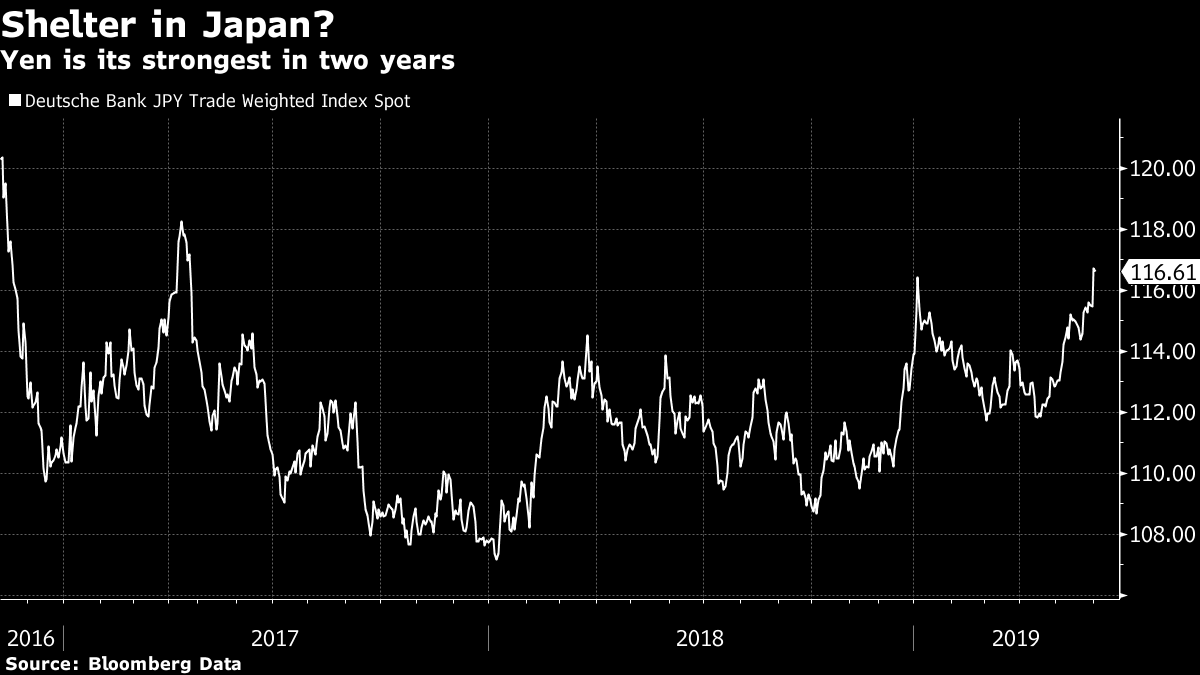

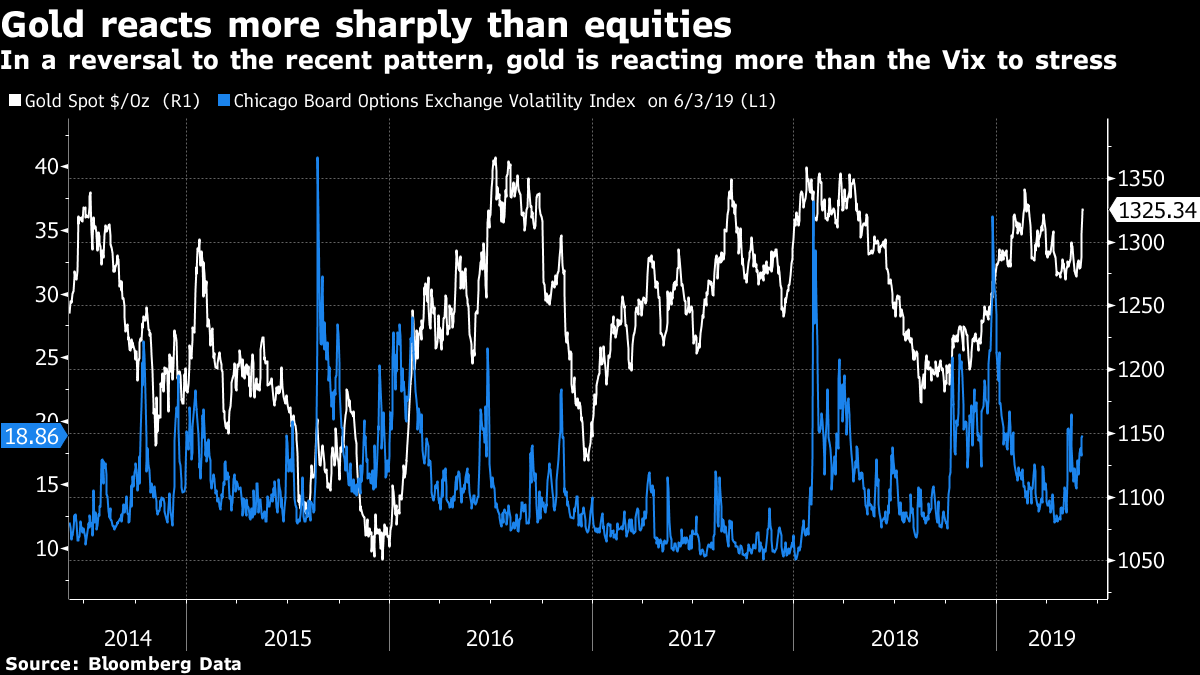

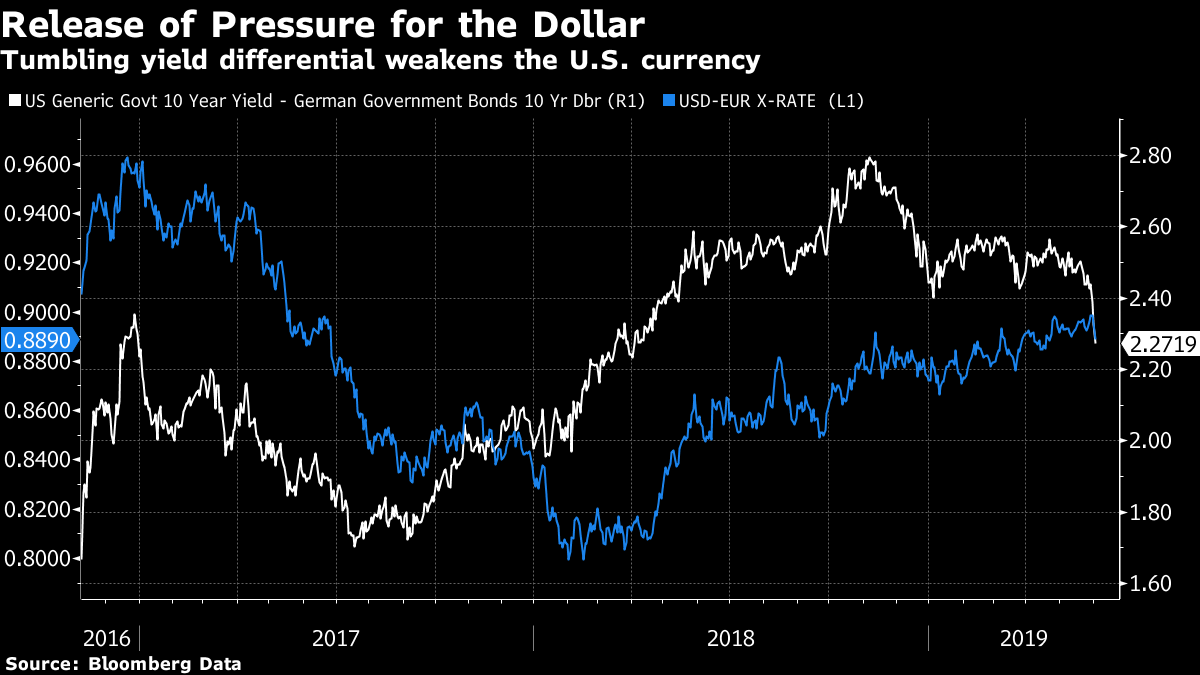

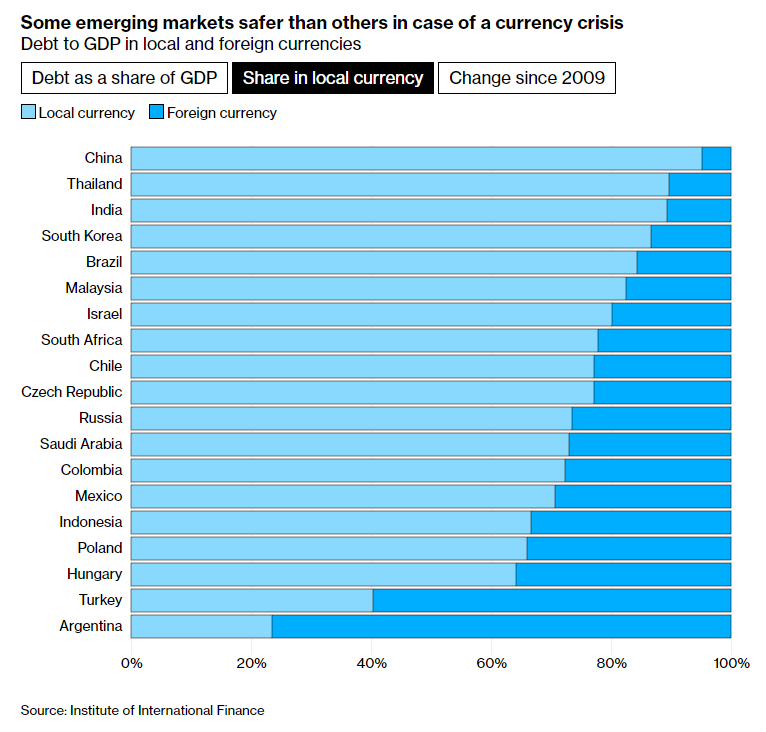

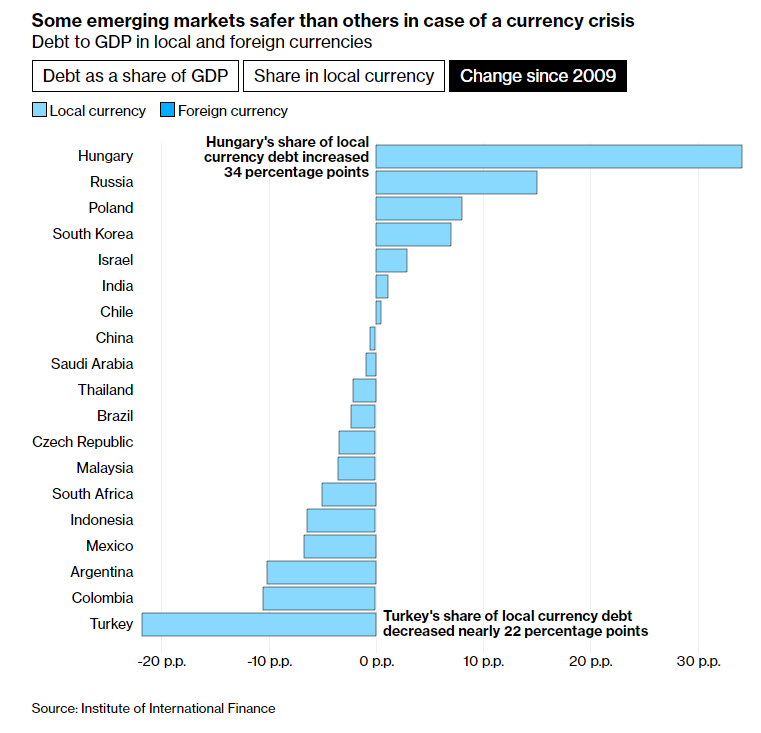

| Before I took some time off, alert readers may remember that I suggested Mexico as a haven from the trade war. The trade war I had in mind was the one between the U.S. and China. Unfortunately, we now also have to worry about a trade war waged by the U.S. against Mexico. Sadly, Mexico will provide no shelter whatever in that conflict. So where do we go for refuge? Various people are trying tosell some sanctuary, but all have their problems. To start with, the Japanese yen, a traditional haven currency, has touched its highest since early 2017 on a trade-weighted basis:  Some have tried to argue that Japan might even benefit from any trade problems for its neighbor China, even though the two economies are very different. The problem with sheltering in Japan is that it stands to be negatively affected by the U.S.-Mexico conflict. Japanese auto manufacturers, just like their American counterparts, have embedded production plants on the Mexican border deeply into their supply chain. This comment comes from Jesper Koll, head of the U.S. fund manager WisdomTree in Japan: Japanese car makers produce approximately 1.3 million cars in Mexico, of which about half (682k units) are exported to the United States. The latest escalation of US Presidential tariff authority threats thus opens a new global flank for potential attack on Japanese equities in general, earnings forecasts in particular. The numbers speak for themselves: although the direct hit to Japanese earnings is still relatively benign at the initial 5% tariff, it becomes worryingly meaningful at a 25% tariff rate. Specifically, I estimate TOPIX earnings would be pushed down approximately 1% if the big four Japan car makers operating in Mexico – Toyota, Nissan, Honda and Mazda – absorbed the entire 5% tariff. At a 25% tariff, however, the hit becomes a more significant negative of around 5%. Anything that hits at the global auto manufacturing industry will not leave Japan unscathed. Other possibilities involve investing in commodities with no productive uses whatever. Bitcoin has enjoyed quite a renaissance of late, and that renaissance has overlapped with the resurgence in concern over the trade war, which may have influenced some people to buy cryptocurrencies. But given that market's extreme susceptibility to booms and busts, any use of "Bitcoin" in the same sentence as "shelter" or "haven" is cause for grave alarm.  Alternatively, there are precious metals. Gold has gained sharply in recent days, even as inflation expectations have fallen. It is now near the top of its range for the last five years. Gold traders also seem to regard the latest dose of trade tension far more seriously than equity investors. The CBOE Volatility Index, or VIX, remains far below its previous highs of the Trump administration, which is surprising. That suggests gold may be working as an effective haven this time:  Nevertheless, there is always something disquieting about falling back on gold. Something more productive would be far more encouraging. One final source of refuge is the market for U.S. Treasuries. They have made money for investors in recent weeks, even though they involve lending money to the U.S., which is perceived now to be at the center of risks. The Pavlovian reaction to buy Treasuries at the first sign of trouble - any trouble - was so strong that they rallied in response to their downgrade by Standard & Poor's in 2011. The same thinking is at work today. Falling Treasury yields do at least help the situation, as far as American authorities are concerned. First, the drop in yields is happening without any significant decline in inflation expectations, which means long-term real yields have fallen sharply, and are now barely any higher than they were when President Donald Trump was elected:  Real yields are ultimately the best indicator of the tightness of financial conditions. Whatever the Federal Reserve chooses to do next, the bond market has engineered a true easing of conditions. The drop in yields also relieves pressure on the dollar. With yields on German 10-year bunds going negative recently, the U.S. Treasury market had offered international investors a very big pick up in yield. The differential between Treasuries and bunds remains wide, but it has narrowed significantly in recent days. That has weakened the dollar, which helps U.S. exporters. As it is presumably the administration's intention to help U.S. exporters, this is a good thing:  But if it's hard to come up with anything better than gold or Treasuries as a hiding place, then that is generally a very bad sign. Emerging-market debt. My latest graphical extravaganza, which I produced with the brilliant Lauren Leatherby of Bloomberg's data visualization department, covers emerging markets. You can find it here. I would like to draw attention to two items. First, the proportion of an emerging-market's debt that is dollar-denominated is crucially important. The more reliant on dollar funding a borrower is, the more exposed that borrower is to a sudden depreciation in thei rlocal currency. And so it should be no surprise that on this measure, Turkey and Argentina, both suffering near-crisis conditions over the last few months, show up as outliers:  What is more disheartening, and genuinely surprising, is that the emerging world as a whole has not made much progress in developing local capital markets and reducing dollar dependence since the financial crisis a decade ago. Many large markets are actually somewhat more dependent on dollar debt.  Many Latin American countries seem to have grown more exposed to changes in the foreign-exchange market. That is a shame because many of them are also very exposed to China, which happily gobbles up Latin American resources. One market which is showing the pressure is Colombia:  I like to think the entire piece on emerging-market debt is worth reading. All feedback would be most welcome. Dear Chairman. These days, we do not communicate by letter, but electronically. Therefore, when we come to discuss Dear Chairman, Jeff Gramm's brilliant history of shareholder activism told through letters to company chairmen, we will do so by holding a live blog on the Bloomberg terminal. This will be the second edition of the Bloomberg book club, as we continue to experiment in how to cover books and build a community. Your chance to question Gramm directly about his book comes up on Thursday at 11 am New York time. Just go to on the terminal. As well as the author, you will also hear from me and from our head of breaking news Madeleine Lim, who spends much of her life covering shareholder activism in real time. The terminal link is: {TLIV 5CEFFC2E68900003 } You can contribute questions ahead of time on the IB chat room that we have set up on the terminal. If you do not have access to it, you can by sending an email to the address for the book club: authersnotes@bloomberg.net. If you do not have access to the terminal, you can also send questions directly to that address via email. All thoughts gratefully accepted. I will try to post something longer and more thoughtful on this tomorrow. I'm sorry my medical adventures got in the way of more coverage of this book over the last month, but we will look forward to meeting on the terminal on Thursday.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment