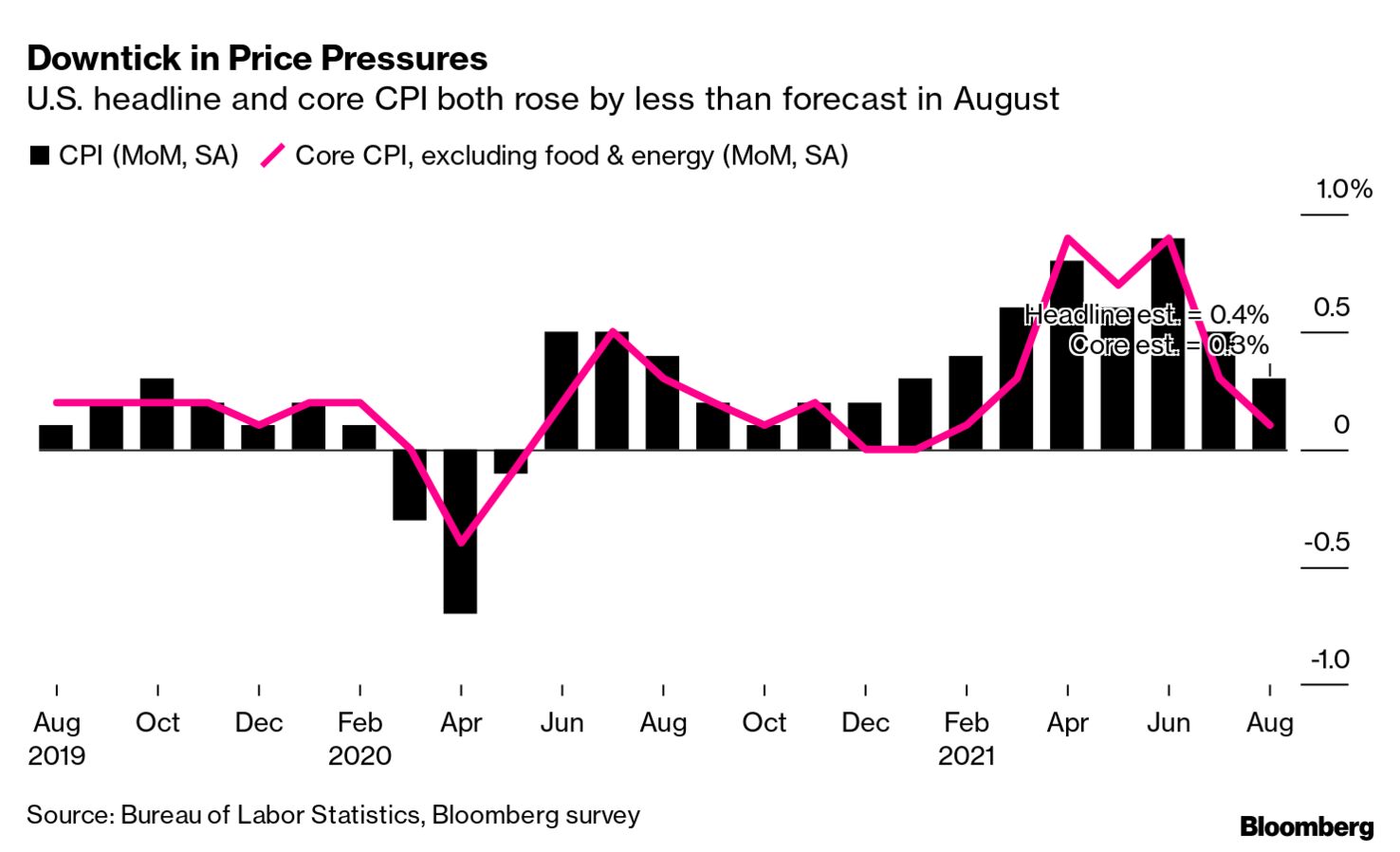

| Growth takes a knock, energy prices rise, and Biden not getting it all his way in the House. China's economy was hit by virus control measures and government measures to reduce risk-taking in August. Retail sales expanded 2.5% from a year early, well below the 7% expected by economists, while construction investment contracted 3.2% through August. As well as the virus, authorities in the country are concerned about problems at China Evergrande Group with the company's bonds pointing to an almost certain default of the world's most indebted developer. Also under the spotlight are casinos in Macau after officials said they would change regulations and appoint representatives to "supervise" the companies. Both Sands China Ltd. and Wynn Macau Ltd. saw as much as a third of the value of their shares wiped out following the announcement. The spike in natural gas prices in Europe continued this morning as uncertainties about supply worsen ahead of the peak-demand winter period. Tropical Depression Nicholas has already affected one facility that produces liquefied natural gas for export, there is uncertainty over supply from Russia, and increased demand for gas for power generation as wind output is low. To add to problems in the U.K. a fire at a major interconnector from France has shut the link, pushing day-ahead electricity costs in the country to another record. In Italy, Prime Minister Mario Draghi's administration is intervening to reduce price increases to consumers.  | There is insufficient support among Democrats in the House to progress President Joe Biden's plan to substantially raise taxes on inherited assets, according to House Ways and Means Chairman Richard Neal. The committee plans to finish its work on the tax portion of the $3.5 trillion package today. The president continues to urge a fast passage of the plan, saying it would both combat climate change and create high-paying jobs. There was some good news for him as networks called the California recall election in favor of Governor Gavin Newsom. The disappointing data from China and moves against the casino sector there is weighing on Asian stocks, while inflation remains a concern for European and American investors. Overnight the MSCI Asia Pacific Index slipped 0.6% while Japan's Topix index closed 1.1% lower. In Europe, the Stoxx 600 Index was 0.1% lower at 5:50 a.m. Eastern Time with retailers the worst performers. S&P 500 futures pointed to a move higher at the open, the 10-year Treasury yield was at 1.275%, oil's rise continued and gold slipped. U.S. August import and export price data and September Empire Manufacturing are at 8:30 a.m. Canadian August CPI is also at that time. U.S. industrial and manufacturing production number are at 9:15 a.m. Signs of more tightening in the oil market are expected to be confirmed by oil inventories data at 10:30 a.m. which are projected to show a significant drop. Here's what caught our eye over the last 24 hours. So you can chalk one up for Team Transitory. Core inflation in August came in nicely below expectations. And if you look at the chart one way, you could even make the argument that the burst of upward price pressure has come to an end, and that we're back to normal.  But the story might not yet be over. As I wrote a week ago, a fundamental seesaw is in motion, between used cars and Owner's Equivalent Rent. Used car inflation will inevitably go down, rent will likely keep going up. In August, the first part definitely happened. Used car inflation turned into used car deflation. But in the meantime, official measures of rent increases remain cool. That's no guarantee that OER won't still pick up substantially going forward.

Furthermore, this month saw some softness in airfares and hotels. As Julia Coronado, the founder of MacroPolicy Perspectives put it, this number had delta's "fingerprints" on it which means some pockets of softness may bounce back and reverse as the pandemic fades. In a note, Citi economists Andrew Hollenhorst and Veronica Clark wrote "August data is not enough to resolve the transitory versus persistent inflation debate. Given the unexpected weakness is concentrated in volatile categories, we do not alter our outlook for somewhat stronger inflation after this reading." That's the fun part about analyzing the economy. No one number ever gives you the full answer. We're always onto the next data point and the next month. Follow Bloomberg's Joe Weisenthal on Twitter at @TheStalwart Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment