| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. President Trump continues his U.K. visit, banks are increasingly predicting a gloomy future and the debate about rate cuts is heightening yet further. Here's what's moving markets. "Big" Deal U.S. President Donald Trump kicks off the second day of his visit to the U.K. by meeting with American and British business executives, so don't be surprised to see more tweets about trade. Prime Minister Theresa May, who will co-host the talks, will call for governments to embrace the opportunity of Brexit to seal a bilateral free-trade deal. Trump barreled into the country yesterday flinging insults at the mayor of London before heading off to see the queen and then making a hint that a "big" trade deal could be on the cards once the U.K. leaves the European Union. On the China trade front, Trump's administration also expressed disappointment over Chinese fingerpointing in the rift. Portents The full impact of the trade war has yet to be felt, according to JPMorgan Chase Co. That's an ominous call. Wall Street rivals Bank of America Corp. and Citigroup Inc. have both cut their earnings forecasts for U.S. companies while adding themselves to the list of banks suggesting recession is imminent. Even a departing Trump administration economist thinks the trade war is pushing growth targets out of reach. To the despair of breakfast-loving millennials worldwide, avocado prices are rocketing again. Still, Vietnam is winning. Rate-Cut Bets Some may thinks there is a "mindless" rally going on in fixed-income markets but if the bet that traders are making in sending Treasuries soaring is that a rate cut is coming, there's enough fuel to believe that might prove right based on St. Louis Fed chief James Bullard's comments. Federal Reserve Chairman Jerome Powell will open a Fed research conference in Chicago on Tuesday where the central bank will be taking a look at everything it currently does. The European Central Bank is facing similar pressures, with money markets now pricing in a 50% chance of a rate cut. FANGtitrust As if the widening span of trade concerns were not enough, stock investors were left reeling by a new wave of antitrust complaints that wiped hundreds of billions of dollars from the value of FANG stocks on Monday. Facebook Inc. is facing a potential U.S. competition probe, as is Apple Inc., to add to the investigation that Google owner Alphabet Inc. will have to confront. By all accounts, the tide has turned since tech giants last faced big antitrust cases, so there are definitely reasons for companies to be afraid. Coming Up... Asian shares fell as the rout in tech stocks in the U.S. soured sentiment. Oil also resumed declines as concerns about a recession outweighed efforts by Saudi Arabia to shore up the market. Australia's central bank also ended a three-year pause and cut rates to a record low, with markets and economists anticipating there will be more to come. U.S. factory orders will be released following weak numbers on Monday from Europe and Asia. And watch for the floodgates to open for analysts on Uber Technologies Inc. as the quiet period after its IPO finishes. What We've Been Reading This is what's caught our eye over the past 24 hours. - Tesla collapsing would be good for Europe's carmakers.

- The world's lowest interest rate could go lower.

- Digital dissidents fighting Chinese censorship.

- The world's longest flight may not be too comfortable.

- Microsoft is no longer the open-source "great Satan."

- The Toronto Raptors took big risks to become Canada's basketball team.

- Why some people are always late to the airport.

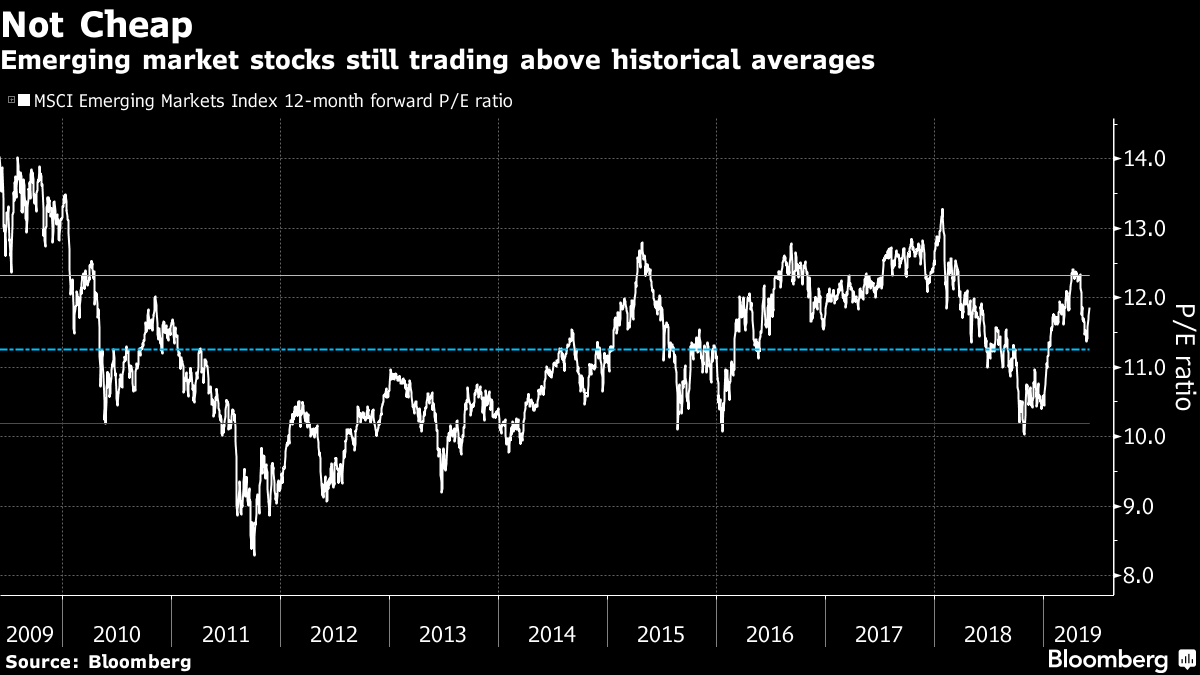

And finally, here's what Cormac Mullen's interested in this morning The recent resilience of emerging-market stocks suggests investors are suffering a case of trade-war exhaustion. The MSCI Emerging Markets Index has risen about 2% since May 28 against a near 2% decline in its developed market counterpart - despite the Trump administration directly targeting two EM stalwarts - Mexico and India. While the gauge is underperforming developed markets this year (up 4.5% vs 9%) there is a sense of complacency evident in investor flows - of the $125 billion taken from global equity funds this year, just $2 billion have come from EM funds, according to EPFR Global data. Lest we forget, the world's two-largest economies are involved in an escalating trade war, global manufacturing was the weakest since 2012 last month, global export orders contracted for the ninth straight month, and China's economy lost momentum in both April and May. The surprise re-ignition of the U.S.-China trade spat, astonishing use of tariff "diplomacy" on Mexico and termination of trade preferences for India and Turkey mean one thing for certain - investors need to price in an extra risk premium for EM assets. Yet stock valuations remain above historical averages and analysts are still estimating generous earnings growth. It looks like there's a storm coming and EM stock investors are still outside dressed for fair weather - it's probably time they head for some shelter.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment