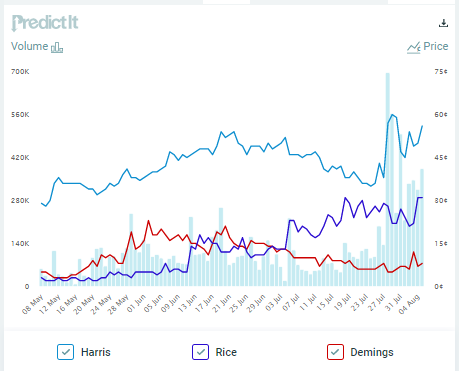

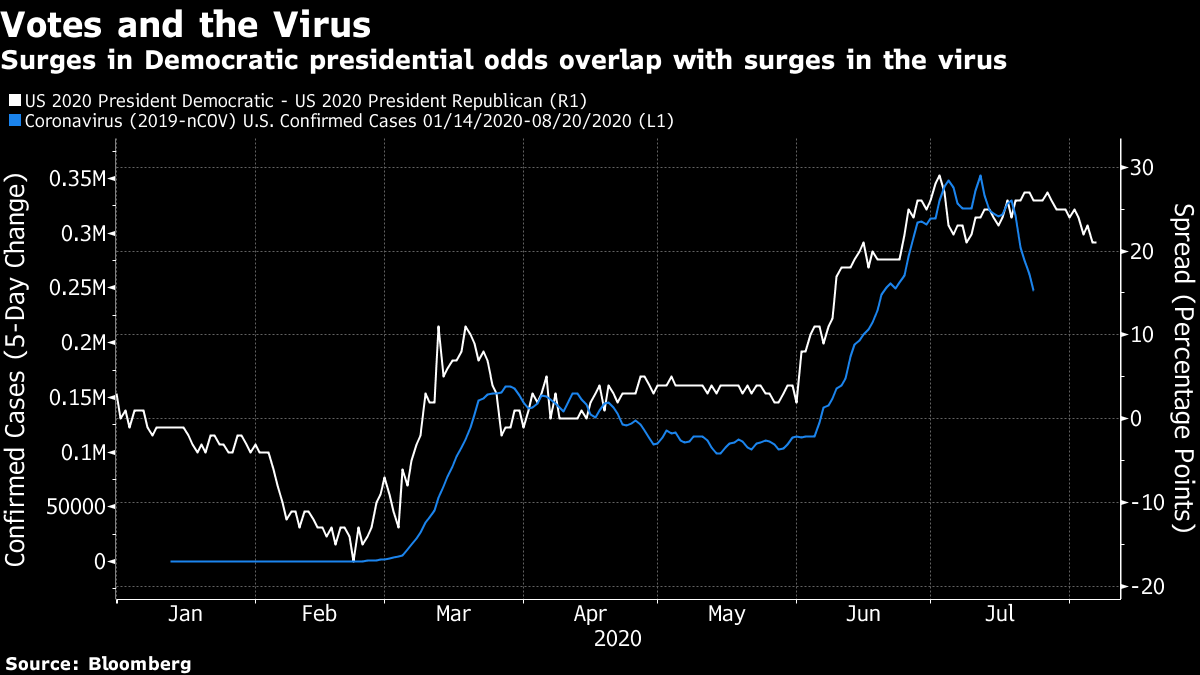

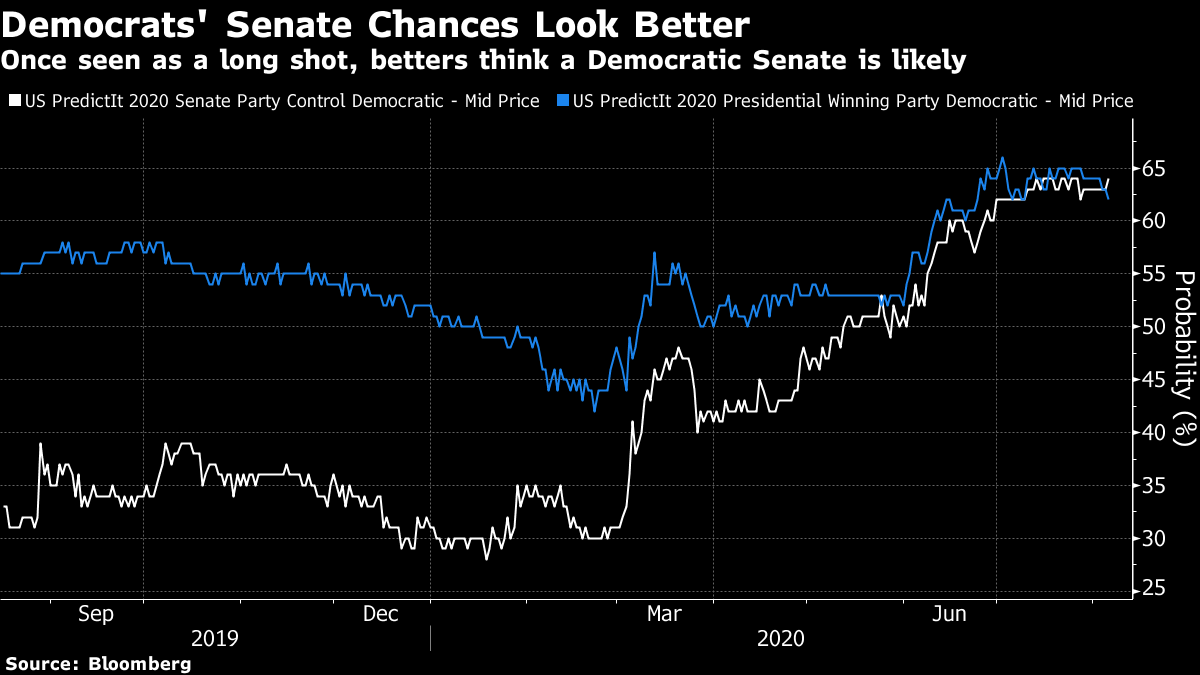

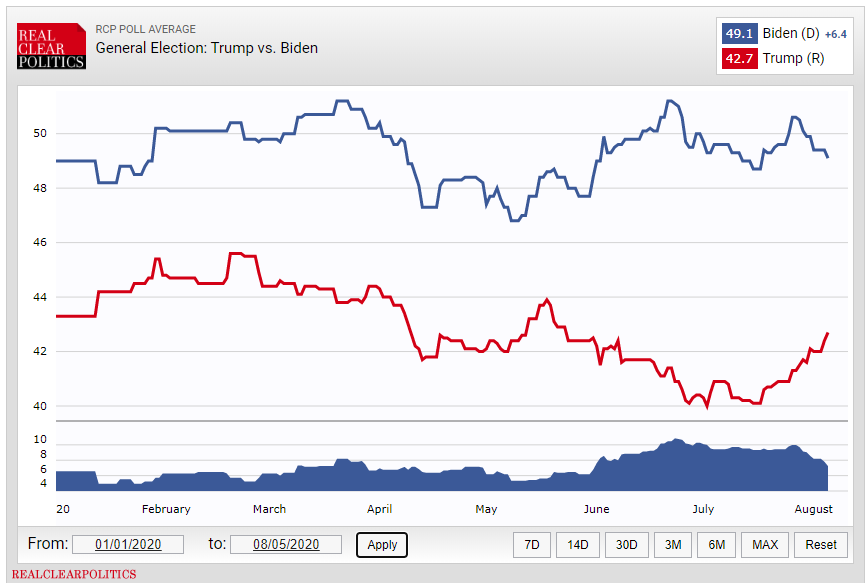

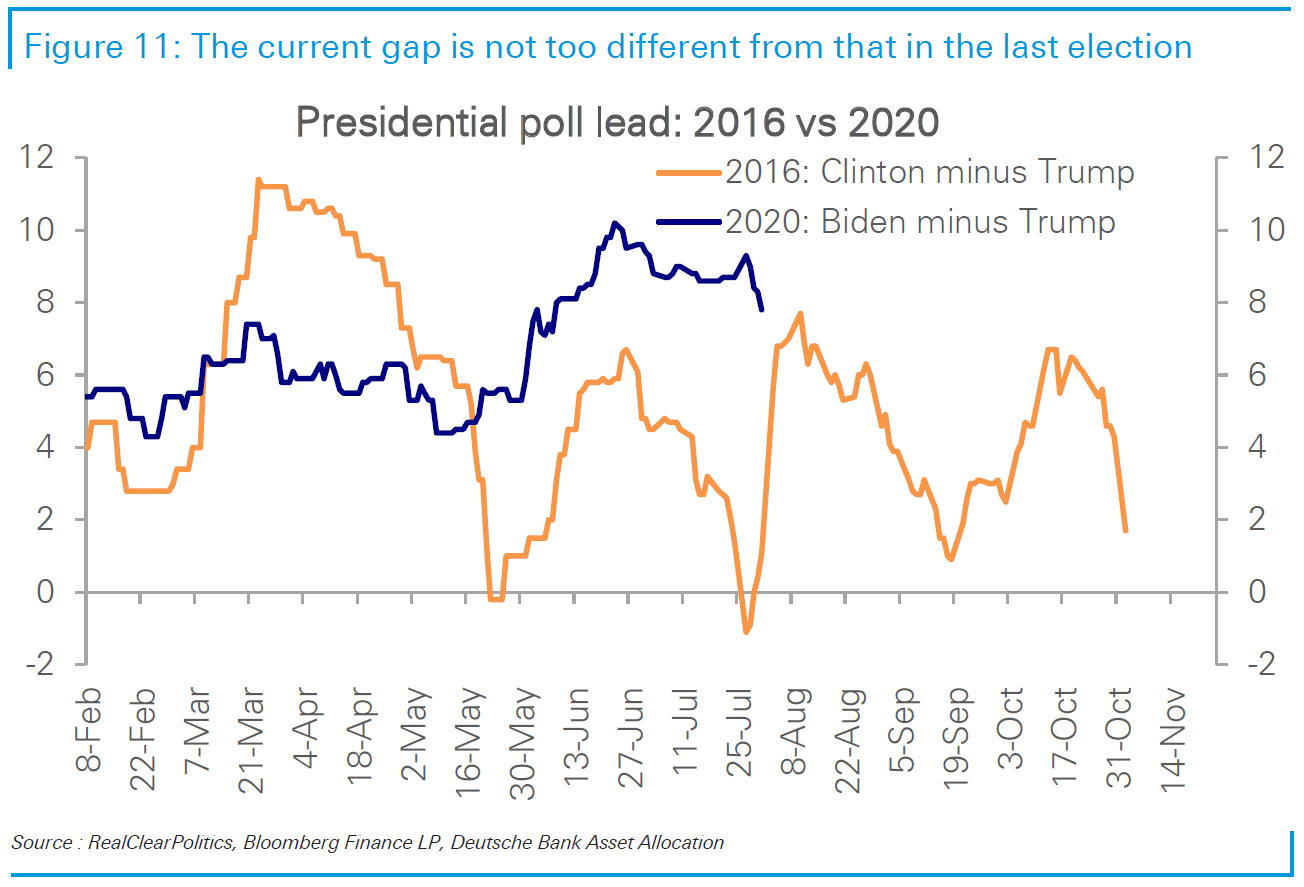

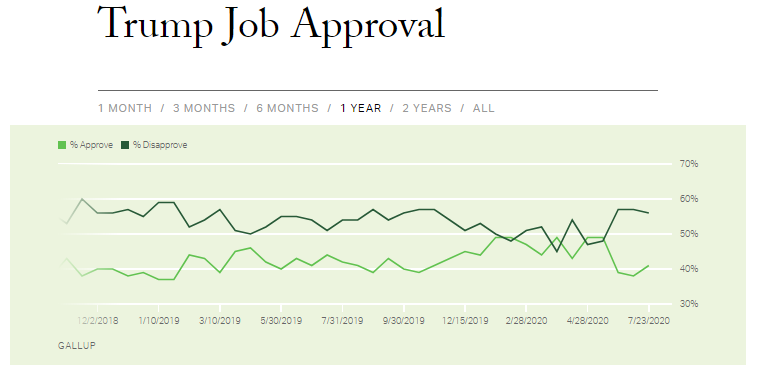

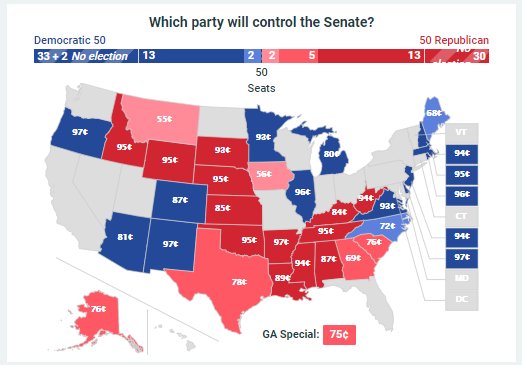

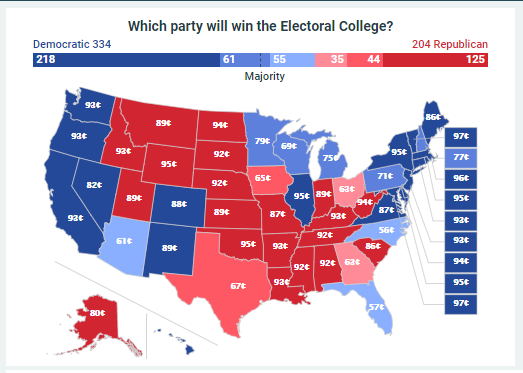

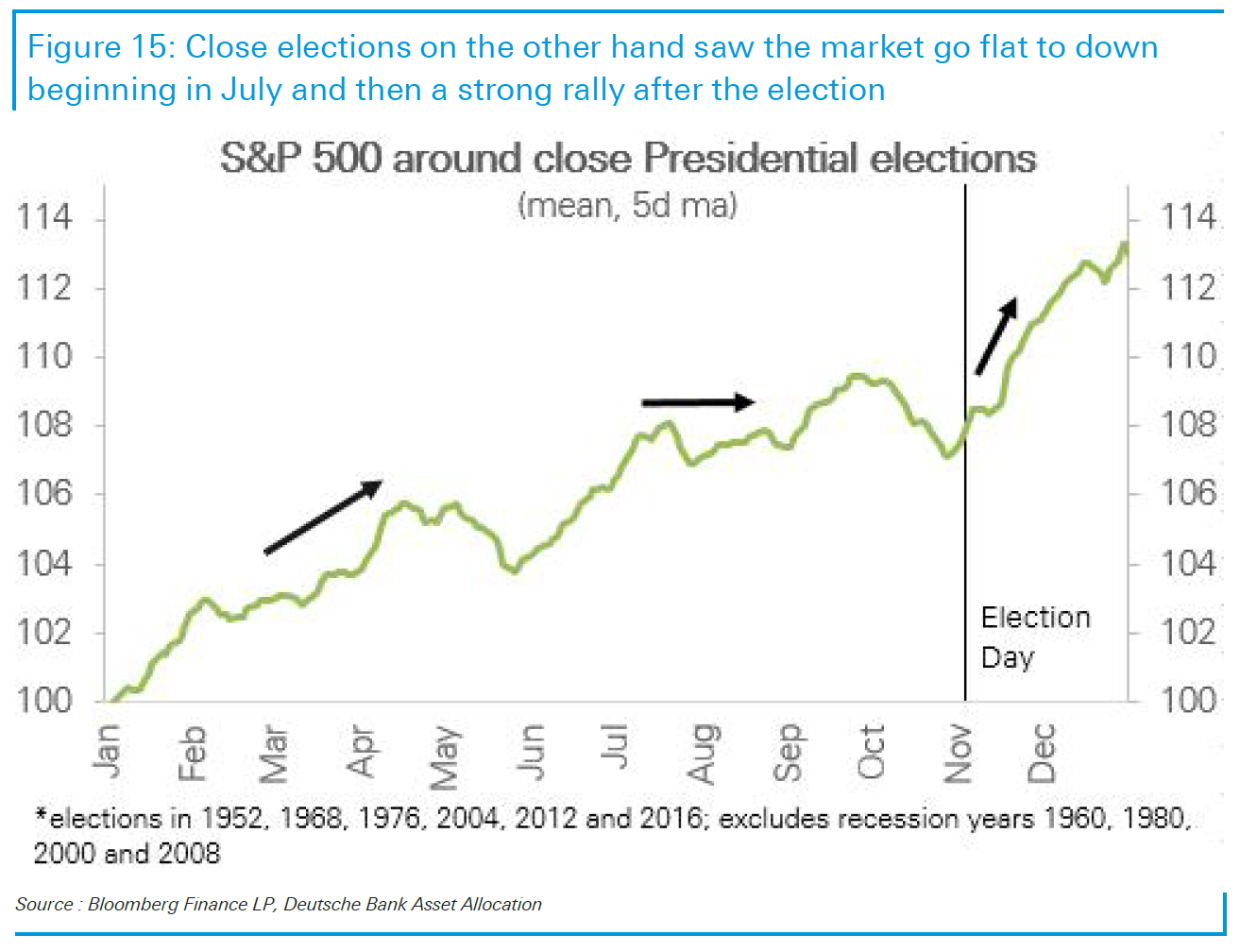

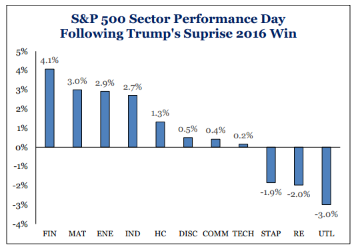

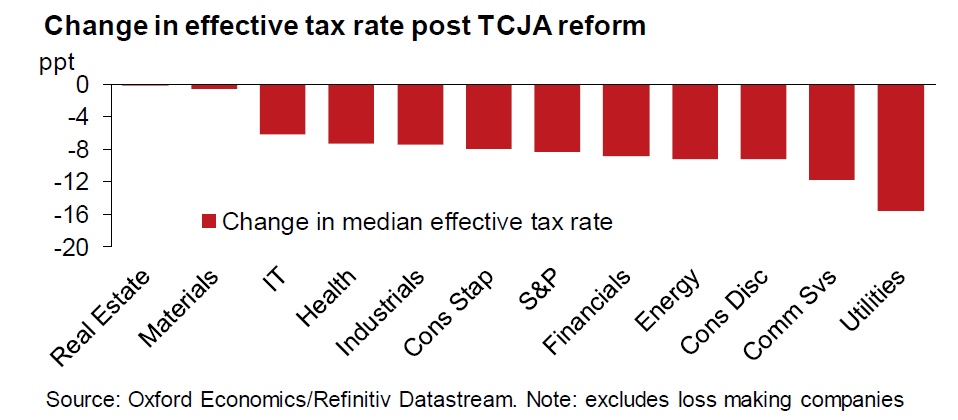

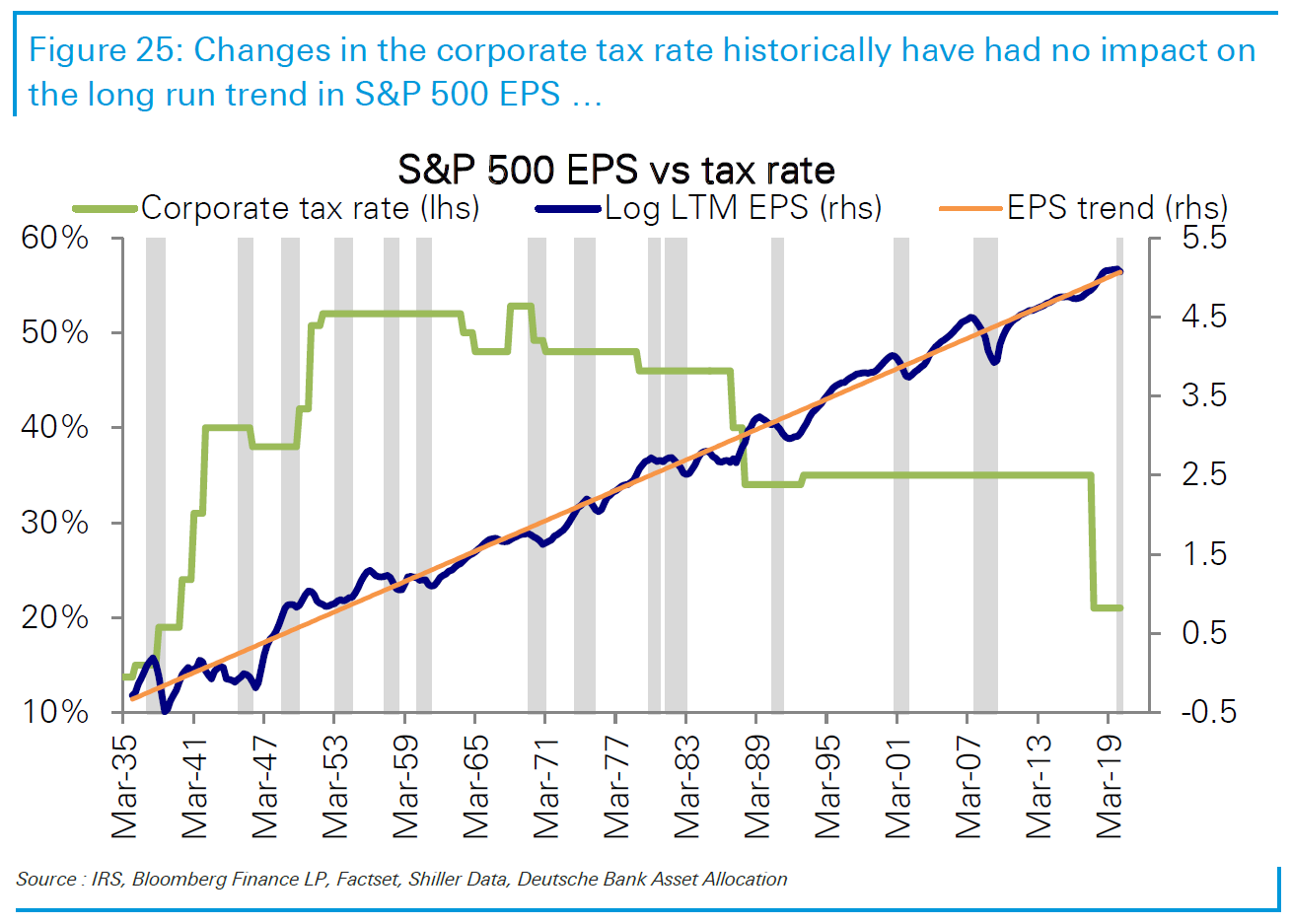

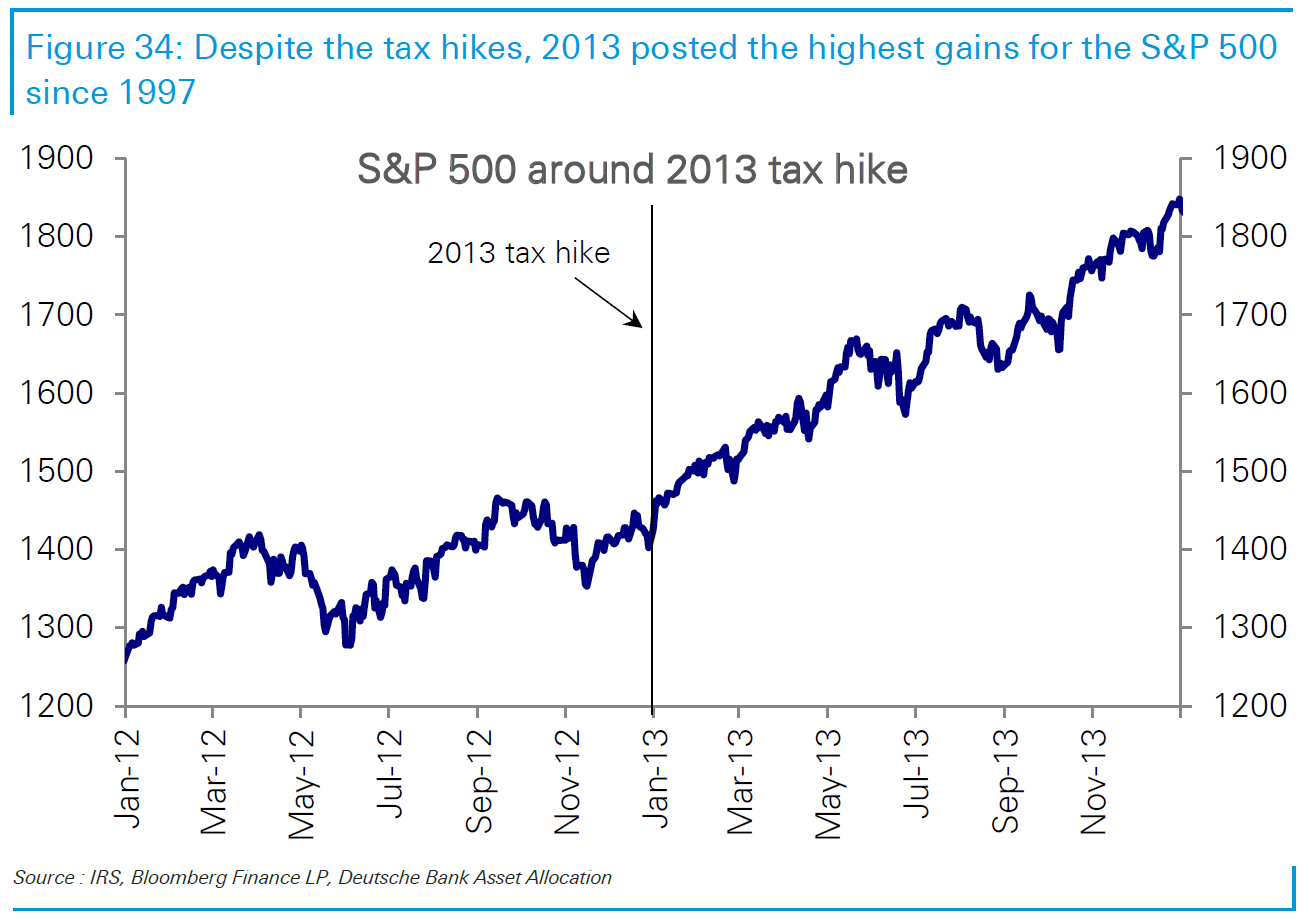

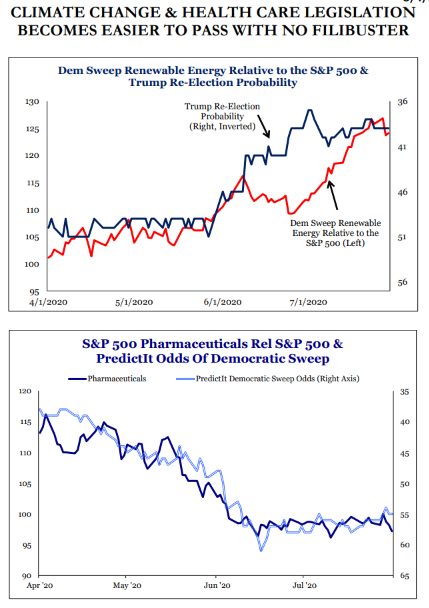

Presidential Race: It's Getting Serious Any day now, we will know who the Democrats will nominate for the vice presidency. In a very strange August in which the two parties' nominating conventions will create far less political theater than usual, there may not be another political event so significant for the campaign until the presidential debates start late next month. The election itself is less than three months away, and it will soon begin to have a much clearer effect on markets and the economy. Here, then, follows your chart book on how to follow the U.S. election. Who is going to win? On the vice-presidential choice itself, the process has revealed a succession of impressive female politicians, all of whom seem to have at least one Achilles' heel. The choice appears to have boiled down to Senator Kamala Harris of California (vulnerable for her prior attacks on Joe Biden during the Democrats' debates, and the way her presidential campaign folded before it reached Iowa), and former national security adviser Susan Rice (vulnerable because she has never run for public office, and would give Republicans licence to talk about Benghazi and unmasking). Despite boomlets for several other possible candidates over the last few months, bettors on the Predictit prediction market have consistently put Harris in the lead. It would be a surprise if she isn't nominated:  It is important for the Democrats to get some kind of a boost from the vice-presidential pick because the dynamics of the race are beginning to turn against them. The following chart maps the Democrats' margin over the Republicans in terms of their chance of presidential victory, against the rolling five-day change in Covid-19 cases, shown with a 14-day lag. The similarity between the two measures isn't coincidental. There have been two big rallies in Democratic chances so far this year — the first in late February and early March as it became clear that the coronavirus was a serious problem, while the Democrats opted for Biden rather than one of the more progressive candidates, and the second in June as the protests over the killing of George Floyd rocked the nation, and the pandemic worsened once more. Biden's margin is no better than it was five weeks ago. Meanwhile, new cases are at last beginning to trend downward. This suggests the momentum is changing in the president's favor:  Meanwhile there is another critical variable: the Senate. Until a few months ago, it was assumed that the Democrats had little chance of winning a majority. That has now changed. For the first time, the betting markets think a Democratic Senate is a slightly better bet than a Democratic White House:  Polling measures confirm the judgment of the prediction markets. The RealClear Politics poll of polls shows Biden in a clear lead of 6.4 percentage points. But Trump is closing the gap, and Biden is below 50%, a position that gives him no reason for comfort:  Then there is the fact that we have a recent precedent for an election that looked to be balanced like this in early August. This chart, from Deutsche Bank AG equity strategist Bankim Chadha, compares Biden's polling margin over Trump with Hillary Clinton's during the 2016 campaign. We know how that one ended:  Then if we look at the president's job approval rankings from Gallup, we can see that his numbers are low, but have recently picked up. Given the disasters of the last few months, this suggests that his bedrock of support is very strong:  Things look closer when viewed state by state. This following map is from Predictit, and colors each state according to its senatorial odds on the Predictit market. If the traders are right, the Senate will be tied 50-50. The Republicans' best chance to hold on lies with the embattled moderate Susan Collins in Maine, where she is seen as having a 32% shot; while the Democrats have chances of 45% and 44% respectively of giving themselves an overall lead by picking up Montana (where their candidate is a popular former governor) and Iowa. While it is finely balanced, the odds plainly favor the Democrats taking control:  The same exercise for the electoral college shows the Democrats on course for a big victory, but also the clear route by which Trump could yet win: He needs to take Florida, Arizona and North Carolina, plus one of the Midwest states that swung the election last time — Wisconsin, Pennsylvania or Michigan, or possibly New Hampshire:  So. This is a close election. The fact that the Democrats haven't been able to take a more decisive lead over the last month suggests that Biden could still be very vulnerable, particularly if the pandemic continues to come under control. How will this affect the market? Markets dislike uncertainty. Occasionally, election results seem so foreordained that they have little impact. The last one of those was Bill Clinton's reelection in 1996; before that came the reelections of Ronald Reagan, Richard Nixon and Lyndon Johnson. This is plainly too close to count as one of those. Deutsche Bank's Chadha provides this chart of the S&P 500's average performance during close election years. It implies that the market is about to start trading in a tight range:  Chadha also makes an interesting point on the way market moves ahead of the last election were misinterpreted. Stocks had a tendency to fall sharply every time Trump rose in the polls. This led to some disastrously inaccurate estimates that the market would tank if Trump won. Chadha explains that the problem was about increasing uncertainty, rather than an increasing chance of a Trump victory: While candidate Clinton led in the polls throughout the run up, the polls swung sharply several times between being wide and being close. On several occasions, as the polls tightened sharply and uncertainty about the outcome ratcheted up, the market sold off and vice versa. In our reading, this reflected the election becoming close again, rather than reflecting fundamental differences to the outlook under either outcome. But it did lead to a popular perception at the time that candidate Trump would be negative for growth and equities, which endured through the early stages of the strong but typical post-election rally. The CBOE VIX index is currently at 22.6, almost exactly where it was at the end of the week before the 2016 election. If you think there is a chance Trump (or Biden, through a misstep) can make more of a race of this, you should expect the VIX to rise between now and election day. Will this create winners and losers? The sectoral breakdown for the S&P 500 on the day after Trump's surprise victory in the last election should give a decent idea of which are perceived to benefit from his continued presidency. The following chart is from Strategas:  Materials may have benefited because Trump talked about infrastructure in his acceptance speech. Beyond this, his victory was seen as a boon for cyclical sectors, particularly financials. Another ranking order to bear in mind, listed below by Oxford Economics, is the change in the effective tax rate that each sector enjoyed as a result of the cut at the end of 2017. Real estate and materials already had plenty of loopholes and didn't benefit much; utilities, which sold off on the day after Trump's election, benefited the most.  Should Biden win, these two league tables will be relevant once again. With a Democratic Senate, he would be virtually certain to reverse at least part of the corporate tax cut. That said, that reduction created a brief melt-up, followed by a nasty correction in February 2018, and then protracted range trading. This chart from Chadha of Deutsche Bank suggests that corporate tax rates have minimal impact on earnings per share in the long run:  He also points to what happened to the market in 2013, after Barack Obama used the political capital from his re-election to push through a tax rise. The S&P 500 subsequently posted its best annual gain in 16 years:  So there seems a decent chance that a scare around a Biden victory and subsequent tax hike might create a buying opportunity, all else equal. Infrastructure might do well (ironically, just as it did on Trump's victory), in the hope that the Democrats might actually go through with borrowing money and building things. If they control the Senate, this does seem likely. Strategas also offers two sectors that clearly have things at stake in this election. For obvious reasons, renewable energy stocks would benefit greatly from the ejection of Trump; and pharmaceuticals companies, following a recovery earlier in the year once it became clear that neither Bernie Sanders nor Elizabeth Warren would be nominated, have been steadily underperforming as Biden's chances have improved. With a Democratic Senate, and with serious pain caused by the pandemic, the chances of pain for pharmaceuticals companies' profits would be very significant:  As to the broader picture, it is as well to be careful. The presidential election is likely to take more and more oxygen for the next three months, in the U.S. and everywhere else, but the powers of the president can be overstated. Progress fighting the pandemic would matter more. Monetary policy won't change regardless of the winner. But the chances are that a President Biden, a veteran of decades of foreign policy, would be somewhat more China-friendly than his predecessor, and much, much more Europe-friendly. The end of the America First policy might just help continue a regime change in which Europe and the emerging markets enjoy a few years of outperforming the U.S. But Biden would need to win first. And at present there is a 40% chance that he won't. Survival Tips After all that, I'd like to suggest going to Netflix and watching The West Wing. It isn't just liberal wish-fulfillment. Almost everyone in the show, on left and right, seems to behave with some integrity, and to take the dilemmas of politics seriously. And if you're prepared to dive in, I suggest going straight to the last two episodes of the fourth season, in which a young Elisabeth Moss, then playing the president's daughter, gets kidnapped to the accompaniment of music by Massive Attack, precipitating an epic constitutional crisis involving John Goodman. It was Aaron Sorkin's sign-off from the show and it's absolutely brilliant. So brilliant that it can even turn politics into escapism. You can find it on Netflix. Have a good weekend. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Hey, thanks for the information. your post s are informative and useful.

ReplyDeleteMAHARASHTRA SCOOTERS