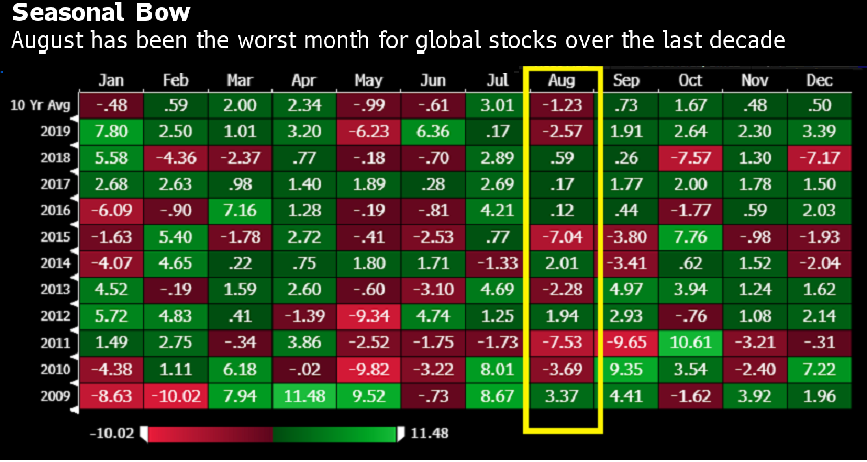

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. The U.K. is looking at options for tackling virus spikes, TikTok is in deal talks and there's been an arrest in the Twitter hack. Here's what's moving markets. A Million Every Four Days Global coronavirus cases surpassed 18 million as the pandemic is now adding a million infections every four days, prompting more lockdowns around the world. The U.K. is looking at all options for tackling flare-ups, following reports that a London-wide lockdown is being considered. Any remaining hope that coronavirus would take a holiday has been all but crushed. At its current pace of about 250,000 or so new cases a day, there could be more than 50 million infections worldwide by the end of 2020. The virus is expected to remain a formidable adversary until a first generation of effective vaccines can be rolled out, which many experts expect in 2021. Wealthy countries are first in line, with about 1.3 billion doses of potential shots secured by the U.S., EU, Britain and Japan. On the Clock Microsoft Corp. confirmed talks to buy TikTok's operations in the U.S., Canada, Australia and New Zealand. Chief Executive Officer Satya Nadella spoke with President Donald Trump about how to secure the administration's blessing to buy the short-video platform owned by China's Bytedance Ltd., after Trump floated plans for an outright ban of the app on national security grounds. The parties have about six weeks to agree on terms, after a Sept. 15 deadline was put in place at the White House's insistence, according to people familiar. The Trump administration will announce measures shortly against "a broad array" of Chinese-owned software deemed to pose national-security risks, U.S. Secretary of State Michael Pompeo said. Child's Play Last month's Twitter hack may have been masterminded by someone fresh out of high school. Graham Ivan Clark, 17, allegedly hijacked 130 Twitter accounts as part of a cryptocurrency scam, according to a criminal affidavit filed in Florida. The accounts that were hacked included those of Barack Obama, Jeff Bezos, Elon Musk and Warren Buffett. Law enforcement officials say Clark impersonated a Twitter Inc. employee and coaxed staff into divulging login details. Two others were charged by federal authorities for allegedly aiding in the scheme, and lawyers or family members for the defendants couldn't be located for comment. Having suffered other embarrassing breaches in recent years, Twitter must now reckon with the possibility that a teenager beat teams of engineers and layers of cybersecurity protections. Flash Crash On Sunday, Bitcoin crossed above $12,000 for the first time since August 2019, before plunging by more than 10% within minutes. The cryptocurrency's notable moves during two consecutive weekends recall a similar phenomenon in 2019, when outsized gains took place numerous times during Saturday and Sunday trading as the price rose from a few thousand dollars into five-digit range. Coming Up… HSBC Holdings Plc posted second-quarter profit that missed estimates, and Societe Generale SA incurred a surprising quarterly loss. Up next, we'll get final first-half results from brewer Heineken NV, which already pre-announced an 53% drop in first-half earnings but is yet to spell out a fresh full-year outlook and strategic direction of its new CEO. Ferrari NV is expected to report during trading hours, and French bank Natixis SA's results are due after markets close. On the macro front, we'll get monthly Purchasing Managers' Index data for manufacturers in the Euro-area, U.K. and U.S. Meanwhile, stock futures in Europe and the U.S. are pointing slightly lower. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning It's the first trading day of August and that means seasonality season has officially started. The month has traditionally been a poor one for risk assets -- the worst over the last decade for global stocks -- with the MSCI AC World Index declining on average about 1.2%. Many market commentators don't have much time for seasonality arguments; academic studies tend to show that any recurring relationship that might have once existed has long been arbitraged away. And August's is a tougher one to argue as it doesn't have a tax deadline or quarter-end in it that could lend weight to why markets would regularly sell off -- outside of low summer liquidity of course. A look at weak Augusts over the past ten years reminds me of Homer Simpson's summary of a memorable series of events as "just a bunch of stuff that happened." The surprise Chinese yuan devaluation of 2015 and European sovereign debt crisis in 2011 that helped push global shares down over 7% those months were not linked to the month of August beyond coincidence. And while we almost had a great parallel from Fitch's warning on the U.S. debt outlook -- Standard & Poor's famously cut its AAA rating in August 2011 -- the Fitch downgrade came out July 31. But traders will still have "August is a weak month" somewhere in the back of their minds and that could make it easier to push the sell button on any negative news that breaks.  Bloomberg Bloomberg Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment