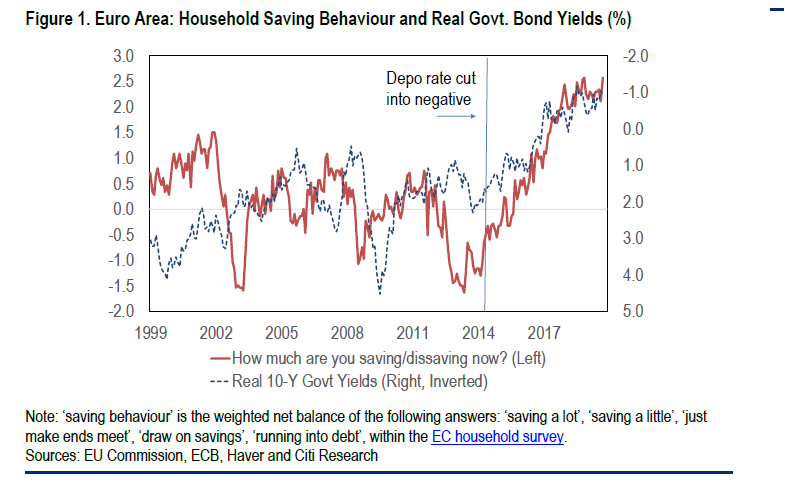

Impeachment process rumbles on, earnings roll in, and the U.K. readies for an election. Unavoidable impeachment updateHouse Democrats will put Intelligence Committee Chairman Adam Schiff in the lead of the next phase of its impeachment inquiry of President Donald Trump as the investigation moves into public hearings under the terms of a resolution released Tuesday. The resolution sets no deadlines to finish the investigations or for putting together any articles of impeachment, but it sets out some parameters for the role of Republicans at hearings and, eventually, Trump and his legal counsel. If, like your favorite daily markets newsletter, you can't keep up with all this, here's a handy primer. Elsewhere, a judge in Florida ordered an associate of Rudy Giuliani to testify within 30 days about the source of funds that were used to make campaign donations to the America First political action committee and former U.S. Congressman Pete Sessions. Predictable earnings sectionA slew of the biggest names in Europe reported today, so let's jump straight in: Volkswagen AG lowered its outlook for vehicle deliveries this year on a faster-than-expected decline in auto markets around the world. Deutsche Bank AG saw earnings from trading debt securities and currencies drop 13%, compared with gains at all big Wall Street peers. Banco Santander SA's quarterly results reinforced the Spanish bank's dependence on a thriving Latin American business as it continues to struggle in Europe. Total SA's third-quarter profit beat analyst estimates and cash flow held firm, as the French giant offset lower oil and gas prices by boosting production and cutting costs. Airbus SE cut its full-year delivery target and said cash flow will be lower than expected. Phew! We think they're all the main ones. In other corporate developments, Fiat Chrysler Automobiles NV and French carmaker PSA Group are talking about a possible combination; European auto shares bucked a broader decline on the news. Not a Brexit bit, for onceStrike up the Benny Hill music, because a British election is coming. The comedy started early with Labour Party leader Jeremy Corbyn's Tuesday U-turn over supporting an early vote, which came at about the same time his political opponents figured out how to arrange one without him. It will continue over the coming weeks until Dec. 12, when the country will go to the polls. Throughout that period, you can expect a lot of pretending that it's not all about Brexit and more polling than you ever thought possible, despite the fact that polling almost always seems to be miles off. For Prime Minister Boris Johnson, the stakes are high and a lot could go wrong. For markets, it's yet more uncertainty. For a daily email newsletter writer, its another couple of months of easy-win content. MarketsOvernight the MSCI Asia Pacific Index slipped 0.1% as most gauges fell, though Japan's Topix index bucked the trend with a 0.2% gain. In Europe, the Stoxx 600 Index was also 0.1% lower at 6:02 a.m. Eastern Time as investors weighed a flurry of earnings from major companies. S&P 500 futures pointed to a directionless open, the 10-year Treasury yield was at 1.831% and gold was slightly higher. Coming up…There are more earnings than you can shake a stick at today, but the biggies are Facebook Inc. and Apple Inc., both landing after the close. To keep yourselves busy until then, why not check out ADP's private jobs data at 8:15 a.m., which will ease you into things nicely before third quarter U.S. GDP arrives at 8:30 a.m. Then it's a simple matter of watching cat videos on YouTube until the Fed decision at 2:00 p.m., when a cut is widely expected. Chairman Jerome Powell's press conference is 30 minutes later. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Sid's interested in this morningOne of the most scary charts this Halloween, courtesy of Citigroup: European households are saving more. That's bad news for aggregate demand in a region where inflation expectations are already at epic lows, while there's diminished monetary firepower to shore up economic growth. Not to mention the fact global trade outlook remains weak. In an excellent report, Citi economists point that slower spending among euro-area households accounts for around 40% of the GDP slowdown since 2017. There are all kinds of theories for this ranging from aging populations and risk-averse consumers prepping for a crisis, to people banking their salary increases. But the elephant in the room is whether the hard-money crowd have a point when they argue monetary easing is counterproductive by forcing people to save more to compensate for falling yields. As the Citi authors point out, if this savings behavior is structural, it also calls into question the effectiveness of any fiscal stimulus. Worrisome stuff.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment