| Good morning. Taliban in control, a new "big short," Deliveroo's rebound and oil steadies. Here's what's moving markets. After a stunning few days of chaos in Afghanistan, the West has been left wondering whether the Taliban will share any power in the country at all. Amid reports the group is already curtailing women's rights, U.S. President Joe Biden defended America's withdrawal, saying another year of heavy deployments would not change the situation. The finger pointing has begun, and the sudden fresh geopolitical tensions probably helped push European stocks lower on Monday amid the jittery global growth outlook. Two familiar faces on Wall Street are in a potential sparring match, with Michael Burry of `Big Short' movie fame placing a bearish bet against the flagship exchange-traded fund of Cathie Wood, who made a name for herself last year with punts on tech stocks like Tesla and her vehement backing of Bitcoin. Christian Bale played the subprime crisis-predicting Burry, but who will play Wood? Investors who've held Deliveroo shares since March's initial public offering are back in the black, with the stock on Monday completing a recovery from a 40% plunge. After one of London's most disastrous trading debuts in recent memory, the food delivery group has been boosted by a favorable court ruling on employment issues and an investment by rival Delivery Hero. Oil steadied after a three-day slide driven by delta variant worries.

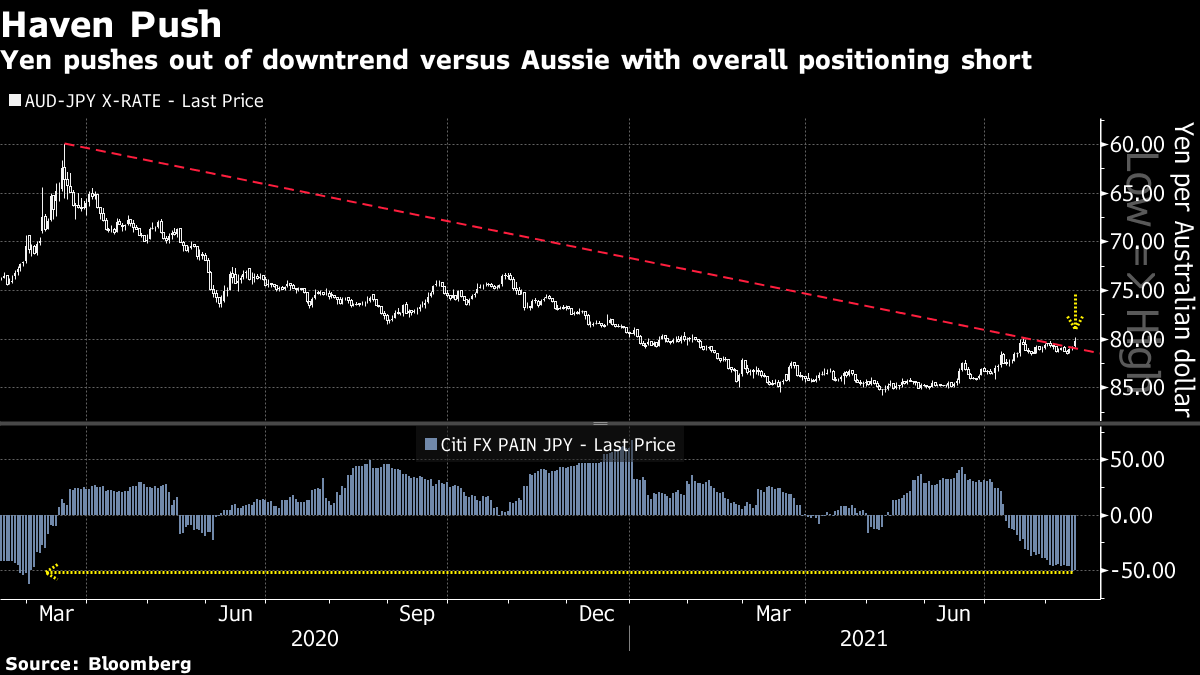

West Texas Intermediate traded near $67 after losing almost 3% over the previous three sessions. U.S. gasoline consumption has fallen for a third week, while data from China revealed a slowdown in economic activity in the world's biggest oil importer in July. Demand in the key consumer India, meanwhile, is largely holding up. European stocks look set for another cautious opening as U.S. equity futures tick lower following the latest record-high close for the S&P 500 yesterday. Deliveroo peer Just Eat Takeaway, Danish jeweler Pandora and Finnish energy firm Fortum are among the biggest earnings reports in Europe today. In the U.S., retailers Walmart, Home Depot and Singapore-based gaming and e-commerce firm Sea Ltd. all report. U.S. Federal Reserve Chair Jerome Powell hosts a town hall discussion, while investors will also be watching U.S. retail sales, expected to have eased in July after jumping in June. This is what's caught our eye over the past 24 hours. The currency market is beginning to show signs of growing risk aversion as investors debate a global economic slowdown. The top-performing G-10 currencies so far this quarter -- by a long way -- are the yen and the Swiss franc, which are up 1.7% and 1.3% respectively against the dollar. The Japanese currency recently climbed out of a year-and-a-half downtrend against the Australian dollar -- a pair which is often used as a gauge of global risk sentiment. And it seems traders hadn't anticipated its strength -- Citigroup's FX Pain Index for the yen, an indicator of active positions, is at its most negative since March 2020. That suggests gains could continue, as traders rush to cover short positions. Strength in these currency havens means the FX market has now joined bonds in signaling an aversion to risk. That leaves equities and to a lesser extent commodities as the assets where investor sentiment remains robust. The key questions for returns for the rest of the year is whether the rush to havens will spread and will those risk assets soon crack.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment