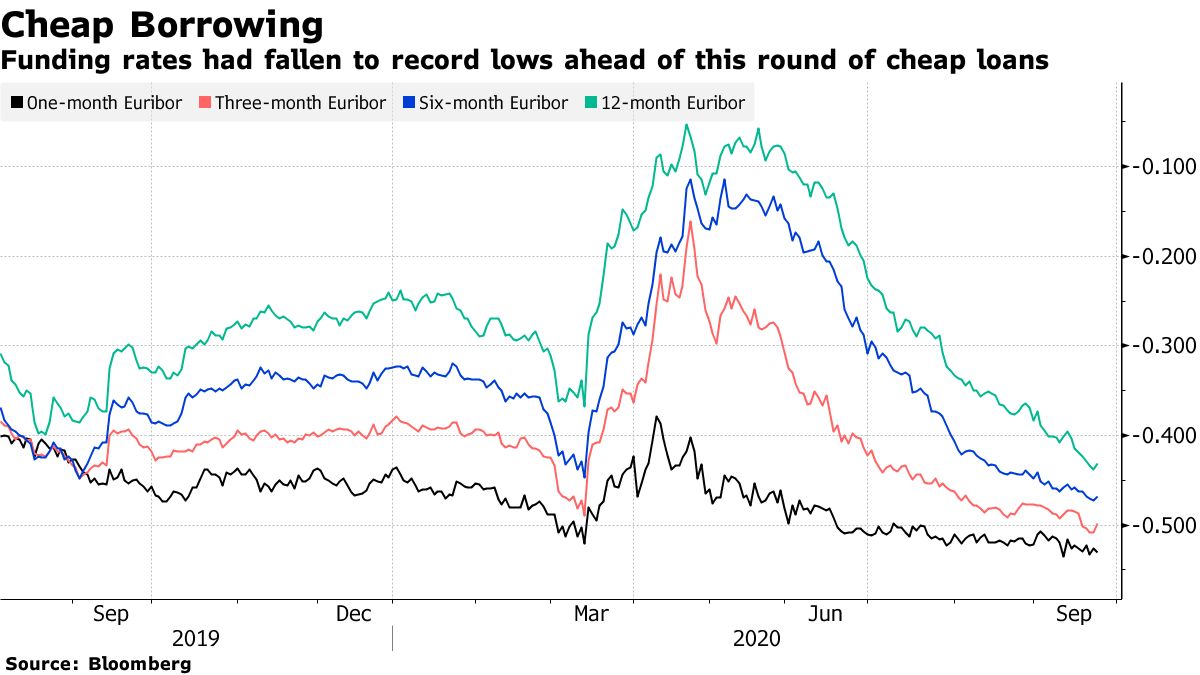

| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. British and European negotiators are hoping to put the rancor of the past two weeks behind them when they hold the final scheduled round of talks on their future relationship in Brussels next week. Despite the EU's threat of legal action over Prime Minister Boris Johnson's controversial plan to breach the terms of the Brexit divorce agreement, the two camps still see a wider trade deal as a real possibility. The week starts with Commission Vice-President Maros Sefcovic and Cabinet Office Minister Michael Gove trying to smooth things over on divorce issues before chief negotiators Michel Barnier and David Frost resume talks on bridging divisions over future ties. — Ian Wishart and Nikos Chrysoloras What's Happening ECB Race | Eurozone governments have until today to nominate candidates for a seat on the ECB executive board. While only the Dutch have made a public bid, we hear at least one more hopeful is likely to emerge. But no female candidates could raise eyebrows among EU lawmakers who'll have to weigh in, though ultimately cannot bloc the appointment. Remote Meetings | After the summit postponement and with an ever increasing number senior officials in quarantine, EU government envoys in Brussels will today discuss if it makes sense to keep having in-person ministerial meetings. An unlikely full return to video conferences would add to signs that the continent is heading back to a situation reminiscent of the lockdown days. Crypto Rules | The EU is taking a major step to regulate cryptocurrencies. The proposal, considered one of the most comprehensive anywhere, also seeks to set rules for so-called stablecoins such as Facebook's Libra, which has been treated as a wake-up call by regulators because it could potentially reach a large number of users and even threaten financial stability. Apple Pay | The EU is weighing legislation that could force Apple to open iPhone payment technology to competitors. The potential rules would grant other payment services a right of access to infrastructure such as near-field communication technology embedded in smartphones, the commission said Thursday, confirming a Bloomberg report last week. Week-Ahead | EU leaders will have another go at holding a summit on Thursday and Friday next week. Aside from Christine Lagarde's hearing at the European Parliament on Monday, the big item that could land next week is a World Trade Organization ruling allowing the EU to retaliate against illegal subsidies to Boeing with tariffs on U.S. exports. In Case You Missed It Airport Measures | Dogs that can sniff out the virus and quick-fire tests that can deliver results in 30 minutes are just some of the trials that airports in Europe are developing as a way to revive stunted international air travel. But will they work? Car Emissions | Germany's car industry is looking for assurances that a plan to make deeper cuts in carbon pollution in the EU will leave a loophole for the combustion engine. A new carbon reduction target proposed by the commission has caught the German car industry on the back foot, Brian Parkin reports. Vatican Scandal | Pope Francis accepted the resignation of an influential Church cardinal who was linked to a financial scandal that has tainted the Vatican. Francis, who placed humility at the core of his papacy, has sought to clean up Vatican finances and ensure transparency. Nightlife Clampdown | Meanwhile, it's Friday, and many of us won't be even be able to get a proper drink tonight. Paris followed London in imposing a 10 p.m. curfew on bars and restaurants. And those who will brave the virus to go skiing this winter, you should forget off-piste partying, according to the latest restrictions announced by Austria. Chart of the Day  Eurozone banks took 174.5 billion euros in another dose of ultra-cheap funding as the ECB gives them every possible incentive to keep lending to the pandemic-stricken economy. The extraordinary access to cheap cash — combined with other monetary stimulus such as massive bond-buying programs — does raise the prospect of side effects such as bubbles and risky lending. Today's Agenda Like the Brussels Edition? Don't keep it to yourself. Colleagues and friends can sign up here. We also publish the Brexit Bulletin, a daily briefing on the latest on the U.K.'s departure from the EU. For even more: Subscribe to Bloomberg All Access for full global news coverage and two in-depth daily newsletters, The Bloomberg Open and The Bloomberg Close. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. |

Post a Comment