| Inside: Norwegian investors warn companies on Amazon fires. Tobacco's potential lesson for fake meat. TPG lowers a social-impact fund target, post-scandal. A gauntlet for Business Roundtable companies. Plus: The hottest teams in baseball. — Eric Roston and Emily Chasan Sustainable Finance TPG lowered the target for its second social-impact fund, which was rocked after its leader Bill McGlashan was indicted in the college admissions scandal. The fund, known as The Rise Fund II LP, is expected to raise about $2.5 billion after setting a goal of $3 billion. Norway's biggest investors, with $170 billion in assets behind them, are warning companies not to contribute in any way to the fires raging through Brazil's Amazon. Store brand ASA and pension fund KLP are mapping out which companies may be responsible for any potential damage. G-7 governments offered Brazil $20 million to help fight fires, and President Jair Bolsonaro said he wouldn't accept it without an apology first from French President Emmanuel Macron over what Bolsonaro said were insulting remarks. Here's why the Amazon is burning and here's why punishing farmers won't help.  BlackRock is holding more in-person meetings to press companies on their climate risk, according to its latest stewardship report. In previous years, the company was more likely to dispatch letters to legal counsel at carbon-intensive businesses. Pimco may expand its roster of environmentally and socially conscious funds. The firm has filed for regulatory approval to launch three products: a climate-focused bond mutual fund, an ESG-equity ETF and an actively managed debt EDF that's also ESG-themed. In Brief - Agricultural commodities trader Louis Dreyfus Co. announced a $650 million revolving credit mechanism with sustainability-linked pricing.

- Australian institutional buyers are seeking stricter scrutiny of ESG products, on concerns about fossil-fuel-related industries.

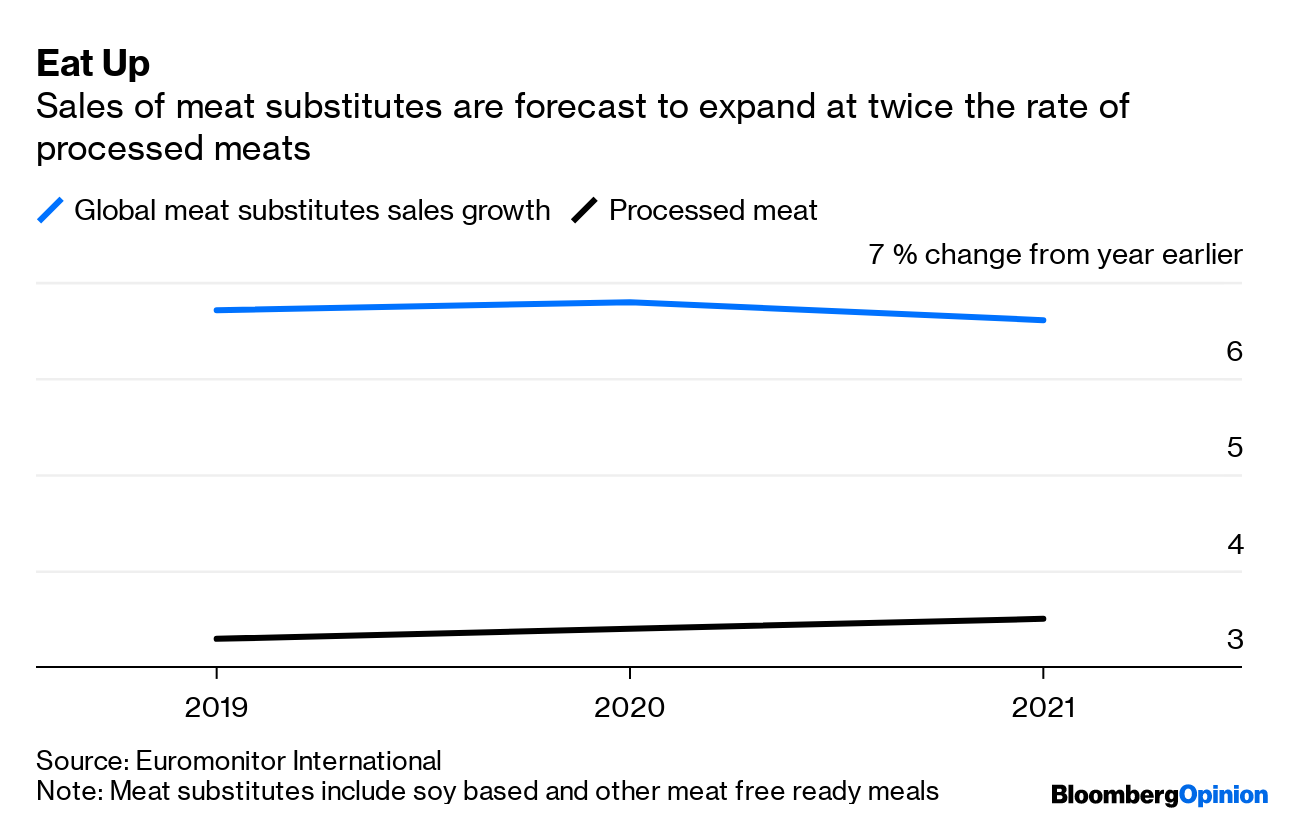

Environment  The bad news for coal keeps getting worse. This time, new technology is threatening the industry's most profitable segment, metallurgical coal, used in steel-making. The rise of electric arc furnaces may tip the met coal market into "secular decline," according to Moody's. Walmart's lawsuit against Tesla over fires at more than a half-dozen stores threatens to undermine the automaker's latest bid to reboot its struggling solar unit. New Mexico Governor Lujan Grisham is pushing an ambitious environmental platform on a state where oil-and-gas receipts dominate the state budget. Germany's central bank is buffing up its green credentials as part of an international effort to spur lenders to brace for the fallout from climate change. The Bundesbank is heading a review of central-bank strategies to support sustainable investments, and scrutinizing the dynamics of the quickly growing market. Making hydrogen gas with renewables will help prices plummet in the coming decades, making one of the most radical technologies for reducing greenhouse gases economical, according to BloombergNEF. President Donald Trump scoffed yet again at a source of electricity championed by his own energy secretary, saying wind power doesn't work "all that well." Texas baseball is heating up, and it it has nothing to do with the teams' win-loss records. Social Traditional food manufacturers are drooling over potential profits from fake meat. They'd be wise to note the obstacles that tobacco has faced with vaping: adoption and regulation, writes Amanda Felsted of Bloomberg Opinion.  Managers overseeing trillions in ETFs are on a quality-control tour, two weeks after Vanguard Group mistakenly included shares of a gun-maker and a private-prison operator in a socially responsible fund. The mishap raises new questions about how ETF managers monitor the indexes that underlie their portfolios, whether or not they have a socially responsible mandate. "Fight for $15," a union-backed campaign to raise minimum wage, are targeting Connecticut highway rest stops, where government ownership and oversight could help establish labor's long-sought foothold in fast food. CitiGroup quietly raised its minimum wage to $15. Governance Patagonia and 29 others challenged multinational companies in a New York Times advertisement Sunday to "walk the walk" and change their legal incorporation status if they are serious about a new way of doing business that treats all stakeholders equally. Their letter was a response to last week's pledge by 181 members of the Business Roundtable to endorse a philosophical redrawing of the purpose of a corporation to serve all constituents in society, not just investors.  Note: Please send tips, suggestions and feedback to Emily Chasan at echasan1@bloomberg.net. New subscribers can sign up here. To see this on the web, click here. |

Post a Comment