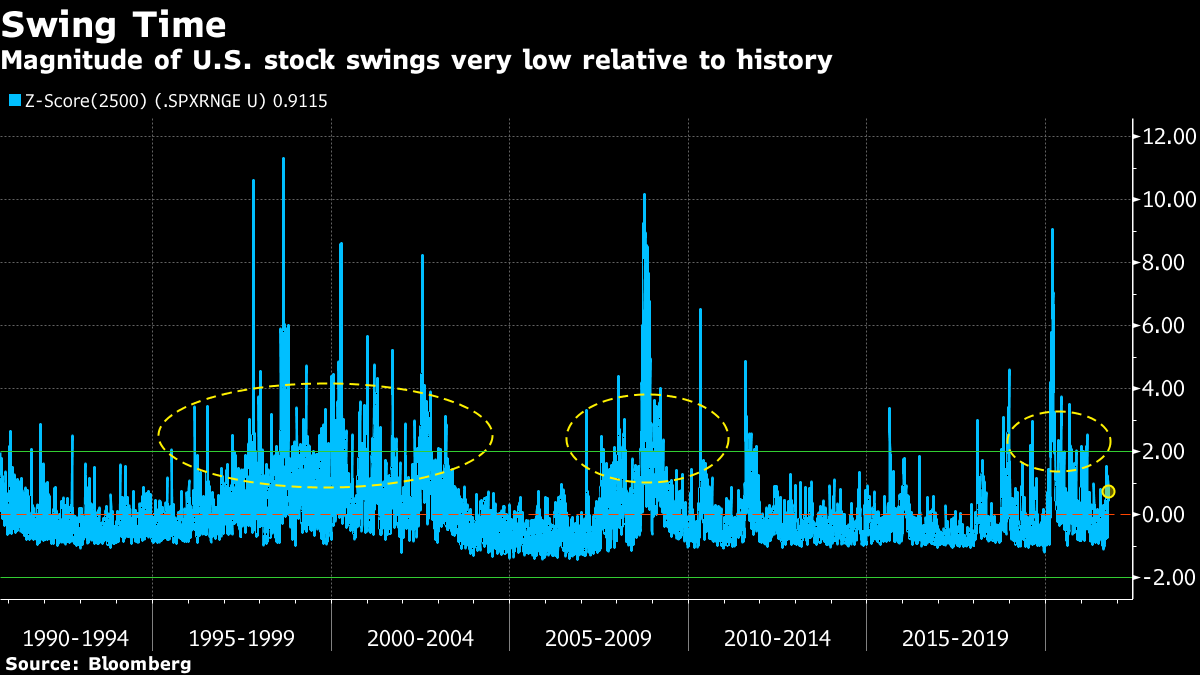

| Good morning. Debt ceiling relief, ECB eyes new bond program, and Putin the gas market savior. Here's what's moving markets. Democrats signaled they would take up Senate Republican leader Mitch McConnell's offer to raise the U.S. debt ceiling into December. That would alleviate the immediate risk of a default but raise the prospect of another bruising political fight near the end of the year. Senate Majority Leader Chuck Schumer said that the two sides were "making good progress" and that he hoped to have an agreement worked out by the morning. The European Central Bank is studying a new bond-buying program to prevent any market turmoil when emergency purchases get phased out next year, Bloomberg reports. The plan would both replace the existing crisis tool and complement an older, open-ended quantitative-easing scheme that's currently acquiring 20 billion euros ($23.1 billion) in debt every month, the report adds. Russian President Vladimir Putin chose an opportune moment to use his country's leverage as an oil and gas superpower. On a chaotic Wednesday that saw European benchmark gas surge 40% in a few minutes, Putin eased prices by offering to help stabilize the situation. Russia could potentially export record volumes of the vital fuel to the continent this year, he said. That could mean quick certification of the controversial Nord Stream 2 natural gas pipeline. There was a positive news for the apparel sector as Levi Strauss posted third-quarter sales that topped Wall Street's expectations, a sign that consumers are still willing to shop for clothing despite ongoing uncertainty around Covid-19 regulations. Levi, like other apparel makers, is grappling with challenges such as supply-chain bottlenecks and factory outages in Vietnam, a major industry hub. European stocks are set to rise, tracking those in Asia and the U.S. after progress on the debt-ceiling and hope for better U.S.-China relations. China's central bank Governor Yi Gang is one of a handful of central banking officials giving speeches today, with New York Fed President John Williams also making an appearance. Packaging company Mondi reports earnings, while Tesla holds its annual shareholder meeting. Oddly, there may be some focus on Elon Musk's dog Floki, which has helped cryptocurrency Shiba Inu soar 367%. Finally, the Nobel Prize in Literature will be announced. This is what's caught our eye over the past 24 hours. Concerns about the recent volatility in stocks are overblown -- the real price swings haven't even started yet. I've been suspicious for a while of what i call `rout deflation' -- when headline writers use the R-word to describe an ever-shrinking magnitude of stock selloffs. In my mind a rout is a 6%-8% intraday decline in an equity benchmark, not 3%-4% or heaven forbid just 2%. So commentary about the wild swings in U.S. stocks in recent weeks and how dip buyers have stepped in after various routs have raised eyebrows. In my mind daily swings in the S&P 500 are nothing like they used to be, and modest moves in the benchmark generate far too much excitement in markets. I calculated a 10-year rolling Z-score of daily high-low swings in the S&P 500 -- to build a gauge of how extreme stock moves are compared to their last decade -- and then looked at that measure since 1990. It showed first of all that the volatility we are experiencing at the moment is completely normal compared to history, in fact markets are even subdued. With the S&P 500 just 4% off its all-time high, that makes complete sense to me. Looking back, the dotcom bubble stands out for having a particularly long volatile period for U.S. stocks -- not just after it burst, but also in the years before. And of course the financial crisis, which saw the most concentrated period of extreme moves. The bottom line is we haven't entered a period of particularly notable volatility and there hasn't been a rout to buy this year -- at least not yet.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment