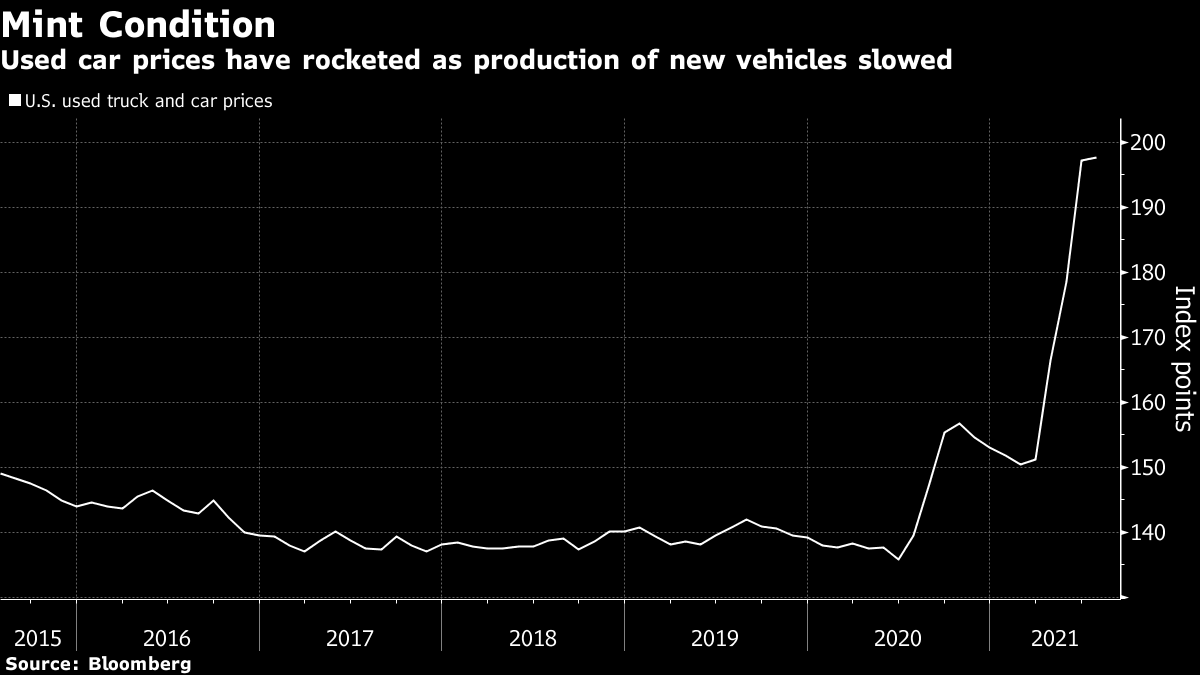

| Good morning. EU mulls curbs on U.S. visitors, Pfizer seeks approval for booster shots, ECB prepared to respond, U.S. and Israel talk. Here's what's moving markets. The European Union will discuss on Thursday whether to reimpose curbs on visitors from the U.S. as new coronavirus cases soar. The change is said to be recommended by Slovenia, which holds the EU's rotating presidency and is responsible for triggering an assessment of countries allowed non-essential travel there. The Airlines for Europe lobby group said such a decision would be "hugely disappointing" for European carriers. Pfizer and BioNTech are seeking full U.S. approval for a Covid-19 booster shot for people 16 and older, asking regulators to sign off on a third dose to quell a rise in infections among vaccinated people. A surge in virus cases caused by the highly transmissible delta variant has raised questions about how well the shot can protect vulnerable people such as organ-transplant recipients and seniors. The Biden administration has said it wants to begin giving more Americans booster doses starting next month. The European Central Bank is prepared to respond to any market disruptions that may arise when the Federal Reserve starts to unwind monetary stimulus, ECB Chief Economist Philip Lane told Reuters. Lane stressed that policy makers are determined to keep financing conditions across the 19-nation euro region favorable and signaled that they'll take their time to decide how to conduct bond purchases once their pandemic emergency program expires. U.S. President Joe Biden and Israeli Prime Minister Naftali Bennett plan to discuss what both countries consider to be an alarming acceleration of Iran's nuclear program when the leaders meet Thursday at the White House. Biden is said to have plans to emphasize his strong support for Israel in a meeting that may reveal divergent approaches on Iran: the U.S. favors a diplomatic pact to halt the Islamic Republic's nuclear program and Israel has said it may use secret attacks to disable Iranian facilities. European stocks are headed lower as investors await the Jackson Hole symposium, the annual U.S. central banker gathering which might provide clues to the future of Federal Reserve stimulus. The Bank of Korea didn't wait however, becoming the first major Asian economy to lift rates and suggesting further hikes could come in the future. Before Jackson Hole, there's earnings today from France's Bouygues, Germany's Delivery Hero and Norwegian fishery Salmar. In the U.S., Dell, HP, VMware, Workday, Peloton and Dollar General are among the firms giving results. This is what's caught our eye over the past 24 hours. Car prices are a hot topic in the Van der Walt household. We bought a slightly used vehicle last year after a fellow road-user decided to follow American convention on British roads, with the ensuing head-on collision leading to my perfectly-serviceable clunker being written off. One upshot of the global chip shortage and the delays it has caused to production in a bunch of areas, notably cars, is that the price of second-hand vehicles exploded. The chart depicting used auto inflation in the U.S. appears broken. We could probably turn a 30% profit if we again flipped our wheels today.  Except, as homeowners riding waves of house-price inflation have learned, it's a false gain. I'd then have to go buy another car or face getting the kids to their various lessons, activities and play dates on foot, which frankly ain't gonna happen. But at least I get to bask in the warm glow of what behavioral economists call the wealth effect, where a change in the general price level means I can think of myself as someone who can afford a car that's worth a lot more than I actually spent. Who said there's no upside to inflation? Eddie van der Walt is a Markets Live reporter and editor for Bloomberg News in London. @EdVanDerWalt Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment