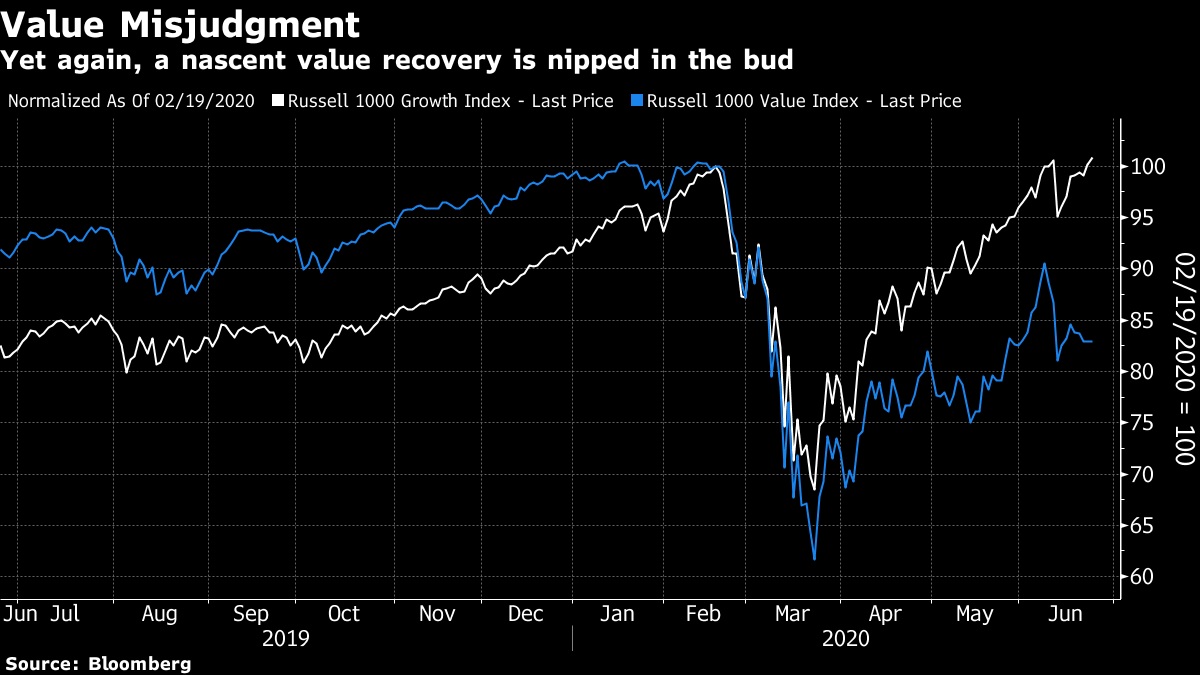

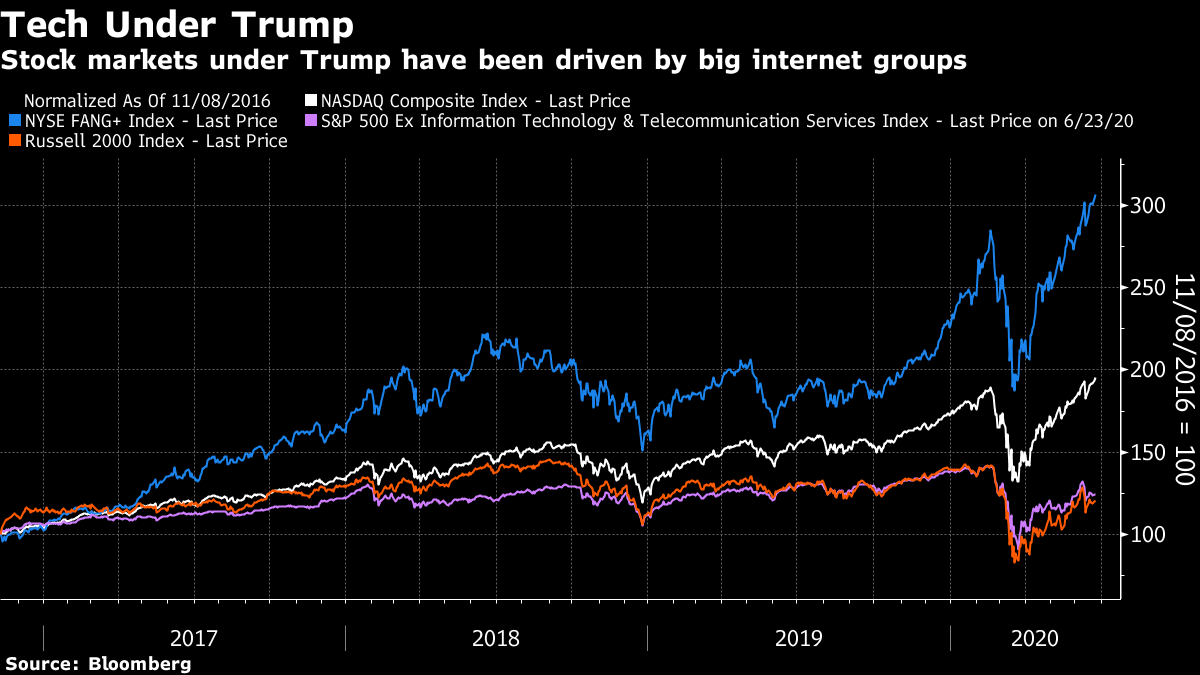

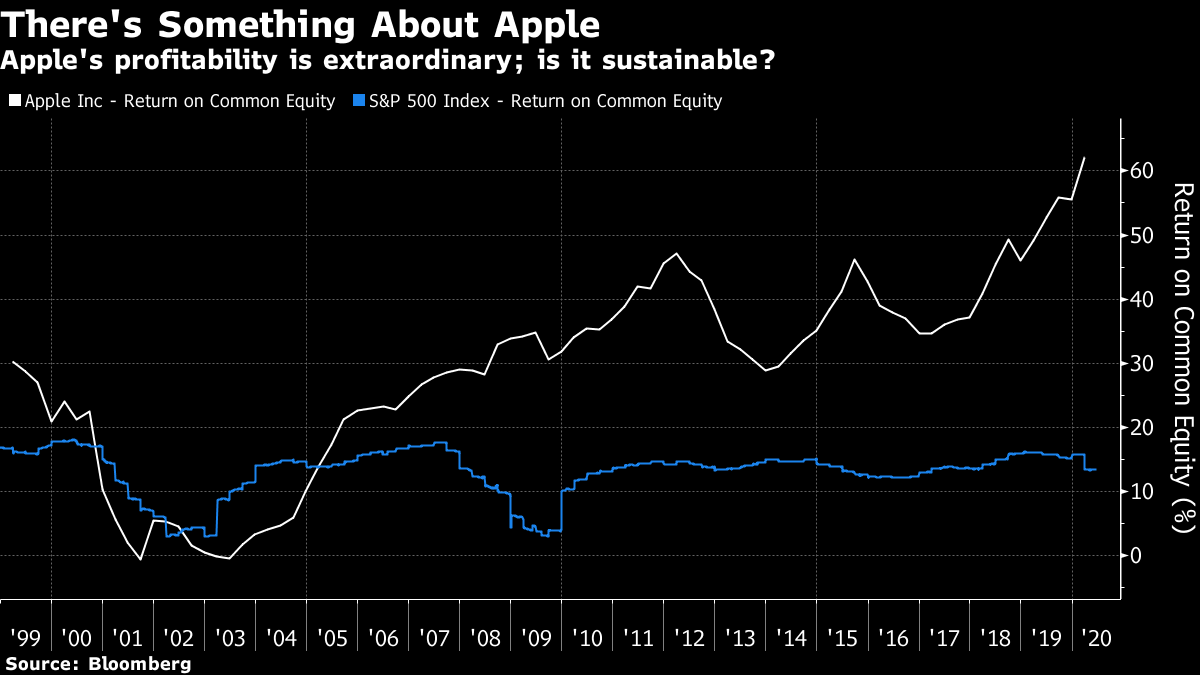

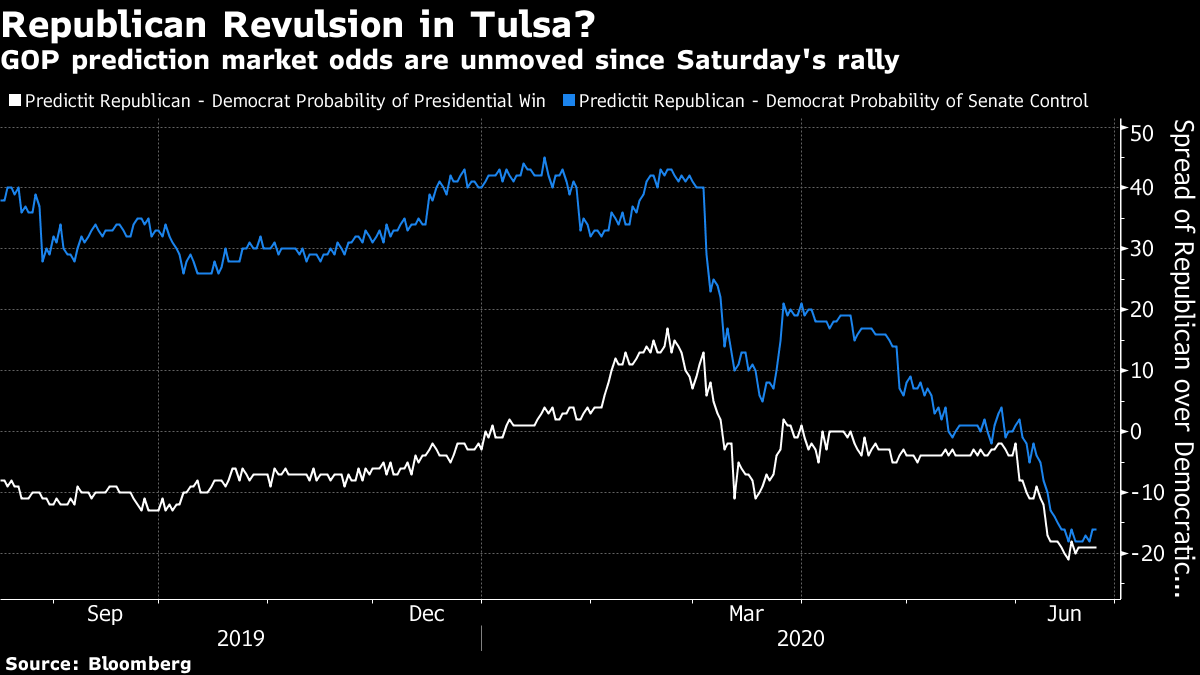

The Football Remains Unkicked Charlie Brown is flat on his back once more. At the end of last month, you may remember I wrote a newsletter rather nervously arguing that it was time for value (buying stocks which look cheap compared to their fundamentals) to start beating growth companies (chosen for their rising earnings), after a losing streak that had lasted more than a decade. Since then, as recorded by the Russell indexes, value stocks have taken a leg back down again, while the growth stocks in the Russell 1000 index of large U.S. companies hit a new all-time high Tuesday:  To put this into further more startling historical context, we need to make comparisons with 2000, the year when arguably the greatest-ever growth rally peaked. Growth is doing even better relative to value than it did then:  The risk that growth stocks will tank as they did in the latter part of 2000 remains very real. It hasn't happened yet. And this should be a matter of some concern. The widening of the market, with the brief strong performance of value, suggested genuine confidence in a broad economic recovery. In such conditions, cheap companies that might have appeared risky are able to survive and flourish, while growth is in broader supply so the companies with growing earnings do not stand out as much. Growth and tech stocks may have hit all-time highs again, but this has come against a background of falling real yields, higher gold prices, and a narrowing market. These are all signs of lower confidence. For another comparison with 2000, look at the performance of the S&P 500 information technology sector compared to the rest of the S&P 500. At the beginning of 2000, tech was nearing the end of a historic bull run. But as of Tuesday, the tech sector is beating the rest of the S&P 500 for the millennium so far. This is the first time this has been true in more than 19 years:  Of course the technology sector has changed a lot in the last two decades, even if Microsoft Corp. remains one of the biggest names. The dominance of a small group of internet platform companies is a relatively recent one, and it has been critical to the overall performance of the market. Neither Amazon.com Inc. nor Netflix Inc. are technically classified as information technology companies but tend to perform in line with fellow "Fang" companies such as Apple Inc., Facebook Inc. and Google's holding company Alphabet Inc. The following chart shows the performance of the NYSE Fang+ index of internet platform companies, and the Nasdaq Composite, which has also broken through to a new high, along with the Russell 2000 small companies index, and the S&P excluding both technology and telecommunications companies. All are indexed to the last U.S. election date:  This rally continues to be led by a small group of companies to a remarkable extent. What is true is that all of the current leaders are far better positioned and well-established than the stocks which created so much excitement 20 years ago. Most dotcom stocks never won inclusion in the S&P 500 index, but the mania around them led to ridiculous valuations for many companies. The NYSE Fang+ index currently trades at a huge 46 times trailing earnings, but valuations were even higher around the top of the last internet bubble. Cisco Systems Inc. notoriously traded at more than 300 times its trailing earnings before that bubble burst. The more important argument in favor of the Fangs these days is that they are genuinely making profits, and have every prospect of continuing to do so. The most dramatic example is Apple, whose return on common equity is shown here going back to 1999, the point when Steve Jobs returned and started to revive its fortunes. At that point, at least when judged by its return on equity, Apple was no more profitable than the S&P 500 as a whole. That has certainly changed:  Rather than asking whether valuations can be maintained, the question now should be whether the dominant platform companies will be allowed to continue operating so profitably. Generally, it is very hard to earn returns like this for very long unless helped by an entrenched monopoly position. For the long term, bulls of the big platform companies should ask themselves whether their business models will be proof against political interference. For the short term, however, it is time for me to acknowledge that value's time to shine has still not arrived. It's not good to feel like Charlie Brown staring up at the sky. But it is also worrying that investors are still not finding many opportunities outside the few dazzling big companies that dominate modern life. A Little Bit of Politics After the failure of my tentative prediction about a turning point for value, let me make another one. The political noise in the U.S. is deafening at present, and President Trump has definitely had several very bad weeks. The coverage for Saturday's great comeback rally that wasn't has been uniformly negative. Not even the president's usual defenders have been able to put much of a spin on an undeniable debacle. His campaign committed the deadly political sin of over-promising and under-delivering. But if we look at the odds on prediction markets, they are unchanged since that disaster, while the chances of Republican control of the Senate have edged up slightly. The Tulsa disaster looks at this point like a moment of catharsis or revulsion, to use the usual market terms. The people who trade on prediction markets don't feel moved to bid down Trump's chances any further:  There is some sense in this. The election is still more than four months away, and lots can happen between now and then. And of course Trump upset the odds four years ago. It doesn't seem wise for those putting money on the outcome to bet any more on a Trump defeat. That seems sensible of them. And for the next few weeks at least, the political risks may well be skewed the other way. After such a crescendo in negative sentiment, there is every chance that Trump's political fortunes are about to appear better. That in turn could help juice markets that are uncomfortable about the prospects of a Democratic clean sweep bringing higher corporate taxes in its wake. After enjoying some of the very funny memes that make fun of the Trumpian embarrassment, it might be as well to prepare for a recovery in his political fortunes, at least for a while. Survival Tips Returning to Apple, I cannot deny it's a good company. Its flagship Manhattan store, on Fifth Avenue at the corner of Central Park, has reopened, and so I took a laptop in for repair Tuesday. Quite a landmark, the store is underground, and can only be reached via a beautiful staircase encased in a glass cube. The store is lit by skylights set into the plaza above. And, I discovered, those skylights are six feet apart from each other. Social distancing therefore couldn't have been easier. I joined the line, stood on a skylight, and periodically moved forward to the next one. Inside, the tables are set out just as they always have been. Six feet apart from each other. If the architects had known exactly what was going to hit us, they couldn't have designed it more perfectly for the world of coronavirus. So there are worse things than sticking with Apple and its products, despite what I said about them earlier. And if the world of retail is going to change as much as many now say, it probably makes sense to expect more outlets to look like Apple stores in future. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment