| Evergrande fallout spooks global markets. U.S. to throw open its doors to vaccinated travelers. Pfizer says shots are safe for children as young as five. Here's what you need to know this Tuesday morning. The ongoing Evergrande saga is spooking global markets. Evergrande's shares lost as much as 19% on Monday, briefly taking its market value to the lowest on record. The resulting market turbulence may add pressure on Chinese leaders to tap the brakes on policy tightening, or at least take steps to limit the fallout. Meanwhile, SEC officials are expanding their warnings for investors considering buying stock in Chinese companies that trade in U.S. markets. And the global rout sparked by the Evergrande crisis is walloping the world's biggest fortunes, with the richest 500 people losing a combined $135 billion in a single day. The stocks selloff looks set to continue in Asia as concern mounts about China's crackdown on the real-estate sector and the Evergrande saga. Treasuries and the dollar rose. Futures retreated at least 1% in Japan, Australia and Hong Kong. China's markets remain closed for a holiday. The S&P 500 fell the most since May, though it pared some losses in the last hour of trading as dip-buyers surfaced. A gauge of Chinese stocks listed in the U.S. tumbled. U.S. contracts were steady in early Asian trading. Treasuries gained and the dollar approached a 2021 high as investors sought havens.  | The U.S. will soon allow entry to most fully vaccinated foreign air travelers, while adding a testing requirement for unvaccinated Americans and barring entry to foreigners who haven't had shots. The U.S. death toll from Covid-19 stands at 675,446 — surpassing the toll of the 1918 influenza pandemic. In other virus news, Pfizer said its Covid-19 vaccine was safe and produced strong antibody responses in children aged between 5 and 11 in a large-scale trial — findings that could pave the way to begin vaccinating kids within months; Singapore is closely monitoring intensive care units as case numbers rise; and Hong Kong's health secretary explains why the city has a super-strict three-week quarantine program in place for many people. France isn't the only country upset about a new security pact between the U.S., U.K. and Australia: Some Southeast Asian nations are also worried the partnership could provoke China and spur a regional arms race.

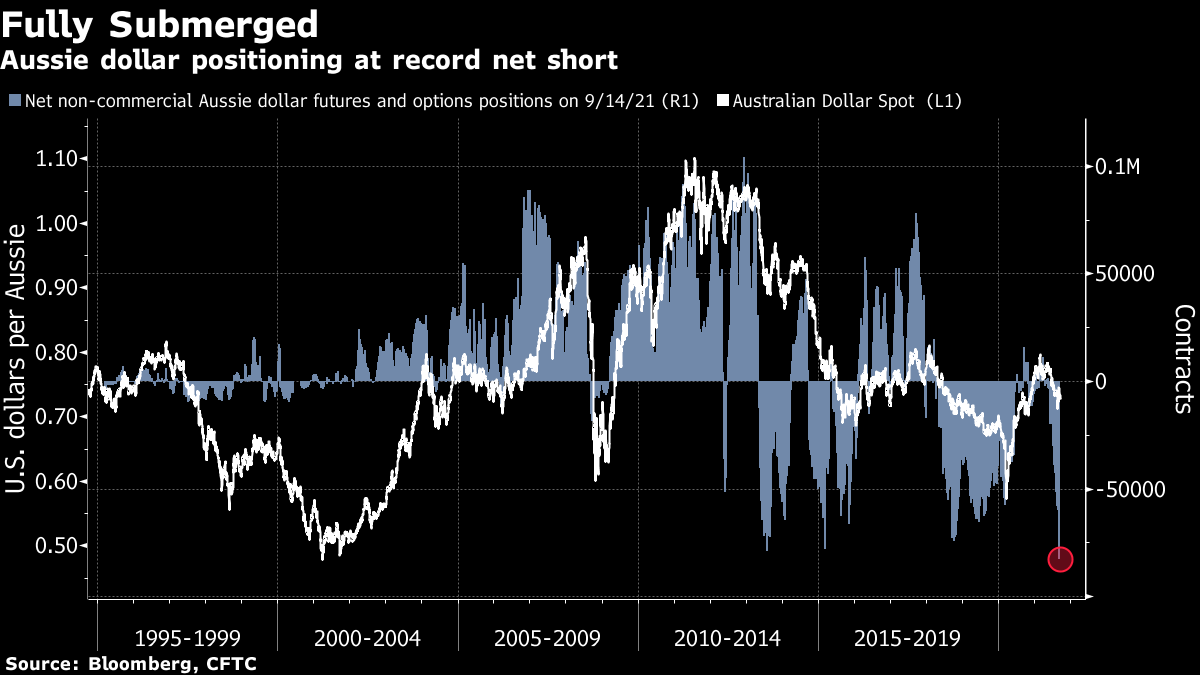

The so-called AUKUS partnership, which will help Australia acquire nuclear-powered submarines, prompted China last week to warn of an arms race in a region riven by maritime territorial disputes. Since then, two key members of the Association of Southeast Asian Nations — Indonesia and Malaysia — have voiced similar concerns. Even North Korea waded into the fray. India's investment bankers are trading their work-life balance for huge fees as local initial public offerings head for an all-time high, despite the devastation brought about by a deadly Covid-19 wave. Listings in Mumbai have already raised $10.2 billion this year. Banks steering those offerings have raked in record fees of almost $189 million, more than double the amount they earned during the previous peak in 2017. This is what's caught our eye over the past 24 hours: It's not just the Élysée Palace on the war path against Australia. Hedge funds have boosted their bearish bets against the Australian dollar to record levels. Net-short non-commercial futures and options positions on the currency grew to the most on record last week, according to the latest data from the Commodity Futures Trading Commission. The Aussie was the worst performing Group-of-10 currency last week against the greenback amid a plunge in iron ore and ongoing lockdowns to deal with coronavirus outbreaks.  Central bank chief Philip Lowe pushing back against bets on early interest-rate increases also weighed, as did weaker-than-expected employment data. And as a key vehicle for risk on/off bets in the FX market, the bearish positioning is also likely influenced by growing pessimism about the strength of the global economic recovery. It's almost a perfect script for Aussie bears but that in itself is now a risk. The sheer size of the short positions in the currency mean it is highly vulnerable to a squeeze on any sign of a respite to Australia's current woes. - Cormac Mullen is a Markets reporter and editor for Bloomberg News in Tokyo.

|

Post a Comment