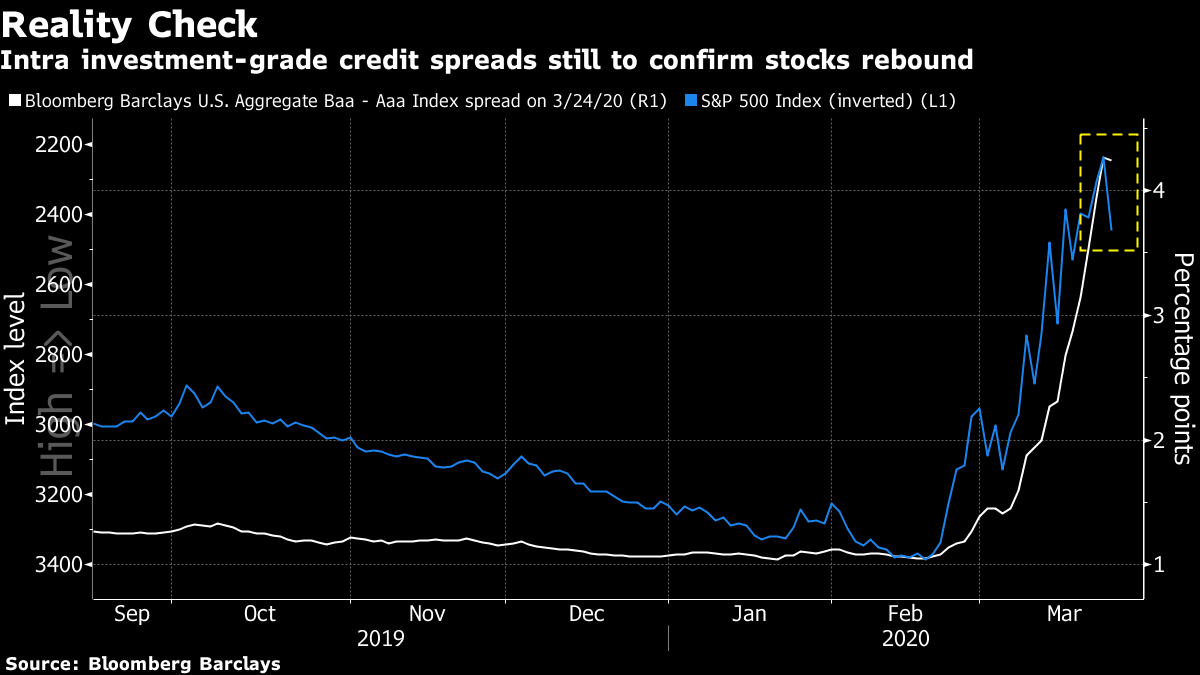

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. U.S. stocks surged massively to pare some of their recent declines, there was more worrying virus news from Italy and the global economy is being ravaged. Here's what's moving markets. U.S. Stocks Surge U.S. shares surged Tuesday to see the S&P 500 close up 9.4%, its biggest daily rise since 2008, while the Dow Jones Industrial Average's 11.4% jump was its largest advance since 1933. The rebound from 2016 lows came as lawmakers in Washington negotiated the final sticking points in a roughly $2 trillion stimulus bill. The White House has now reached an agreement with Senate Democrats and Republicans, two people familiar with the talks said. Asia stocks continued the mover higher and European equity futures are creeping up this morning. Italy Deaths Rise Again Hopes of a slowdown in the Italian death toll were dashed as the country reported its second-deadliest day of the outbreak. Italy's fatalities on Tuesday rose again to 743, after falling in each of the last two days, while over in Spain, authorities recorded a further 514 deaths, also a single-day high. Elsewhere, the U.K. government announced plans to turn a conference center into a hospital, India said it will lock down 1.3 billion people, and in New York, it was suggested that riders touching metal surfaces in in the subways may have accelerated the spread of the disease. Economy Ravaged The global economy hasn't looked this fragile since the Great Depression of the 1930s, according to a Harvard economist, and investors looking at Tuesday's purchasing managers index data might find that difficult to argue with. The euro-area measure for manufacturing and services dropped to the lowest since the series began in 1998, while gauges for the U.K., Germany and France and the U.S. also plunged. There was an ominous sign from Scandinavia, too, where the number of Norwegians seeking unemployment benefits rose almost 350% in the past two weeks. But here's why Europe's aversion to hiring and firing is looking like a good idea. Nike Spikes Amid all the corporate gloom, there is the odd bright spot. Nike Inc. soared almost 10% in late trading after online-order growth helped sales top estimates, and the sports apparel giant laid out its blueprint for coping with the pandemic. The firm posted revenue of $10.1 billion for the three months ended Feb. 29, a period that included shutdowns across China, versus a consensus estimate of $9.6 billion. While Nike's latest results don't give a full picture of the disease's impact, since its fiscal third quarter only ran through February, keep an eye on shares of peers like Adidas AG this morning. Coming Up… U.K. inflation, German Ifo business climate survey and U.S. durable goods provide today's macroeconomic data after those dismal readings Tuesday on the purchasing managers indexes. And in corporate earnings, E.ON SE and United Utilities Group Plc are reporting numbers. And finally, here's what Cormac Mullen is interested in this morning The superlatives have skipped the financial crisis, barreled past the 1987 crash and burrowed back in time to the Great Depression, although thankfully this time it is stock gains, not losses, that are in focus. Tuesday's surge in U.S. stocks was the best for at least one gauge -- the Dow Jones Industrial Average -- since 1933. American shares haven't enjoyed a two-day rally since Feb. 12, and the last three surges of more than 5% in the S&P 500 Index were immediately followed by equivalent losses, so the question on everyone's mind is what's next. The correct and unfortunately completely useless answer is nobody knows, so the next best thing is to check in with moves in the credit market. There the response is muted. While spreads of the lowest level of investment grade debt to the highest-rated did narrow, the move was marginal -- 2 basis points -- and they remained close to their highest since 2009. That suggests while some sort of stabilization in stocks was appropriate, the credit market is not pointing the way to a sustained rebound -- yet. U.S. futures were volatile in Asia trading Wednesday, as traders mulled Washington's stimulus plan.

Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. What We've Been Reading This is what's caught our eye over the past 24 hours. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment