Trade talks are on ice, breakthrough on fiscal deal may be close and stock market eyes fresh record. Talks cancelledPresident Donald Trump called off last weekend's talks with China, raising questions about the future of a trade deal that's kept the world's biggest economies from hurtling back into a tariff war. The agreement, which came into force in February, was due for review after six months. While it's unclear why Trump walked away from the meeting, he's ratcheted up complaints about China, particularly over the spread of the coronavirus, which he regularly calls the "China Virus." In the latest salvo, the State Department is asking colleges and universities to divest from Chinese holdings in their endowments to get ahead of a "wholesale de-listing" from U.S. exchanges on tighter standards. Cliff edgeDemocrats signaled they might be willing to meet Republicans halfway on a stimulus deal to avert the approaching fiscal cliff. House Speaker Nancy Pelosi said they're entertaining scaled-back Covid-19 relief to seal a deal now and introduce more legislation after the November election. In fact, both sides in the stalemate sounded more conciliatory, with Senate Majority Leader Mitch McConnell saying that Democrats' willingness to break out funding for the Postal Service from their original plan was an opening for talks. Federal Reserve officials have warned fresh fiscal aid would be critical for the U.S. recovery, a view that may be re-iterated today when the Fed releases minutes of its last meeting. Virus updateWhile stock markets are at records, governments continue to sound the alarm over the course of the pandemic. Ireland is tightening restrictions on gatherings and New Zealand is increasing the military presence at its border as it battles a new outbreak. Germany's Chancellor Angela Merkel ruled out any further loosening of virus measures, saying that a doubling in the number of daily cases in the country in the last three weeks needs to be brought under control. Global virus cases topped 22 million, with the U.S., Brazil and India accounting for more than half the total. Markets upFutures suggest the S&P 500 Index will extend its record today as investors take to heart indicators that coronavirus infection is ebbing in the U.S. Overnight, the MSCI Asia Pacific Index ended flat, while Japan's Topix index closed 0.2% higher. In Europe the Stoxx 600 Index was 0.3% higher by 6:07 a.m. Eastern time. The 10-year Treasury yield was at 0.654% and gold slipped back below $2,000 an ounce. Coming up...All eyes will be the Federal Reserve minutes of its July meeting, due at 2 p.m., that may give clues about inflation targeting. Before that though, Canada will release inflation data at 8:30 a.m., data from the EIA on crude inventories arrives at 10:30 a.m. while the Treasury will sell $25 billion sale of 20-year securities at 1:00 p.m. Retail earnings are on the slate again, including from Target Corp. and Lowe's Cos. What we've been readingThis is what's caught our eye over the last 24 hours. - What the 'tech exodus' could mean for Silicon Valley.

- Mystery grows over virus spread via contaminated food packaging.

- Epic's battle with Apple and Google actually dates back to Pac-Man.

- How hackers bled 118 Bitcoins out of Covid researchers in U.S.

- Ireland tightens curbs after 'appalling' bar scene, food woe.

- Millennials have found an unlikely hero.

- Forget French Rosé, Italy's under-explored pink wines offer big value.

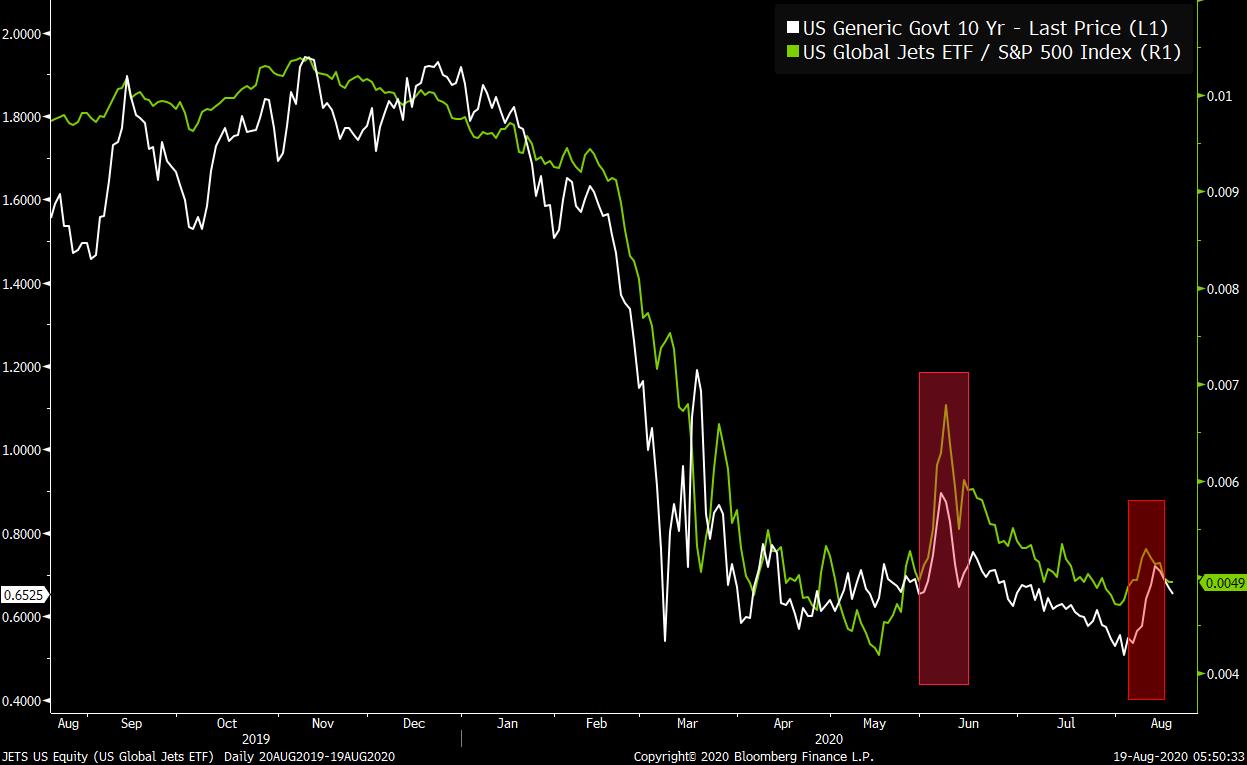

And finally, here's what Joe's interested in this morningEvery once in awhile, yields on long-term bonds rise for awhile and you start to hear about how there's all this supply coming to the market, and investors are choking on all the supply, or rebelling against all the issuance. But almost every time this happens, it's clear that if you zoom out just a little bit that's not what's going on. Instead, people are selling safe-haven bonds (sending yields higher) during periods of more optimism about sustainable cyclical recovery. I've posted versions of this chart before, but here's the latest. The white line is the yield on the 10-year Treasury, which currently sits at a scant 0.65%. The green line is the ratio of the popular JETS ETF (airlines) relative to the S&P 500.  As you can see, the two major up-moves we've seen in rates this year (early June and the first half of August) coincided with outperformance by JETS. In other words, when people were feeling good about a solid "return to normal" rates rose. During other periods where the market has been dominated by megacap tech and so forth, rates haven't been going up. Sure, at times maybe some technical things matter in the short term or at the margin. But when you see this kind of alignment it's obvious that the long end of the curve is driven by factors other than how much paper is actually being issued. Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment