Inside: New UN climate findings are "bleak." Californians are moving deeper into risky fire zones. Investment management is a boy's club. Big beef scrubs its image. — Emily Chasan and Eric Roston Sustainable FinanceCentral Banks should develop climate-related stress tests, according to IMF chief Kristalina Georgieva. The tests can help identify the impact of climate shocks to the financial system. Georgieva wrote a piece for an edition of an IMF magazine dedicated to the economics of climate change.

In a move to boost clarity around ESG ratings, MSCI ESG Research is making public its ratings of over 2,800 companies and will increase that to 7,500 companies in 2020. "We want to encourage open discussion among investors and companies on how to improve sustainability across the board and hope that making the MSCI ESG Ratings available to all will facilitate these discussions," Remy Briand, head of ESG at MSCI, said in a statement Monday. NN Investment Partners says 11 emerging markets fund managers have now resigned from the firm over disagreements about responsible investing. NN is making ESG criteria a "standard component" of all investment processes. Those who left NN expressed concern about how that would apply to emerging markets and how it would impact fund performance. Investors are moving away from carbon footprinting toward a "carbon footpath" Axa Investment Managers' Lisa Renelleau and Shah Khan wrote in a paper this month. Divestment from big emitters is one way to reduce the carbon footprint of a portfolio, but investors shouldn't look at decarbonization as just a one point-in-time exercise, they said. Axa SA announced it will double its green investments by 2023, to $26 billion, and restrict its underwriting of coal-related businesses. In Brief - "What is sustainable finance?" is now a $4 trillion question.

- Europe's green government bond market is expected to triple to nearly 140 billion euros by 2023 from about 42 billion euros at present, ABN Amro forecast in a note.

- S&P Global said it will acquire an ESG ratings business from RobecoSAM, with the deal expected to close in the first quarter.

Environment Failure to address climate change is locking in either danger or extremely sharp emission cuts, according to the UN Environment Program's annual Emissions Gap Report. Global pollution must fall 7.6% a year by 2030 — an incomprehensible rate. In a break from tradition, scientists described their findings as "bleak." Forest fire emissions from Indonesia are worse than the Amazon. Brazil's deforestation problem has become great, which the Bolsonaro government has now acknowledged. Europe is pushing toward climate neutrality.

California's housing crunch is pushing developers to design new communities in the heart of wildfire country. Housing developers say they are designing anti-wildfire fortresses. Ecologists say they might burn anyway. The state's wildfire crisis is also roiling its insurance market.

The world is about to set a record for quitting coal, with power generated by coal expected to drop by 3% worldwide this year. Developing markets are not on the same path, with the amount of electricity generated from coal up 7% in emerging markets last year, according to a BNEF ClimateScope report. In Europe, Sweden is seeing boom times in wind power.

This battery recycler is helping to fuel the future of cars.

The future of fashion isn't buying items and letting them sit in your closet for eternity, said Rent the Runway's CEO Jennifer Hyman. Instead, people will pay for "access" to clothing.

Making seeds to withstand climate change is getting harder.

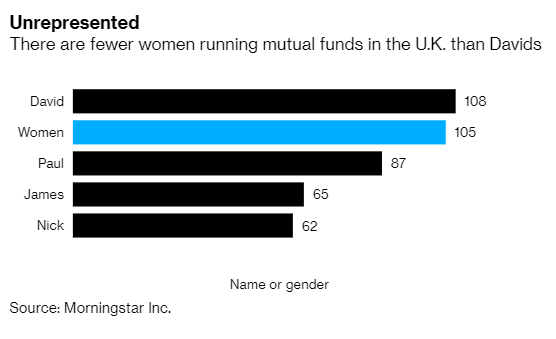

Big beef is trying to scrub its image as a polluter amid a boom in plant-based meat. Meat-eating in general is gaining globally, but growth is slowing. SocialInvestment management is still a boy's club. All-male teams run 409 out of 528 large-cap mutual funds, a study by Goldman Sachs found. By comparison, only 15 funds had all-female teams. In the U.K., a Morningstar study found more mutual funds are run by managers named David than by women.  Google fired four workers, including a staffer tied to recent employee protests over the company's work with military contractors, escalating tension between management and activist workers. The company said that the workers violated data-security policies. The next big thing might be at risk, as fewer women and minorities are getting patents, according to a recent report from the U.S. Patent and Trademark Office. GovernanceWhy aren't companies owned by the people who work for those companies, asks Noah Smith of Bloomberg Opinion. "It seems like a natural way to organize a business." There's no legal reason companies have to be structured the way they are currently, with outside shareholders electing a board that hires executives, he says. Investors are asking the SEC to double the comment period on its proposed proxy rule changes to 120 days. Letters were filed at the agency by the Council of Institutional investors, and New York State and City Comptrollers Tom DiNapoli and Scott Stringer. "The two concurrent proposed rules individually, and collectively, if adopted, would result in the most significant changes to the voting rights of shareowners in decades," Ken Bertsch, executive director of the Council of Institutional Investors, wrote. Investors might penalize companies in the market for adding women to their boards, despite the theory that diversity boosts returns, academic researchers found. An analysis of 14 years of market returns across about 1,889 companies finds that when they appointed female directors, they experienced two years of stock declines.  Note: Please send tips, suggestions and feedback to Emily Chasan at echasan1@bloomberg.net. New subscribers can sign up here. To see this on the web, click |

Post a Comment