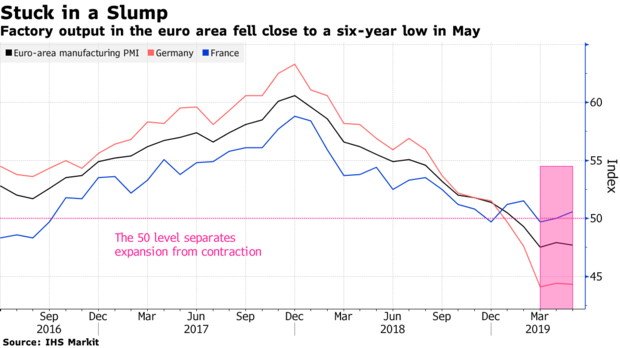

| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. With confidence in the euro area's recovery wilting amid global trade tensions, the latest raft of data comes at a critical time. May readings for euro-area inflation are due today, and economists predict a deceleration in both core and headline figures. The numbers will come too late to be plugged into the European Central Bank's new forecasts (due Thursday), but they will influence investor sentiment over whether the ECB, whose Governing Council meets this week, will raise interest rates in this economic cycle. — Viktoria Dendrinou What's Happening Roman Friction | Italian Prime Minister Giuseppe Conte threatened to resign if the partners in his populist coalition don't stop posturing, demanding they get to work on new policies to help the country. Conte called on his deputies — League leader Matteo Salvini and Luigi Di Maio of the Five Star Movement — to halt what he called their permanent election campaign. Transatlantic Rift | EU government envoys will discuss the state of transatlantic ties behind closed doors today, after Brussels and Washington spent the best part of last month threatening each other with sanctions, retaliations, warnings over China, and more tariffs. Officials hope to get some clarity on additional restrictive measures and the type of confrontation on foreign policy issues expected from the U.S. in the next couple of months. German Woes | Angela Merkel's administration can take a breath — for now. Germany's Social Democrats, the junior coalition partner, said it will remain in government following the surprise resignation of its leader. Its departure would have forced Merkel to rule with a minority government, seek new allies, or face snap elections. But the shifting political landscape continues to test her hold on power. Moving On | With the U.K. obsessed by the Conservative Party's race to decide the next prime minister, Brussels' Brexit machinery grinds on slowly. Diplomats hold one of their regular catch-up meetings on the issue this morning as the EU Commission reiterated (again) yesterday that, despite it being the policy of most leadership candidates, the Brexit deal won't be renegotiated. In Case You Missed It Austrian Balance | Austrian Constitutional Court President Brigitte Bierlein was appointed chancellor yesterday, two weeks after a video scandal took down Sebastian Kurz's coalition with right-wing nationalists. The country's first female head of government will preside over a cabinet of technocrats, half whom are women, until a new executive is appointed after snap elections in September. Finnish Stimulus | Finnish policy makers struck an accord to form a five-party coalition with plans to increase public spending by more than 4 billion euros as the economy cools. After four years of center-right rule, parties from the left and center agreed on a common platform that involves additional spending on road and rail projects as well as on education and innovation. Estonian Remorse | Estonia is attempting to boost its credibility after being at the center of Europe's dirty-money scandal. The Baltic nation intends to beef up fines for financial crimes to as much as 5 million euros and revive plans by a previous administration to allow assets whose legitimate origins can't be established to be frozen for up to a year. French Persistence | President Emmanuel Macron said reforming France is like a journey through the valley of death — the only way to succeed is to keep moving forward. He's already changed labor laws, the wealth tax and the transport system and unemployment benefits and the public pension systems are next. France is nonetheless losing its shine as a place to invest. Chart of the Day  Factory output in the euro area fell close to a six-year low in May, with slumping orders and declining workforces signaling a bleak outlook for demand. A Purchasing Managers' Index came in at 47.7, matching a flash estimate. Weakness was concentrated in the intermediate and investment goods sectors, while consumer goods output continued to expand. Today's Agenda All times CET. - 9 a.m. Informal meeting of EU agriculture ministers in Bucharest

- 9:45 a.m. European Stability Mechanism Secretary General Anev Janse speaks at UniCredit's Financial Institutions Conference in Munich

- 11 a.m. Eurostat publishes flash estimate of euro-area inflation for May and April unemployment

- 3 p.m. EU Working Party on Transatlantic Relations convenes in Brussels to discuss EU-U.S. cyber-security dialogue and threat of U.S. lawsuits against European companies doing business with Cuba

- Ukraine President Zelenskiy will make his first official foreign trip to Brussels. He will meet with the EU's top officials and NATO Secretary General Stoltenberg. Zelenskiy wants to discuss how to boost international efforts to end the war in Ukraine's east

- European Council President Tusk speaks at 30th anniversary of Poland's 1989 elections, which helped trigger the downfall of communism

- Working Group of senior euro-area finance ministry officials meets to discuss plans for a budget for the currency bloc, as well as ESM reform and a joint deposit guarantee system

Like the Brussels Edition? Don't keep it to yourself. Colleagues and friends can sign up here. We also publish the Brexit Bulletin, a daily briefing on the latest on the U.K.'s departure from the EU. For even more: Subscribe to Bloomberg All Access for full global news coverage and two in-depth daily newsletters, The Bloomberg Open and The Bloomberg Close. WhatsApp: Join us on WhatsApp to get news, insight and analysis of the day's top stories. Sign up here. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. |

Post a Comment