, written when he was a teenager. It's performed here by the remarkable Swedish maestra Malin Broman, who plays all eight instruments at once. The video (but not the music) reminds me a little of this one. Finally, to relieve the tone from all the Classical music of late, this is Slow Down by Morcheeba, which may be the closest musical equivalent to a warm and comforting bath I know. Have a good week. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment