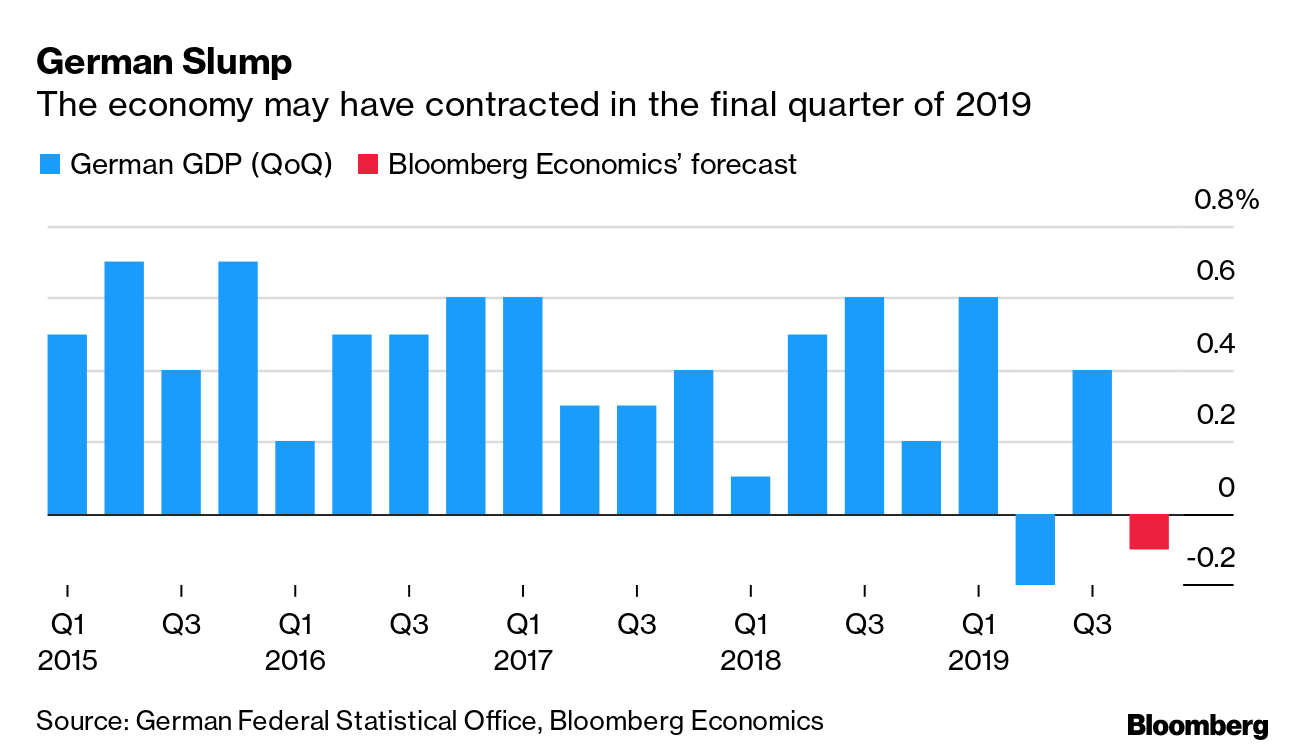

| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. As coronavirus cases spread to Europe, so do worries that contagion won't be limited to public health. China is the EU's third-biggest export destination, and key to supply chains: Fiat Chrysler said last week it may even have to close a European factory because of its reliance on one part from China. With Germany already in a slump, the Chinese lockdown has the potential to derail Europe's first-quarter recovery. EU health ministers will hold an emergency meeting in Brussels on Thursday, when the European Commission is also expected to touch upon the impact of the virus in its quarterly economic forecasts — though it's likely to say that the situation is too uncertain to make meaningful projections at this stage. —Nikos Chrysoloras What's Happening Google Hearing | Google's decade-long antitrust fight with the EU is set for more twists and turns this week as the internet giant battles the first in a trilogy of fines that cost the company nearly $9 billion. Lawyers say the court clash — at a three-day hearing at the EU's General Court in Luxembourg — will help set the scene for a broader crackdown on U.S. tech giants by Margrethe Vestager. Merkel Management | Chancellor Angela Merkel will attempt to pick up the pieces this week after her party's flirtation with the far right in eastern Germany led to a political fiasco. With the small state of Thuringia suddenly dominating national politics, Merkel and other leaders of her Christian Democratic Union, who meet today in Berlin, are trying to exclude the nationalist Alternative for Germany party, or AfD, from the region's government. Libya Conflict | United Nations-backed talks aimed at ending the conflict in Libya continue and it's becoming increasingly clear the much-advertised Berlin truce accord was little more than empty words. Meanwhile, the "geopolitical" EU is still struggling to equip its naval mission tasked with enforcing an arms embargo with actual warships. Three-Way Split | Ireland saw a seismic election over the weekend. While the final outcome remains uncertain, it's clear Sinn Fein, long considered toxic for its IRA links and left-wing policies, has moved to the center of the political landscape, becoming a key power broker in the process. Salvini's Fate | The Italian Senate will vote Wednesday on whether right-wing leader Matteo Salvini should face prosecution for kidnapping by refusing to allow a coastguard ship that had rescued 131 migrants to dock in Sicily in July. Salvini says that he defended Italy, was applying government policy and was waiting for other EU countries to accept the migrants. In Case You Missed It Chinese Warning | China warned France against treating Huawei differently from European competitors when it comes to future 5G network equipment contracts, as the U.S. presses ahead with a campaign to keep the tech giant at bay. As France prepares to auction 5G spectrum in April, its main carrier, Orange, has already announced it would leave Huawei out and work instead with Nokia and Ericsson. Ousted Envoy | Gordon Sondland announced he'd been ousted as U.S. ambassador to the EU, as President Donald Trump moved swiftly to exact retribution on those he blames for his impeachment. We suspect he won't be missed by EU officials and diplomats in Brussels. Educating Finns | In Finland, which just topped the UN's World Happiness Index, the central bank is drawing up a financial-literacy strategy for citizens. They won't stay the most cheerful people on earth for much longer if they keep borrowing so much, so some help with managing their finances was deemed necessary. Protests Uncorked | Sommeliers, wine importers and restaurateurs took to the streets of Washington on Sunday with a message for U.S. Trade Representative Robert Lighthizer: "Keep your tariffs off our Beaujolais." The march was a last-ditch effort to stave off the threat of tariffs as high as 100% on a range of European products including wine, cheese and olive oil that could be announced as soon as this month. Chart of the Day  Germany's industrial woes showed no sign of abating at the end of 2019, and a slump in December raises the prospect the economy could have contracted in the fourth quarter. Bloomberg Economics estimates gross domestic product shrank in the three months through December, as do analysts at Societe Generale and ABN Amro. Today's Agenda All times CET. - 2:15 p.m. EU's chief Brexit negotiator Barnier briefs press after meeting with Luxembourg Prime Minister Bettel

- 2:30 p.m. EU Enlargement Commissioner Varhelyi speaks at CEPS think tank in Brussels

- EU tech and antitrust chief Vestager hosts First Minister of Scotland Sturgeon

- 2:30 p.m. Sturgeon speaks at EPC event in Brussels

- EU Parliament Plenary begins in Strasbourg, to debate Commission's review of euro-area economic governance and proposal for revision of enlargement methodology

- EU Council President Michel continues visit to Ethiopia

Like the Brussels Edition? Don't keep it to yourself. Colleagues and friends can sign up here. We also publish the Brexit Bulletin, a daily briefing on the latest on the U.K.'s departure from the EU. For even more: Subscribe to Bloomberg All Access for full global news coverage and two in-depth daily newsletters, The Bloomberg Open and The Bloomberg Close. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. |

Post a Comment