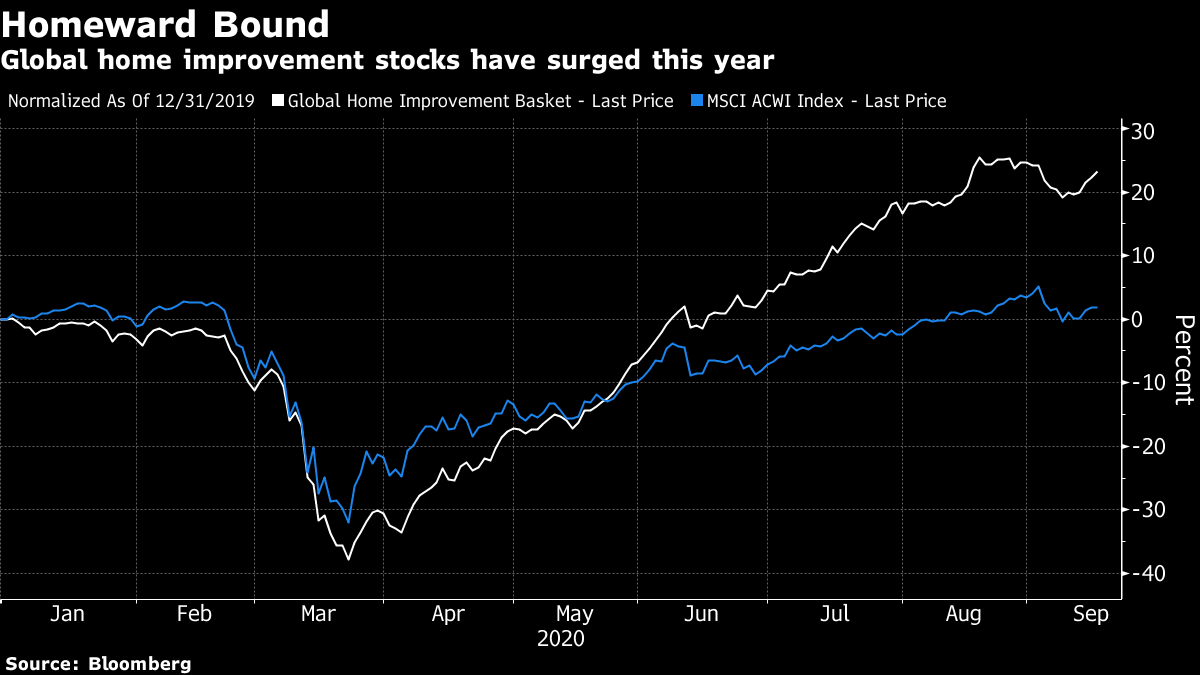

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. It's Fed day, Boris Johnson is trying to stem a party revolt, and the FTC has Facebook in its sights. Here's what's moving markets. Violation The World Trade Organization undercut the main justification for President Donald Trump's trade war against China, saying that American tariffs on Chinese goods violate international rules. While the ruling bolsters Beijing's claims, Washington can effectively veto the decision by lodging an appeal at any point in the next 60 days. That's because the Trump administration has already paralyzed the WTO's appellate body, a tactic that has rendered toothless the world's foremost arbiter of trade. Mutiny Boris Johnson has held talks with rebels in the U.K.'s ruling Conservative Party in an attempt to win their backing for his controversial law rewriting part of the Brexit deal he struck with the European Union last year. The prime minister is facing a revolt from Tories dismayed at his plan to break international law by unilaterally re-writing parts of the Brexit Withdrawal Agreement he signed with the EU. No deal has been struck with the rebels yet, and officials are still braced for an ugly fight over the proposals next week, people familiar with the matter said. Meanwhile, the U.K. government is also facing criticism about its coronavirus test and trace system, with labs overwhelmed as demand for tests rises. Scrutiny The U.S. Federal Trade Commission has been investigating Facebook Inc. for more than a year over whether the social media giant has harmed competition and could file a case by the end of the year, according to a person familiar. A lawsuit by the FTC would mark another major escalation by U.S. officials in their campaign against America's technology giants, which have come under intense scrutiny in Washington over their dominant market positions. Facebook and the FTC declined to comment. At a hearing in July, House lawmakers investigating U.S. tech giants had accused co-founder and CEO Mark Zuckerberg of acquiring smaller companies as a strategy to eliminate competition from rivals. Documents showed Zuckerberg internally discussed how Instagram "could be very disruptive to us." Crunch Time The global race to develop coronavirus vaccines is approaching a key milestone, with the first results from broad trials of shots developed by researchers in the U.S., Europe and China expected in coming weeks. On Tuesday, U.S. President Donald Trump again raised hopes -- and concern -- about swift approval for a coronavirus vaccine, saying that the shot could be ready within four weeks. He made the comments at a town hall one day after Chinese claims that a vaccine could be ready by November. Meanwhile, researchers monitoring Pfizer Inc.'s giant trial of an experimental Covid-19 vaccine have reported no safety problems even after more than 12,000 people received their second of two doses. Coming Up… This morning, Spanish textile giant Inditex SA is due to report first-half results, with analysts forecasting a net loss, and we're getting the August reading for U.K. inflation. EU Commission President Ursula von der Leyen will deliver her first annual State of the Union address, where she is expected to comment on deteriorating Brexit talks, relations with China, and the region's recovery from the pandemic. Later, the U.S. Federal Reserve is highly likely to leave rates untouched, while updating its economic projections and forward guidance on monetary policy. The officials are expected to project rates staying near zero though 2023. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning Global tech stocks aren't the only ones due an investor checkup. Home improvement companies have also surged during the pandemic, and it's fair to ask if this is as good as it gets for them. An equal-weighted basket of 30 of the world's biggest home improvement companies is up 23% this year, easily besting the 2% rise in the MSCI AC World Index, according to data compiled by Bloomberg. The gauge has almost doubled from its March lows, outpacing even the 63% rise in the high-flying Nasdaq-100 Index. The gains have left stocks in the basket -- including U.S. giant Home Depot Inc., Kingfisher Plc from the U.K. and Germany's Hornbach Holding AG -- trading on an average of 25 times forward earnings, up from 19 times at the end of February. While the coronavirus has upended large swathes of the global economy, worldwide lockdowns have ignited a boom in home improvements. Home Depot reported second-quarter revenue growth that was more than double an already high level of expectations, while reports from Germany suggested do-it-yourself sales soared by 16% in the first half. But in a stock market that's ever forward looking, it's probably the right time to question whether the boom is sustainable, particularly as lockdowns ease and stimulus payments from governments look set to come to an end. Not to mention the hopeful competition home DIY budgets will get from vacations and other outside activities, should a vaccine become widely available next year.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment