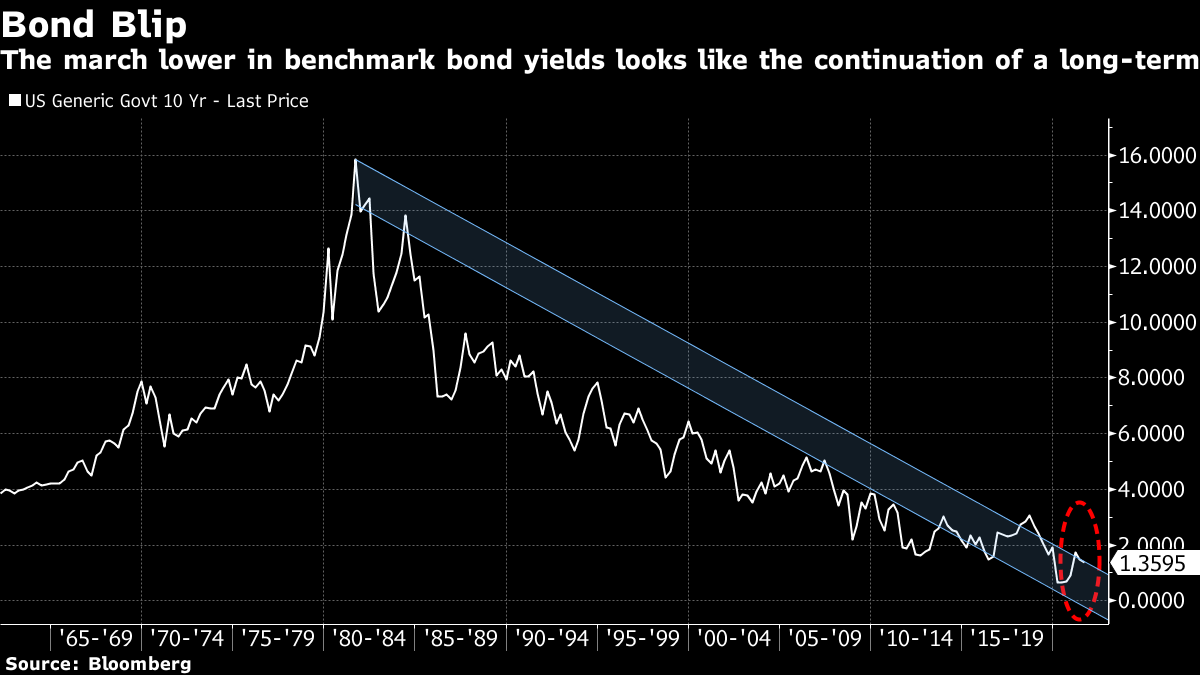

| Biden "stands squarely" behind his decision to withdraw U.S. troops from Afghanistan. China embraces the new Islamic regime next door. Here's what you need to know this Tuesday morning. President Joe Biden has defended the withdrawal of U.S. troops from Afghanistan, saying: "I stand squarely behind my decision," and adding that the U.S. would continue to fight terrorism in Afghanistan from the outside. With land borders now under the control of the militant group, the airport is the last remaining exit point for thousands looking for escape from the new regime, and there are fears that option may close soon. The panic in Afghanistan's largest city follows the Taliban's rapid territorial advance, which has returned the fundamentalist group to power two decades after the U.S. military invaded and kicked it out. Meanwhile, China has been among the first to embrace the new Islamic regime next door. Asian stocks are set for a muted open as traders weigh a record-breaking run in the S&P 500 against concerns the delta virus variant will choke global growth. Treasuries and the dollar climbed. Futures edged up in Japan and were little changed in Australia and Hong Kong. U.S. equity contracts fluctuated after the S&P 500 closed at another all-time high, doubling from its pandemic low in March 2020. Health-care and utility companies advanced, while Apple hit a record. Tesla sank on an investigation into the electric-vehicle firm's Autopilot system. U.S. Securities and Exchange Commission Chair Gary Gensler issued his most direct warning yet about the risks of investing in Chinese companies, following a sweeping crackdown by Beijing which has roiled markets. Gensler said in a video message there is much that American investors don't know about some Chinese companies listed on U.S. stock exchanges. His remarks come just weeks after the regulator halted IPOs of Chinese companies until they boost disclosures, and warned that investors may not be aware that they are actually buying shares of shell companies instead of direct stakes in Chinese businesses. China's crackdown triggered a dramatic selloff in shares as investors struggled to determine how far the government would go in tightening its grip on the economy. Pfizer and BioNTech submitted early-stage data to U.S. regulators showing that a third dose of their Covid-19 vaccine led to higher levels of protective antibodies when given eight to nine months after the initial regimen. The companies expect results from a larger final-stage trial evaluating the effects of the third booster dose shortly. Elsewhere in the world, Hong Kong upset businesses by tightening travel curbs for residents returning from 16 countries, including the U.S., France and Spain; Australian authorities are ramping up lockdown restrictions and extending stay-at-home orders; and the number of people dying with Covid-19 in U.S. hospitals is hitting previous highs in some hot-spot states. Malaysian Prime Minister Muhyiddin Yassin and his cabinet resigned after more than 17 months in power, fueling a crisis of leadership in a country beset by a weakened economy and a surge in coronavirus cases. Muhyiddin, 74, will stay on as a caretaker prime minister until a successor is named. The king had accepted his resignation and said a fresh election is not the best option during a pandemic. Muhyiddin had been resisting calls to step down since taking office in March 2020. Malaysia's political upheaval might not be over yet. This is what's caught our eye over the past 24 hours: It's hard to ignore the desperate scenes playing out in Kabul, but markets appear to have done just that, with little signs of a flight to safety on Monday. The yen traded slightly up while gold was pretty flat. The yield on the 10-year U.S. Treasury was mixed but bears watching. We all know that bond yields have been stubbornly low in recent months. In fact, if you look at a chart of yields on the benchmark 10-year, it's the move upwards earlier this year that starts to look out of place. That move coincided with a Democratic sweep of Georgia and the flipping of the Senate into Democratic control, which basically solidified expectations that the party would be able to push through its massive infrastructure bill. There's some historical evidence that bond yields tend to go higher when U.S. politicians coalesce around an agenda and control of the U.S. government shifts from two parties to one party (for instance, when Donald Trump won the presidency with Republicans in control of both the Senate and the House of Representatives in late 2016). The same thing arguably happened earlier this year.  That means watching U.S. Treasuries right now might not be so much about factoring in risk appetite and a bid for safe haven assets, but more about how the market is pricing in the added pressure that the Afghanistan situation puts on the Biden administration and its potential to complicate Democrats' political goals. |

Post a Comment