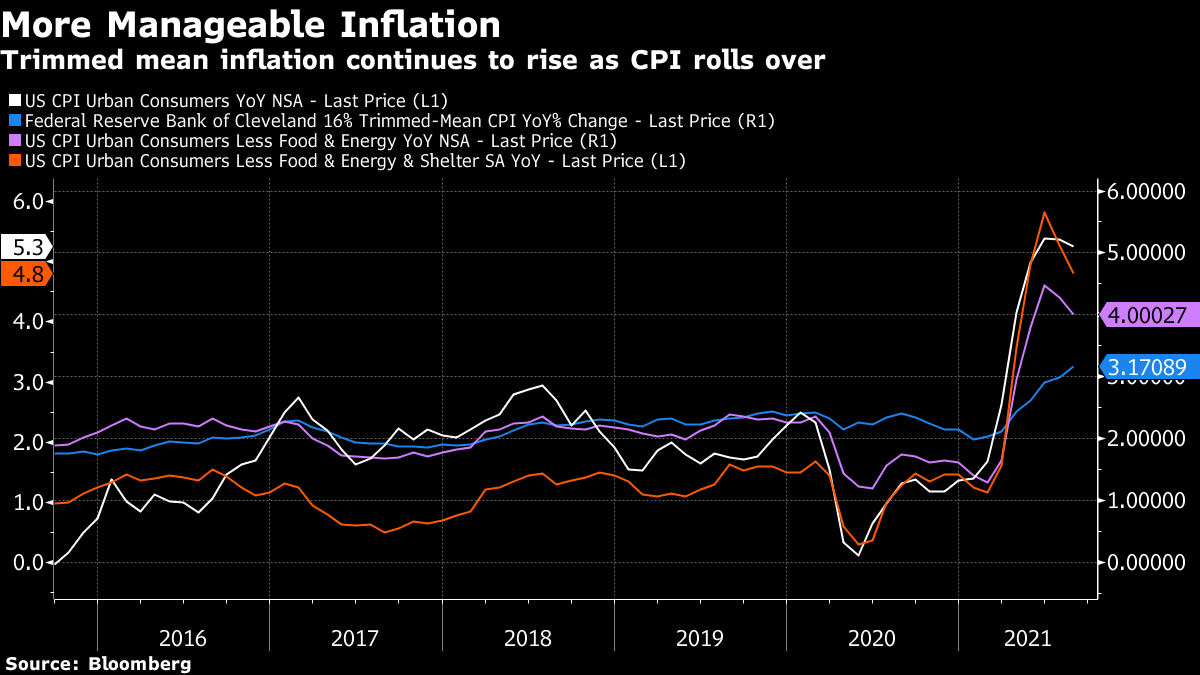

| Xi turns down Biden's invitation for a face-to-face. Differing Covid strategies are tearing Australia apart. Apple launches the iPhone 13 (and lots more). Here's what you need to know this morning. U.S. President Joe Biden suggested the possibility of an in-person meeting with Xi Jinping during a phone call last week, but the Chinese president declined as he continues to avoid leaving his country even for major gatherings amid the Covid-19 pandemic. Elsewhere, Wall Street executives and top Chinese regulators plan to hold a virtual meeting on Thursday to discuss topics including Beijing's market-roiling crackdown on the private sector and U.S.-China relations. In other news, China's new ambassador in London, Zheng Zeguang, was banned from a meeting in Parliament after his invitation sparked outrage among British politicians placed under sanctions by China; and Beijing is assembling a group of accounting and legal experts to examine the finances of China Evergrande ahead of its potential restructuring. Asian stocks look set to fall after Wall Street slipped on growth concerns, while Treasuries rallied in the wake of an inflation report that suggested the Federal Reserve won't rush to taper stimulus. Equity futures slid in Japan, Australia and Hong Kong. U.S. contracts were steady after the S&P 500 and Nasdaq 100 both retreated overnight. The benchmark 10-year Treasury yield fell below 1.3%, narrowing the yield gap between short- and longer-maturity U.S. debt. The dollar was steady and gold held a climb.  | Hundreds of thousands of people may be getting infected annually by animals carrying coronaviruses related to the one that causes Covid-19, according to a new study. An average of 400,000 such infections occur each year in China and Southeast Asia, with most going unrecognized because they cause mild or no symptoms and aren't easily transmitted between people. But each one represents an opportunity for viral adaptation that could lead to a Covid-like outbreak, researchers say. Meanwhile, clashes around differing Covid strategies are tearing Australia apart; Japan is planning to lift its virus restrictions gradually; Russian President Vladimir Putin will go into self-isolation after several of his entourage got infected; and the U.K. will begin offering booster shots to people age 50 and over and other vulnerable groups next week. Apple unveiled a new line of iPhones at a wide-ranging product event, looking to entice consumers with improvements to the camera and processor in lieu of major design changes. The company is counting on the iPhone 13 phones and a slew of other upgraded devices to fuel growth this holiday season. A new Apple Watch with larger displays, fresh faces and an updated user interface was announced, but the company didn't provide a specific release date. And the iPad Mini was revamped with an iPad Pro-like design, while its entry level sibling was given 64Gb of storage and a speed boost. Swipe your bracelet, watch or even a walking stick, and you can pay for your goods with digital yuan. These are just some of the quirky gadgets that China's central bank, lenders and technology giants are showcasing to Beijing residents ahead of a broader rollout of the e-currency when the city hosts the Winter Olympics in February. The People's Bank of China is pulling out all the stops to promote its own digital currency to a population far more used to transacting on a daily basis using Tencent's WeChat Pay and Alibaba's Alipay. This is what's caught our eye over the past 24 hours: It's really a shame that the Federal Reserve settled on the word "transitory" to describe the current state of inflation. As I've noted before on Odd Lots, it might have been better to use something like "narrow" (versus "broad-based") or "manageable" (versus uncontrollable prices increases) to describe the current state of inflation. Instead, use of the word "transitory" has focused everyone's minds on how long it will take for current price spikes to go away, when we should really be thinking of whether or not the current price spikes are worrisome enough to warrant raising interest rates. Tuesday's CPI print is a case in point. The overall number came in much lower than expected thanks to a drop in certain things associated with the U.S. reopening. Used cars and trucks fell 1.5%, hotels and motels were down 3.3% and airfares plunged 9.1%. On the other hand, there are some categories that are going up. Apparel, sporting goods and laundry equipment increased by 4.2%, 7.6% and 11%, respectively. Home furnishings also recorded their biggest ever increase at 1.2% thanks to a record jump in the cost of living room, kitchen and dining room furniture.  As Ben Emons at Medley Global Advisors puts it, it looks like inflation is "changing and getting ready for the holiday season." That's one reason why trimmed mean inflation can still be going up even as the overall CPI number is starting to come down. So the theme here is rotation, as some price pressures fade away and others come to the fore. With global supply chains still snarled and given ongoing transport gridlock and labor issues, it feels like idiosyncratic price pressures are going to be with us for some time — although they might change frequently. In that sense, it would have been much better to call them something other than "transitory." |

Post a Comment