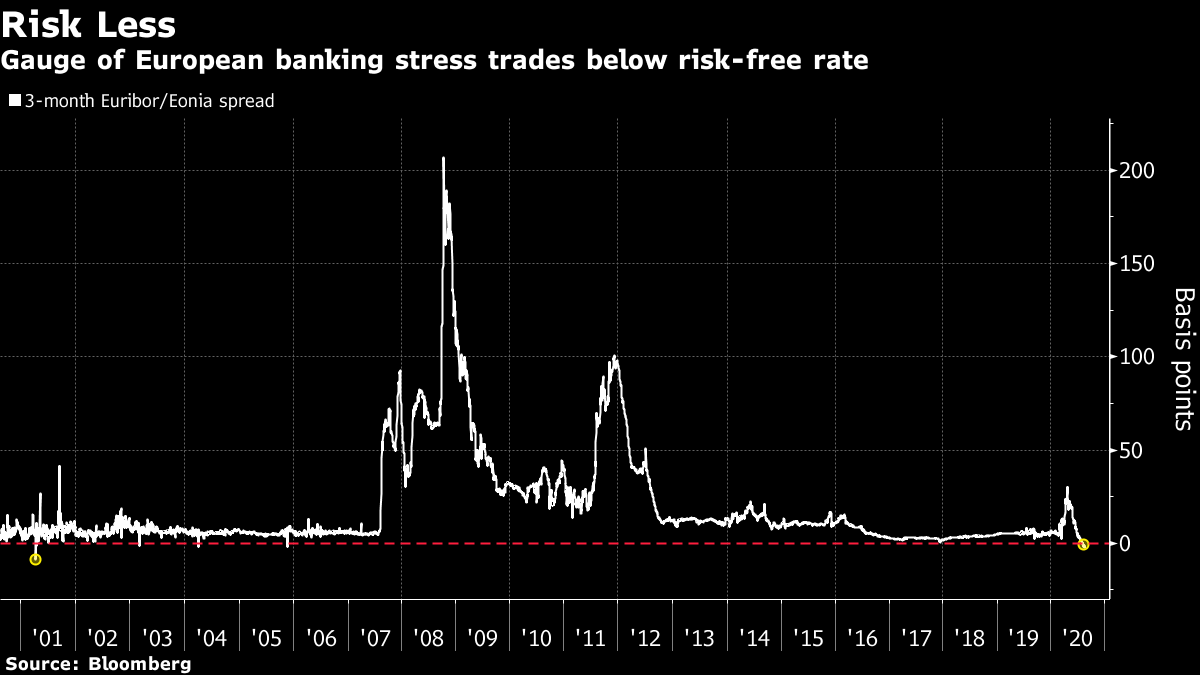

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. Travel brings Europe's case count up, old behemoths leave the Dow, and Navalny was likely poisoned. Here's what's moving markets. Travel Effect With Spain, France and Germany recording the highest number of virus cases since they emerged from lockdown, the danger that Europe blows its best chance of taming the coronavirus grows by the day. One big factor has been the restart of intra-European travel, including people going on vacation or visiting family and friends. Almost 40% of recent German cases are thought to have been contracted abroad, according to the Robert Koch Institute. That's similar to Italy, where almost a third of new cases were imported from overseas. In another disconcerting development elsewhere, a man in Hong Kong caught the coronavirus after recovering from an initial bout in April in what scientists said was the first case showing that reinfection may occur within a few months. Out With the Old In the biggest reshuffling in seven years, Exxon Mobil Corp., Pfizer Inc. and Raytheon Technologies Corp. were kicked out of the Dow Jones Industrial Average, making way for Salesforce.com, Amgen Inc. and Honeywell International to enter the 124-year old equity gauge next week. The actions were prompted when Apple Inc. -- currently 12% of the 30-stock index -- announced a stock split that reduced the sway of computer and software companies in the price-weighted average. The changes mark a stunning fall from grace for Exxon, the world's biggest company as recently as 2011, whose ejection reflects the steady decline of commodity companies in the American economy. Trouble Credit Suisse Group AG faces a criminal probe in Belgium amid suspicions it helped more than 2,600 clients to hide money in Swiss accounts. Investigators are looking for evidence of money laundering and whether the lender acted as an illegal financial intermediary, prosecutors said. The probe is at the fact-gathering stage and it's not certain that it will result in formal charges, they said. Swiss banks have been caught up in global tax crackdowns over the past decade as the country's tradition of banking secrecy came under siege. "We strictly comply with all the applicable laws, rules and regulations in the markets in which we operate," Credit Suisse said in a statement. Poison A German medical team determined that Alexei Navalny, the Putin critic transferred to a Berlin hospital after falling severely ill last week, was likely poisoned. "In view of Mr. Navalny's major role in Russia's political opposition, the country's authorities are urgently called upon to fully investigate this act as a matter of urgency -- and to do so in a completely transparent way," German Chancellor Angela Merkel said in a statement. The demand marks a sharp escalation in tensions between the West, led in this case by Merkel's government, and the Kremlin. A U.S. official warned earlier Monday that confirmation he was poisoned would turn the case into a major issue. Coming Up… Stock-index futures are pointing to a slightly higher open in Europe, following gains in Asia on optimism about treatments for the coronavirus and signs of progress on trade negotiations. The German Ifo survey and final second-quarter reading on economic growth will give further clues about the trajectory of Europe's largest economy, with the confidence indicator expected to rise over last month. Hungary's central bank rate, due in the afternoon, is expected to remain unchanged. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning The sheer lack of risk evident in the European funding market is another sign of investor complacency. The main benchmark rate for borrowing between European banks, three-month Euribor, is trading around minus 0.49% and hit a record low last week. As my colleague Stephen Spratt points out, it continues to be lower than three-month Eonia -- a proxy for the risk-free rate -- with the spread between the two the most negative in almost two decades. In layman's terms that means investors see lending money to Europe's debt-laden banks as not only risk free, but better than that. On the surface, the pricing is understandable and reflects the flood of cheap money provided to the sector by the European Central Bank. But it still bears no reflection to the economic reality on the ground in Europe, nor the potential impact of the recent resurgence of virus cases in the region. And as Bank of America recently noted, it doesn't reflect the 29% of investors in investment-grade debt that reckon defaults are just around the corner in Europe. The ECB may have solved the liquidity risk issue, but that doesn't mean there's no credit risk.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment