| Hello. Today we look at divisions in London, the rise of women in the Nordic region and the latest on who will run the Federal Reserve. One of the world's greatest cities is finding its families pulled in two different directions, a trend exacerbated by the pandemic. In London, the average home costs over half a million pounds, but more than a third of children there live below the national poverty line. The result is a widening inequality gap, as those who are growing wealthy on properties increasingly live near people who can barely get enough to eat, Olivia Konotey-Ahulu writes today.

The borough of Camden just north of the city center is a prime example. Home values there have surged 10% in the past year to 1.1 million pounds ($1.5 million), Acadata figures show. In the same district, 16% of adults struggle to get food at least once in a month. "London is a city of two worlds," said Sharon Baah, operations manager at Camden's Castlehaven Community Association who has run the local food bank since the pandemic hit last year. "There are people who live on the doorsteps that are not making that income. The gap between the rich and poor, the haves and the have-nots, is quite significant." The trend is undoubtedly international too given property costs elsewhere are rocketing as well, fueled by loose monetary and fiscal policies. Such widening gaps between the rich and the poor will leave more people in need for years to come, leading to uneven economies that policy makers will struggle to balance out. —Simon Kennedy Women may soon have greater say over economic policy in the Nordic region. In Sweden, Finance Minister Magdalena Andersson is emerging as the frontrunner to replace the outgoing prime minister. She told Bloomberg this week that a robust economic recovery leaves room for an expansionary budget in the upcoming election year. Meantime, in Norway, Oystein Olsen's announcement that he'll step down as central bank chief in February puts Deputy Governor Ida Wolden Bache in pole position to succeed him running monetary policy, according to economists. And in Finland, Prime Minister Sanna Marin told us that women must be included in rebuilding economies after the pandemic marked "a step backward" for equality in many countries by hitting them disproportionately. - For the latest on how companies and institutions are confronting gender, race and class, subscribe to the Equality newsletter

- Powell plan | Joe Biden's advisers are considering recommending to him to pair a second term for Jerome Powell as Federal Reserve chair with the nomination of Lael Brainard as the central bank's chief regulator, a plan that could assuage progressives resistant to Powell.

- Jackson Hole | Powell speaks virtually at the central banking conference at 10 a.m. New York time. He and predecessors have often used it as a stage for signaling shifts in monetary policy. Here's the full agenda.

- Stop working | China has issued its most comprehensive warning yet against the excessive-work culture, using real and richly detailed court disputes to address a growing backlash against the punishing demands of the private sector.

- India's manufacturing scramble | For decades, the services industry powered growth and tempered unemployment in the world's second-most populous nation. The coronavirus pandemic is now leading to calls for an urgent rebalancing of the economy toward manufacturing.

- Stimulus crossroads | Paraguay will continue to dial back pandemic support next year as its fast growing economy cushions austerity measures that have proved unpopular in other South American countries, Finance Minister Oscar Llamosas said in an interview.

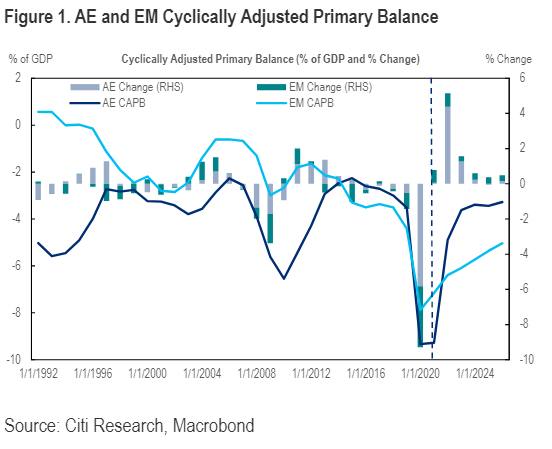

Fiscal policy is set to tighten across the world economy next year, but Citigroup economists counsel this shouldn't be a major concern. There are large spending plans in the pipeline in the U.S. and euro area, and robust tax revenues offer the chance to spend more without bloating budget deficits, they said in a report to clients on Thursday. "Political outcomes will be a key determinant of future of fiscal policy," they wrote. "Case in point is Germany where the September election will play an important role for the direction of future fiscal policy." With Germany's election less than a month away, here's a look at the political landscape on budgetary matters... Read more reactions on Twitter - Click here for more economic stories

- Tune into the Stephanomics podcast

- Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter

- Follow us @economics

Bloomberg New Economy Conversations — China's Tech Crackdown: Join New Economy Forum Editorial Director Andrew Browne on Sept. 8 at 10 a.m. as he analyzes the sweeping regulatory crackdown underway in China. The private sector helped power China's economic rise, but President Xi Jinping seems determined to rein in what he sees as its excesses. Is this transitory or a game-changing shift? Joining Andy are Keyu Jin, Associate Professor of Economics at the London School of Economics & Political Science, and Kevin Rudd, President and Chief Executive Officer of the Asia Society. Register here. |

Post a Comment