| Good morning. Unrest in Guinea, Italy shields supercar makers, Mideast deals rush and vaccines are in focus. Here's what's moving markets. Aluminum climbed to the highest in more than a decade as political unrest in Guinea fueled concerns over supply of the raw material needed to make the metal. A unit of the military seized power and suspended the constitution, with head of special forces, Colonel Mamady Doumbouya, urging the army to back him. That rattled global aluminum markets Monday as the political instability raises the possibility of disruptions to bauxite shipments from the key global supplier. Italy is in talks with the European Union on ways to shield supercar makers, including Ferrari and Lamborghini, from the planned phase-out of combustion engine vehicles by 2035. While the Italian government fully backs Europe's commitment to cut emissions by phasing out the most-polluting engines, there are ongoing discussions with the EU Commission on how the new rules would apply to high-end carmakers that sell a much lower number of vehicles than mainstream producers, said Roberto Cingolani, minister for ecological transition. Goldman Sachs is hiring bankers from rival firms Citigroup and HSBC as the U.S. lender seeks to expand its business in the Middle East amid a surge in deals from the region where governments are looking for new ways to raise money and diversify their economies. At the same time, the United Arab Emirates announced plans to deepen its trade ties in Asia and Africa, and draw $150 billion in foreign investment. Elsewhere, Iraq's government and TotalEnergies agreed on a $27 billion package of investment deals aimed at boosting oil and gas output and reducing power outages in OPEC's second-biggest producer. The U.K. is considering a requirement for vaccine passports to be shown in order to access large venues as early as this month, but has yet to decide whether to roll out jabs to healthy schoolchildren.

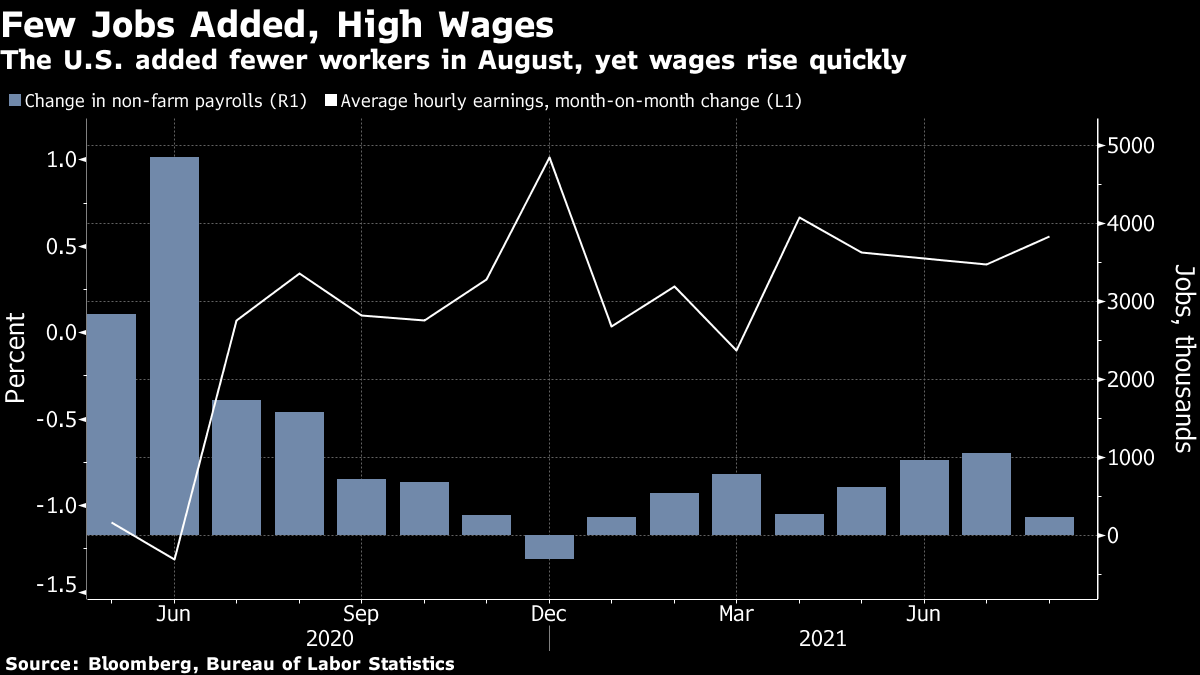

Elsewhere, Italy will decide by the end of September whether Covid-19 vaccines will become mandatory for all people aged 12 and over. Meanwhile, wealthy countries are facing mounting pressure to divert vaccine supplies to lower-income regions, with a new analysis showing they'll likely have about 1.2 billion extra doses available by the end of the year. European stocks are looking at a muted start with the S&P 500 little changed on Friday after disappointing jobs data. Asian stocks rose, particularly in Japan where the planned resignation of unpopular Prime Minister Suga led stocks to rally to the highest since 1990. It's a quiet day for events with markets in the U.S. and Canada closed for the Labor Day holiday. Keep an eye on the U.S. this week with President Joe Biden likely to decide whether to nominate Federal Reserve Chair Jerome Powell to a second term. Dechra Pharmaceuticals, Esprinet and Delta Plus are among the few firms reporting in a quiet day for earnings. This is what's caught our eye over the past 24 hours. Where, exactly, are we in the business cycle? I asked this question on Twitter last week, as a result of a debate I had with colleagues Guy Johnson and Alix Steel on radio. And really, I don't think I'm anywhere closer to an answer. Particularly after Friday's giant miss in U.S. jobs data. Most of the respondents who ventured a guess said we were between double dips.  Logically, given the world has just been through one of the deepest recessions on record, and that activity is still picking up, one should assume that we're in the early expansion phase. And by that measure, zooming stocks and steeper yield curves -- Friday's gyrations notwithstanding -- make sense. That's exactly what's supposed to happen at the start of the business cycle. Except, it doesn't feel like the start of another growth cycle. Sure, wage growth is solid and demand for goods and services are robust. What it feels like, is that we're living in an economy propped up by stimulus. For one thing, we never had the wave of bankruptcies that's supposed to occur during the recession that ended the previous cycle. And that's a problem, because as any good gardener knows, the renewal of spring can only come after the darkness and despair of winter. The old hasn't been cleared away to make way for the new. That leaves policy makers and traders with a real conundrum. If stimulus is removed, there's a real risk stocks would fall and the reverse wealth effect will lead to lower spending broadly, with a double-dip recession following. But if the stimulus taps are open for too long, rising wage costs and supply-chain disruption may trigger persistent inflation. Dare we utter the word: Stagflation? Eddie van der Walt is a Markets Live reporter and editor for Bloomberg News in London. @EdVanDerWalt Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment