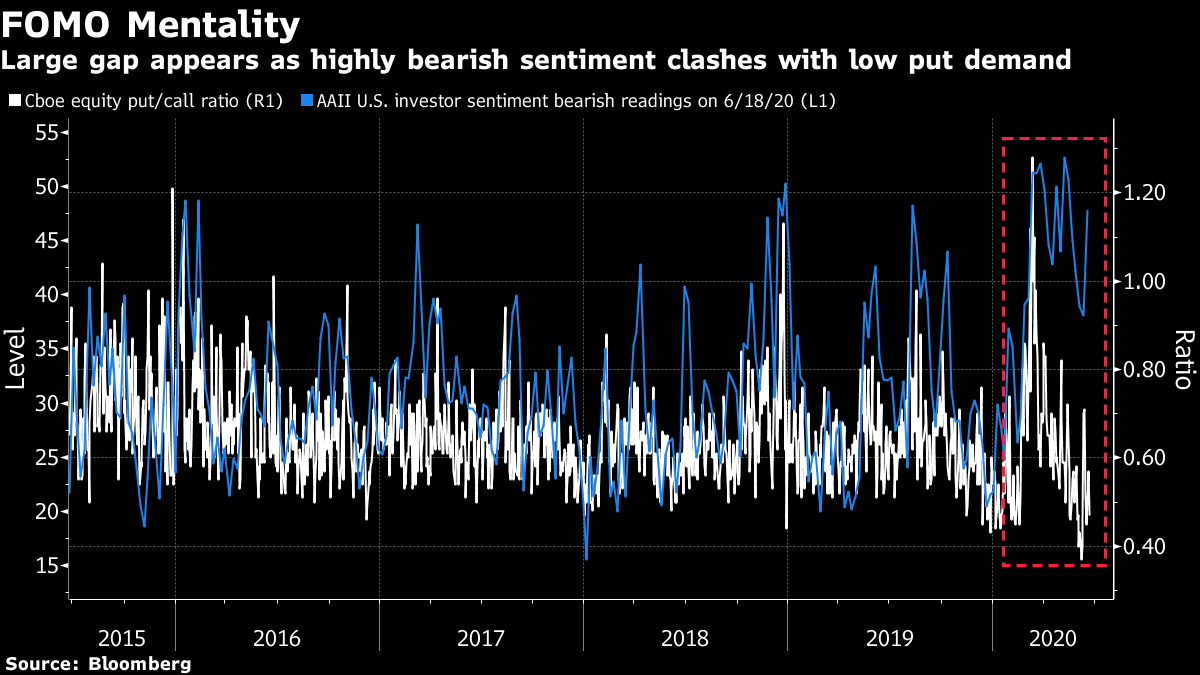

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. The European Union could keep a ban on American travelers, infections are surging in U.S. hot spots and there are several potential M&A deals on the horizon. Here's what's moving markets. Travel Ban The European Union could maintain a ban on visitors from America coming to the bloc when they meet on Wednesday as Europeans are still barred from entering the U.S. under virus travel restrictions. The Covid picture in Europe is mixed. Italy reported the lowest number of new infections since February but Germany has seen its infection rate increase amid localized outbreaks. The U.K., meanwhile, finally outlined its plans to cut the social distancing guidance to one-meter from two and said pubs, cinemas and museums can all reopen on July 4. It's a gamble for Prime Minister Boris Johnson, a bet on getting the economy going again with the risk that reducing restrictions could result in a second wave of infections. Infections U.S. virus cases are surging in hot spots including California, Florida, Texas and Arizona, and "creeping up" in New Jersey, throwing the process of reopening local economies into disarray. Top U.S. infectious disease expert Anthony Fauci said the country plans to step up testing and cautioned against linking a stable mortality rate to a rise in cases among young people. None of which will calm nerves about a possible second wave for an economy that may need more federal aid for cities and where people may have to start dipping into the money they've saved during lockdown. The misery spreading through the U.S. economy also poses a significant threat to President Donald Trump's re-election chances. Deals, Deals, Deals A smattering of European M&A news to consider for Wednesday. A host of private equity houses are lining up to make bids for the tea business of Unilever and there may be plenty of suitors for Borsa Italiana SpA should London Stock Exchange Group Plc have to sell the Milan-based exchange operator to appease regulators. Volkswagen AG is said to be exploring a bid for car-rental firm Europcar Mobility Group, while Schneider Electric SA and Emerson Electric Co. are among the groups considering an offer for SoftBank Group Corp.-backed industrial software group OSIsoft LLC. And Italy's Benetton family is seeing interest from international funds for its stake in wireless towers operator Cellnex Telecom SA. Stimulus Expectations that more stimulus is on the way continues to drive European and U.S. stocks higher, turning some more bullish on European assets, driving biotechs to outperform FAANGs and closing in on creating a new member of the $1 trillion market cap club. Yet, warnings abound. The faith traders have in using government bonds as a hedge is fading, others are fretting about valuations, some are worried about zombie companies and there are concerns about a growing risk that emerging markets will get hooked on stimulus. Even more broadly, some notable economists are calling for a rethink of capitalism in its entirety. Coming Up… European stock futures are trending lower and U.S. futures are mixed after equities in Asia drifted on light volumes. Gold continues to rally despite the ongoing appetite for risk assets and is getting close to hitting the tough-to-crack $1,800-per-ounce mark. The German IFO survey and French manufacturing confidence data will arrive following the pick-up in economic activity seen in PMIs on Tuesday, albeit pointing to a sluggish recovery accompanied by growing unemployment. Watch too as clients distance themselves from German payments firm Wirecard AG following its spectacular fall. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning Investors looking for evidence of the fear-of-missing-out mentality prevalent in today's stock market should keep an eye on the unusual gap that's opened up between a gauge of sentiment and one of action in U.S. equities. While bearish readings from the American Association of Individual Investors have jumped to a historically high level, demand for downside protection via the options market remain very subdued, according to the Cboe's ratio of puts to calls. That suggests investors are swallowing their fears and continuing to maximise their exposure to any upside. As Citigroup's Tobias Levkovich describes it, it's a case of the concerned investor not putting their money where their mouth is. Still, signs of both bullishness and bearishness were clearly evident in Tuesday's trading. The Nasdaq 100 closed at a record, yet gold rallied to its highest in eight years.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment