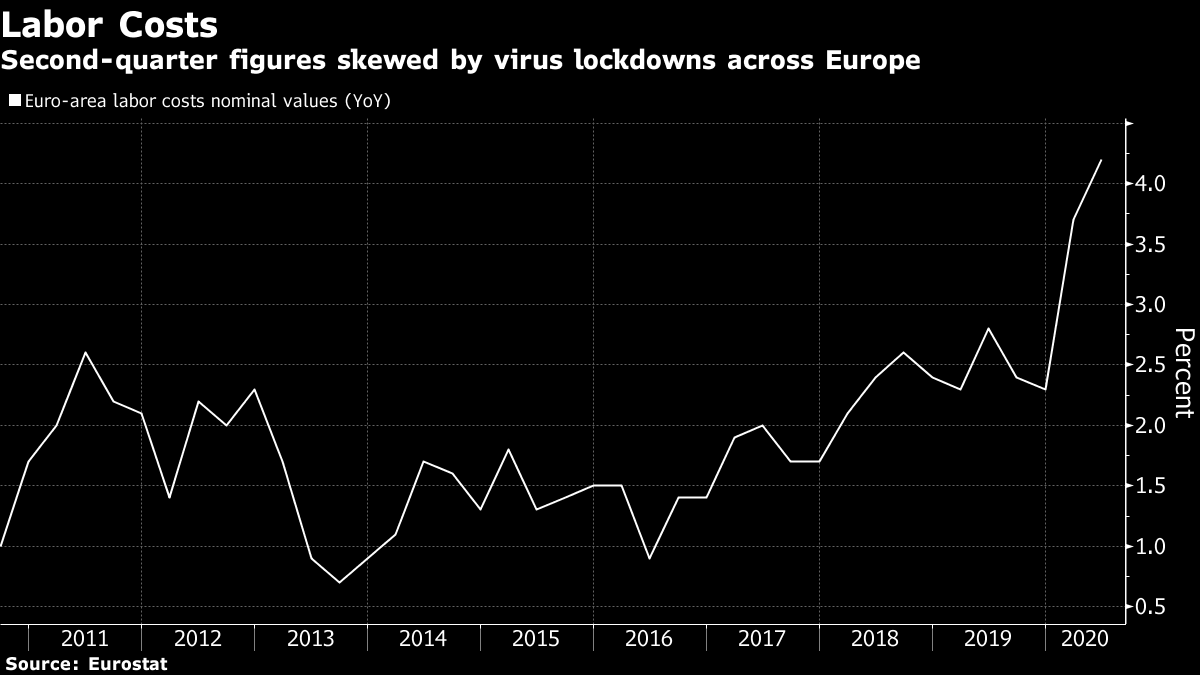

| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. Ursula von der Leyen will today lay out the EU executive arm's vision for the post-pandemic world. Expect policy messages across the board — from how to manage migration to dealing with China. But in her first State of the Union address, von der Leyen will mostly double down on the two key themes that have defined her presidency so far: the Green Deal and digital transition. Along with a more ambitious emissions-cutting target for 2030, she will talk about flagship projects to be co-financed from the EU budget that can shape the European economy of tomorrow. While acknowledging that the state of the Union is fragile, her message will be that after the deal on a jointly-financed recovery fund, the money, the vision and the plan to build a more resilient Europe are here. As for her message to the U.K.? She will say that you can't build a new relationship without trust. — Nikos Chrysoloras and Alexander Weber What's Happening Merger Control | Are mega deals that spawn European champions and act as counterweight to China and the U.S. a good thing? Paris and Berlin seem to think so and would like to see EU competition authorities show a more lenient approach. Here's what leaders will likely decide about this during their summit next week. Brexit Reprieve | The EU is set to give finance firms 18 months of access to critical derivatives infrastructure in the U.K. after the end of the Brexit transition period, removing the most pressing concern for the industry ahead of a potentially chaotic divorce. Italy meanwhile insisted that the bloc shouldn't pull out of trade talks with the U.K. despite Boris Johnson's plan to renege on parts of the divorce accord. Pound Bets | Pound traders betting that the U.K. and EU are bluffing in their latest Brexit dispute are set for a windfall if history repeats itself. That's because options to position for sterling gains have now become relatively cheap, as most investors are rushing the other way to hedge against a slump in case Britain fails to agree a trade deal with the bloc this year. China's Response | Zhang Ming, head of the Chinese Mission to the EU, lambasted the bloc's restrictions on Huawei and accused the U.S. of "economic bullying." His comments highlight Beijing's increasing assertiveness against what it sees as unfair treatment from Western governments. Going Tough | Italy has been gradually shifting its stance toward Beijing after the previous government joined China's massive Belt and Road Initiative infrastructure project in March 2019. Now it's pledging to march in line with its Western allies, after the U.S. and EU took Rome to task for cozying up to the Asian power. In Case You Missed It Turkey Ties | EU foreign-policy chief Josep Borrell said EU relations with Turkey are at a crossroads as the bloc presses Ankara to halt controversial energy exploration in the eastern Mediterranean. The bloc fully supports Greece and Cyprus in the dispute, and Turkish de-escalation is needed, he told lawmakers in Brussels. Wirecard Failure | The Wirecard collapse prompted Ernst & Young to send a letter to clients expressing "regret" that it didn't uncover fraud at the company sooner. The accounting firm has faced widespread criticism over its failure to properly scrutinize Wirecard's accounts over several years. Climate Agenda | The pandemic could easily have derailed Christine Lagarde's plan to enlist the European Central Bank in the fight against climate change. But instead of allowing Covid-19 to bump the issue off her agenda, Lagarde has used it to try to persuade skeptics that phenomena such as global warming are well within the remit of monetary policy. Swine Sickness | German authorities said five more wild boars have tested positive for African swine fever, close to where the nation's first case was found last week and which prompted some non-EU countries to ban imports. Germany can still ship meat within the bloc under certain conditions, but livestock prices have taken a hit. U.K. Support | Chancellor of the Exchequer Rishi Sunak gave the strongest hint yet that he'll support U.K. jobs after the government's furlough program ends next month, meeting a key demand of business lobbies and the opposition Labour Party. The U.K. stands out among major European economies for refusing to extend the flagship crisis plan. Chart of the Day  Labor costs in the euro area surged in the second quarter, skewed by coronavirus lockdowns that shut huge parts of the economy and reduced workers' hours. The loss of hours wasn't matched by a decrease in wages, as businesses kept people on payrolls thanks to subsidies from government furlough programs. Today's Agenda All times CET. - 9:15 a.m. Von der Leyen delivers State of the Union address at the European Parliament

- 10 a.m. Updated OECD forecasts for G-20 economies

- 11 a.m. Eurostat to publish July trade data

- 2:15 p.m. EU antitrust official Guersent speaks at International Competition Network online conference

- 3 p.m. Turkish Deputy Foreign Minister and Director for EU Affairs speaks at EPC event

- Informal meeting of EU education ministers

Like the Brussels Edition? Don't keep it to yourself. Colleagues and friends can sign up here. We also publish the Brexit Bulletin, a daily briefing on the latest on the U.K.'s departure from the EU. For even more: Subscribe to Bloomberg All Access for full global news coverage and two in-depth daily newsletters, The Bloomberg Open and The Bloomberg Close. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. |

Post a Comment