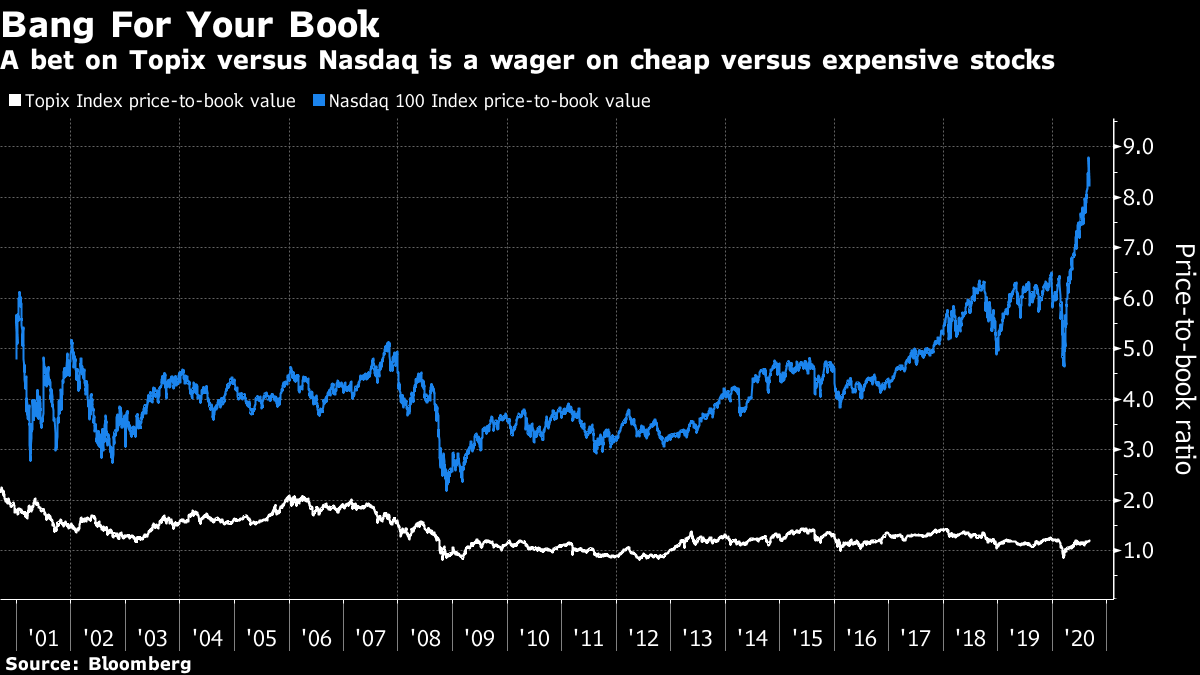

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. Brexit talks face a reckoning, European infection rates are ticking higher and call options are dominating stocks. Here's what's moving markets. 'Moment of Reckoning' Face-to-face talks between U.K. and European negotiators will resume in London with both sides having bemoaned the lack of progress that has been made. Any signs that will change are thin on the ground. The U.K. is stepping up its preparations for the trade talks to fail and is planning new legislation that would override key parts of its withdrawal agreement, a move that could threaten the negotiations further. U.K. Foreign Secretary Dominic Raab said this week is the "moment of reckoning" for getting a deal done but warned over the impasse that still exists over state aid and fisheries, while U.K. negotiator David Frost sought to temper any high hopes that some headway will be made. All this as the rumblings in Westminster suggest growing discontent among Conservatives with Prime Minister Boris Johnson's grip on the leadership. Covid Fatigue U.S. virus cases remain steady but the infection numbers in the U.K. increased by the most in more than three months, while the rate in Germany also ticked higher. France is also seeing a spike in numbers, just as schools start to head back to class, and all of this comes ahead of a crucial few weeks for authorities trying to keep rates under control in which university students will start heading to campus. Across Europe, the increasing concern is a growing fatigue among citizens with the virus and the constraints it has placed on general life, a risk that a former head of the U.S. Food and Drug Administration has highlighted too. Elsewhere, India has overtaken Brazil as the country with the world's second-highest number of virus cases. Call Options U.S. markets will be closed for Labor Day, providing a breather after a volatile week for mega-cap tech stocks dominated by big options positions. This huge increase in call options has been driven by another overriding theme of the recent rally in stocks, the boom of retail trading. This trend is happening on a grand scale in the tech sector and Japan's Softbank Corp. was revealed among those profiting from it, while fund managers are often left baffled by the outsized reactions some stocks are seeing compared to the underlying news driving the move. Now the question will be how long things can keep defying gravity or whether bloodbaths like those seen last week will be repeated. Looking at the history, at least one more bad day may be on the cards. IPO Frenzy A byproduct of these hot markets is a surge in enthusiasm to go public, a pattern which has emerged in the U.S. and Asia, leaving Europe's market for new listings in the dust. But there are signs of life. Along with a small German camper van maker and a mini-revival in London courtesy of an online retailer, academic publisher Springer Nature is preparing to kick off an IPO in Frankfurt and pharmaceutical giant Sanofi SA plans to sell shares in its drug-ingredients unit in coming months. Still, it pales next to a dating app, self-driving cars and an Asian tech behemoth, so there remains plenty of work to be done for Europe to catch up. Coming Up… European stock futures are pointing firmly higher after a mixed session in Asia, with the dollar edging higher and the crude oil continuing with its recent losses. German industrial production tops the agenda for economic data on a slow day for European earnings, though watch for more on the bid made by Veolia Environnement SA for fellow French water and waste group Suez SA, which the latter's chief rebuffed as undervaluing the company over the weekend. Still, that leaves plenty of time to consider the uncertain final leg of the year the global economy faces. What We've Been Reading This is what's caught our eye over the weekend. And finally, here's what Cormac Mullen is interested in this morning Two of the most-talked-about trades in markets recently have involved Japan — Warren Buffett's wager on the country's historic trading houses and now SoftBank founder Masayoshi Son's bullish option bets on U.S. tech stocks. While one is a long-term investment and the other seems more like a trade, both are giant wagers on the value versus growth theme at a key moment in history when global equities are already at record highs. So who do you follow? The fundamentalists will quickly opt for Buffett; after all, Japan's Topix Index is trading at 1.2 times its book value versus a nosebleed 8.2 times for the Nasdaq 100 — using the benchmarks as proxies for the two strategies. The momentum traders will point to the seemingly unstoppable rise in megacap tech which, unlike during the dotcom bubble, comes with solid earnings and strong growth prospects. But focusing on the two billionaires behind the giant wagers, it's hard not to have more comfort with the level of diligence Buffett is renowned for over the seemingly more instinctive approach of Son. Reports the tech trades have been deeply controversial within SoftBank — a company not known for a shrinking violet approach to corporate valuation — are worrying and its investors clearly weren't impressed, with shares slumping Monday despite the reported size of paper gains. I'm going with Buffett on this one.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment