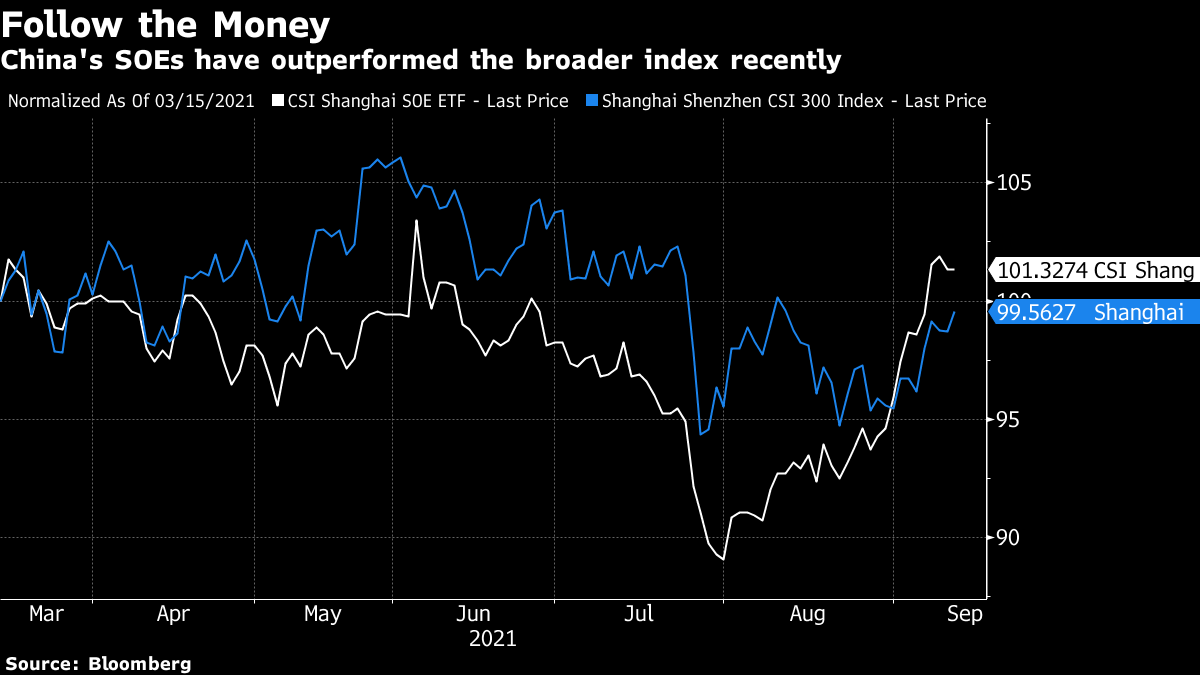

| Asian stocks look set to fall on the risk of a slower economic recovery. U.S. Democrats propose a corporate tax rate hike to 26.5%. North Korea says it tested new long-range missiles. Here's what you need to know today. It's not the cheeriest news to kick off the week. For anyone hoping to see light at the end of the Covid-19 tunnel over the next three to six months, scientists have some bad news — not much is going to change just yet. Here's what the next few months of the pandemic are likely to bring, according to experts. In Southeast Asia the economic cost of the pandemic is forcing economies to open up just to survive, even as millions of unvaccinated remain at risk. Meanwhile Israel is preparing for a possible fourth vaccine dose in case a fresh round of boosters is required; China has sent a health team to Fujian province in an attempt to stamp out a fresh outbreak of several dozen cases; and Singapore will start administering booster shots to the most vulnerable from tomorrow.\ Asian stocks look set to dip as the risk of a slower economic recovery from the pandemic amid elevated inflation saps sentiment. Futures fell in Japan, Australia and Hong Kong. U.S. stocks last week chalked their biggest decline since mid-June on investor caution over the challenges for economic reopening highlighted by the delta virus strain. Treasury yields have advanced as traders assess price pressures and their impact on the likely timeline for a reduction in Federal Reserve stimulus. An update on U.S. consumer prices this week will feed into the debate about whether elevated costs are transient. And a raft of key Chinese data is set to show weakening growth.  | House Democrats are set to propose raising the corporate tax rate to 26.5%, people familiar with the matter said. The plans fall short of President Joe Biden's target, in a bid to help improve chances of passing a major social-spending package. Democrats on the House Ways and Means Committee plan to put forward an increase in the business rate that's currently 21%, compared to the 28% Biden sought. The top rate on capital gains would rise from 20% to 25%, instead of the 39.6% the president proposed. North Korea said it successfully test-fired "new-type, long-range" cruise missiles over the weekend, ratcheting up tensions on the Korean Peninsula. They flew for more than two hours over land and waters off North Korea in "pattern-8 flight orbits" and hit targets 1,500 kilometers (932 miles) away, the state-run media Korea Central News Agency reported. If true, the weapons would have a range to strike most of Japan. The news comes days after North Korea held its first military parade since Joe Biden became U.S. president, where Kim Jong Un showed off a new trim, tanned look. China Evergrande Group may undergo one of the country's biggest-ever debt restructurings, if the developer's distressed-level bond prices are any indication. It's "almost unavoidable," said Nomura International Hong Kong credit analyst Iris Chen. Her base case is a government-supervised deal that ensures Evergrande delivers homes and pays suppliers, under which dollar debt investors would get 25% of their money back. Any disorderly failure by the firm may pose a threat to the financial system. The lack of clear precedents also means Chinese authorities have yet to test mechanisms in solving a debt problem quite like Evergrande, which has more than $300 billion in liabilities. This is what's caught our eye over the past 24 hours: China's various crackdowns have spooked investors who worry that they won't be able to predict Beijing's next target. But, as I've written here before, the easier task might be identifying the companies that won't be affected rather than trying to identify the ones that will. As political commentator Ren Yi (a.k.a. @ChairmanRabbit on Twitter) put it several weeks ago: "Go to the countryside, to the frontiers, to the places where the motherland needs it most." In other words, savvy investors should be aligning themselves with the Chinese government's strategy rather than trying to forecast it.  One obvious area to look at are China's lumbering state-owned enterprises, or SOEs. Long ignored by growth-obsessed investors whose attention was diverted by the flashy valuations of Alibaba and Didi, boring old SOEs are now getting another look as China recalibrates its economy. Over at CLSA, for instance, Quant Strategist Kelly Kwok and Head of Regional Research Shaun Cochran are both arguing that SOEs are now more attractive given pressures on the private sector. "Policy supportive industries like ESG-related and infrastructure-exposed should outperform, and SOEs will become more attractive as an investment than private sector companies," writes Kwok. "This is not about an abandonment of markets or the end of allowing attractive returns," writes Cochran. "The control hierarchy is being clarified." You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment