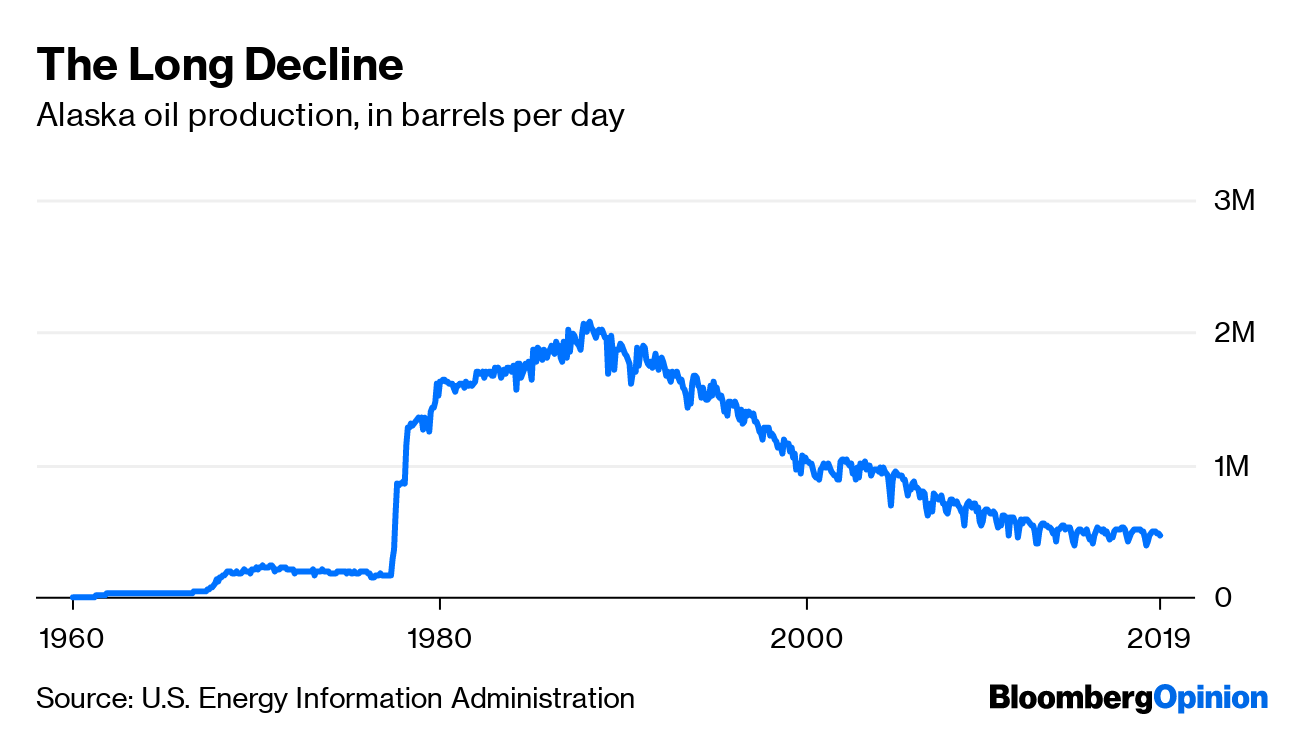

Today's Agenda  You Want Lower Rates? You Got 'Em The stock market has been praying for lower interest rates for a long time, with the Reverend President Donald Trump tweeting a loud "amen" every so often. Now their prayers are being answered, but it doesn't seem like much of a blessing. Interest rates are falling, all right, but mainly because the outlook for the global economy is souring daily. The 30-year Treasury yield is retreating quickly toward its record low of just 2.088%. That's for 30 years. The "yield curve," or gap between short- and long-term interest rates, is as upside-down as it's been since 2007, an almost sure-fire recession indicator. That three different Asian central banks slashed rates this morning by more than expected shows how badly the outlook has deteriorated, writes Dan Moss. (It also inspired another anti-Fed rant by Trump.) Despite falling rates, stocks have had a rocky week. And no wonder, writes Robert Burgess; from the trade-war-driven slowdown to geopolitical tensions and weakening profits, stock traders have many reasons to worry. Ordinarily when stocks fall, investors run to bonds. But they're so hot now that $15 trillion of the global market has negative yields, meaning you pay for the privilege of lending money. That sounds bananas. But an economist at the High Church of bond investing, Pimco, recently suggested it's less crazy if you consider retirees are living longer, making access to the long-term savings offered by bonds more valuable. As Brian Chappatta notes, it certainly makes any debt that still pays interest even more attractive. John Authers writes one easy way to make money in these crazy times is to ply the "carry trade" – borrowing in currencies with rock-bottom rates and investing in those with higher, or even just positive, rates. But the ground is shifting so quickly this could be like picking up $50 bills in front of a steamroller that occasionally accelerates from zero to 90 mph. You might be tempted to put your money in cash. But Brian Chappatta warns that, with the Fed likely to cut rates even more, money-market funds are risky too. No wonder many investors are turning to that barbarous relic, gold; and as Tim Culpan notes, Bitcoin is behaving a lot like gold lately too. These are interesting times – which is also considered a curse. What's in a Currency Manipulator Label? This latest meltdown in rates achieved critical mass when China let the yuan weaken for a bit, hinting at a currency war. The Trump administration responded by labeling China a "currency manipulator." This has some obscure bureaucratic implications, but mainly it signals tensions won't cool any time soon, writes Mohamed El-Erian, because this fight is now about much more than just trade. Ironically, the "manipulator" designation comes years too late; China has for a long time been propping its currency up, notes Noah Smith. A sustained decline in the yuan could hurt China badly, in fact, by sparking capital outflows and a deep recession. One likely outcome is that China keeps stabilizing its own currency and those of its neighbors, just as it did during the 1998 currency crisis, writes Dan Moss. That episode ended with China in a much more powerful position, and history may repeat. Trump: Uniter or Divider? While fostering hostility in global trade, Trump's job at home is to sow unity after another wave of deadly shootings. This isn't exactly his forte, but we should still give him the chance to play his traditional role, Bloomberg's editorial board writes. Unfortunately, aside from a grudging teleprompter speech, early indicators of Trump's capacity to heal the nation aren't promising. He attacked Democrats and the media before even getting on the plane to El Paso and Dayton today. Though daughter Ivanka and other spinners try to distract from it, Trump laid the groundwork for the El Paso attack with his violence-encouraging, anti-immigrant rhetoric, writes Tim O'Brien. He probably won't change his ways. Little wonder that Trump's approval rating is stubbornly, historically low, notes Jonathan Bernstein. His disapproval rating, meanwhile, has been far worse for far longer than any other president's in the modern polling era. This isn't good for his reelection chances. Happy Anniversary to a Bad Tweet A year ago today, Elon Musk was annoyed by nagging questions from critics about Tesla Inc.'s ability to make, sell and turn a profit from electric cars. So he fired up the Twitter machine and announced he had "funding secured" to take the company private. Funny thing: Turns out he did not, actually! Boy was the SEC mad about that one. A year later, much has happened to Tesla – it has sold a bunch of cars and occasionally turned a profit, notes Liam Denning. But it has also still not answered those nagging, fundamental questions. Telltale Charts Walt Disney Co. is doing the right things for the future, but it's going to be a wild and expensive ride for a while, warns Tara Lachapelle.  Alaska's golden goose of oil and gas money is just about out of eggs, writes Justin Fox.  Further Reading FedEx Corp. seems to be waking up to the fact that Amazon.com Inc. is a rival, but is it too late? – Brooke Sutherland Brexiteers want to avoid Britain being a "vassal," but a harsh trade deal with the U.S. would reduce it to just that. – Lionel Laurent Vladimir Putin can either stimulate Russia's economy or keep his grip on power; he can't have both. – Leonid Bershidsky Iran and Saudi Arabia have recently thrown some crumbs to women but still mistreat them and imprison activists; they've got more work to do. – Bobby Ghosh It's fine to name and shame Trump's rich donors. – Jonathan Bernstein Medical science still doesn't understand Lyme disease. – Faye Flam ICYMI This week brought three bad signs for Trump's reelection. The banker, his lawyers, his wife and her (alleged) lover. How to switch careers with little experience. Kickers Scientists bake bread with 4,500-year-old yeast. Ancient parrot was more than 3 feet tall. (h/t Scott Kominers for the first two kickers) Pro tip: Don't put the octopus on your face. (h/t James Greiff) No, the Mets aren't really this good. Note: Please send yeast and complaints to Mark Gongloff at mgongloff1@bloomberg.net. New to Bloomberg Opinion Today? Sign up here and follow us on Twitter and Facebook. |

Post a Comment