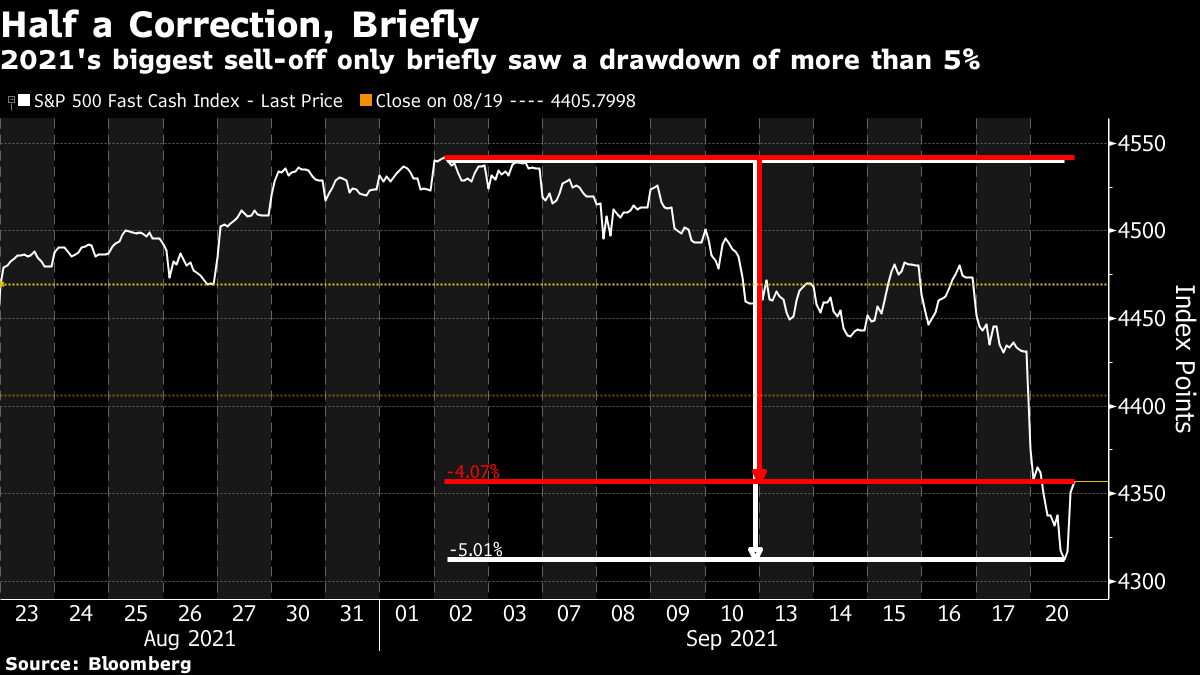

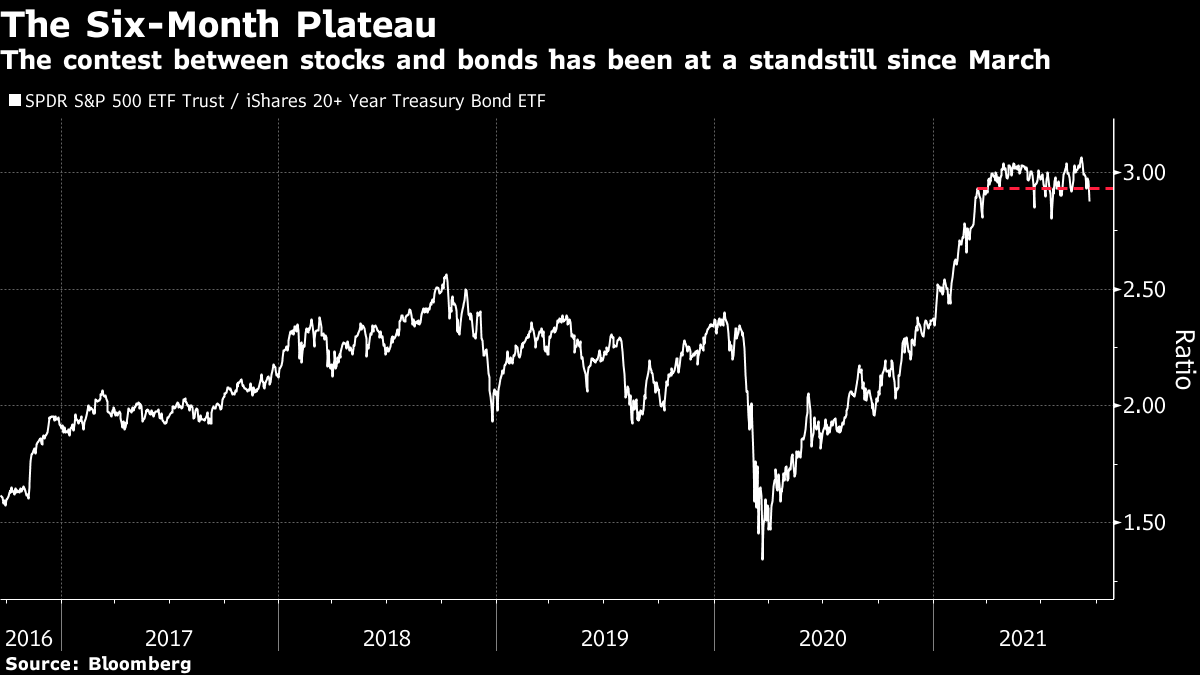

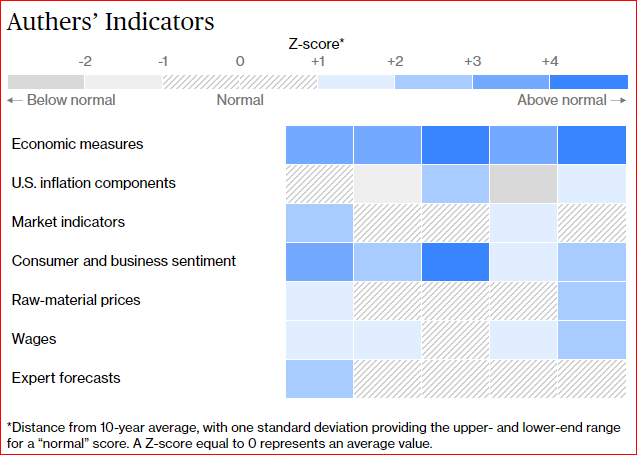

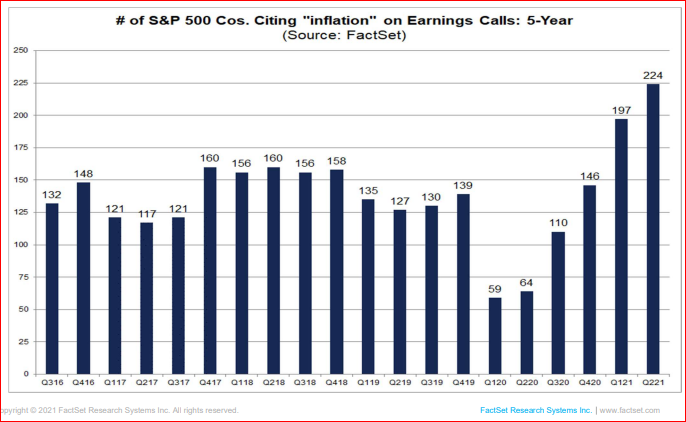

| Fleetingly, the U.S. stock market managed to get halfway to a correction. By 3:30 p.m. New York time Monday, the S&P 500 stood 5.1% below its all-time peak from earlier in September, on an intra-day basis. Then came the now-customary dose of "buy-the-dip" buying into the close. As you read this, the S&P is almost exactly 4% below its record; not even halfway to the 10% fall from peak to trough that is traditionally taken to denote a "correction." As one wag put it in my Twitter feed, 40% of the way there means we've had a "corr":  This was still the S&P's worst day since May, sparked by problems for a property developer on the other side of the world. The situation at China Evergrande Group is certainly perilous, as I covered yesterday. It gives good reason for anyone to take a few more precautions against risks than they otherwise would. In addition to this, the day started with a big selloff in Hong Kong, followed by further falls for equity markets in Europe, ramming home for Americans that there was risk in the air. Monday was the first day that Evergrande would be unable to make debt payments in full and on time. Against that, there were no obvious items of news about the developer over the weekend. The situation there has been steadily deteriorating for months. So part of the initial violence of the fall in New York was simply because investors were ready for it. The proportion of retail investors who told the weekly American Association of Independent Investors survey that they felt bearish rather than bullish rose last week to its highest level since last September. And that, not coincidentally, was when the index staged its last significant selloff. After a period of protracted calm, there were ample reasons for concern. The Evergrande situation came along as the catalyst for a consummation already devoutly wished for by investors:  It's also important to note that the market has been set in a pattern for about six months now. From the beginning of the recovery from the Covid lockdown last year, stocks gained while bonds fell — the classic pattern when there is strong risk appetite and resolute belief in the economy's growth prospects. But for the last six months, they have matched each other. The reflation trade has given way to the awkward balance-setting in which lower bond yields (caused by rising prices) help to support stocks. On Monday, lower bond yields as stocks were falling showed that this was a traditional "risk-off" day. And the rally at the end of the New York afternoon showed that the mentality of "TINA" — There Is No Alternative to stocks — remains intact. With bond yields falling, it was hard not to buy back into stocks:  There is a lot more news to come this week, including some very tense negotiations on Capitol Hill, central banks meetings all over the world (not just in Washington, London and Tokyo), and at the end of the week the election in Germany that will remove the reassuring figure of Angela Merkel from the world stage after 16 years. There are reasons for anxiety to rise and for stock markets to tremble. But the afternoon rally demonstrates that the stock market continues to have a friend in TINA — and the assumption continues to be that TINA will still have a friend in the Fed when the Federal Open Market Committee meets. The FOMC makes its next much-heralded announcement on monetary policy on Wednesday afternoon in the U.S., and the latest stock market turbulence has probably switched the dial one notch toward dovishness from whatever position the Fed's governors were previously likely to take. A 4% fall is not, and should not, be enough to change the overall thrust of policy. Everyone should brace for the Fed to come one step closer toward a taper of its asset purchases, and to give itself some discretion over exactly when it starts, and exactly what criteria it sets for itself. We should all brace for some minute textual analysis come Wednesday afternoon. Meanwhile, the debate over inflation is as murky as ever. My own inbox is roughly divided between people certain that inflation has taken a significant shift upwards, and those confident this is a transitory blip that is already simmering down. The latest indicators shows almost no change to help the discussion, as there has been very little new data since we last updated them after the release of the August CPI data. The full indicators, with a full explanation of how they were chosen and what the heat map means, can be found here. We update the numbers weekly, so if you want to follow the progress of inflation, it's worth bookmarking that page. Here is the latest heat map, which summarizes how hot or cold each of the 35 indicators look compared to their average over the last decade. It shows enough inflationary pressure to suggest that the Fed needs to tread very carefully:  More on inflation, and more on the way it seems to matter more and more to corporate executives. They certainly seem to be talking about it more. John Butters of Factset traced the number of S&P 500 companies citing inflation in earnings calls — and in the second quarter mentions surged to a new high:  But CEOs don't seem overly worried that inflation will eat into their profits. As Butters says: is inflation having a negative impact on expected earnings and profit margins for the full year? The answer appears to be no. Both the estimated earnings growth rate for CY 2021 (42.6%) and the estimated net profit margin (12.4%) for CY 2021 are higher today compared to the estimates back on June 30. At the sector level, ten of the eleven sectors are projected to report higher earnings and nine of the eleven sectors are predicted to report higher net profit margins for CY 2021 today relative to June 30.

So if companies are worried about inflation, but not worried about their margins, they're confident that they can pass on higher costs to consumers without denting sales volumes. Such assumptions may not be safe, but they can have serious ramifications. I'm sorry about this Canada. The beautiful country not that far to my north as I write, populated by some of the nicest people on the planet, had a general election tonight, which appears to be going down to the wire. There are bound to be many market implications, but I haven't had the time to include any of them. Given the amount of time and space I devoted to the U.S. election last year, this seems unfair. So it's time to celebrate some of the musical greatness that is Canada, from Glenn Gould through Rush (not that they dragged things out at all but the intro on the version I linked here goes on for six and a half minutes before they actually embark on the song) and the Tragically Hip to Arcade Fire and The Weeknd. Never to forget personal favorite Sarah Neufeld. Or for comic genius, Canada gave us Mike Myers, Phil Hartman, Jim Carrey (who among many other things did a good job of replacing the late , great Hartman as Ronald Reagan), Dan Aykroyd, and the late, greatly lamented Norm Macdonald, who was equally great telling jokes on late night talk shows, and delivering fake news on SNL. Thank you, Canada. All of these great Canadians will help you survive, however the nation voted. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment