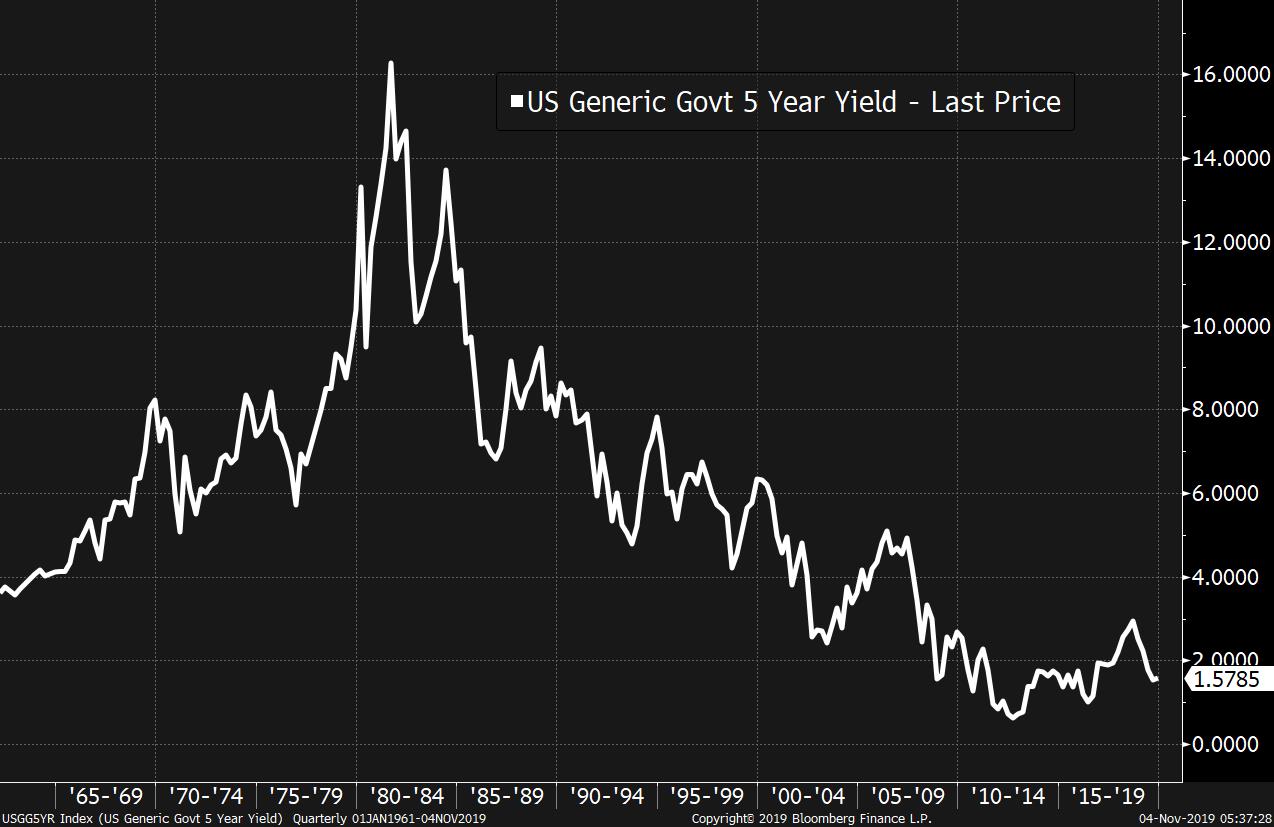

Aramco (finally) launches IPO, progress made on trade talks, and a raft of corporate news. At lastSaudi Aramco published an intention to float document yesterday, putting the company on track to list it shares on the Riyadh stock exchange three years after the IPO was first mooted. One of the big unknowns so far is the valuation of the company, with Bank of America offering a range of $1 trillion between its high and low estimate, according to investors who reviewed the research. It does seem likely that Saudi Arabia's initial target of $2 trillion will not be met, with the kingdom likely to accept a figure between $1.6 trillion and $1.8 trillion, even with incentives offered to make the deal more attractive. Deal optimism Commerce Secretary Wilbur Ross said "there's no natural reason" a phase one trade deal between the U.S. and China could not be signed this month. He made the comment in a Bloomberg interview in Bangkok before meeting Chinese Premier Li Keqiang at a regional summit. President Donald Trump yesterday said that a deal, if one is completed, could be signed in the U.S. In further good news for trade, Ross said the U.S. may not need to place tariffs on imported automobiles after "good conversations" with manufacturers in the European Union, Japan and elsewhere. Company newsMcDonald's Corp. shares dropped more than 2% in pre-market trading after the board of the company announced it was firing Chief Executive Officer Steve Easterbrook because he had a consensual relationship with an employee. Things were worse at Under Armour Inc. which saw its shares plunge by as much as 16% after the company disclosed that federal officials have been probing its accounting practices for more than 2 years. Under Armour reports earnings today. Tiffany & Co. is expected to reject LVMH's proposed $14.5 billion takeover of the American jeweler as too low. Markets rise The positive noises on global trade are driving markets higher today. Overnight, the MSCI Asia Pacific Index climbed 0.6%. Japan's Topix index was closed for a holiday. In Europe, the Stoxx 600 Index was 0.9% higher at 5:45 a.m. Eastern Time with automakers posting the strongest gains as the risk of U.S. tariffs seems to be fading. S&P 500 futures pointed to a strong open, the 10-year Treasury yield was at 1.756% and gold was lower. Coming up…The final September reading for U.S. factory and durable goods orders is published at 10:00 a.m. San Francisco Fed President Mary Daly speaks in New York later, and European Central Bank President Christine Lagarde gives her first speech in her new role in Berlin. Ferrari NV, Uber Technologies Inc., Shake Shack Inc., and Hertz Global Holdings Inc. are among the companies reporting earnings today. What we've been readingThis is what's caught our eye over the weekend. And finally, here's what Joe's interested in this morningWill yields on U.S. government bonds ever go into negative territory? It remains a hotly debated question, and a fresh report from Bank of America argues that we'll see them in the next downturn. Anything is possible, but here's something to bear in mind: Negative yields only make sense if you think that at some point the Fed is going to cut its short-term policy rate to below zero. Ultimately, negative rates on government bonds are a policy choice by the central bank. Negative yields exist in Europe and Japan because their central banks allowed it. So if you think that U.S. Treasury rates will go negative, then it means you think that the next time the Fed gets to zero, it will keep cutting, as opposed to trying other measures such as further QE, expanded-asset QE, more aggressive forward guidance, or something else entirely. There are good reasons to be skeptical the Fed will cut rates into negative territory. For one thing, Fed speakers have been pretty consistently against that idea. For another, it hasn't exactly been a smashing success where it's been tried (see: Europe, Japan). Furthermore, it would likely be incredibly unpopular. If you thought QE was controversial, wait until banks start offering savers negative rates. Of course it's possible that the Fed insists it will never go negative, but the market doesn't believe the central bank, in which case we end up with a game of chicken. But the bottom line is that rates on government bonds are essentially estimates of the trajectory of short-term rates, and so negative yields only make sense if you think at some point the rate that the Fed controls goes below zero.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment