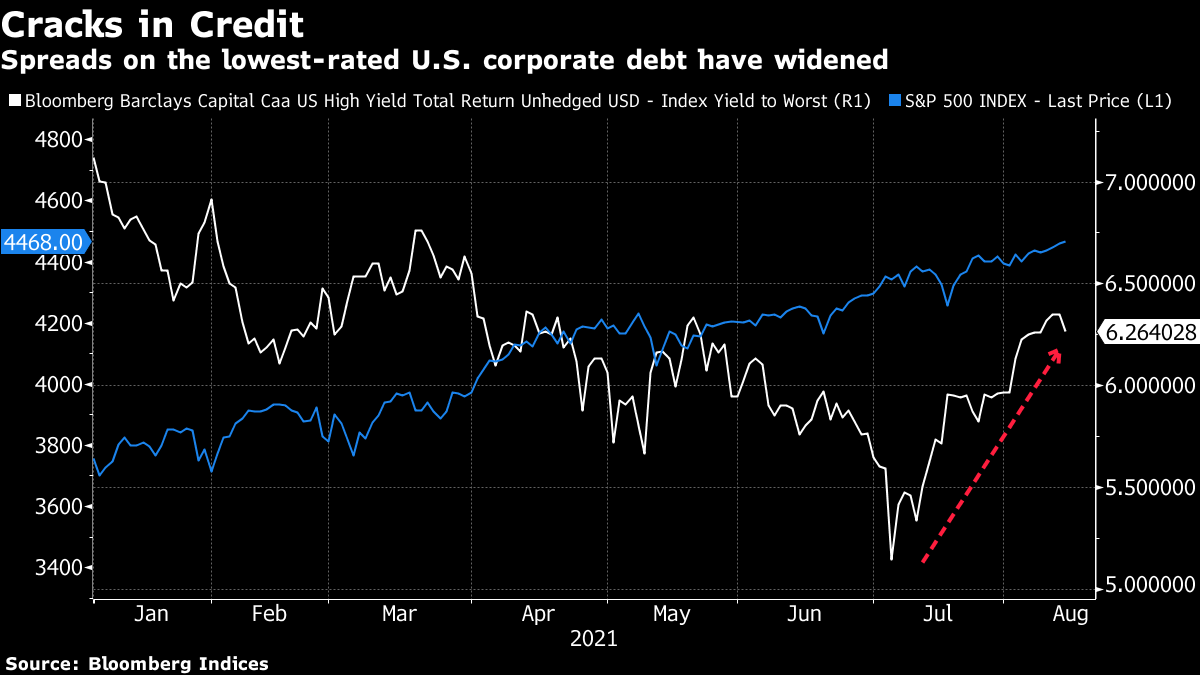

| The Taliban take control of Afghanistan after president flees. Malaysia's prime minister tells party he will resign. India aims to invest over a trillion dollars in infrastructure. Here's what you need to know this Monday morning. Taliban leaders marched into Kabul on Sunday, preparing to take full control of Afghanistan two decades after they were removed by the U.S. military. The militant group said it has occupied the presidential palace, and plans to soon declare a new "Islamic Emirate of Afghanistan." Hours earlier, American-backed President Ashraf Ghani fled the country. The Al Jazeera network broadcast what it said were live images of armed Taliban fighters roaming the presidential palace and posing at desks. The Biden administration raced to evacuate remaining personnel in Afghanistan, marking a symbolic end to America's longest-running war and raising alarm in Congress that the country would reemerge as a threat to U.S. national security. What is next for Afghanistan? Asian stocks are set for a steady start to the week as investors await key Chinese data to gauge how the delta virus strain is impacting the recovery from the pandemic. China retail sales and industrial output numbers may show growth slowed in July. Futures fell in Japan and Australia but inched higher in Hong Kong, while U.S. contracts dipped. U.S. stocks eked out another record Friday but a drop in consumer sentiment to a near-decade low injected some caution, pushing down Treasury yields and the dollar. India aims to invest $1.35 trillion in infrastructure to boost economic growth and create jobs, Prime Minister Narendra Modi said, laying out national priorities on the country's 75th Independence Day. The investments will be made in India's logistics sector to help integrate the country's varied modes of transport. The government has also pushed for a rationalization of labor laws, sought to reform agriculture and to amend tax laws amid rising risks to growth, including inflation. Modi aims to wind down India's energy imports in the next 25 years as part of the nation's carbon efficiency goals. Companies in China are scouring ministries and regulators for officials willing to cross over and help them navigate Xi Jinping's sweeping crackdown on the private sector that has upended some of the nation's most high-profile firms. Officials at watchdogs in charge of the financial system, and those from ministries overseeing commerce, industry and information are the most sought after, with pay packages in some instances approaching half a million dollars, about 60 times the average for civil servants, according to headhunters. We took a look at the hedge fund winners — and losers — of China's sudden crackdown. Malaysia's Prime Minister Muhyiddin Yassin told his party he plans to resign on Monday, potentially fueling further political and economic challenges in the pandemic-hit country. Muhyiddin, 74, told members of his ruling Parti Pribumi Bersatu Malaysia that he plans to meet the king on Monday and submit his resignation letter, according to a minister in the Prime Minister's Department. Muhyiddin has resisted repeated calls to step down since taking office in March 2020, making it unclear if he will actually submit his resignation. His rule has been beset by constant demands and threats of defection by lawmakers from the largest party in the ruling coalition. This is what's caught our eye over the past 24 hours: Don't look now but there's a crack opening up in credit markets. Risk premiums on the lowest-rated U.S. corporate debt — that rated CCC, or just a notch above default — have been widening over the past month. As Ben Emons at Medley Global Advisors notes, that's a relatively unusual occurrence given high-yield bonds have mostly been moving in tandem with stocks in recent months. So a downdraft in corporate debt when U.S. equities are up 1.65% so far this August (after a bumper earnings season no less), is notable.  What's going on? Credit analysts at Barclays, led by Brad Rogoff, say that debt issued by companies that are most exposed to Covid is underperforming. (Though it's worth pointing out that energy issuers — a big component of the CCC ratings bucket — are also following lower oil prices). As concerns about the Delta variant grow, it makes sense that investors might be re-evaluating the already-slim compensation they receive in exchange for buying debt issued by the companies deemed most exposed to the pandemic. |

Post a Comment