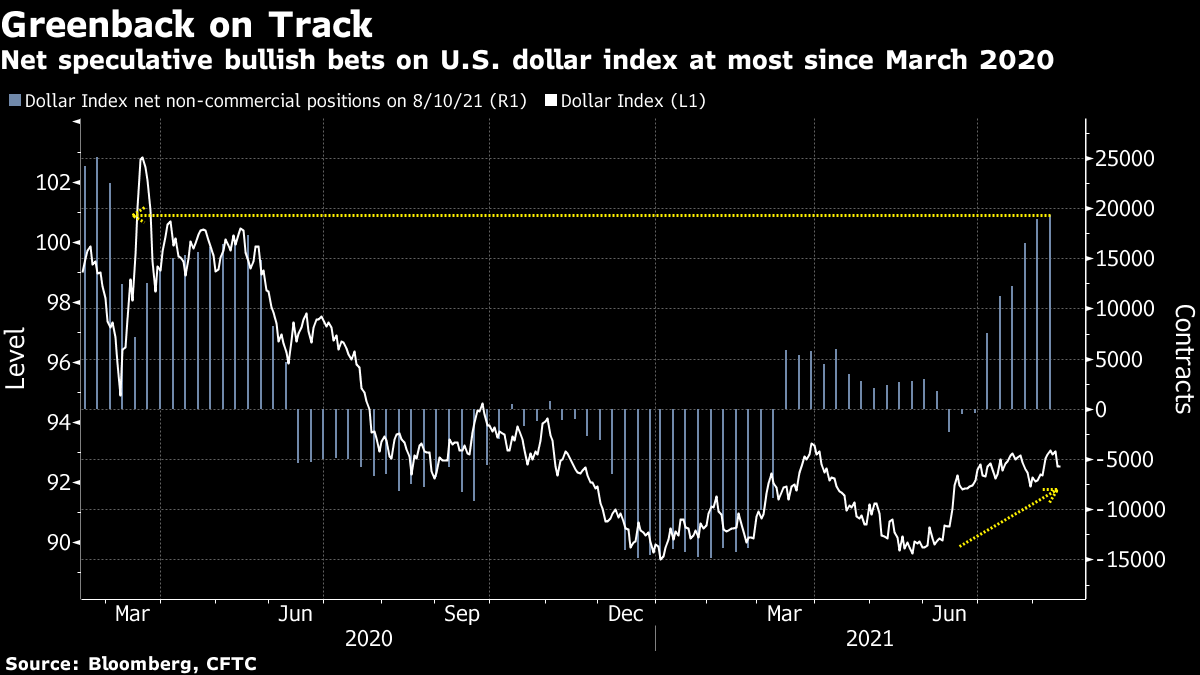

| Good morning. Afghan crisis, Hella deal, delta wreaks havoc and cryptocurrencies rise. Here's what's moving markets. Taliban leaders marched into Kabul Sunday, preparing to take full control of Afghanistan two decades after they were removed by the U.S. military. The militant group took over the presidential palace, and said it plans to soon declare a new "Islamic Emirate of Afghanistan." Hours earlier, American-backed President Ashraf Ghani fled the country. The speed of the Afghan government's collapse shocked NATO allies and prompted condemnation from both sides of the U.S. political divide over how President Joe Biden's administration appeared to be blindsided by the Taliban's easy advance. Faurecia SE agreed to take over Hella GmbH in a deal valuing the German automotive supplier at 6.8 billion euros, beating out rival bidders from the European car-parts industry. France-based Faurecia is said to have beat out competition from German car-parts maker Mahle GmbH and France's Cie Plastic Omnium SA. Hella's shares have surged in recent months as competition for the company heated up, closing on Friday above what Faurecia is offering. The delta coronavirus variant left cases near record highs in Thailand, Vietnam, as well as the Philippines. The strain also drove daily Russian deaths to a record and cases in Germany rose the most since May. In the U.S., the seven-day average of Covid-19 deaths almost doubled in two weeks to the highest since May. Meanwhile, pediatricians in U.S. Covid-19 hotspots are anticipating a delta-fueled swell of children with a rare, serious, and sometimes deadly virus-linked condition as the fall resumption of school looms. The total market value of cryptocurrencies rose above $2 trillion again as Bitcoin continued to climb and the likes of Cardano, XRP and Dogecoin advanced as well. Crypto's market value rose to $2.06 trillion on Saturday, according to CoinGecko. The moves higher came even after the cryptocurrency industry failed to win a change to crypto tax reporting rules in a U.S. infrastructure bill. European stocks look set to follow those in Asia lower, with sluggish Chinese economic data and fresh virus outbreaks weighing on sentiment. There's little action in earnings today, with Grand City Properties, Lotus Bakeries and Aeroports de Paris updating alongside South Africa's Sasol and Absa. In the U.S., social gaming giant Roblox reports. And in England, the threat of the "pingdemic" comes to an end today, as fully vaccinated people who've been in close contact with Covid-19 cases will be exempt from self-isolation. This is what's caught our eye over the past 24 hours. Bullish bets on the greenback are back at levels last seen at the height of the market's coronavirus fears last year. Net long non-commercial positions in futures linked to the ICE U.S. Dollar Index have surged to the most since March 2020, according to the latest Commodity Futures Trading Commission data. The gauge of the U.S. currency has climbed about 3% so far this year -- against consensus -- with some strategists now predicting further gains as the Federal Reserve moves toward tighter monetary policy. While the greenback wobbled on Friday's slump in U.S. consumer confidence, bulls will look to the Fed's Aug. 26-28 symposium in Jackson Hole as the next key catalyst for the currency. That could see Fed Chair Jerome Powell flag the start of its much-anticipated tapering of bond purchases, a move which could see yields pushing higher and bringing the dollar along with them.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment