|

The IMF cuts its global-growth forecast. Apple will likely slash its iPhone 13 production targets. Australia is swimming in avocados. Here's what you need to know today.

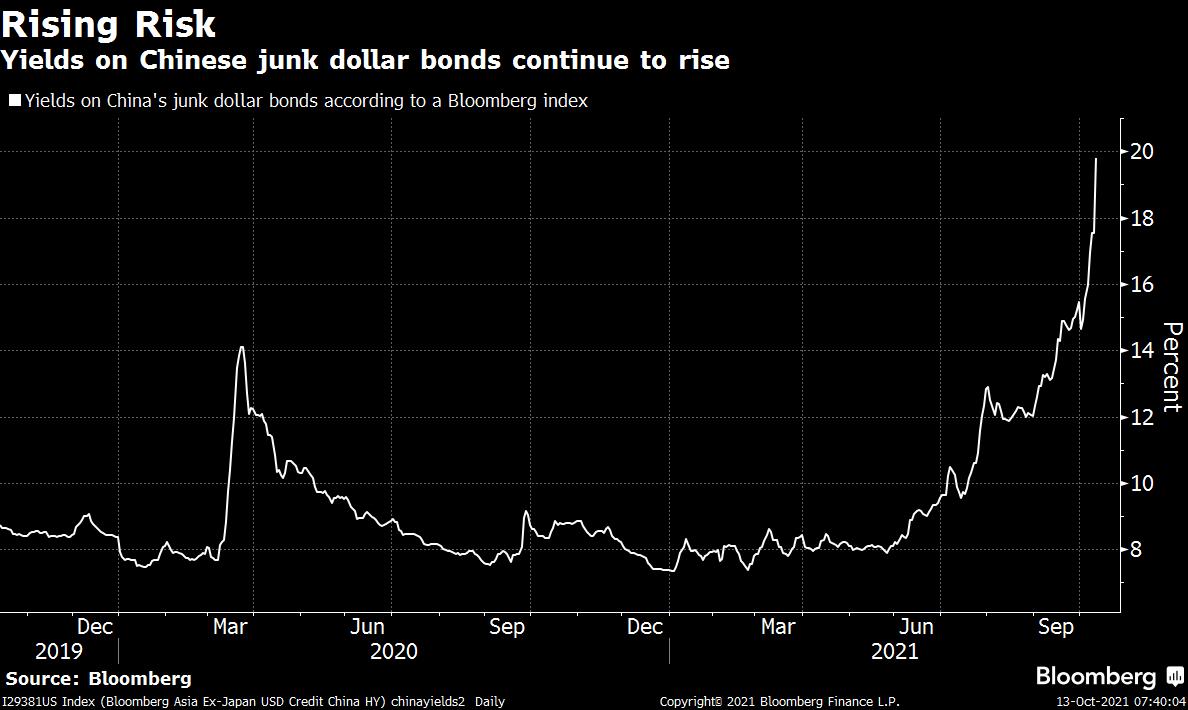

China faces tough trade-offs in dealing with the fallout from Evergrande, says the IMF. On one hand, China risks being seen as backing off from its economic deleveraging drive if it provides too much support. And on the other hand, it could spur more stress if it puts off arranging backing for the financial system. The IMF cut its global growth estimate slightly to 5.9% from 6% this year. It held the forecast for 2022 at 4.9%. The fund lowered its 2021 forecast for the U.S. to 6% from 7%, mainly because of supply constraints, but boosted its 2022 estimate. The IMF raised the euro area outlook to 5%. China will grow at a rate of 8% this year and 5.6% next, both a decline of 0.1 point, it said. China is holding back fiscal spending just as its slowing economy needs it most. Apple is likely to slash its projected iPhone 13 production targets for 2021 by as many as 10 million units over prolonged chip shortages. The company expected to produce 90 million new iPhone models in the last three months of the year, but it's now telling manufacturing partners that the total will be lower because Broadcom and Texas Instruments are struggling to deliver enough parts. In China, Apple may face more challenges as its balancing act gets trickier. Beijing's regulatory crackdown has seen Apple — one of the most profitable American players in China — sail through mostly unscathed, but the firm's luck may be running out. China's top court last month effectively granted consumers the right to sue Apple for alleged abuse of market power. Regulators have so far focused on whittling down the influence of China's tech giants, but the powers-that-be have never been shy about going after American interests.  | Asian stocks look set for a steady start as traders weigh the impact of elevated inflation and await a flurry of earnings. Futures for Japan and Australia edged up. Hong Kong delays its morning trading session while a typhoon signal is in force. U.S. contracts fell after the S&P 500 and Nasdaq 100 dropped, with investors waiting to see whether the profit outlook can repair sentiment. In China, concerns are mounting about contagion among indebted developers. Sinic Holdings has become the latest real-estate firm to warn of imminent default. Some nations experience deadlier Covid-19 outbreaks than others. Why? A number of mostly developing countries relied on Chinese or Russian vaccines that have proven less effective than the mRNA shots used in the U.S. and throughout Europe. Those places have experienced an increase in both cases and deaths since July, when delta started wreaking havoc globally, compared to outbreaks that occurred before widespread vaccination was an option. Recent moves by several countries to buy supplies of Merck's promising Covid pill before it's even approved are raising concerns that some poorer nations could be left behind again. In other news, nearly one-third of Singapore's residents now support living with Covid-19, a poll showed. Australia is swimming in avocados thanks to bumper harvests and months of stay-at-home orders that have kept people away from cafe brunches. Once considered a symbol of lavishness on the brunch menu, avocado prices in Australia more than halved from around A$3 ($2.21) a piece to around A$1 this year — a trend that looks set to stay. Some of Australia's avocados are finding their way to Asian markets including Singapore, Malaysia, Japan and Hong Kong, where demand for healthy foods is soaring thanks in part to the pandemic. The drop in prices is also making Australian exports more attractive. What's caught our eye over the past 24 hours: Last week in this space I wrote that we would soon get to see the results of any attempts by China to ringfence troubles at Evergrande and other vulnerable real estate firms. "As contagion threatens, we might get to see how successful those measures have been," I said. Fast forward to today and it looks like contagion has arrived. As my Bloomberg colleague Sofia Horta e Costa points out, another three Chinese developers have missed interest or principal payments, paid less than what investors expected, or have asked for a repayment extension. Meanwhile, as the chart below shows, yields on junk-rated Chinese dollar debt continue to rise.  There's some debate about whether or not property developers may be taking advantage of the current climate to strategically miss payment, but suffice to say that recent events highlight an overarching problem for the space: the difficulty of rolling over your debt when bond buyers and other lenders are waiting to see how far troubles in the property space actually go. As Peking University Finance Professor Michael Pettis described it recently, nonproductive investment only really works so long as you can keep accumulating new debt. As he put it: "When you're borrowing money to invest in nonproductive investment, then by definition your debt servicing needs your debt, your debt is going to rise faster than your debt-servicing capacity." Without a steady pool of willing lenders, a lot of these business models look pretty shaky. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment