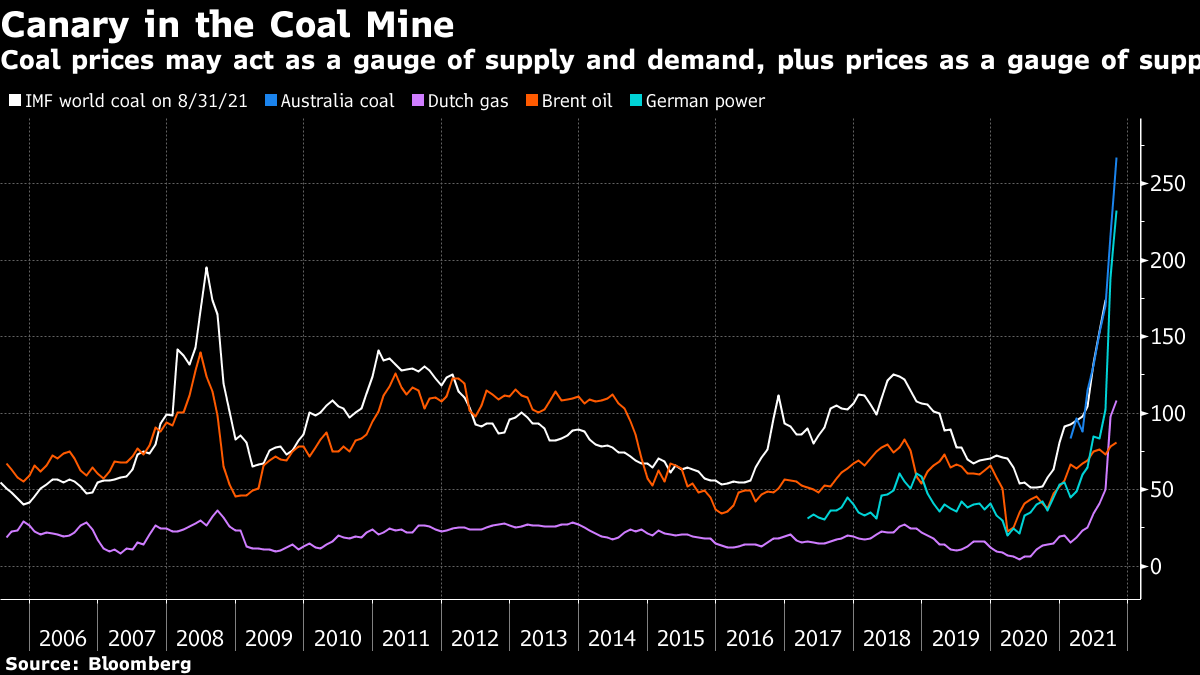

| Biden plans to meet virtually with Xi. Putin eases fuel prices. Immunity provided by Pfizer shot wanes within months. Here's what you need to know today. President Joe Biden plans to meet virtually with Chinese President Xi Jinping before the end of the year, following discussions between top envoys for the two countries in Zurich. Details of the meeting between still need to be thrashed out. Prior to the Zurich talks Biden told reporters after returning from a trip to Michigan that he and the Chinese president spoke about Taiwan and had agreed to stick to the existing consensus on managing disputes over the island. In other China-U.S. related happenings, U.S. Secretary of State Antony Blinken criticized China's recent military maneuvers around Taiwan, urging leaders in Beijing to halt the provocative military flybys for fear of a miscalculation. Asian stocks look set to climb after progress on the U.S. debt-ceiling impasse lifted equities on Wall Street. The dollar advanced and Treasuries were steady as traders await key American jobs data. Futures rose in Japan, Australia and Hong Kong. The S&P 500 and Nasdaq 100 erased losses of more than 1% to close with gains on a possible deal to boost the debt ceiling into December, alleviating the immediate risk of a default but leaving the political fight simmering in Washington.  | With winter fast approaching and a stunning energy price surge pummeling Europe, Russian President Vladimir Putin chose an opportune moment to use his country's leverage as an oil and gas superpower. On a chaotic day that saw European benchmark natural gas surge 40% in a few minutes, Putin eased prices by offering to help stabilize the situation — with strings attached. Elsewhere, fuel prices are surging across Asia; the power crisis is fanning inflation fears in India; and here's what China needs to do to prevent a future energy meltdown. China's property industry has suffered its first default on a dollar bond since developer Evergrande sank deeper into crisis, after Fantasia failed to repay a $205.7 million bond that came due Monday. That prompted a flurry of rating downgrades to levels signifying default. Meanwhile, Chinese Estates, controlled by a long-time backer of embattled Evergrande, offered to take the company private after the stock plunged to an 18-year low. The Lau family taking the Hong Kong real estate firm private represents the biggest retreat yet by a long-time backer of Evergrande and its billionaire Chairman Hui Ka Yan. Lau is part of the so-called "Poker Club" of tycoons who have backed Hui's ventures over the years. Hong Kong's leader outlined plans for a massive urban development on the border with China that appeared designed both to ease the world's most expensive housing market and prove her own loyalty to Beijing. The major development answers Beijing's call for the city to ease pressure on the world's least-affordable housing market that Chinese officials consider a catalyst for 2019's mass protests. Meanwhile, European companies are discussing relocating staff from Hong Kong, the region's local chamber of commerce said, as the city commits to a "Covid Zero" strategy that almost every country apart from China is abandoning. This is what's caught our eye over the past 24 hours: Back in June, I wrote in this space that inflation pressures could end up complicating or even rolling back recent efforts in green investing. Since much of ESG is about depriving polluting businesses of capital (or at least making that capital more expensive), it becomes much harder for traditional and dirtier energy sources to invest for exploration, expansion or efficiency. Fast forward four months and it seems the world is waking up to the costs of transitioning to cleaner fuel. Energy prices are now soaring at the same time that inflation has picked up in other essentials (like food).  So the question now is whether we see an inflationary pushback to ESG investing in the sense of governments rushing to roll back some of the clean energy transition, and perhaps reviving dirtier forms of fuel. That's the thinking of Marko Kolanovic over at JPMorgan. He suggests following coal prices as a gauge of supply, demand, and the cost of capital and broader "energy transitioning issues for all fossil fuels." The concern, as Kolanovic writes, is that coal ends up being the proverbial canary in the coal mine for higher oil prices, which would be a much bigger deal for the global economy and overall levels of inflation. As he puts it: "The most likely outcome of the current energy crisis is increased production at significantly higher energy prices, which would stabilize the global economy and energy infrastructure, but also temporarily slow down the energy transition." |

Post a Comment