| Hello. Today we look at China's crackdown on big tech and what it means for the economy, the week ahead in global economics and the interplay between evictions and virus infections in America. A sweeping new vision for the world's second-largest economy is emerging from the crackdown on big tech — one where the interests of investors take a distant third place to ensuring social stability and national security. In a flurry of action Friday, Chinese authorities summoned the country's largest technology companies for a lecture on data security, vowed better oversight of overseas share listings and accused ride-hailing companies of stifling competition.

That follows new requirements for data security reviews ahead of overseas IPOs, directives for food-delivery firms to pay staff a living wage and escalating curbs on unaffordable housing, and a crackdown on tutoring companies. Add it all up, and it's leading to a growing realization that the old rules of Chinese business no longer apply and leaving investors wondering which sector will be the next target for regulators.  For decades, even as they kept strict control over strategic sectors like banking and oil, China's leaders gave entrepreneurs and investors freedom to drive the adoption of new technologies and open up fresh opportunities for growth. Deng Xiaoping set the tone back in the mid-1980s when he said it was OK if some got rich first. Now, with growth slowing and relations with the U.S. hostile, they're emphasizing different goals. Bloomberg News's Tom Hancock and Bloomberg Economics's Tom Orlik describe the new order as progressive authoritarianism. China this year began a "new development phase," according to President Xi Jinping. It puts three priorities ahead of unfettered growth: - National security, which includes control of data and greater self-reliance in technology

- Common prosperity, which aims to curb inequalities that have soared in recent decades

- Stability, which means tamping down discontent among China's middle class

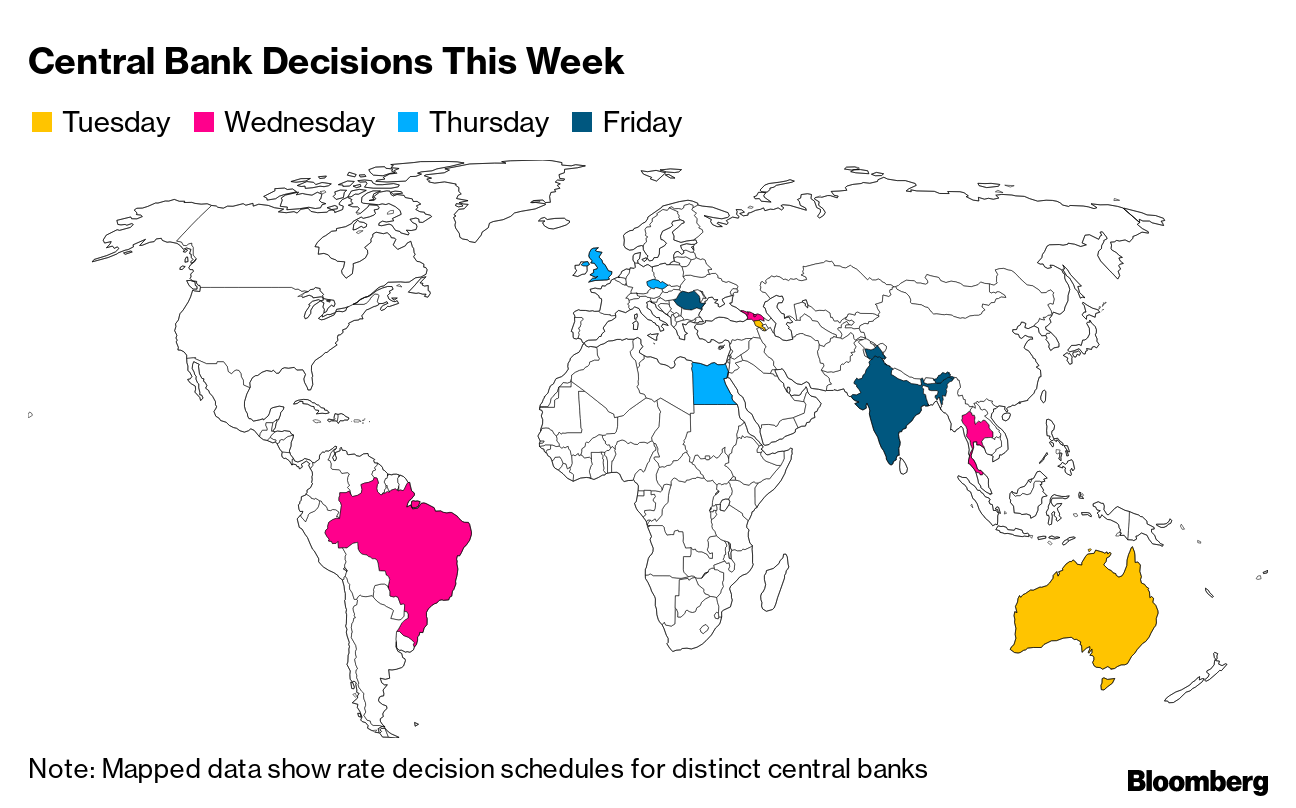

The events of recent weeks, where markets have been rocked by the regulatory onslaught, show investors had better get themselves acquainted with those new priorities as the focus on common prosperity suggests they'll have to settle for a smaller share of the spoils in the future. — Malcolm Scott  A week after U.S. Federal Reserve Chair Jerome Powell said there's still some way to go before stimulus can be reduced, a similar message may come from the Bank of England this Thursday. The rise in coronavirus infections in the wake of the European soccer championship has heightened uncertainty about Britain's economic recovery — at least in the short term. The U.K. central bank's rate-setting panel — down a member after the departure of chief economist Andy Haldane in June — is forecast to see the doves prevail when policy-makers meet. Before taking their foot off the stimulus pedal, they're likely to want to know how the U.K. jobs market fares when the government's wage-support program ends in September, and whether the success of the vaccine rollout can tame the delta variant ahead of the start of the school year. Elsewhere, central bankers in Brazil and the Czech Republic are predicted to hike interest rates yet again, while policy makers in Australia, India, Thailand and Egypt are set to hold. For a full rundown of the week ahead, click here. - Brainard's bid? | Fed Governor Lael Brainard staked out some different ground from Chair Jerome Powell on regulation and a digital dollar as the policy makers await a presidential decision on who should lead the central bank in the coming four years. Meanwhile, Minneapolis Fed President Neel Kashkari said the spread of the delta variant of Covid-19 could keep some Americans from looking for work.

- Countering the taper effect | For the first time in more than five years, the U.S. Treasury in coming months will be scaling back its mammoth quarterly sales of notes and bonds, Wall Street dealers say -- in a shift so large it's likely to more than counter the Federal Reserve's looming reduction in purchases.

- Post-Apartheid inequality | Among 18 million South Africans are still on welfare. Those people — about a third of the population — are now reeling from the first real erosion in social payments in more than a quarter-century.

- Boom fades | Australia's housing market posted its weakest month of growth since January, as declining affordability and waning pandemic stimulus weigh on the stellar gains seen this year. The data comes a day ahead of the central bank's meeting where it may delay taper plans.

- Divergent outlooks | Manufacturing managers in Southeast Asia saw a slump in activity as the region grapples with one of the world's worst Covid-19 outbreaks, while North Asia continued to see a pick up. Meanwhile, euro-area factories are hiring new workers at record pace to keep up with persistently strong orders.

- Staying put | Peru's finance minister Pedro Francke said in an interview that he wants to retain the central bank president after the two men spoke, and said he's been given room by the new government to implement his economic policies.

- Israel currency | The country's biggest exporters are bracing for the end of central bank support that's helped them stay competitive during the pandemic, a move they say may weigh on a $100 billion industry crucial to the recovery.

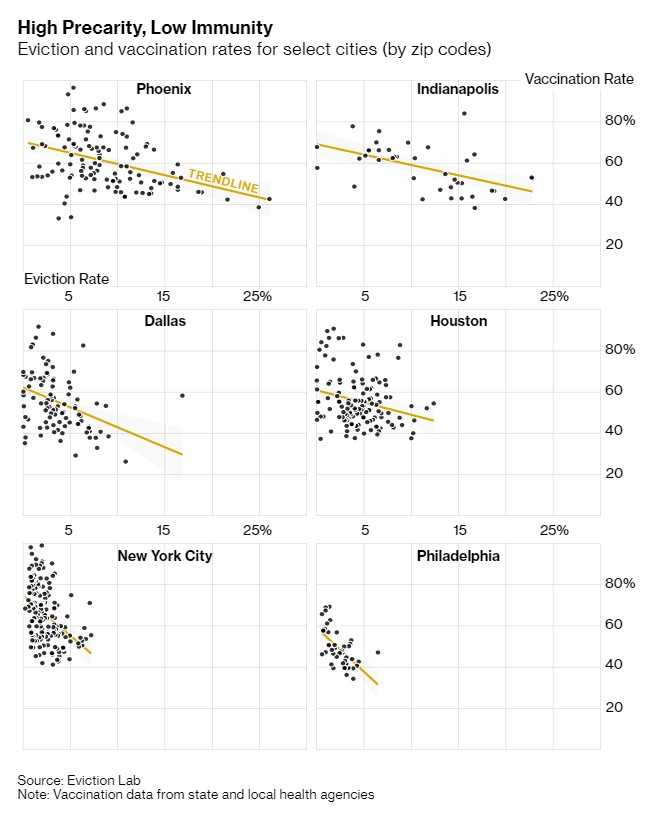

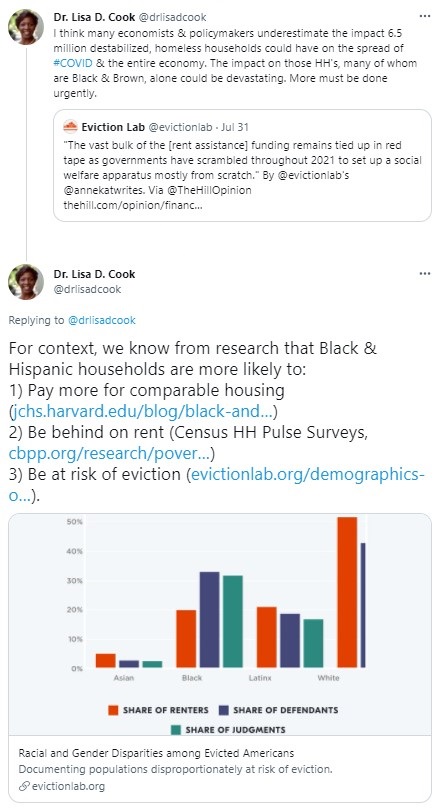

Widespread U.S. evictions could worsen a growing wave of infections where vaccinations have stalled, according to researchers at Princeton University's Eviction Lab. Looking at nine cities where data are readily available, the researchers found a correlation between high eviction filings and low vaccination rates. "Those zip codes where eviction filings were most prevalent during the pandemic, those were the same zip codes with the lowest rates of vaccinations," says Emily Lemmerman, an Eviction Lab research specialist. "Those also tended to be majority-minority neighborhoods." Eviction Lab's research was also highlighted by Lisa Cook, a professor of economics and international relations at Michigan State University, who served at the Council of Economic Advisers under President Barack Obama.  Read more reactions on Twitter - Click here for more economic stories

- Tune into the Stephanomics podcast

- Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter

- Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment