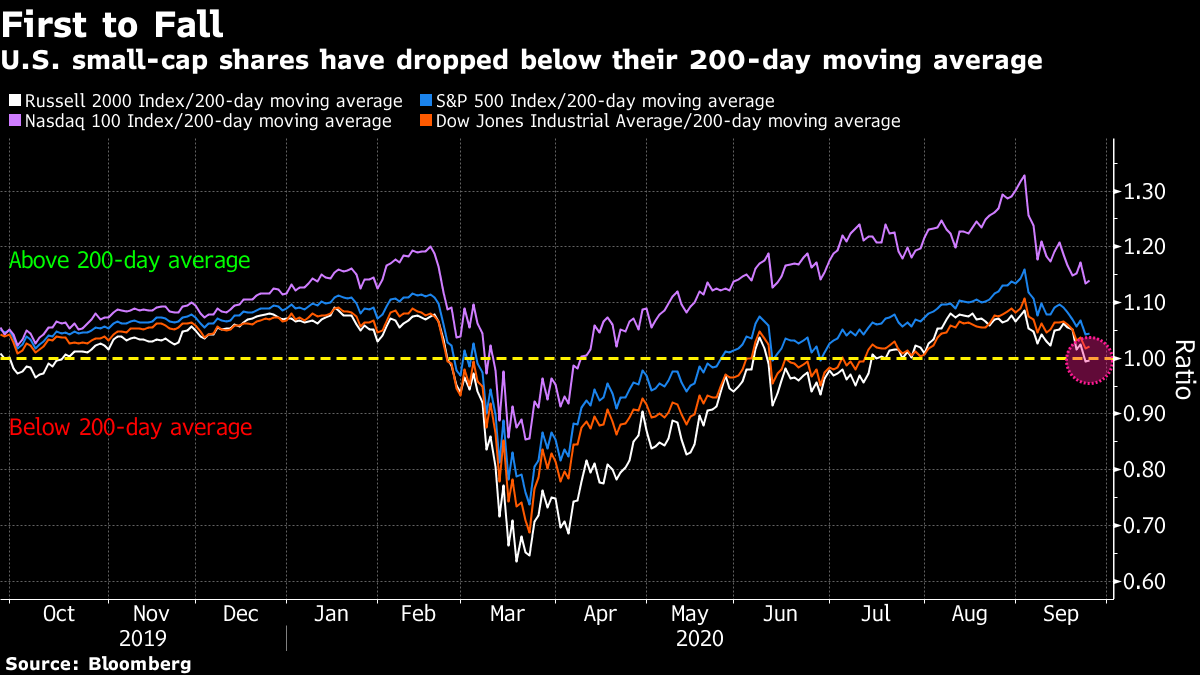

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. Coronavirus cases continue to jump in Europe, there's reasons to be cheerful on U.S. stimulus prospects and Deliveroo is eyeing an initial public offering. Here's what's moving markets. Here To Stay This week has been marked by the realization that Covid-19 and restrictions to control the disease aren't going away any time soon. Hospitals in Madrid are filling up with seriously ill patients again, and the U.K. has reported its highest number of new coronavirus cases in a single day since the start of the pandemic -- though it's worth keeping the country's increased testing capacity in mind when making comparisons with the surge six months ago. France also reported a record number of new cases, and Austria is the latest country to add to its controls, banning apres-ski partying for the upcoming winter season. U.S. Stimulus Hope House Democrats have started drafting a stimulus proposal of roughly $2.4 trillion that they can take into possible negotiations with the White House and Senate Republicans, according to House Democratic officials. Economists have expressed doubts over whether additional funding would be seen this year. The U.S. S&P 500 briefly erased its year-to-date gain yesterday, amid additional risks like high-frequency data indicating a slowdown in the recovery and as protests continue to rage over the fatal shooting of Breonna Taylor. IPO Market Delivers U.K. food-delivery startup Deliveroo has begun preliminary talks to explore an initial public offering, people familiar with the matter said. The Amazon.com Inc.-backed company has had discussions with potential advisers regarding the possibility of an IPO in 2021, the people said, asking not to be identified as the talks are private. Meanwhile, three new companies will join European exchanges today. Defense supplier Hensoldt AG is listing in Frankfurt, while London will welcome restaurant firm Various Eateries Plc as well as hydropower company China Yangtze Power Co. via the Shanghai-London Stock Connect program. Fleeting Romance LVMH and Tiffany & Co. are staying away from the negotiating table even though a U.S. judge urged them to settle lawsuits over their ill-fated deal to combine, according to people familiar with their thinking. The companies instead are preparing for a trial scheduled to begin on Jan. 5, said the people. That could temper investor optimism, after 53% of those responding to a Sanford C. Bernstein poll said they thought the deal could still go through. While the companies don't currently plan to enter negotiations, there are likely to be pressure points that could prompt renewed discussions, a person familiar with the matter said. Coming Up… European futures are edging higher this morning, with the Stoxx Europe 600 benchmark looking to avoid its worst week since June. European Brexit negotiators have agreed to put aside their opposition to U.K. Prime Minister Boris Johnson's plan to break international law as they continue to try to secure a deal. Meanwhile, rebel Conservatives might attempt to seize powers to block Britain's new virus rules, while there may be further reaction to Chancellor Rishi Sunak's latest stimulus plan. Incidentally, we'll also get data on U.K. public sector borrowing today, in addition to Italian consumer confidence and U.S. durable goods orders. In corporate earnings, Soccer club Borussia Dortmund updates as Germany attempts to bring some fans back into stadiums. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning While the early-September stock slump was sharp and somewhat unexpected, there's a growing sense that U.S. equities are set for a steady grind lower, at least until the election fog clears. The 50-day moving average tried and failed to halt the retreat in the major U.S. benchmarks and now traders are warily eyeing the longer term 200-day ones. There, the first domino has fallen. The Russell 2000 Index of smaller companies has dropped below its closely watched technical level, the first notable index to do so. Amid mounting concern over the likelihood of further U.S. stimulus and worries about a resurgent coronavirus, it seems small-cap shares are once again flagging a warning to investors. The path of small-cap stocks is often seen as an indicator of strength in the U.S. economy, so the bearish technical signal represents an additional blow to investor sentiment.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment