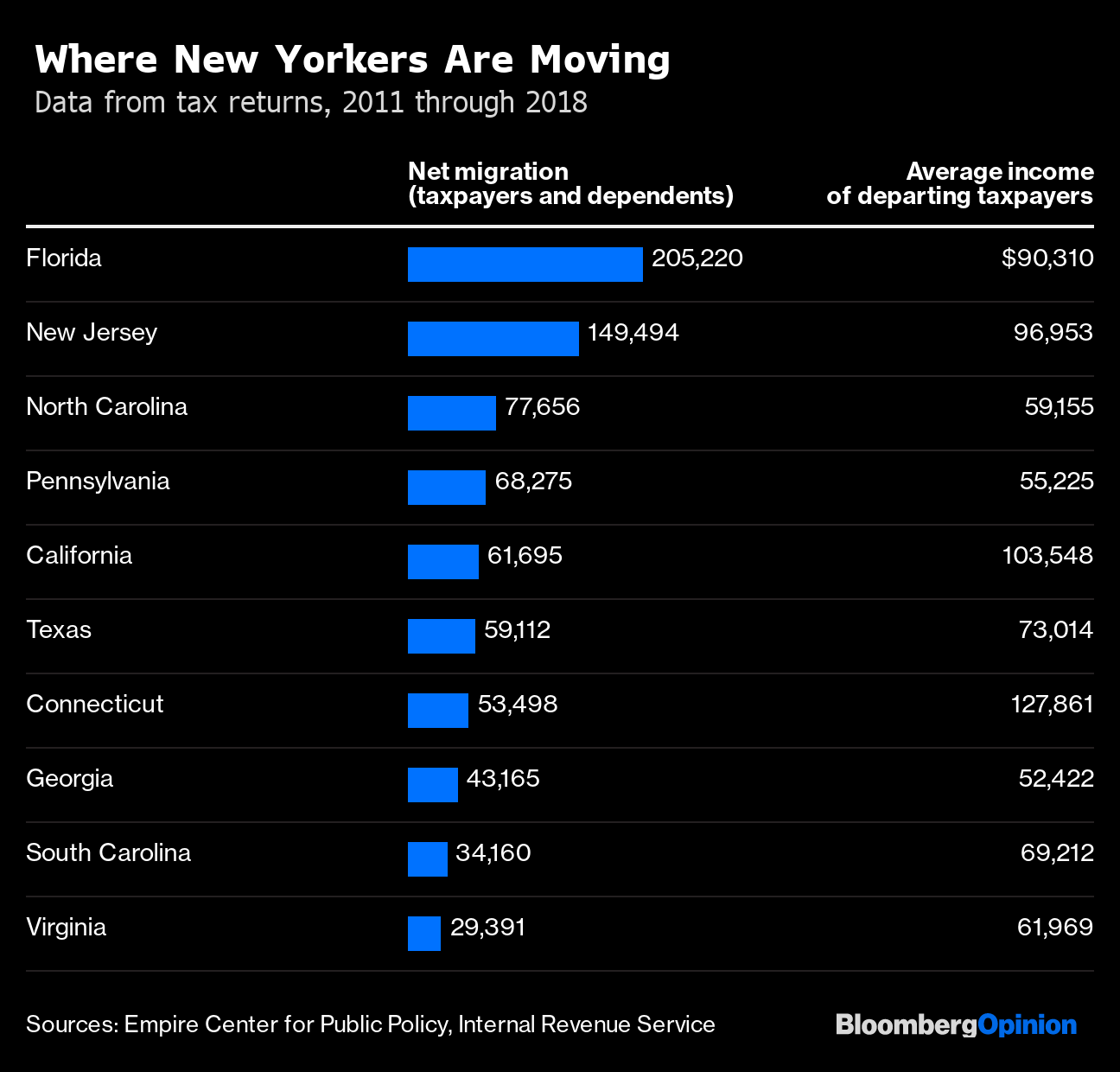

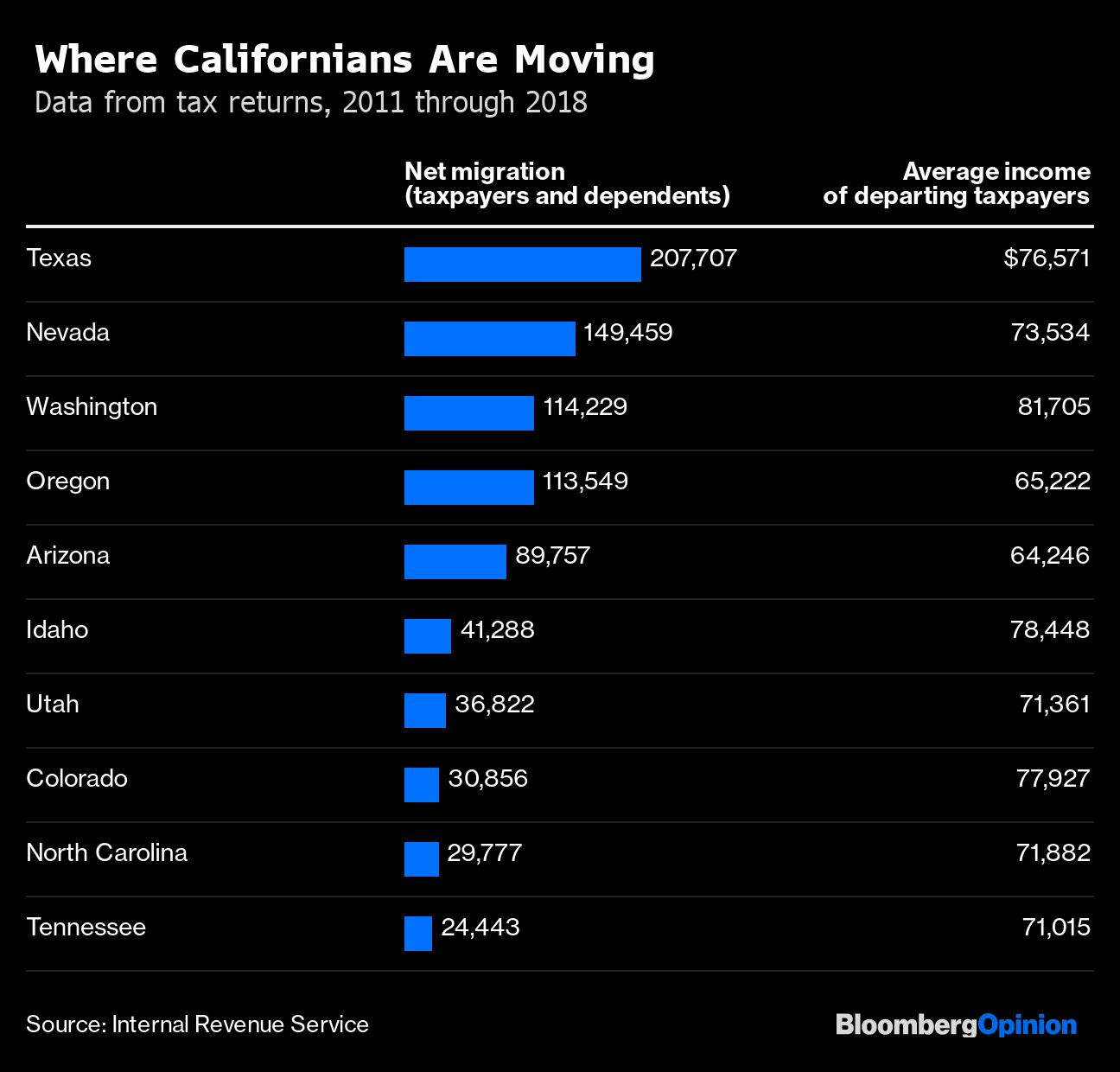

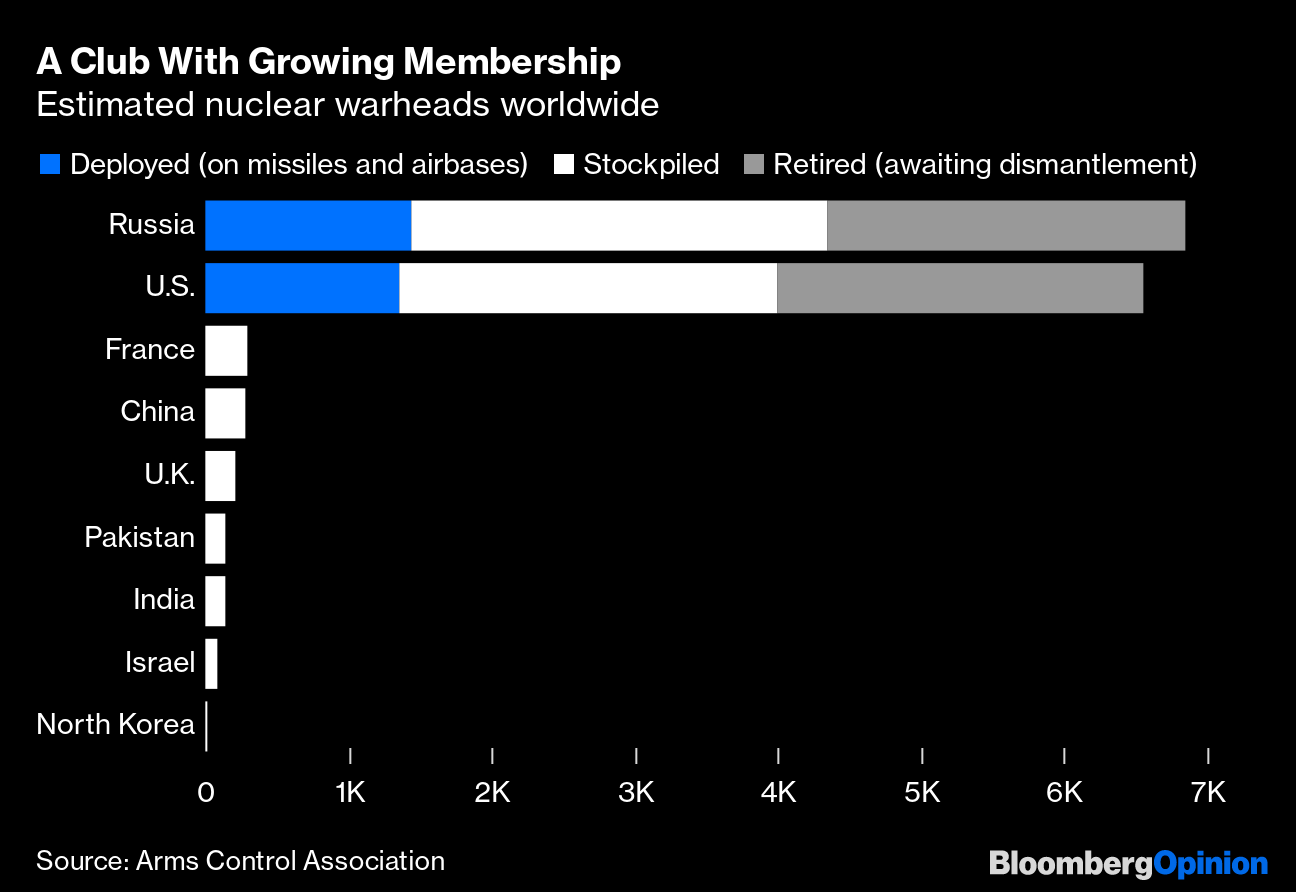

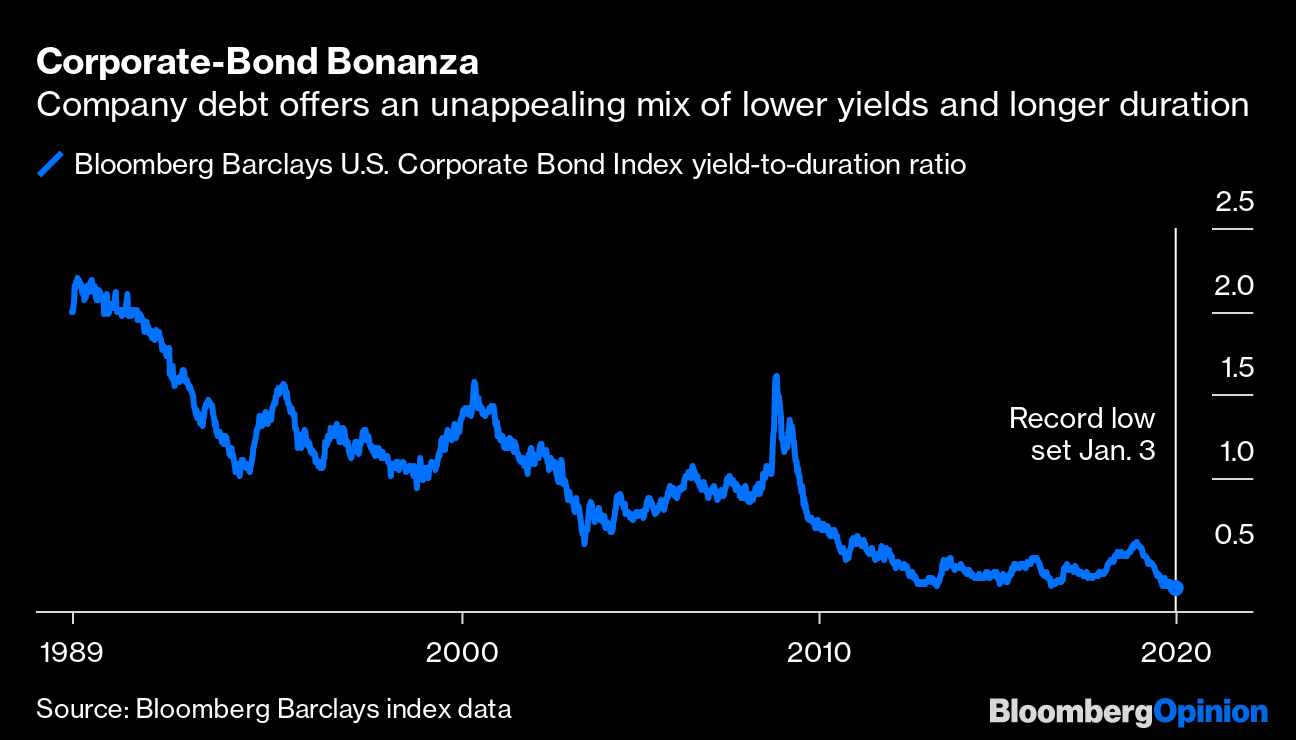

| This is Bloomberg Opinion Today, a cowboy stew of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  Better than shoveling snow. Photographer: Robert King/Hulton Archive/Getty Images We Are Not All Florida Man Now There's a story some of us like to tell ourselves, about downtrodden rich people fleeing the ultra-liberal, ultra-taxed blue states of California, Illinois and New York to such red-state paradises as Florida and Texas, where the air is warm, the taxes are low, and the McMansions are all above average. But this tale is way too simple, according to some heavy number-crunching by Justin Fox. Yes, many rich people ditch New York for Florida, as they always have. (Usually right after they start contemplating clearing snow with a flamethrower.) But many, many more people are leaving big, pricey blue states simply because they can't afford to live there any more. And some of the richest people leaving New York go to … California, giving new meaning to the frying pan-fire thing:  Many more New Yorkers move across the river to New Jersey, where the taxes are decidedly not low, and the pizza is way worse. (And New Jersey Governor Phil Murphy doesn't make awesome posters like New York Governor Andrew Cuomo.) As for California, Justin finds the people fleeing that state are not typically the super-rich (though maybe they're just waiting for Peter Thiel to launch his floating city-state). Its expats have average adjusted gross incomes less than the $84,641 of those who stay:  Like round-up newsletters, myths are fun but don't tell you the whole story. So you should go read Justin's whole piece. Iran Focus Shifts From Tension to Tragedy The tentative truce-iness between the U.S. and Iran held for a second day, inspiring another stock-market rally. It helped a lot that President Donald Trump's address about the crisis yesterday strongly hinted he has zero interest in all-out war with Iran, writes Eli Lake. Trump's speech had something to please everybody but the hawkiest hawks, writes Meghan O'Sullivan. Most of his supporters were probably happy with his tough rhetoric, while war opponents were relieved it wasn't more belligerent. Iranians were probably glad for a break from the hostilities. He even offered Europeans a chance at constructive involvement. The people probably left coldest were the Iraqis trapped in the no-man's land between the two countries. They got bupkus. Most of the focus on Iran turned to yesterday's plane crash outside of Tehran. U.S. officials, and Canadian Prime Minister Justin Trudeau, now say the plane was probably shot down, in what may have been a tragic error — perhaps an unintended consequence of heightened tensions. Iran may be loath to invite American help with this investigation; but if it does, then the U.S. should seize the chance to build some goodwill, writes Esfandyar Batmanghelidj. And no matter the cause of this crash, flight safety in Iran has suffered under sanctions restricting sales of parts needed to repair and upgrade planes. The U.S. should lift those, Esfandyar writes, to avoid even more tragedies. My, How the Tech Tables Have Turned You can't say stuff doesn't move fast and get broken in tech. Just three years ago, it was the Unicorn Age, when anybody with a dream and SoftBank's phone number could own a private tech company worth billions. Big, established, publicly traded tech companies were unloved, notes Conor Sen. Three years, a couple of bad IPOs and one WeWork later, unicorns are an endangered species, while publicly traded tech is more stupid-expensive than that Bel Air mansion with the "Airwolf" helicopter. This dramatic role reversal means there are bargains to be found by acquirers in the unicorn wasteland. That's not to say famous unicorn-herder SoftBank won't still play a role. Food-delivery company Grubhub Inc. has been public for a while now, but it's reportedly considering selling itself to the highest bidder. But SoftBank, which has big stakes in two of its competitors, is an obstacle to the two most sensible possible deals, writes Alex Webb. Telltale Charts The risks of nuclear war keep rising, and the Nuclear Non-Proliferation Treaty is a joke based on game theory that no longer applies, writes Andreas Kluth. We need mediators to keep things from getting out of hand.  One bond measure shows just how scary-expensive the bond market has gotten, writes Brian Chappatta: It won't take much of an interest-rate rise to wipe out returns for bonds people own.  Further Reading A steelmaker's plea for an exemption from tariffs his company once cheered shows just how tricky trade wars can be, and how the current one is still stinging. — Liam Denning Cable companies are finally starting to unbundle their triple-play packages, but don't worry: They'll still find ways to make money, including by rebundling. — Tara Lachapelle Kohl's Corp. is starting to run out of ideas for saving itself. — Brooke Sutherland Think of the royal family as a business and Harry and Meghan as disgruntled employees. — Sarah Green Carmichael Utah's Mike Lee showed why he's one of the handful of Republican senators who might vote for Trump's conviction. — Jonathan Bernstein Congressional Republicans are making a strong new push against Roe v. Wade. — Ramesh Ponnuru Labour is struggling to move on from Jeremy Corbyn. — Therese Raphael Maybe climate scientists have been hedging their warnings too much. — Mark Buchanan ICYMI The hidden dangers of index funds. (And Matt Levine on same.) Taco Bell is offering some managers $100,000 starting salaries. What financial freedom means for Prince Harry and Meghan. Kickers 2,600-year-old brain imitates Big Mac, refuses to decompose. (h/t Mike Smedley) Scientists find ways to extend nematode lifespans fivefold. Area fisherman catches mysterious NASA device. Area man makes New York subway map, gets threatened by the MTA. Note: Please send subway maps and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment