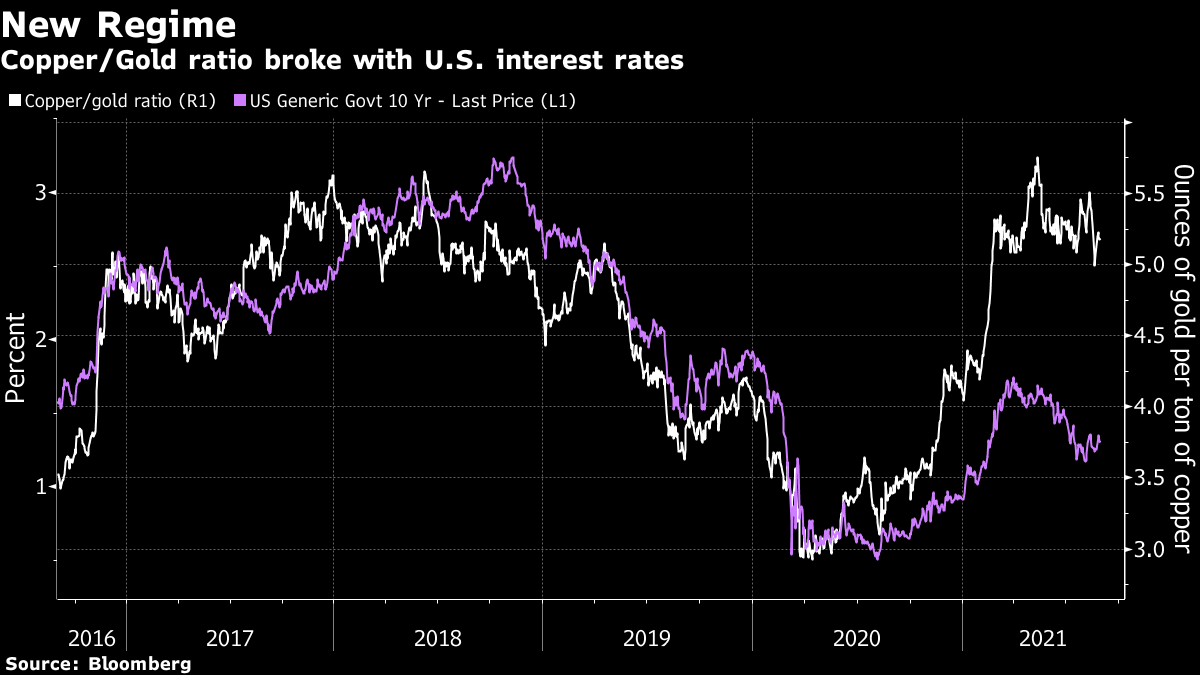

| Good morning. Travel across the Atlantic is getting harder again, the U.S. completed its planned pullout from Afghanistan, and New Orleans is assessing its storm damage. Here's what's moving markets. European Union countries voted to subject the U.S. to fresh restrictions on nonessential travel amid a surge in new coronavirus cases, dealing a blow to the tourism industry. A qualified majority of ambassadors voted to reintroduce the curbs, which had been lifted in June, according to an EU statement Monday evening. The change appears most likely to affect unvaccinated Americans. Around the same time, the U.S. State Department raised its travel advisory for Germany one notch to Level 3, saying Americans should reconsider travel due to Covid-19. The U.S. officially ended its military presence in Afghanistan last night when the final C-17 Globemaster took off at exactly 11:59pm Kabul time, meeting President Joe Biden's deadline and concluding two decades of American involvement. A rushed withdrawal of more than 123,000 people followed the Taliban advance to Kabul, and the killing of 13 U.S. service members in a suicide bombing outside the capital city's airport last week. Those deaths come on top of the loss of about 2,400 Americans and tens of thousands of Afghans, and about $1 trillion in U.S. spending since the conflict began. While the second-most intense hurricane to ever hit Louisiana is now weakening as it travels inland, more than a million homes and businesses around the U.S. Gulf Coast remain without power. The impact on oil and refining industries is still being tallied, though gasoline prices look set to hit the highest level on a Labor Day holiday since 2014. As Ida slowly travels north, it may unleash as much as two feet of rain, a level that could yet prove catastrophic. Analysts estimate that the storm could cost insurers at least $15 billion. Apple plans to add satellite functions on future iPhones that can send SOS texts out of cellular range, a person familiar told Bloomberg. Analyst Ming-Chi Kuo said the phone will probably work with Globalstar, whose shares surged. Separately, the iPhone maker bought classical-music streaming service Primephonic and plans to launch an app dedicated to the genre. Apple shares climbed to a record on Monday, topping $2.5 trillion in value. Earlier reports have led to conjecture that the iPhone will become something akin to a satellite phone, freeing users from having to rely on cell networks, but Apple's plan seems to be more limited in scope for now. European stocks are set for a flat open, after Chinese PMI data indicated the economy took a hit from the delta variant outbreak. The most significant earnings of the day are also in China, where beleaguered Evergrande reports as it aims to stave off a cash crunch. Bunzl, EMS-Chemie and Ackermans & van Haaren are among the bigger firms reporting in Europe. Elsewhere in the continent, ECB Governing Council members Robert Holzmann and Klaas Knot are among the speakers at a conference in Alpbach, Austria. In the U.S., cybersecurity firm CrowdStrike and Chinese gaming giant NetEase are among firms reporting, amid China's latest crackdown on how long kids can play online each week. This is what's caught our eye over the past 24 hours. If you want to sound well informed about markets, there are few things that will build your street cred faster than dropping references to a strong cross-asset correlation. Discover and promote a little-known relationship between seemingly disparate assets – particularly one that can be explained by plausible economic fundamentals – and they may just name it after you. Enter the Gundlach Ratio – named for DoubleLine Capital's Jeffrey Gundlach who pointed at the relative price of copper and gold as a tool for forecasting Treasury yields. Since copper is a cyclical commodity, and gold a perceived inflation hedge, a ratio of their prices should react to similar drivers as nominal 10-year yields. And statistically, it works. The ratio and yields registering 0.5 correlation on a weekly basis over the past five years.  Then, in the six months that spanned the calendar turn to 2021, the pair suddenly decoupled, with the copper-gold ratio suggesting yields should double. But what simplistic analysis misses is that it's not the absolute level that matters. Copper jumped in price relative to the fundamental drivers it has in common with the other two assets, thanks to optimism over its use in electric vehicles and supply-chain constraints. In other words, there was what statisticians call a regime shift in the data. The copper-gold ratio isn't broken, it's just that we need to look at the direction of travel, rather than the level, for clues on changes in interest rates. Eddie van der Walt is a Markets Live reporter and editor for Bloomberg News in London. @ EdVanDerWalt Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment