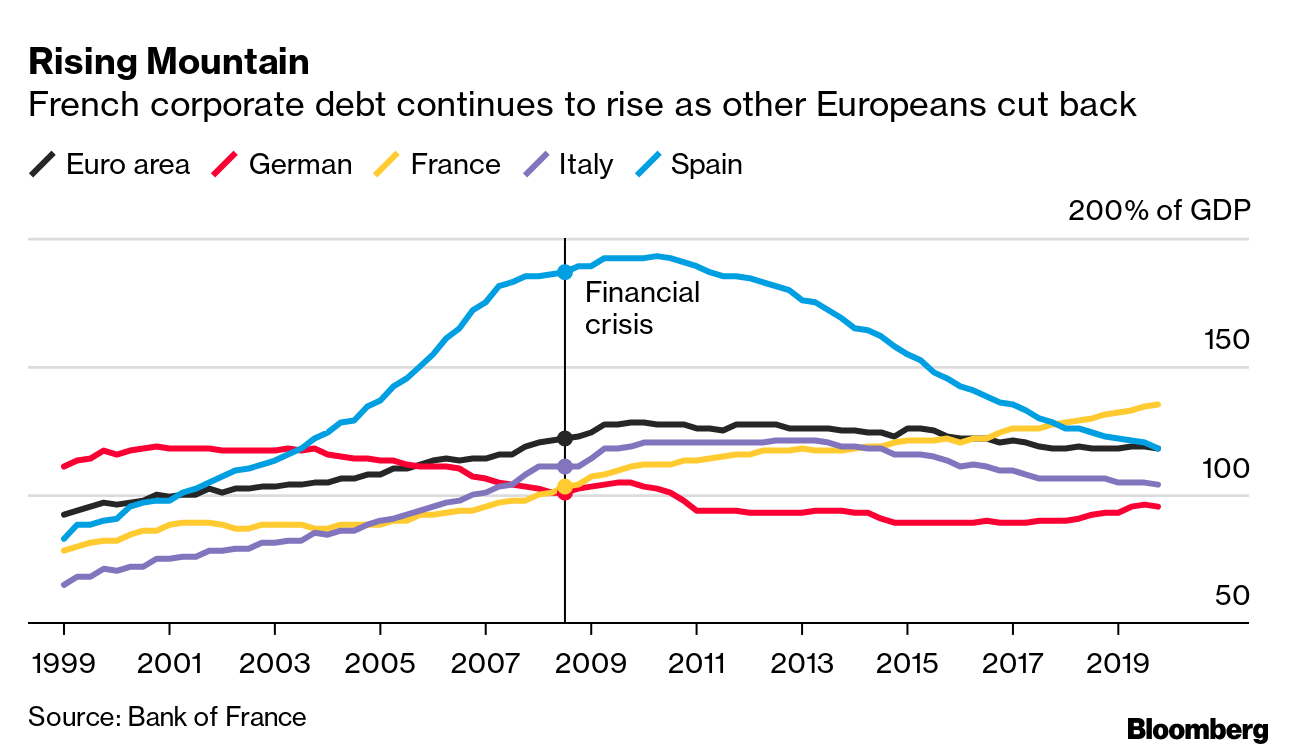

| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. Two months after forecasting the steepest global recession in almost a century, the International Monetary Fund is readying another round of dire predictions. Its updated outlook due today will probably give an even bleaker view on how economies are coping with the coronavirus outbreak. Chief Economist Gita Gopinath has told European lawmakers that the region faces a difficult recovery even after governments acted quickly to mitigate the damage and countries start to reopen. Yesterday's data on euro-area activity did little to change expectations of a long, slow road back to normality, with rising unemployment still a particular concern. — Alexander Weber What's Happening U.S. Travel | The EU may decide to keep the door shut to Americans when officials convene today to discuss the criteria for lifting a curb on non-essential travel to the bloc as of July 1. One point that's up for debate would mean U.S. citizens wouldn't be allowed into the bloc starting next month because Europeans are still barred for health reasons from traveling to their country. Lufthansa Options | The future of Germany's flagship carrier hangs by a thread ahead of a crunch shareholder vote on its 9 billion-euro state bailout package. Were taking a look at the options for Lufthansa, the government, and key shareholder Heinz Hermann Thiele, who's hinted that he might vote against the rescue deal. Great Reunion | EU leaders will hold an extraordinary summit in Brussels on July 17-18, their first in-person meeting in five months, to try to reach a deal on their 750 billion-euro recovery plan. After positions were exchanged via video conference last week, it's time to cut to the chase if the differences are to be sorted out before the summer break. WTO Run | Ireland is planning to nominate EU trade chief Phil Hogan to be the next director-general of the World Trade Organization, according to a person with knowledge of the plan. Hogan's announcement this month that he was exploring a candidacy left many EU officials puzzled because his current role is among the most coveted of any political post in Europe. Missing Billions | The question everyone in the German business world is asking is as simple as it is perplexing: How, exactly, do you lose almost 2 billion euros? That's the mystery surrounding Wirecard, a former darling of the financial community whose ex-chief executive officer was detained by Munich prosecutors this week after the cash went missing. Virus Update | The German state of North Rhine-Westphalia reimposed a lockdown on a municipality hit by a spate of infections at a large meat factory, while Novak Djokovic, the world's leading men's tennis player, tested positive for Covid-19. England's pubs and hotels will reopen from July 4. Here's the latest. In Case You Missed It Listen Up | In this week's episode of the Brussels Edition on radio, we spoke to former NATO Secretary General Anders Fogh Rasmussen to coincide with the EU-China summit this week. Rasmussen told us Europe must stand up to China and warned that another Trump win could further bolster autocracies across the world. You can listen to the interview here. Italian Exit | If Senator Gianluigi Paragone had his way, Italy would pull out of the European Union and free itself of the euro. Paragone, a former member of the anti-establishment Five Star Movement, told Bloomberg in an interview Monday that he'll launch his new party in mid-July — and that the word "Italexit" may figure prominently in the new group's logo. Lisbon Infections | The coronavirus crisis has shone a light on the plight of hundreds of families, mostly of African descent, living in shanty towns on the outskirts of Lisbon, where there's been a spike in the number of infections. Minority communities are being hit hardest in a country that's drawn generations of immigrants from former colonies. French App | France's coronavirus tracing app is having a slow start, with just 1.9 million downloads since June 2 and 14 notifications sent to users. It's an example of how governments are struggling to develop their own digital tools to fight the pandemic; The U.K. abandoned efforts to launch its own app and will instead use technology developed by Apple and Google. Parked Cars | European car sales are forecast to drop by a record 25% this year after the pandemic shuttered showrooms. That's the steepest percentage drop on record and the lowest number of cars sold since 2013, when the industry was just emerging from a protracted decline following the 2008 financial crisis. Chart of the Day  Risks in France's financial system have reached systemic levels and are set to rise further after the coronavirus shuttered the economy and firms loaded up on debt, according to the central bank. The sudden spike in corporate leverage exposes firms to a "heightened solvency risk" that could later hurt asset quality and bank profitability, the Bank of France said yesterday. The institution had already flagged high corporate debt levels before the disease struck. Today's Agenda All times CET. - 4 p.m. EU's chief Brexit negotiator Michel Barnier speaks at EPC event

- EU Commission holds "structured debate" on racism, unveils report on the application of the General Data Protection Regulation, EU Strategy for Victims' Rights

- Polish President Andrzej Duda to meet Trump at the White House

- Latest IMF outlook due to be published

- Austria's Chancellor Sebastian Kurz testifies in parliamentary Ibiza scandal probe

Like the Brussels Edition? Don't keep it to yourself. Colleagues and friends can sign up here. We also publish the Brexit Bulletin, a daily briefing on the latest on the U.K.'s departure from the EU. For even more: Subscribe to Bloomberg All Access for full global news coverage and two in-depth daily newsletters, The Bloomberg Open and The Bloomberg Close. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. |

Post a Comment