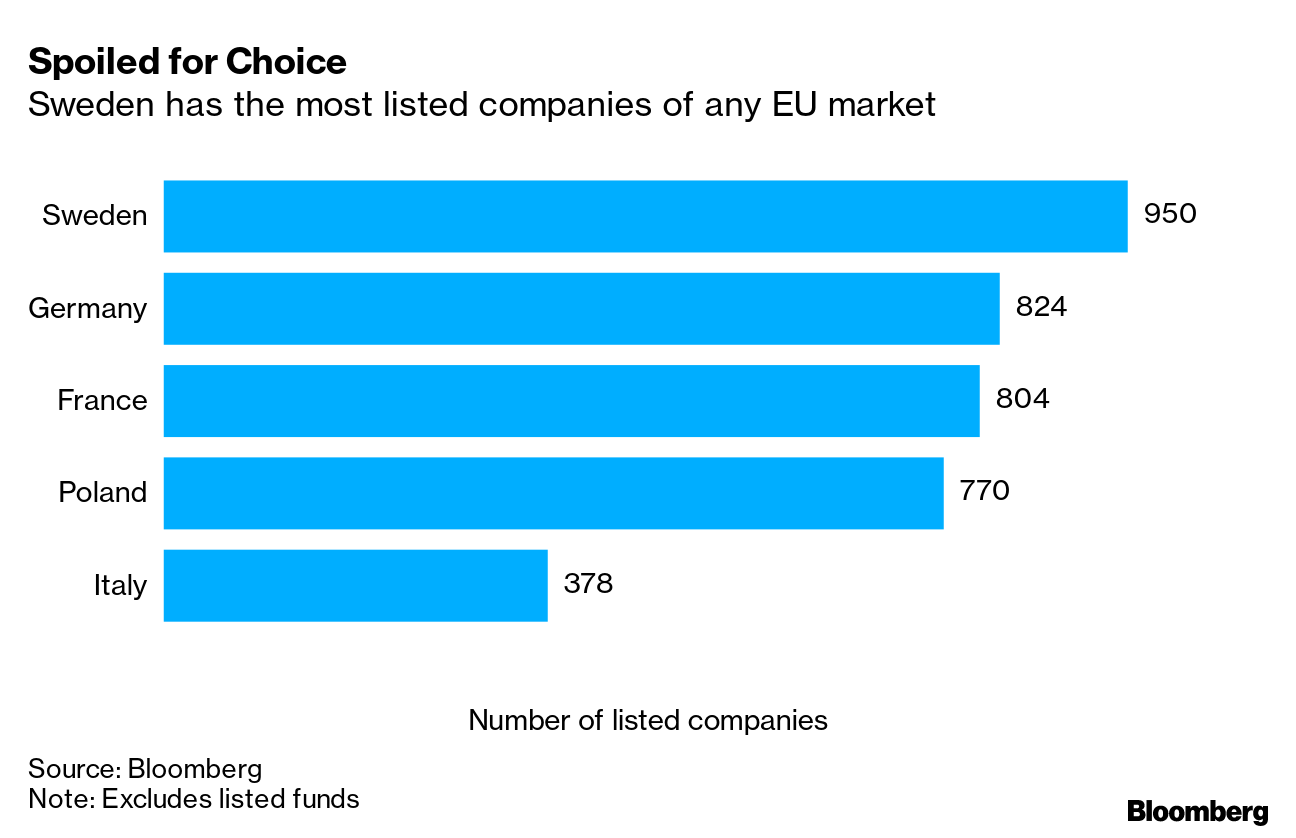

| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. The EU is baring its teeth in an increasingly contentious battle over the bloc's core values. It is harnessing powerful new budgetary tools in an unprecedented push to compel Poland and Hungary to reverse moves that undercut the rule of law or risk losing access to billions of euros. As Commission President Ursula von der Leyen prepares to deliver her annual State of the Union speech tomorrow, the shock-and-awe approach seems to be having the desired effect — to some extent. European officials tell us there are indications that Poland has been backing away from its hard stance on LGBTQ rights and judicial independence. But with Hungary fully dug in, the EU's unity will be tested in a confrontation that could reshape the alliance in the coming years. We talked to diplomats to bring you the full account of the escalating conflict and its potential consequences. — Katharina Rosskopf Hungarian Borrowing | Hungary plans to sell a range of dollar and euro bonds to shore up its budget as it faces a potential delay in accessing EU funds. The country may offer 10- and 30-year bonds in dollars, as well as seven- and/or 20-year bonds in euros, we were told. It last tapped the euro market in November and hasn't sold dollar bonds since 2014. Cozy Winter | Europe is more likely to get above-average temperatures this winter, according to the EU's Copernicus Climate Change Service. There is a 40% to 50% probability that temperatures will be significantly above historic norms. Warmer temperatures would provide a reprieve for utilities who's natural gas reserves are depleted. We have the details. Price Crunch | Soaring energy prices and high volatility are more than a one-off shock, think-tank Bruegel said yesterday. EU governments should quickly approve reforms to deepen emissions reductions in order to help the region avert future spikes. After all, the energy supply-demand balance in the EU will be volatile depending on how quickly fossil fuels are phased out and green energy is phased in. Read more. Post-Merkel Banking | Frankfurt's once-powerful investment banks are anxiously waiting the outcome of Germany's election. Diminished by years of negative interest rates and tighter regulation that Angela Merkel helped drive, how they emerge from that long decline depends on whether the next chancellor can complete a key project that has remained unfinished: Europe's banking union. ECB Ready | European Central Bank board member Isabel Schnabel used an event in Germany to try to allay fears about quickly accelerating inflation in her home country. She assured the audience that with prices rising on the back of temporary factors, the ECB is monitoring the situation closely and will act "equally quickly and resolutely" if the target of 2% is sustainably reached unexpectedly soon. Labor Shortage | France's rapid economic recovery from the pandemic is reviving deep problems in the labor market that have long hobbled growth, the country's central bank said. While activity in the euro area's second-largest economy is nearing normal more quickly than the Bank of France forecast in June, companies are reporting a sharp rise in hiring difficulties. Gas Flows | Nord Stream 2 has triggered the start of the certification process by Germany's federal network regulator BNA, a spokesman for the agency told us. BNA now has four months to send a draft decision to the Commission. The pipeline has fueled worries in the U.S. and beyond that the Kremlin's leverage over Europe and its energy market will increase once it's operational. Scholz's Hope | The German Social Democrats stood a 78.6% chance of winning Germany's Sept. 26 election, up from 70.8% the week before, according to betting odds compiled by the analysis platform Wettbasis. The SPD's Olaf Scholz was favored to become the next chancellor with a 76.6% chance of success, compared with 24.6% for the CDU's Armin Laschet, who is playing the security card in a bit to turn the tide.  Sweden isn't just one of the best-performing equity markets in Europe this year, it's also the country that offers investors the most choice. The Nordic country — with a population of 10.2 million people — now has almost 1,000 listed companies, according to data compiled by Bloomberg, the most in the EU. So far this year, 83 companies have gone public in Stockholm, raising $6.4 billion, and Sweden is heading for its busiest year for IPOs in more than two decades. All times CET. - 2:30 p.m. German Chancellor Merkel news conference with Albanian Prime Minister Edi Rama in Tirana

- 3 p.m. EU foreign policy chief Josep Borrell speaks in the European parliament on Afghanistan

- 3:10 p.m. Merkel and Italian Prime Minister Mario Draghi give welcome remarks remotely at a German-Italian industry forum in Cernobbio

- Meeting of the College of Commissioners

- European Council President Charles Michel meets Belgian Prime Minister Alexander De Croo

Don't keep it to yourself. Colleagues and friends can sign up here. For even more: Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. |

Post a Comment