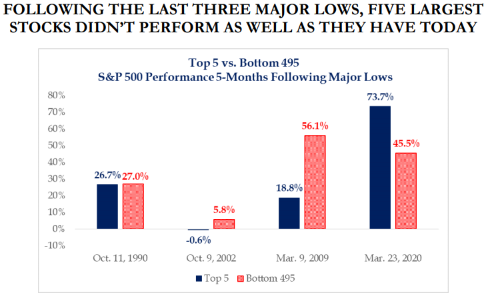

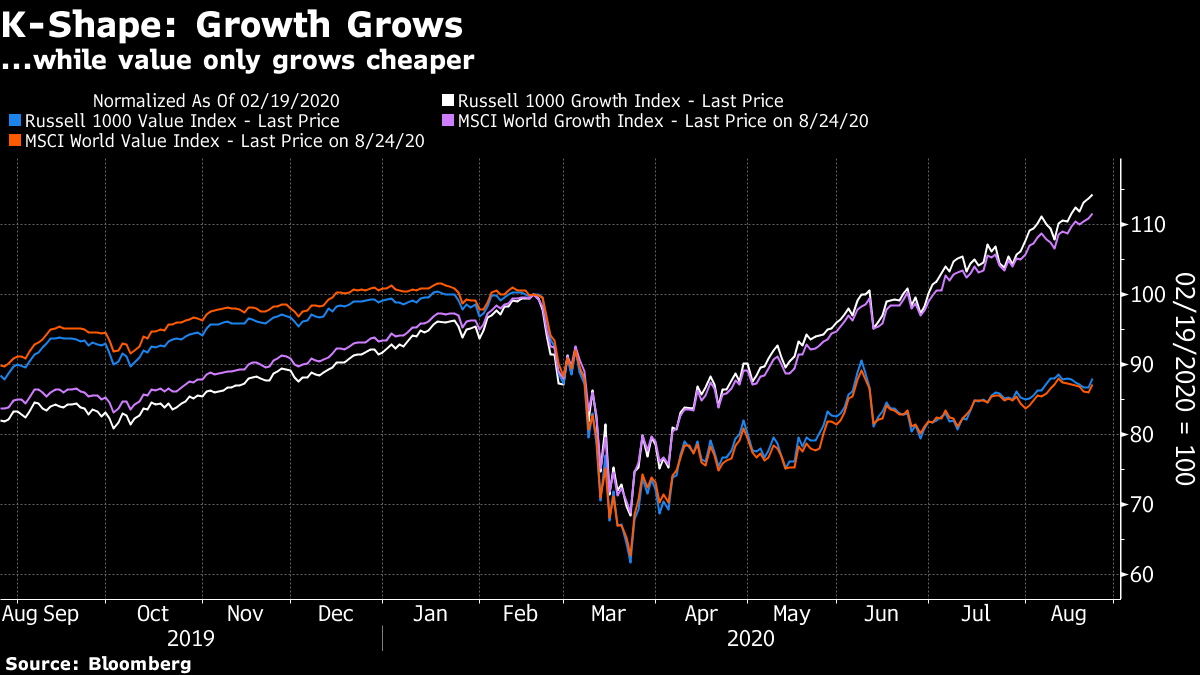

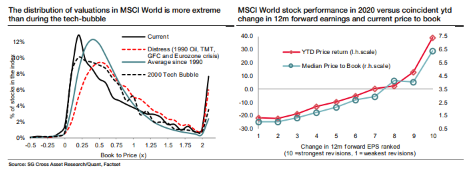

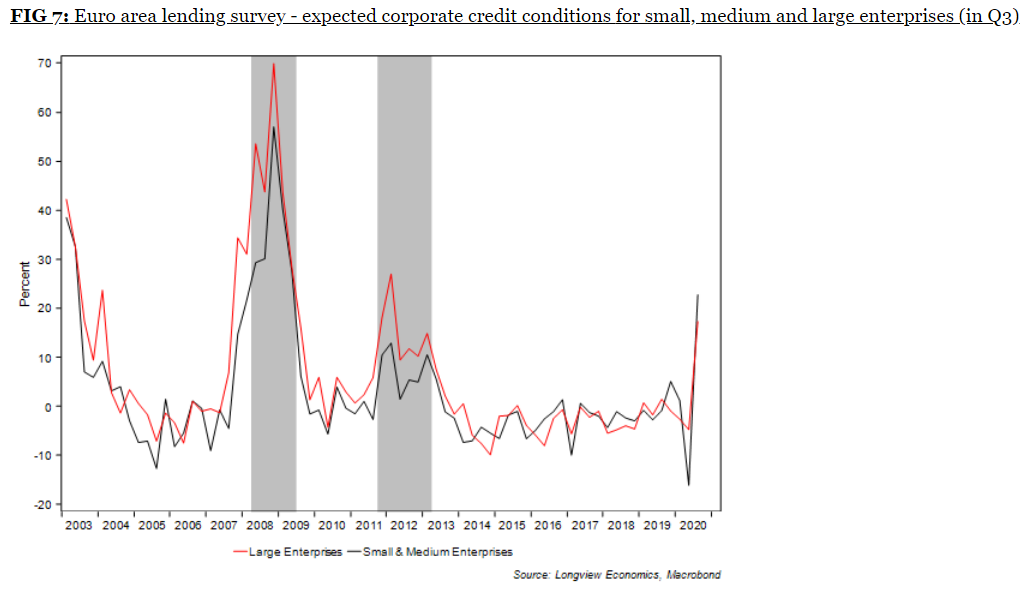

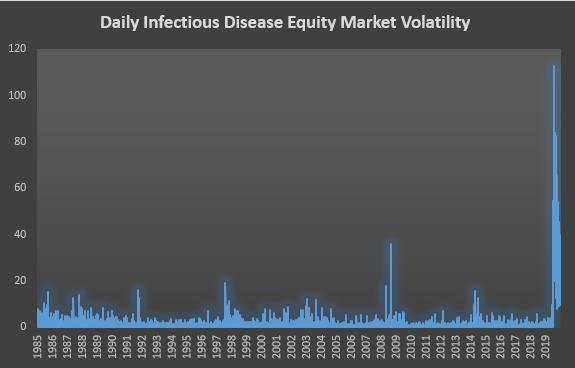

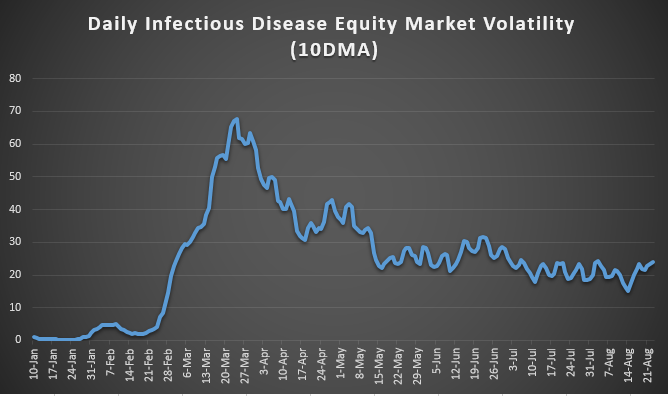

K Is Not OK Stocks started the week strongly, and the global market is now almost at a record to match the high set by the S&P 500 in the U.S. This is obviously exciting, but markets tend to run on narratives, and another narrative is gaining strength. In its most popular incarnation, people are talking about a "K-shaped" recovery. The phrase, which comes from Peter Atwater, who runs the Financial Insyghts consultancy, refers to the notion that the rebound is unequal. Following the Covid-driven crash, some markets have shot back up again, and others have fallen, forming a K. This is his collection of references in major media outlets in the last week:  The problem is that when a narrative gains such prevalence, it is generally a sign that a trend is reaching a peak. To quote Atwater: When extreme inequity is this obvious and this widely applicable, we've reached the point where the arm and the leg of the K are more like alligator jaws, primed to snap closed. Talk about the perfect accompaniment to an extraordinary financial market peak. Even inequity has been taken to extreme excess. He's right that this is a remarkably unequal recovery. Most obviously, large-cap stocks have done much better than small ones, led by the FANG internet platform companies:  A recovery so imbalanced in favor of the five biggest companies is very unusual. This chart by Strategas compares the current top five's rebound since the low, with prior top quintets' recoveries after three previous major lows:  Less widely appreciated is that this recovery has been very much led by China, which resorted to an old-fashioned stimulus to jolt itself back into life. Chinese stocks are at new highs for the year. The rest of the developed and emerging stock markets are not:  Most intriguingly, the performance of large Chinese companies with American depositary receipts quoted on Wall Street is well ahead of the S&P 500. Despite government attempts to clamp down on China, American investors still seem very happy to provide them with capital:  The power of China can also be seen in the performance of industrial metals. More indirectly, it can be seen in the recovery of growth companies, while value stocks, bought because they look cheap compared to their fundamentals, continue to languish. This is true both in the U.S. and across developed markets as a whole:  Within developed world stocks, the spread of valuations, in terms of price-book multiples, is more extreme even than at the top of the tech bubble. In other words, there are very long "tails" of companies with very high and very low book multiples. This is driven by a wide range in forecasts for future earnings, as illustrated in the chart on the right below, from Societe Generale SA's Andrew Lapthorne. The more earnings forecasts have improved, the better returns have been, and the higher a company's valuation has become:  Some of this is a direct result of Covid-19 and the attendant lockdown. The gap in performance between department stores and internet retailers is massive — and the online sellers were already far more profitable even before the pandemic, as this chart from Gavekal Economics shows:  Another important factor is the lingering risk of a solvency crisis as bills for the months of stilled activity come due. As this Strategas chart shows, banks in the U.S. are putting money aside in loan loss provisions at a faster pace than during the last credit crisis:  This leads to a division. Companies dependent on banks for financing have a problem, because lending standards are tightening, as shown by the Federal Reserve's most recent survey of senior lending officers. Meanwhile, larger companies that can access capital markets are in a much easier position, because high-yield bond issuance is booming. The result, as shown in the chart from Longview Economics, is a very clear K-shape:  The tightening in banks' standards, shown in more detail in the next chart, is almost as universal as it was during the last crisis, and has happened more quickly:  This isn't a uniquely American phenomenon. The European Central Bank carries out a similar survey, and it finds the same result. Credit is tightening sharply, particularly for smaller companies:  It appears there will be big losers to go with the winners from this crisis, as financing isn't going to flow equally. The narrative has some truth to it, even if it may be somewhat overstated. The stock market is trading against the backdrop of a U.S. election campaign in which both parties are attacking inequality and over-mighty corporations. Yes, the reaction to the K-shaped recovery story could turn kaotic. WFH: WTH? Another narrative is also taking hold. Investors are taking comfort in the notion that the end of the extreme reaction to the pandemic is in sight, even without a vaccine, and debate is turning to the effects of working from home. Is it with us for good? And how much has it affected the momentous events of the past six months? Policyuncertainty.com has an index for how much pandemic worries have driven market volatility. It does this by scraping news stories to see if key words about diseases and epidemics occur in the same stories as key words about the economy and about market volatility. Unsurprisingly, this year's spike dwarfs the volatility caused by SARS, Ebola or swine flu:  Looking at the index over the course of this year, Covid-19 is driving market volatility far less than it was. Even if there is still guardedness about Covid-19, there is a belief that it has probably done its worst:  This assumption seems reasonable. Absent a true "second wave" as seen in the Spanish flu of 1918, which was far more deadly than the first, it is hard to see how Covid will do much more economic damage. This view may owe something to wishful thinking, though, because people are getting fed up with working from home, as Jens Nordvig, the influential foreign-exchange analyst who runs Exante Data LLC, documented in a Twitter thread: The novelty, the convenience, the flexibility is giving way to claustrophobia, disconnectedness and fatigue… I hear more and more from staff that there is a real desire to get back into a normal office environment, to learn more (more mentorship) and to get more informal feedback, not to mention 'fresh air' (or simply a different wall to look at). Meanwhile, the camaraderie and "groupthink" produced by working in an office — which can be dangerous — has been replaced with an even more dangerous kind of groupthink that comes from sitting on your own in front of a computer. A fascinating blog post in The Margins by Ranjan Roy asks if working from home could be affecting the S&P. He builds an interesting case. This is a key passage: Lots of websites are blocked at offices; your information universe is limited to sources and channels deemed worthwhile by some compliance officer and knowledge manager working in tandem. With a Bloomberg Terminal you are clearly not going to be missing any major news but there is also some corporate filter keeping you away from dark corners. There's also the socializing filter of not wanting to have coworkers walk by and see you just scrolling Twitter or Facebook if those sites happen to be allowed. Consuming information in the office was a very specific thing, with norms and systems developed over the decades. That specific information flow drove markets. I've now been seeing finance friends who had long shied away from finance twitter and the blogosphere diving into the deep end. They're even sending me ZeroHedge links!!!!! This changes the topics followed and the general mindset. It definitely amplifies feelings of FOMO as algorithmic feeds are built to do. Tesla becomes a much more central company of conversation. People start having a much more emotional viewpoint on Gold. Journalists have no choice but to spend a lot of their time on Twitter. (It's one of the downsides of the job.) My own anecdotal evidence is that a lot more people suddenly started following and interacting with me in the early weeks of the crisis, so I can believe that many people in finance were liberated to use social media during the working day. The K-shaped market might well be getting some of its oomph from a social media world that is hyping up gold and the FAANGs, while inveighing against the Fed and its role in stoking inequality. All of this implies that it will be no bad thing when we all get to return to our offices. But will we? That is the source of another frenetic debate. I tend to agree with Nordvig that most of us will be glad to go back to the office. There probably will be a noticeable shift toward more flexible working, and a reduction in the amount that companies need to spend on space, but offices will persist. However, there has been great controversy online this week following a LinkedIn post by James Altucher (full disclosure, I used to be his editor in a former life) proclaiming that New York City was dead as a result of Covid-19. The key point compared to previous crises, he said, is that bandwidth is now wide enough to allow free and easy video communication over Zoom: Nobody wants to fly across the country for a two hour meeting when you can do it just as well on Zoom. I can go see "live comedy" on Zoom. I can take classes from the best teachers in the world for almost free online as opposed to paying $70,000 a year for a limited number of teachers who may or may not be good. James is one of the cleverest people I've ever met, but I don't think I agree. I'd love to get in a plane and fly somewhere different so I can meet someone in person. And I'd far rather my kids go to a college where they can meet their friends and their teachers in person. The limitations of online learning have been cruelly exposed in the last few months. Somebody else who really disagrees with James is the comedian Jerry Seinfeld. In an op-ed for the New York Times, he defended his native city: You ever wonder why Silicon Valley even exists? I have always wondered, why do these people all live and work in that location? They have all this insane technology; why don't they all just spread out wherever they want to be and connect with their devices? Because it doesn't work, that's why. It's worth reading all these pieces in full. Is working from home really going to be the dominant paradigm for the future? And if it is, does that really deliver us even more fully into the arms of social media algorithms? Comments are welcome. Survival Tips As summer nears its end in New York, restaurants and cafes have finally adapted. All over the city, there are wooden platforms built into the streets in front of restaurants, where diners can eat in the open air. It's great — feels almost Mediterranean. The future for New York and other big cities, assuming they survive, with any luck will involve spending more time outdoors. That will be a very good thing. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

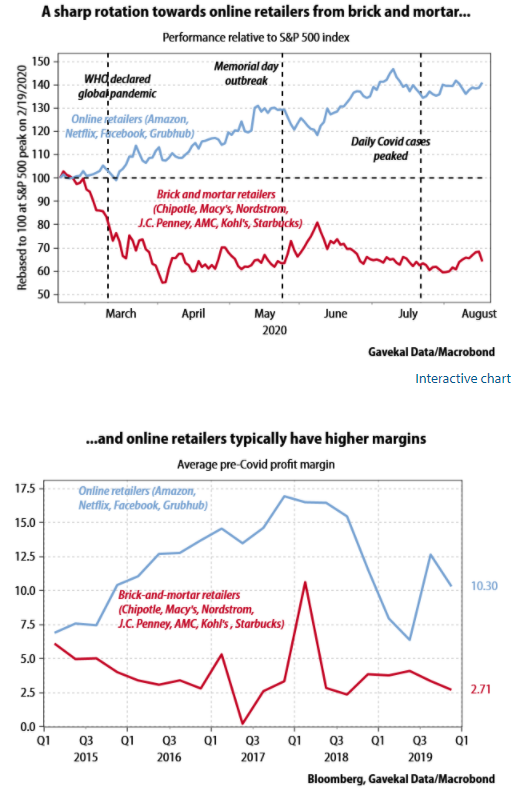

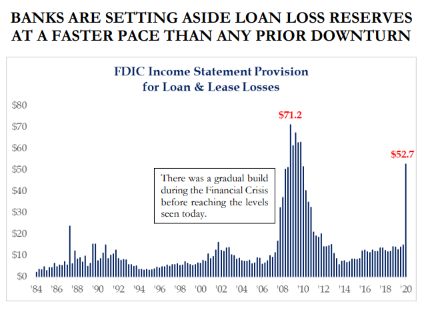

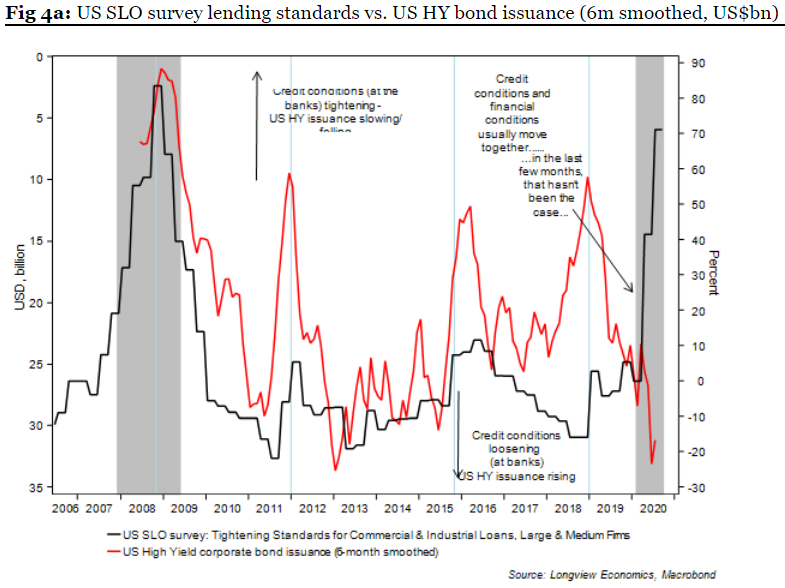

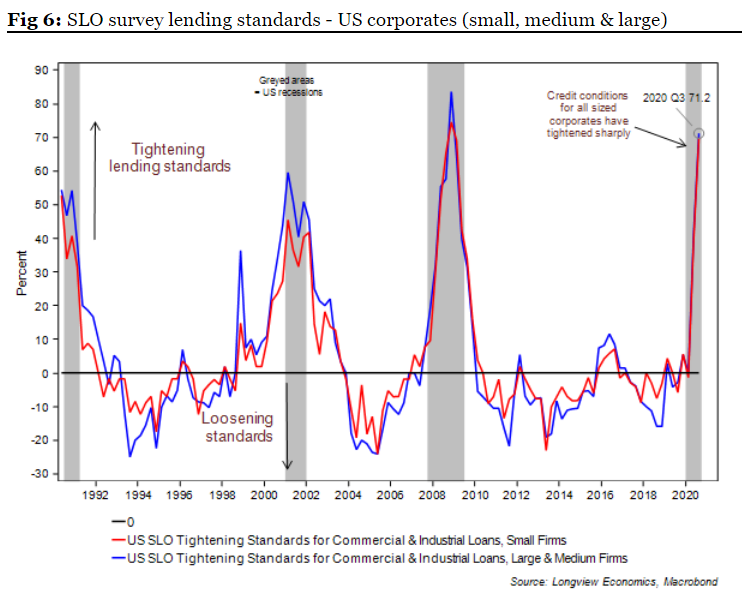

Post a Comment