Fed decision day, vaccine optimism, and a less-gloomy OECD. Zero The Federal Open Market Committee is all but certain to keep its benchmark rate unchanged when it announces its monetary policy decision, the last before November's election, at 2:00 p.m. Eastern Time. The release will be accompanied by new economic forecasts that are expected to show officials see interest rates close to zero through 2023. Investors will be on the lookout for any further clarity on the changes announced by Chair Jerome Powell at the Jackson Hole symposium last month. Less than half the economists surveyed by Bloomberg think the bank will commit today to allowing inflation overshoot its 2% target before tightening. Powell will hold a press conference 30 minutes after the decision is announced. Vaccine soon? President Donald Trump again raised hopes for a Covid-19 vaccine saying it could be ready in "three weeks, four weeks." The president is not alone in predicting results before year-end, with China's top bio-safety scientist saying that she sees that country's vaccine ready for public use as early as November. The pressure to find an effective defense against the disease remains as high as ever, with little sign the pandemic is under control in many parts of the world. The challenges facing Wall Street banks pushing to get employees back into the office were highlighted after JPMorgan Chase & Co. sent some of its Manhattan workers home after an employee tested positive for the virus. Not as bad as expectedThe latest forecast for global growth from the OECD shows that the slump won't be as sharp as previously feared. The Paris-based organization this morning said that it now expects the world economy to shrink 4.5% this year, less than its June prediction for a 6% decline. The less-gloomy view reflects recent positive developments in U.S. employment and better-than-expected China data. The report did say that the recovery would need support from governments and central banks for some time yet. Markets rise Global equity benchmarks are creeping higher again as investors look for the Fed to maintain its dovish stance and perhaps take some cheer from the optimistic vaccine forecasts. Overnight the MSCI Asia Pacific Index added 0.5% while Japan's Topix index closed 0.2% higher. In Europe, the Stoxx 600 Index had gained 0.5% by 5:50 a.m. with traders favoring cyclical stocks in the wake of the OECD report. S&P 500 futures pointed to a higher open, the 10-year Treasury yield was at 0.679% and gold gained. Coming up...This morning's retail sales report for August at 8:30 a.m. will give the first snapshot of consumer behavior after the expiration of the $600 unemployment benefit top-up in July. The EIA oil inventory report at 10:30 a.m. may confirm a reduction in stockpiles after industry data pointed to a surprise decline. After the Fed decision, we have July TIC flow numbers at 4:00 p.m. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningThe latest BIS quarterly review has a great discussion on the stock market rally that has occurred over the last six months, despite the depressed levels of economic activity. If you scroll down to 'Box B', there's an interesting section authored by Fernando Avalos and Dora Xia that attempts to decompose the market's gains into short- and long-term considerations by looking at dividend futures on both the S&P 500 and the Euro Stoxx 50 Index. Traditional finance states that equity prices represent the discounted present value of all future dividend payments, and so the pricing of dividend futures can be used as a reasonable proxy for how investors see the fundamentals of the business evolving.

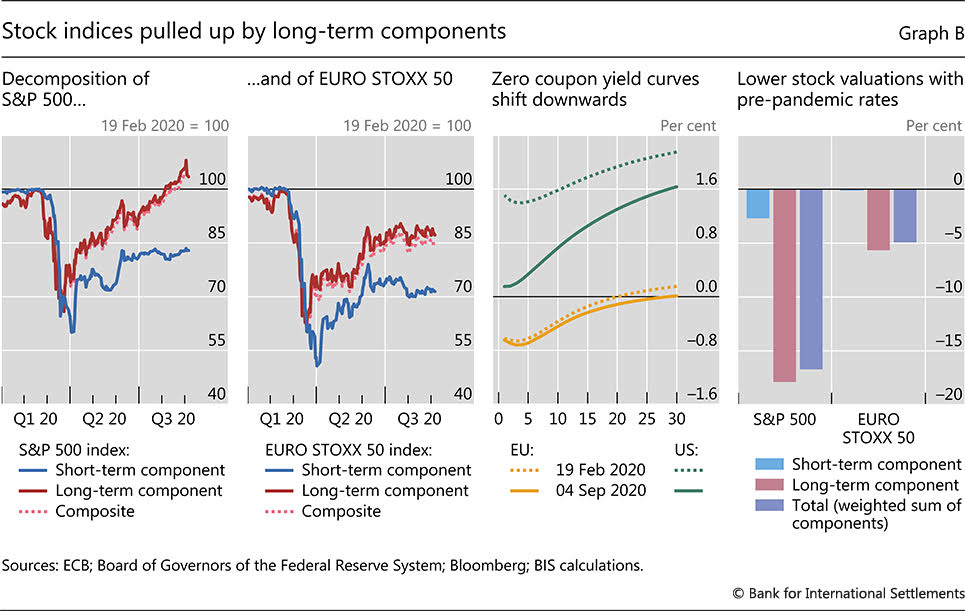

Their analysis does two things. First, by looking at these futures they find that contracts expiring in 2024 have rebounded a lot more since the March-April trough than contracts that expire this year. In other words, while this year is expected to be still quite rough, the long-term impairment to corporate earnings power isn't expected to be as bad as it was earlier in the crisis.  The next thing they note is that because interest rates have plunged so hard (particularly in the U.S.), the value of those dividends in 2024 are worth a lot more than they otherwise would have been had rates stayed the same. Again, this is basically Finance 101 stuff. In theory, the lower interest rates are, the more you're willing to pay for cash flow or dividends far out into the future. If interest rates are higher, you'd demand greater compensation for 2024 and beyond earnings. As such the authors find that the huge surge in stocks can be explained, especially in the U.S., by the combination of a strong rebound in expected dividends combined with a big drop in rates. Had rates stayed the same, valuations may be over 15% less than they are now.

There's one more implication that's interesting here, which they don't get into, but explains why growth stocks have absolutely obliterated value stocks this year. If the whole story is that investors will pay up extra for out-year dividends (or earnings, or any other proxy for corporate performance) then companies which are expected to grow rapidly will see an even greater valuation boost than those whose fortunes are expected to proceed on a more stable, linear path. Relative to the present situation, investors expect your typical cloud software company's 2024 earnings to be much higher than that of, say, a bank. And this analysis helps explain why investors have gone wild for them this year. Joe Weisental is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment