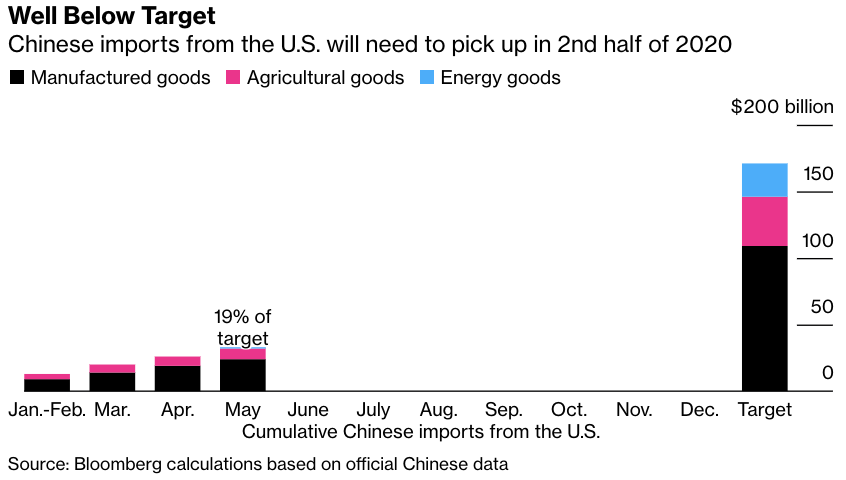

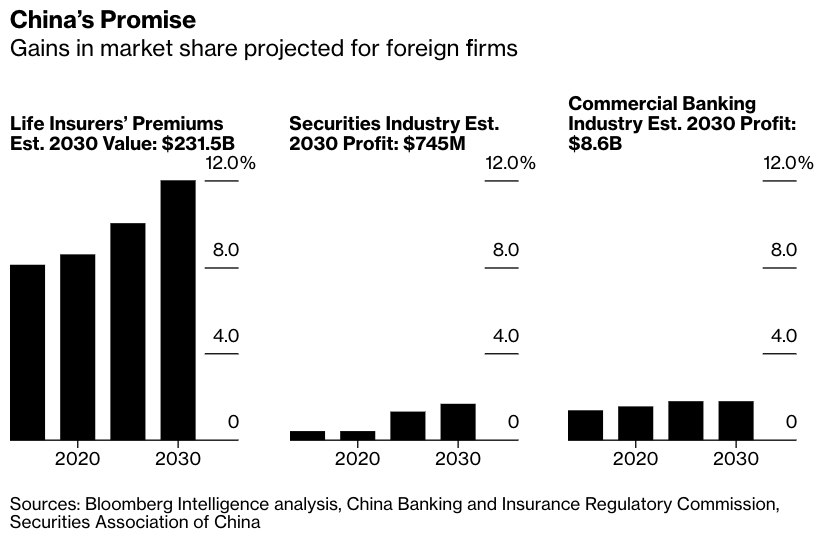

| The passage of sweeping national security legislation for Hong Kong brought thousands of protesters onto the streets and prompted rebukes from foreign governments. U.S. Secretary of State Michael Pompeo declared that Hong Kong's days as a prosperous city were over. That wasn't quite what Hong Kong's financial markets signaled when they opened for their first trading day after the law was passed. The city's benchmark stock index gained the most in a month and its currency traded near the strongest that its peg to the U.S. dollar allows. There are a number of factors that could explain this outcome. For one, there's been little doubt the national security law would be implemented since Beijing first announced its intention to do so in late May. Looking back, Hong Kong stocks did fall sharply when the initial announcement was made. But this is not a wholly satisfying explanation either, given that the city's benchmark index is now 3% higher than where it was before that plunge on May 22.  Demonstrators march during a protest in Hong Kong on July 1. Photographer: Roy Liu/Bloomberg Some investors and analysts have suggested that it would be bullish for markets if the protests that have wracked Hong Kong subsided because of the national security law. Others note, however, that while the legislation could provide some short-term respite for businesses, it also introduces more uncertainty about Beijing's role in Hong Kong in the longer term. And then there's the makeup of the market. Investors from mainland China have become more and more influential in Hong Kong, with some market participants attributing the city's resilient stocks to money coming in from across the border. Chinese companies are increasingly also the most-traded in Hong Kong. Of the ten companies with the largest weightings on the city's benchmark Hang Seng Index, seven are based on the mainland, with Tencent at the top of that list. That tilt is set to get even more pronounced after the index adopted changes that will allow Chinese tech giants such as Alibaba, JD.com and Meituan to be added. Hong Kong's importance as a financial center has leaned progressively more on its role as a portal through which to invest in Chinese growth. That could help to insulate the city's finance industry from some of the potential upheaval engendered by the security law. Whether buoyant markets also translate into prosperity for the city is a different question. Farm Goods Shipments of American farm goods across the Pacific have become one of the more-watched barometers for China's relationship with the U.S. and the viability of the first-phase trade deal signed in January. This week, it was revealed that China has stepped up its buying of corn, much of which will come from suppliers in the U.S. That comes after Beijing was said to be preparing to speed up purchases following Politburo member Yang Jiechi's meeting with U.S. Secretary of State Michael Pompeo in Hawaii. While those are positive signs, they don't solve the problem of volume. By the end of May, China had only bought about 19% of the American agriculture, manufactured goods and energy it committed to buy this year as part of the deal. That leaves $139 billion more to go.  India Ties Tensions between India and China are spilling increasingly into the business world. Chinese imports have been piling up at Indian ports awaiting clearance to enter the country, with Indian companies beginning to complain publicly about the delays. More eye-catching, though, was New Delhi's decision to ban 59 Chinese apps, including the popular short-video service TikTok. By some estimates, the prohibition could affect one in three smartphone users in India. It's a substantial setback for Chinese tech giants such as Alibaba, Tencent and TikTok's owner Bytedance, which have made notable headway in the world's fastest-growing mobile market. What could make a bad situation even worse is if this ban in India is a signal that the future of technology is becoming a far less open one. Bigger Better China's finance industry is undergoing quite the seismic shift. The catalyst has been Beijing's decision to open up the market more widely to some of Wall Street's mightiest firms. That's naturally led to questions about what domestic institutions should be doing to make sure they're ready for the competition. So far, the answer seems to be consolidation. China's two biggest investment banks this past week inched closer toward a merger, with the Communist Party committees at Citic Securities and CSC Financial — both of which are state-owned — agreeing on a blueprint for the deal. Meanwhile, regulators are also getting ready to issue investment banking licenses to some of China's largest commercial banks, which would make for far more formidable competitors. The 131 Chinese brokers currently in this sector have combined assets equal to one Goldman Sachs and less than a third of Industrial & Commercial Bank of China, the country's largest lender.  New Pathogen Chinese scientists have discovered a new strain of influenza spreading among the country's pigs that has shown the ability to jump to humans. Tests found the virus in about 10% of 338 farm workers whose samples were collected between 2016 and 2018. Although there have yet to be wider human infections, the researchers did conclude that this strain of influenza poses a "serious threat to human health." Even as the world struggles to contain Covid-19, there are already more pathogens with pandemic potential waiting in the wings. The (potentially) good news? At least this virus has been identified already. What We're Reading: And finally, a few other thing that got our attention: |

Post a Comment